Importance of banking system in a country is increasing day by day. It is quite impossible for any country to develop in industrial and commercial sector without sound banking system in modern economic era. Mobile Banking is one of the significant functions of the bank. It plays a vital role in overall economy of the country. Bank collects information from numerous sources relating to cost and revenue from Customer Management.

Globalization of national economies has given a boost to international trade. The seller and the buyer in an international trading transaction must agree for a product or its quality, price etc. enter into a sales contract, spelling out precisely shipping and delivery details, terms of payment, required documentation and other related issues including dispute settlement procedure and legal framework available.

The major objectives of my report is to describe the Mobile banking system of Dutch Bangla bank limited, measurement the employee behavior and performance, determine the wide range of services, and evaluate the banking performances of these banks. To do this report I have collected necessary information from primary and secondary sources, face to face conversation with the customers and respective officers.

This internship report has been prepared to fulfill the requirement for getting BBA degree. As a part of my course, it is mandatory to get involved with an organization for a certain period of time to acquire the practical knowledge. The report covers organizational aspects of Dutch-Bangla Bank Ltd and a report title “Mobile Banking (Banking in your Hand)”.

Rational for selecting the Report:

As a student of the Business Administration Discipline in “American International UniversityBangladesh” it is compulsory to do internship in an organization and I have to meet that obligation with the support of Dutch Bangla Bank Ltd. I am carrying out my internship at the Mobile Banking focus on DBBL. This study will enable to know Mobile Banking. The report will provide information about Mobile Banking, its operation, its benefit and its influence in Bangladesh economy. I am working in Dutch-Bangla Bank at Uttara Branch, which had a great opportunity to have in depth knowledge of all the banking activities. So, as the part of the study this internship program helps me to gaining knowledge and understands about Mobile Bankingsystem.

Background of The Study:

We Know Bangladesh Bank play an important role of our country. The banking system of Bangladesh is composed variety of banks working as National Commercial Banks, Foreign bank, Specialization, banks and Development Banks. However there are many Banks in Bangladesh at Present. Under internship program each student has to prepareda report on a particular topics related with the organization. According to this requirement, I have already completed my Internship at DBBL Uttara Branch. On the basis of my practical experience as well as theoretical knowledge, I have completed the report regarding, “Mobile Banking (Banking In Your Hand)A Study on Dutch-Bangla Bank Limited, Uttara Branch. The main focuses of my study is to analysis about Mobile Banking which is new banking system in Bangladesh and its strength and weakness.

Scope of the Study:

The Report mainly focuses on the following areas:

- Mobile Banking and Internet Banking extended by Dutch-Bangla Bank Limited.

- What kinds of standard documents are required for different types of account opening like

- Mobile account, saving account, Current Account, STD, Excel, Power, Power Plus.

- How different kinds of projects are appraised and financed at Dutch-Bangla Bank Limited. S Present scenario and prospective of Dutch-Bangla Bank Ltd.

Objectives of Study:

The main objective of the study is to write a report on Mobile Banking System of Dutch-Bangla Bank Ltd.

Methodology

Both primary and secondary data is used to accomplish the objectives of the study. A good number of literatures have been reviewed to sharpen the thought on Mobile Banking and its different facets in the context of Bangladeshi banks. Data on various indicators relating to readiness of the banks have been collected from different sources such as Bangladesh Bank (BB) publications and reports, websites of different banks, Bangladesh Institution of Bank Management, World Bank policy paper and Bangladesh Bank mobile banking policy paper about Mobile Financial Services in Bangladesh, Internet, BTRC (Bangladesh Telecommunication Regulatory Commission) and different mobile phone companies websites. It must be emphasized that information is also collected from several dailies, Wikipedia etc. through Internet. Various policies and circulars of BB issued by the Banking Regulation and Policy Department and other departments have also been consulted for preparing this paper.

Limitations

- Up to date data about Mobile Banking are not available. Because mobile banking is not attaining maturity. It is very much new in Bangladesh.

- Literature review and methods of research is not sufficient.

- There was a time constraint to prepare this paper.

I have little knowledge about Mobile Banking technology.

DBBL in Bangladesh:

Banking system occupies an important place in a nation’s economy. Banking institution is indispensable in a modern society and it plays a vital role in the economic development of a country. Against the background of Liberation of economic policies in Bangladesh. Dutch-Bangla Bank Ltd. Emerged as a new commercial bank to provide efficient banking services with a view to improving the socio-economic development of the country. The Bank provides a broad range of financial services to its customers and corporate clients. The Board of Directors consists of eminent personalities from the realm of commerce and industries of the country.

Background of Dutch Bangla Bank Limited:

Dutch-Bangla Bank Limited is a second generation bank that was established in 1995 with a dream and a vision to become a pioneer banking institution of the country and contributes significantly to the national economy and society also. The banks journey began when it was incorporated as public limited company on July 04, 1995. The registrar of Joint Stock Companies and firms issued the Certificate of Commencement of business of the bank on the same date. The banks first branch was inaugurated at the busiest commercial hub of the country at 1, Dilkusha Commercial Area, Dhaka on June 03, 1996.1n its arduous journey since, Dutch-Bangla Bank Limited has succeeded in realizing the dreams of those who established it. Today is one of the leading banks in the private sector, contributing significantly to the national economy and society also. The authorized capital of the Bank is today Tk. 4000.00 million. Its Paid-Up-Capital Tk. 2000.00 million and Reserve reached to Tk. 2524.72 million as on Septembers 1, 2010. The Dutch-Bangla Bank Limited was established by the leading business personalities and eminent industrialists of the country and abroad with stakes in various segments of the national economy. They established the Bank with a vision to bring efficient and professional banking service to the people and the business community of Bangladesh to help the national economy to grow. The incumbent chairman of the bank is Mr. Abedur Rashid Khan. The Bank’s operations are built upon unequivocal emphasis on effective corporate governance. The objective here is to create, promote and build long-term company value. The Banks first and highest priority is to provide effective services and maximum satisfaction to the customer. The ethos of harmony and cooperation is widely practiced in the bank. It believes that transparency in decision-making, monitoring mechanism and full disclosure to shareholders and regulatory authorities are essential aspects of bank’s corporate governance and that they create an intense pressure to rationalize bank’s services and search for new competitive advantages. It works ceaselessly within these parameters. A team of efficient professionals manages the bank. They create and generate an environment of trust and discipline that affects everybody in the bank to work together for achieving the objectives of the bank. A commitment to quality and excellence in service is the hallmark of their identity. Now, the Dutch-Bangla Bank Limited has become a synonym of quality banking products and services. It has an array of such products services tailored carefully to cater to the needs of all segments of customer. It has been achieved much of its goals but it has been performing its activities to satisfy the country people as it did before well.

Objectives of Dutch Bangia Bank Limited:

Objective:

To achieve positive Economic Value Added (EVA) each year.

To be market leader in product innovation.

To be one of the top three Financial Institution in Bangladesh in terms of cost efficiency.

To be one of the top five Financial Institutions in Bangladesh in terms of market share in all significant market segments we serve.

Financial Objectives:

To achieve a return on shareholders’ equity of 20% or more, on average.

Vision:

Dutch-Bangla bank, as a first class pioneer banking financial institution, dreams of a better Bangladesh, where arts and letters, sports and athletics, music and entertainment, science and education, health and hygiene, clean and pollution free environment and above all a society based on morality and ethics make all our lives worth living. DBBL’s essence and ethos rest on a cosmos of creativity and the marvel -magic of a charmed life that abounds with spirit of life and adventures that contributes towards human development.

Mission:

The Dutch-Bangla Bank engineers enterprises and creativity in the business and industry with a commitment to social responsibility. “Profits alone” does not hold a central focus in the banks operation; because “man does not live by bread & butter alone.”

Core values:

The Dutch-Bangla Bank believes in its uncompromising commitment to fulfill its customer’s needs and satisfaction and to become their first choice in banking. Taking cue from its pool of esteemed clientele, the bank intends to pave the way for a new era for a banking that upholds and epitomizes its vaunted marques “Fo«r trusted partner.”

For the community strengthening the corporate values and taking environment and social risks and reward into account

Functions of DBBL:

Dutch-Bangla Bank is one of the well known second generation private bank in Bangladesh. It has much better reputation, position in, and contribution to the economic sector of Bangladesh only for its better quality services and efficient team of performers. But it has. not reached here over night. It has some distinction features so that it is now very close of the peak of success. Those distinctive features are as stated:

- The Dutch-Bangla bank provides service with high degree of experienced & expert & use of modern technology.

- The bank has the biggest IT investment as a bank in the country.

- The institution creates long term relationship based on mutual trust.

- It responses to customers needs with speed & accuracy.

- It shares its values & beliefs with the clients.

- It provides products & services at competitive pricing.

- It ensures safely &. security of customers valuables in trust with us.

- It introduces diversified & dynamic banking system.

- It targets every income level person for its banking service.

- The financial institution ensures higher level of transparency and accountability at all level of doing business for having efficient and effective business operation.

- It is the pioneer in maintaining Corporate Social Responsibility (CSR) as a banking financial institution all over the country.

- It holds the biggest ATM (Automated Teller Machine) network.

Organizational Goals:

- To employ funds for profitable purposes in various fields with special emphasis on small scale industries.

- To undertake project promotion on identify profitable areas of investment.

- To search for newer avenues for investment and develop new products to suit such needs.

- To establish linkage with other institutions which are engaged in financing micro enterprises.

- To cooperate and collaborate with institutions entrusted with the responsibility of promoting

Mobile Banking

Mobile Banking is a Banking process without bank branch which provides financial services to un-banked communities efficiently and at affordable cost. To provide banking and financial services, such as cash-in, cash out, merchant payment, utility payment, salary disbursement, foreign remittance, government allowance disbursement, ATM money withdrawal through mobile technology devices, i.e. Mobile Phone, is called Mobile Banking. Mobile banking (m-banking) involves the use of a mobile phone or another mobile device to undertake financial transactions linked to a client’s account. M-banking is one of the newest approaches to the provision of financial services, made possible by the widespread adoption of mobile phones even in low income people. The roll out of mobile telephony has been rapid, and has extended access well beyond already connected customers in rural area. There is mounting evidence of positive social impact on poorer people and communities as a result There are sound reasons for the hope that m-banking could have similar impact A mobile network offers a high technology platform onto which other services can be often provided at very low cost to deliver an effective result. Mobile data channels are often under-used and therefore may be offered at low cost by the network operator. M-banking services which use channels such as text messaging/ SMS can be carried at a cost of less. The low cost of using existing infrastructure makes such channels more amenable to use by low income customers.M-banking is new in our country, and there has been limited donor support in this sector to date. This report considers the case for donors to support m-banking as a sector. Bangladesh Bank permitted 10 commercial bank to do such kind of mobile banking business that the rural people who have mobile but haven’t banking facilities, Service holders can get there salary by the mobile banking.

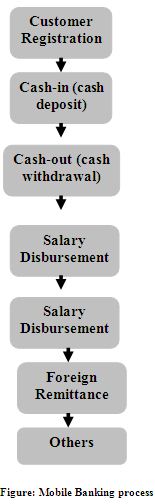

Mobile Banking Process

Mobile Account opening procedure in a flow chart

After registration of DBBL Mobile Banking DBBL cell center call customer for choosing the password. Customer chose four digit number what they like. The mobile banking number will be like mobile number with one cheque digit. It will be active within 1-2 working day.

Necessity

A person who wants to open an account he/she should have some documents to open an account, these are-

1. 2 copies PP size photo of Applicant

2. Photocopy of National ID Card

3. 100 take as account opening charge.

How does it work:

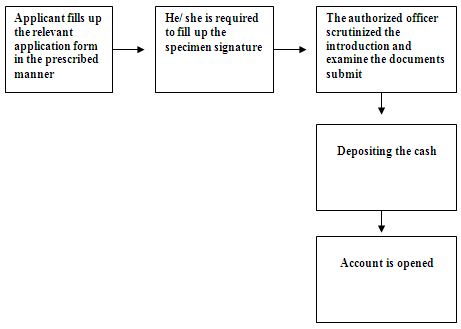

- Customer fills up the Application Form and submit to agent along with his photograph & National ID (NID).

- Agent checks the Application Form, photograph & NID.

- Agent goes to Customer Registration Menu in his/her mobile and insert customer’s mobile number.

- Customer receives a call and in reply, s/he gives a 4-digit PIN number of his/her choice (please remember your PIN).

- A Mobile Account is created in the DBBL system which is his/her mobile number + one check digit.

- Customer receives an SMS which contains his/her Mobile Account number (please remember your check digit).

According to the Law and Practice the Banker – Customer relation arises only from contract between the two. And opening of Mobile Account is the contract that establishes the relationship between a banker and a customer. So this section pays very important role in attracting customer and therefore be handled with extra care

Cash-in (cash deposit):

Customer can cash-in (deposit) at any authorized agent of DBBL (at present Citycell & Banglalink agents) or DBBL Branch.

How does it work:

- Customer hands over cash to the Agent

- Agent initiates the transaction from his/her mobile

- Agent gets prompt menu and in reply agent enters customer’s mobile account number (including check digit) and amount

- Agent enters his/her PEST

- System credits customer’s account for the same amount

- Agent issues a receipt to the customer

- System sends an SMS to the customer’s mobile

- For security reason, customer needs to check the sending number of SMS and the amount.

- SMS will be sent from 16216.

Cash-out (cash withdrawal):

Customer can cash-out (withdraw) at any authorized agent of DBBL (at present Citycell & Banglalmk agents), DBBL ATMs and DBBL Branch.

How does it work:

- Customer asks the Agent for withdrawal of an amount from his/her mobile account

- Agent initiates the transaction from his/her mobile

- Agent gets prompt menu and in reply agent enters customer’s mobile account number (including check digit) and amount to withdraw

- DBBL system sends prompt menu to the customer’s mobile (or IVR Call): “You are going to withdraw Tk. XXXX from your mobile account with DBBL. If you want to continue, please enter your 4-digit PEST

- Customer enters his/her PIN

- System debits customer’s account and send an SMS to the customer’s mobile

- Agent hands over money to the customer

Foreign remittance:

It can be sent to Mobile Aeeount-

- Exchange houses at abroad receive remittance against beneficiary’s mobile account number

- Exchange houses send the mobile account number and the amount to DBBL

- DBBL will centrally credit the amount against respective mobile account

- The beneficiary will get an SMS regarding such transaction.

- The beneficiary can go to any agent or DBBL ATM or DBBL Branch for withdrawal of money

Others:

- Merchant Payment

- Utility Payment

- Air-time Top-up

- Fund Transfer

Advantages of Mobile Banking :

The biggest advantage that mobile banking offers to banks is that it drastically cuts down the costs of providing service to the customers.

- You can make transactions or pay bills anytime. It saves a lot of time.

- Mobile banking thorough cell phone is user friendly. The interface is also very simple. You just need to follow the instructions to make the transaction. It also saves the record of any transactions made.

- Cell phone banking is cost effective. DBBL provide this facility at a lower cost as compared to banking by self.

- Banking through mobile reduces the risk of fraud. You will get an SMS whenever there is an activity in your account. This includes deposits, cash withdrawals, funds transfer etc. You will get a notice as soon as any amount is deducted or deposited in your account.

- Banking through cell phone benefits the banks too. It cuts down on the cost of tele- banking and is more economical.

- Mobile banking through cell phone is very advantageous to the banks as it serves as a guide in order to help the banks improve their customer care services.

- Banks can be in touch with their clients with mobile banking.

- Banks can also promote and sell their products and services like credit cards, loans etc. to a specific group of customers.

- Various banking services like Account Balance Enquiry , Credit/Debit Alerts, Bill Payment Alerts, Transaction History, Fund Transfer Facilities, Minimum Balance Alerts etc. can be accessed from your mobile.

- You can transfer money instantly to another account in the same bank using mobile banking.

- Mobile banking has an edge over internet banking. In case of online banking, you must have an internet connection and a computer. This is a problem in developing countries. However, with mobile banking, connectivity is not a problem. You can find mobile connectivity in the remotest of places also where having an internet connection is a problem.

- Mobile banking is helping service providers increase revenues from the now static subscriber base.

- Service providers are increasingly using the complexity of their supported mobile banking services to attract new customers and retain old ones.

- A very effective way of improving customer service could be to inform customers better.

Disadvantages of Mobile Banking:

Uncertainties over the speed and nature of customer adoption: This is to be expected with any new offering, although the uncertainty is compounded by the relative lack of knowledge of the needs of un-banked people in many places, and the market potential. Consumer education may speed adoption; but more likely, adoption on scale will happen as it has happened with mobile phones: by forced to adapt their offerings as they encounter feedback in The market place. Therefore, it is necessary to have sufficient providers in the market who Can remain in the market long enough to ensure that to identify the elements of a successful model. Hence, support to providers may assist in overcoming this barrier. Generally available research into the patterns and needs of the un-banked target market may also help.

Lack of interoperability with existing systems/Interoperability of different payment systems is primarily a question of market structure and regulation. It arises initially only in markets where there is an existing payment infrastructure with which new providers can inter-operate (and later on, once new infrastructure becomes the standard). Without inter-operability, the fixed costs of deploying financial infrastructure may be much harder to recover, since usage per item of proprietary infrastructure will fall. Clearly, one solution may be to give regulators the power to require interoperability; however, it may be sufficient to encourage the identification of appropriate standard upfront. This could take place via support to regulators or industry bodies, where these exist.

Regulatory barriers .”Specific regulatory impediments vary by market; but in general, a lack of openness to new models of provision and a lack of policy certainty limit the potential of new models. Increasing openness and certainty may require support to regulators to outline high level policy, as well as to amend existing regulations or draft new ones where and when required.

The case for donor support therefore rests on removing barriers such as these, thereby making it more likely that transformational models of m-banking will emerge at all, or at least, sooner; and that they will develop more rapidly than otherwise would be the case.

Objective of Mobile Banking:

Around 87% of the total population of Bangladesh is un-banked. To bring such a huge population into the banking channel, DBBL is implementing a system to launch mobile banking soon. The project is in its final stage now. With this facility any person having a mobile number will be able to use his number as a bank account. In this mobile account they will be able to do the following:

- Cash deposit to any Agent of DBBL

- Cash withdrawal from any Agent of DBBL

- Cash withdrawal from DBBL ATMs

- Funds transfer to another mobile account

- Utility bill payment, Tuition fee payment, Air time top-up.

- Receive remittance from home and abroad

- Salary disbursement

- Disbursement of Govt. allowances

- Merchant Payment

- Balance Inquiry

Some other purpose of Mobile Banking:

While poor people have little money, they are active managers of what they have. Holding cash comes at high price to poor people because of the risk of crime in many poor People, but they often have few alternatives to cash based services.

In particular, appropriate financial services help poor people to access usefully large lump sums of money, which may either enable a pathway out of poverty through investment in income generating activities (such as micro enterprises) or asset creation (such as housing); or may reduce vulnerability to sudden shocks to cash flow, as a result for example of illness or climate conditions.

In our country, poor people are forced to rely on informal financial services, which may be unsafe, or fringe formal financial products which may be expensive as well as unsafe. In other words, their exclusion from formal financial services has economic and social impacts which may exacerbate their poverty.

The cost efficient provision of formal financial services (payments/ remittances, savings, credit or insurance) is predicated on customers having access at least to a basic transactional account, from which electronic transfers can be made as like purchase product and pay one another by M-banking and cash withdrawn as necessary.

M-banking holds the prospect of offering a low cost, accessible transaction banking platform for currently unbaked and poorer customers. In addition, as mobile networks expand their coverage, they offer the opportunity of bringing payment and remittance services into that areas where banking services is unable able.

However, not all m-banking products will be transformational in the sense of broadening access to financial services substantially at first or even at all. However, it is likely that even m-banking services which start targeted at existing banked customers may over time extend to un-banked groups.

Identified/Observed in the Organization :

I get the following Strengths, weaknesses, opportunities, and threats from my practical observation in three months Internship Program, of DBBL as follows:

Strengths

1. Potential customer in rural and urban area where branch banking is not possible.

2. Partner is available.

3. New investment like Mobile Banking where no bank in Bangladesh is not start such kind of business

4. Low cost for opening Mobile Bank Account.

5. Possible to give hand to the remote area customer of there remittance earn from abroad.

6. Mobile bill pay or recherche through Mobile Banking is possible.

7. Out let is available.

8. Transection process is easy

9. Save money in rural area.

10. Salary/Allowance Disbursement

11. Strong network of telecom company

12. Efficient Employee of DBBL as well as Telecom Partner.

13. Cost effective

Weaknesses

1. Out Let is not available as per requirement.

2. Mobile ATM booth is not available.

3. Amount of transaction is very little.

4. Advertisement is not adequate that most of the people don’t know about Mobile Banking.

5. Employee are not efficient that M-Banking is new in Bangladesh.

6. Insecure out let that rubbery the money in remote area where security is not available.

7. New concept in Bangladesh is the beast weakness

8. Cash in and out cost is more than interest rate

9. Lack of Knowledge of operating Mobile transaction within customer.

Opportunities

1. Lot of potential customer in Bangladesh that around 7 corer people use Mobile phone.

2. It may that the shopkeeper receive there payment through Mobile transaction.

3. Salary and allowance may distribute through Mobile Banking

4. Government and other International agencies positive attitude toward low classification rate.

5. Opportunity to expand banking business.

6. Large market for bank.

7. Gain more profit through Mobile Banking.

8. To reach the modern banking facilities to the rural area where banking facilities does not reach till now.

Threats:

1) Customer may not use properly the process of M-Banking.

2) Reaching deeper into rural areas without costly investment in infrastructure.

3) Reducing the costs of servicing.

4) Interoperability

5) Security risks from robbery & holdup.

6) Scalability & reliability

7) Personalization

8) Customer education

9) Reduce cost of clients

10) Lack of out late

11) Cost of cash in and out is high compare to interest rate on bank deposit.

Recommendation:

Continue Mobile Banking in the rural areas to increase the use of E-Money especially in commercial applications. Continuous pilot testing of the other M-Banking services to model cost effective ways of reaching more and more people in areas farther away from bank.

Develop a mobile banking website as information portal particularly for M-Banking. Continuous support and training workshop on Mobile Banking Procedures develops on going Developed M-banking system to automated transecting.

- Major problems in a business arises when it’s new. The officer should observe that whether there is loss of the top executive, demand, or any other most important new one has entered and often the change may be worse.

- DBBL and concern partner should advertise more for attracting all level of customers.

- DBBL should encourage students for Mobile account opening because students are a potential source for a bank.

- DBBL should increase facility to fulfillment customers need.

- DBBL should increase its outlet.

- Bank should also be aware of significant changes in the training of M-Banking officer and concern Partners employee.

- Changes in industry trends may directly affect business so that it can no longer completely profitable. Therefore, the Bank should keep information about the environment of each industry in which its customers operate

- Real value of business can come from making regular visits to the customer’s place of business rather than holding all meetings in the Bank.

- Against big willful defaulters legal action should be taken promptly for customer M-Money Security.

- Should arrange more and more campaign in public place to increase M-Banking customer.

- The cost of cash in and out should decrease.

- Try to involve small business to raise customers.

- Advertisement should increase through Radio, Newspaper, Poster, Banner.

Conclusions :

For service providers, Mobile banking offers the next surest way to achieve growth. Countries like Bangladesh where mobile penetration is nearing saturation, mobile banking is helping service providers increase revenues from the now static subscriber base. Also service providers are increasingly using the complexity of their supported mobile banking services to attract new customers and retain old ones. For the fact is that one day, in most of the world emerging markets, more people will use mobile telephones than use fixed telephone lines. Businesses that are based on mobile financial serviced will thus be a natural fit for these economies. What is more, there is no need to wait for the next generation mobile networks; these businesses can be built using today’s technology. But to capture this significant opportunity, financial firms and telecommunications companies will have to partnerships with one another and, possibly, with merchants and retail chains as well. Dutch-Bangla Bank is pioneer of Mobile Banking in Bangladesh and it has a lot of possibility to reach customers door as well as banking in the hand of customers.