A price ceiling is a price restriction, or limit, established by the government or a group on the amount that can be charged for a product, commodity, or service. The price established by the price ceiling must be lower than the natural equilibrium price for the measure to be effective. Governments use price ceilings apparently to shield shoppers from conditions that could make items restrictively costly. Models incorporate, food, lease, and energy items which might become excessively expensive to shoppers.

Price ceilings can be beneficial in that they keep basics cheap, at least temporarily. Economists, on the other hand, dispute whether such ceilings are advantageous in the long term. Deadweight loss becomes inefficient as a result of this. Despite the fact that deadweight loss occurs, the government sets a price cap to safeguard consumers. Rent control is an example of a price ceiling in the United States. Such conditions can happen during times of high expansion, in case of a speculation bubble, or in case of syndication responsibility for the item, all of which can cause issues whenever forced for a significant stretch without controlled proportioning, prompting deficiencies.

Price ceilings prohibit a good’s price from rising. As a result, the producer is discouraged from increasing supply to the market. Soldiers were returning home after years of battle after World War II to start families. The deluge of returning warriors provoked an exorbitant interest for lodging. Because of the appeal, property managers expanded the cost of the lease to coordinate with the flood popularity.

However, because of the increasing rental costs, housing for troops returning from the war was expensive, especially because many were no longer getting military pay. To deal with the issue, the government set a rent cap to ensure that troops could find cheap homes in New York. While price ceilings are frequently forced by governments, there are additional cost roofs that are carried out by non-administrative associations, for example, organizations, for example, the act of resale value support.

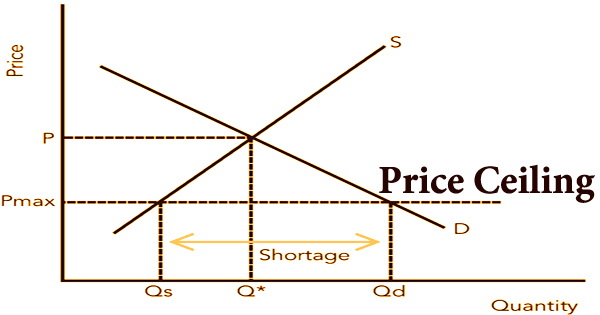

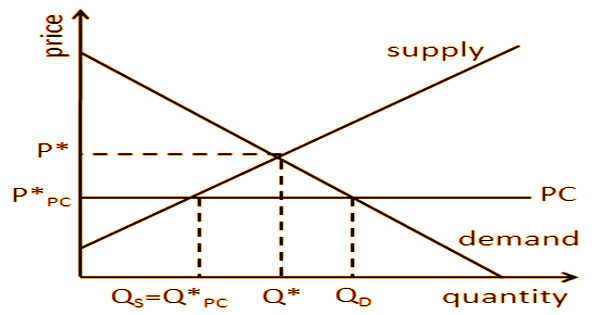

Price ceilings that are set too low below the equilibrium price can be devastating for producers, despite the fact that they are meant to promote justice and protect consumers. Unrealistic ceilings have the potential to damage enterprises and cause an economic downturn. A price floor, on the other hand, is a position below which prices cannot be set. At the point when a successful price ceiling is set, an abundance request is made combined with an inventory deficiency makers are reluctant to sell at a lower cost and shoppers are requesting less expensive merchandise.

As a result, deadweight loss occurs; if the demand curve is somewhat elastic, consumer surplus will be net positive but producer surplus will move in the negative direction. A manufacturer and its distributors agree to sell the manufacturer’s goods at certain pricing (resale price maintenance), at or below a price ceiling (maximum resale price maintenance), or at or above a price floor (resale price maintenance). Price limits, according to economists, generate a deadweight loss in an economy, rendering it inefficient.

There aren’t many issues that financial analysts will, in general, concede to, however, value roofs are one of them. As indicated by the Center of the American Experiment, 81% of financial experts concur that value roofs are awful financial matters. Price limits can, paradoxically, lead to higher costs in some instances, according to a large body of data. Price limits help to coordinate cooperation among suppliers who would otherwise compete on price, according to the most common argument.

While price limits appear to be clearly beneficial to consumers, they also have long-term consequences. Costs will undoubtedly fall in the short term, which will help to increase demand. All the more unequivocally, firms shaping a cartel becomes beneficial by empowering ostensibly contending firms to carry on like an imposing business model, restricting amounts and raising costs. The maximum cost is restricting and makes the harmony amount change amount requested increments while amount provided diminishes.

Price ceilings generate black markets, which are unlawful in and of themselves. Price ceilings, on the other hand, can lead to greater crime in different ways. If a price ceiling has no influence on market players’ decisions, it is considered to be useless. In any case, makers need to discover some approach to make up at the cost (and benefit) controls. They might apportion supply, cut back on creation or creation quality, or charge extra for (in the past free) alternatives and highlights.

Because the ceiling price is higher than the equilibrium price, natural equilibrium is maintained, and no quantity shortages or deadweight losses occur. Forming a cartel, on the other hand, is difficult due to the need to agree on volumes and pricing, as well as the fact that each business will have an incentive to “cheat” by decreasing prices in order to sell more than it committed to. Antitrust laws make arrangement considerably more troublesome as a result of legitimate assents. Subsequently, business analysts can’t help thinking about how proficient value roofs can be at shielding the weakest customers from significant expenses or in any event, securing them by any means.

At the point when costs can’t respond to requests, what ordinarily happens is a decrease in supply. Be that as it may, it can likewise prompt a reduction in the nature of the great or administration. A more extensive and more hypothetical issue with value roofs is that they make an extra weight misfortune to society. This is an economic deficit produced by improper resource allocation that disrupts a marketplace’s equilibrium and leads to it becoming more inefficient.

It may be simpler for businesses to agree on a price and monitor pricing if a third party, such as a regulator, announces and enforces a maximum price level. The regulated price can be thought of as a focal point, where both parties are expected to charge. When price limits are established, they are done so that those who would otherwise be unable to acquire the necessary items can do so.

Information Sources: