EXECUTIVE SUMMARY

National Credit and Commerce Bank Ltd. (NCCBL) is a Public Limited Company incorporated in Bangladesh under company Act. 1994. It is also guided by the Bank Company Act. 1991 (and its subsequent amendment) and Bangladesh Bank Ordinance 1972, so as to enable the company for doing banking business.

I have worked all the key major departments of this bank. General Banking Department plays a vital role in facilitation of the country.

General Banking comprises of account opening, bills, remittance, clearing, cash and computer sections. Through these it establishes Banker Consumer relationship, collects bills for customers, remit funds of customers from one place to another, and honor Cheque drawn on this branch. General banking department provides these services in a faster and better manner.

Bank investments are greatly emphasized and we all know that this is the ‘Heart’ of the bank because they are a major source of bank’s income. They are very important to the economy as a whole because the expansion and condition of the bank investment affect the level of business activity through their effect on the nation’s money supply. The bank extended its Investment facilities to different sectors to diversity its Investment portfolio in compliance with credit policies of Bangladesh Bank. Investment Department plays a vital role in augmenting the bank’s growth and earnings. It provides different types of Investment facilities too its customers like Secured Over Draft, Cash Credit, House Building Loan, Trust Receipt (TR), Inland Bill Purchase (IBP), Foreign Bill Purchase etc. To give security to the banks funds, Investment section takes various documents like DP notes, Letter of Lien, Registered Mortgage of Collateral Security etc.

Background of the work study:

Achievement of high economic growth is the basic principles of present economic policy. In achieving the objectives the banking sector places an important role. The banking sector channel resources through deposit mobilization and providing credit for different business venture. The successful running of a bank business depends upon how effective the credit management is & how bank recovers the funds. NCCBL as a new commercial bank in Bangladesh responsibility bestows upon it to ensure efficient and effective operation and sound manner. The main objectives of NCCBL are

v To ensure the safety of depositor and give them different types of credit facilities, consumer credit is one of its kinds of credit facilities which help limited income people to buy any house hold effects including car, computer and other consumers durable.

v Credit management is mainly concerned with the credit disbursement and recovery in order to strength credit management and recovery position of the loans/advances by a bank it has been decided by NCCBL to follow some tools and technique for credit appraisal. With the use of such tools NCCBL credit management has shown there efficiency.

NCCBL is always ready to mention the highest quality of services by upgrading banking technology prudence in manage and by applying high standing of business ethics through its established commitment and heritage objective of a private intuition like NCCBL is to maximize profit through optimum utilization of resources by providing best customer service.

Objective of the study:

The main objective of the study is to know the overall operational performance of National Credit and Commerce Bank Ltd, through different aspects of the banking sector and its effectiveness in this regard:

The specific objectives of the study are given below:

¨ To gather comprehensive knowledge on overall banking functions of NCCBL.

¨ To trace origin of the NCCBL.

¨ To identify the weakness and problem in successful/effective credit management system.

¨ To analyze the disbursement and recovery performance of loans and advances.

¨ To understand the need and objective of credit management.

¨ To have and idea of the existing systems of loan and advances innovated and practiced by the NCCBL.

¨ To explain the meaning and concept of credit management.

¨ To acquire in depth knowledge on about NCCBL credit management.

Scope of the study

This report covers NCCBL’s organizational over view, management & organizational structure, functions performed by NCCBL. Its also covers over view of the credit Division, identification of problems regarding credit extended & sector of credit allocation of NCCBL MIRPUR BRANCH.

Methodology Of the report:

The study requires various types of information past and present policies, procedures and methods of credit management. Both primary and secondary data available have been used in preparing this report.

Sources of data:

- 1. primary sources:

Þ Discussion with officials of NCCBL.

Þ Expert’s opinions comments.

- 2. secondary sources:

Þ Relevant books, newspapers, journals etc.

Þ Monthly reports.

Þ Published documents.

Þ Office circular.

Þ Other published papers, documents and reports.

And carefully developed, disguised queries, trend and growth rate analysis, ratio analysis, graphical presentation such as pie chart, bar, graph processed, edited for the purpose of the study.

Limitation of the study:

I have obtained whole-hearted co-operation from the employee of NCCBL Elephant Road branch and head in Dhaka. All the day they were extremely busy, but they gave me much time to make this report properly. I have faced the following problem which may be termed as the limitation/shortcoming of the study. These are:

- Short time period: The first obstruct is time itself. Due to the time limit, the scope and damnation of the study has been curtailed. For an analytical purpose adequate time is required. But I was no given adequate time to prepare such as in depth study.

- No availability of adequate data: To understand the facts about the study in a realistic way and more clearly the quantitative expression of information is represented by data. It was very difficult to collect data, which is very essential, because of the branch of NCCBL was newly established that’s why I could not provide necessary secondary data in all area of the study.

- Lack of records: Sufficient books, publications, fats and figures are not available. This constrict narrowed the scope of accurate analysis if this limitations were not been there, the report would have been more useful and attractive.

- Poor library facility: Most of the commercial bank has its own modern, rich and wealthy collection of huge and various types of banking related books, journals, magazines, papers, case studies, term papers, assignment etc. but the library of NCCBL is not well ornamented.

- Lesser experience: Experience makes a man efficient; I do such kind of research activity for the first time. That’s why inexperience creates obstacle to follow the systematic and logical research methodology.

Background & History:

Banking system occupies an important place in a nation’s economy. A banking institution is indispensable in a modern society. It plays a pivotal role in the economic development of a country. Against the background of liberalization of economic policies in Bangladesh, NCCBL emerged as a new commercial bank to provide efficient banking service with a view to improving the socio-economic development of a country.

National Credit and Commerce bank Ltd(NCCBL) started its operation in 25th November 1985 as a non banking financial institution under the name of National Credit Ltd(NCL).26 businessman sponsored it as a public limited company under the companies Act 1913 with an authorized capital of taka 300 million. NCC bank was incorporated as a banking company under the companies Act 1994. In end 2001 it had 30 branches all over Bangladesh. Its carries out all its banking activities through these branches among which 17 branches are authorized dealer of foreign exchange. The bank is listed in the Dhaka and Chittagong stock exchange as a private quoted company for its general class if shares. The authorized capital of the bank is now taka 2500 million. The bank raised its paid up capital from taka 607.81 million during the year 2004 to taka 975.04 million during the year 2005 through IPO of which sponsor directors/stockholders equity stood at taka 1859 million. With the increase of paid up capital to taka 975.04 million, the capital base of the bank has become strong. NCC bank is now positioned to best suit the financial needs of its customers and make them partners of progress.

Management Structure of NCCBL:

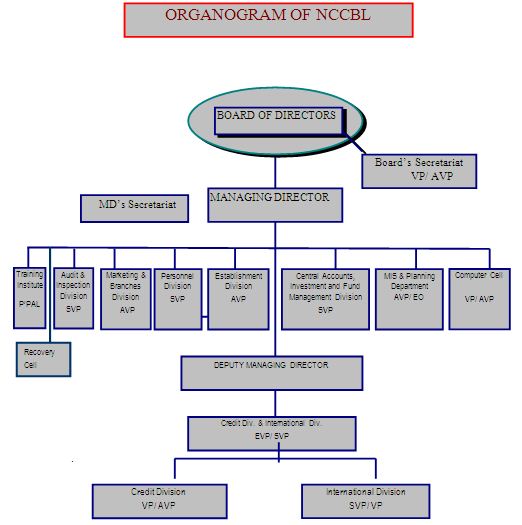

Management of NCCBL is professional and experienced. Top management and policy formulation of the bank is vested on the board of Directors. The boars of directors consist if 26 members headed by chairman. Most of the directors are owners of the large business group having high net worth. The executives and officers of the bank execute the policies and programs formulated by the board. The managing director is the chief executive of the bank and he is assisted and supported by other qualified executives like Senior Executive vice-President, Executive vice president (EVP), Vice President (VP), senior assistant Vice president and other officers and staffs. There are nine divisions in this Bank and one training institute.

Organizational Chart of National Credit & Commerce Bank Ltd

Vision:

To be in the forefront of national development by providing all the customers inspiration strength, dependable support and the most comprehensive range of business solutions, through our team of professionals who work passionately to be outstanding in everything we do.

Mission Statement of NCCBL:

➢ To assist in bringing high quality service to their customers and to participate in the growth and expansion of our national economy.

➢ To set high standards of integrity and bring total satisfaction to their clients, shareholders and employees.

➢ To become the most sought after bank in the country, rendering technology driven innovative services by their dedicated team of professionals.

Corporate Objectives:

NCCBL’s objectives are reflected in the following areas:

➢ Highly personalized services.

➢ Customer driven focus.

➢ Total commitment to quality.

➢ Contribution in the economy.

➢ Quality of human resources.

➢ Commitment to its clients at each level.

The company believes that communication with, and feedbacks from its clients help it achieves its goal of providing world-class product and services. NCCBL regularly conducts client satisfaction surveys and make immediate accommodations and adjustments where needed. It also constantly monitors its standards, and strives to meet client’s requirements.

Products and services:

Since the commencement of banking operation; National Credit and Commerce bank Ltd(NCCBL) has not yet only gained enormous popularity but also in successful in mobilizing deposit and loan products. The bank has made significant progress within a very short time period due to its dynamic management and introduction of various customer friendly loan and deposit products. There have also had other departments that can be termed as support and these are operations, credit administration, financial control and Human Resource.

All the products and services offered by the bank can be classified under three major heads:

Personal Banking

Deposit schemes:

n Savings Account.

n Current deposit Account.

n Locker Service.

n Fixed Deposit Receipt.

n Bearer Certificate of Deposit.

n Short Term Deposit.

Credit & loans:

n Consumer credit Scheme

Education Credit Scheme

Multipurpose loan

Loan General

n Education Credit Scheme

n Multipurpose loan

n Loan General

Foreign Currency Account:

n Resident Foreign currency Account.

n Non-Resident Foreign currency Account.

Corporate Banking

Small and Medium Business:

n Cash Credit Hypothecation (CC Hypo)

n Cash Credit Pledge(CC Pledge)

n Secured Overdraft.

n SOD against Work Orders.

Large Business

n Short Term Industrial Loan

n Mid Term Industrial Loan

n Long Term Industrial Loan

n Transport Loan

n CommercialHouseBuilding Loan

Foreign Trade

: National Credit and Commerce bank Ltd (NCCBL) provide solutions in the field of international business and trade finance.

n Letter of Credit(L/C)

n Back To Back letter of Credit(BTB)

n Loan Against Trust Receipt(LTR)

n loan Against Imported Merchandise(LIM)

n Packing Cash Credit(PCC)

n Export Development Fund(EDF)

n Payment Against Document(PAD)

n Bank Guarantee

Lease Financing:

An entrepreneur, under this scheme, may avail of the lease facilities to procure industrial machinery (without having to purchase it by down payment) with easy repayment schedule. The clients also get special rebate in their income tax payment under the scheme.

Islami Banking:

Some of the branch of NCC bank open profit loss sharing term/savings deposit amounts and also allow loans on Mudaraba, Musharaka, Murabaha system. Attractive profit is given at the end of the year after deducting the banks service fee through proper accounting.

Financial products:

Financial products of the National Credit and Commerce Bank Limited (NCCBL) are mainly in three different categories:

These are:

n Short term financing products

n Mid term financing products.

n Long term financing products.

Above categories of financing covers the following areas, which are draft with at general Credit Division.

n Agricultural sector.

n Large and medium term loan.

n Working capital financing in industrial units including small industries.

n Commercial Credit scheme and any other new product as and when launched for.

n Term loan in small industries

n Term loan in small industries.

n Term loan in commercial house building at urban area & transport loan.

n Commercial loan.

Micro Credit Financing:

To fulfill its commitment to play a vital role to its socio-economic development of the country NCC bank Ltd has introduce a small and medium scale credit scheme for its customers. The objective of the scheme is:

n To encourage and develop medium and small entrepreneurs.

n To provide credit with minimum complexity.

n To generate employment.

This scheme covers agricultural sector, small and cottage industry, service industry, household durable and consumer credit, information technology sector and energy sector. The amount of small and medium credit range from 5 Lac to 50 lacks.

Special services:

Consistent with the modern age and competing in a perfectly competitive market. The National Credit and Commerce Bank Ltd (NCCBL) have introduced some innovative banking services that are remarkable in a country like Bangladesh. T services offered by the bank are as follows:

ATM service:

The bank has joined the shared ATM network Bangladesh with a pool of 7 banks. The client of any member bank will have access to any ATM situated at different location of Dhaka city. This banks client will get 24 hours cash withdrawal and utility bills payment facility. 16 ATMs will be installed gradually in Dhaka city and the network will be extended to other cities if the country in the near future.

Credit Card:

To provide best possible customer services to its clients, the bank is going to launch Master Credit card shortly.

Money Grams:

Money Gram is one of the innovative products of the bank. This has been functioning satisfactory and rendering prompt and efficient services to the wage earners.

Swift:

The bank has become a member of SWIFT and is providing a fast and accurate communication network for financial transactions to their valued clients through uninterrupted connectivity with thousands of users institutions in 150 countries around the world.

Deposit Section

In fact, a bank operates with the people’s money. The banking activity of a person starts with the opening of an account. NCCBL generally gives facility to open the following accounts:

n Current Deposit (CD)

n Savings Deposit (SB)

n Short Term Deposit (STD)

n Fixed Deposit (FDR)

n Bearer Certificate of Deposit (BCD)

Different Deposit of NCCBL

a) Current Deposit Account:

NCCBL opens current accounts for its clients to facilitate their day-to-day operations. The amount deposited in the current account can be withdrawn at any time. No interest is given on the current account. In certain cases, however, interest is available at an agreed rate where withdrawals are subject to a written notice for a specified period. The minimum balance requirement for this account is TK. 1000/- and TK.250/-is deducted from the account in case of closing the current account.

b) Savings Account:

The bank provides savings account services for the ease of its clients. It offers both personal and corporate Savings account to its clients in every branch. The current rate on the deposit amount is 6% and the minimum balance requirement is TK.5000/-. The bank requires no other service charge for this account is TK.250/-.

c) Short Term Deposit (STD):

According to characteristics, short-term deposit is similar to current deposit except interest. Though it is C/D account but bearing some interest. Currently this interest rate is 5.50%.

Rules and Regulation for opening Short Term Deposit (STD) Account:

STD account rules and regulation are just like current deposit account except following rules

STD Account Holder enjoys interest by following cases:

| Account Holder Type | Amount (Daily) | Interest Rate |

| Collection account of DESCO, TNT | Above TK. 10.00 Lac | 4.5% |

| Other type of Customer | Above TK. 1.00 Lac | 4.5% |

d) Fixed Deposit:

Fixed Deposit is very much important for its contribution to the bank’s deposit creation process, because the highest amount of Bank fund from its direct customers comes in the form of Fixed Deposit. For increasing the deposit base every commercial bank offers its customers various rates according to the amount of deposit. NCCBL also offers its valuable customers some significant rates for different amounts. Those are:

Table

| Fixed Deposit/Bearer Certificate of Deposit for 1 Months 9.50%

Fixed Deposit/Bearer Certificate of Deposit for 3 Months 10.00%

Fixed Deposit/Bearer Certificate of Deposit for 6 Months 10.25%

Fixed Deposit/Bearer Certificate of Deposit for 1 Year 10.50%

Fixed Deposit for 3 Year and above 10.50% |

e) Bearer Certificate of Deposit:

It is an instrument of deposit, where depositors name and address is not mentioned; only a receipt number is there. Just two of three years ago Government of Bangladesh ruled in this type of deposit. They are discouraging about bearer certificate of deposit. As a result bearer certificate of deposit of every bank is declining. Some amount of bearer certificate of deposit is keeping by the banks, which are not yet matured.

f) Sundry Deposit:

It is a non-interest bearing deposit. Any sort of non-interest bearing deposit is good for the institution. Though it is a liability, but bank doesn’t pay any interest against this deposit. So the sundry deposit of any bank’s increase that will be a good part for the concern bank.

Rates of Different Deposit A/C of NCCBL

Table:

| SL | Particulars | Interest Rate P.A. |

| 01 | Saving Deposit | 6% |

| 02 | Short Term Deposit | 4.5% |

| 03 | Fixed Deposit

a) Fixed Deposit/Bearer Certificate of Deposit for 1 Months b) Fixed Deposit/Bearer Certificate of Deposit for 3 Months c) Fixed Deposit/Bearer Certificate of Deposit for 6 Months d) Fixed Deposit/Bearer Certificate of Deposit for 1 Year e) Fixed Deposit for 3 year above | |

| 9.50% | ||

| 10.00% | ||

| 10.25% | ||

| 10.50% | ||

| 10.50% |

Necessary papers/documents for opening of an account:

Individual/Joint Account:

For any individual/joint account the-following papers/documents are required:

a) Two copies of photograph of the account holder(s) who will operate A/C.

b) Introducer-attested by current/savings account holder.

c) Service paper photocopy or Nationality certificate by commissioner or photocopy of Passport.

If the account is a joint account, then the joint account holder submit a declaration and operational instruction of the account along with their signature. The declaration is

“Any balance to the credit of the account is and shall be owned by us as joint depositors. Any liability whatsoever incurred in respect of this account shall be joint and several.”

Proprietorship Firm

The following documents have to be submitted for preparing an account of a Proprietorship firm:

a) Name of the firm.

b) Name of the proprietor.

c) Copy of Trade License.

d) Shell of Proprietorship firm.

Partnership Firm

The following documents have to be submitted for preparing an account of a partnership firm:

a) Partnership deed.

(1) If the partnership firm is a registered one, then one copy of registration forms.

(2) If not, then a copy of certificate from the notary public.

b) Certified copy of valid trade license.

c) Trade seal.

d) Partnership account agreement (Draft enclosed)

Limited Company:

For the opening of an account of a limited company, following documents have to be submitted:

a) A copy of resolution of the company that the company decided to open an account in the NCCBL.

b) Certified true copy of the Memorandum & Articles of Association of the Company.

c) Certificate of Incorporation of the company for inspection and return along with a duly certified Photocopy for Bank’s records.

d) Certificate from the Register of Joint Stock Companies that the company is entitled to commence business (in case of Public Ltd. C for inspection and return) along with a duly certified Photocopy for Bank’s records.

e) Latest copy of balance sheet.

f) Extract of Resolution of the Board / General Meeting of the company for opening the account and authorization for its operation duly certified by the Chairman / Managing director of the company.

g) List of Directors with address (a latest certified copy of Form-12).

Cooperative Society:

Following documents have to be obtained in case of the account of Cooperative Society:

a) Copy of Byelaw duly certified by the Co-operative Officer.

b) Up to date list of office bearers.

c) Resolution of the Executive Committee as regard of the account.

d) Certified copy of Certificate of registration issued by the registrar, Co-operative societies.

The Cash Counter Section

We know that Bank is the Dealer of Money; it receives money and pay money. Where cash counter should be the heart of any commercial bank’s branch office as it receives and pay cash every moment at its working time. Cash Counter also does a very important work by managing the Bank’s flow of Fund. All the money of any Bank Business enters & exits through the cash counter. This section is the major part of Bank that words as the customer service oriented section. The efficiency of this section of a Bank crates the good image of that Bank to the all type of customers. If the officials can serves at once the customer than it proves the strong human resources of that Bank and increases customer satisfactions, which improve the overall position of that Bank in the market. It must be mentioned that NCCBL has a very strong group of employees, especially in the elephant road Branch, Whom all the time serves the customers satisfactorily. Generally followings are some tasks done by the cash counter of Prime Bank:

- Cash Receive

- Cash Payment

- Receiving Current Bill, TNT& AkTEL Bill

- Working as Agent at the time of issuing IPO of different companies.

- Fund Management by maintaining sufficient amount of cash each day. Because if the amount of cash receives of any day is more than that of estimated, the bank has to pay mere to the Insurance Company as premium of that excess amount. On the other hand if for any reason the amount of cash is less than the estimated amount, the Bank can’t satisfy the customers’ demand.

- Payment of ATM cards.

- Payment of Money Gram.

- Payment of Express Money.

The Account Department:

This is the mist confidential department of a bank. Recording all kinds of transactions of the branch, confirming their accuracy and preparing statements are the main job of this department. Now a day under computerized banking system, the jobs of accounts department become very easy. Now the computer directly prepares the clean cash statement on party ledger vouchers. The function of the accounts department can be divided into two parts:

a) Daily function

b) Periodical functions

Daily functions:

- The routine daily tasks of the accounts departments are as follows:

- Record the daily transactions in the cash book.

- Record the daily transactions in general and subsidiary ledger.

- Prepare the daily position of the branch comprising of deposit and cash.

- Prepare the daily statement of affairs showing at the assets and liability of the branch as per ledger and subsidiary ledger separately.

- Pay all expenditure on behalf of the branch.

- Make salary statement and pay salary.

- Checking whether all the vouchers are correctly passed to ensure the conformity with the ‘Activity Report’; if otherwise making it correct by calling the respective official to rectify the voucher.

- Records inter branch fund transfer and providing accounting treatment in this regard.

Periodical Tasks:

- The routine periodical tasked performed by the department are as follows:

- Prepare the monthly salary statements for the employees. Publish the basic data of the branch.

- Prepare the weekly position for the branch, which is sent to the Head Office to maintain Cash Reserve Requirement.

- Prepare the monthly position for the branch, which is sent to the Head Office to maintain liquidity requirement.

- Prepare the weekly position for the branch comprising of the break up of sector-wise deposit, credit etc.

- Prepare the weekly position for the branch comprising of the denomination wise statement of cash in tills.

- Preparing the budget for the branch by fixing the target regarding profit and deposit so as to take necessary steps to generate and mobilize deposit.

Cheque Clearing Section:

In Clearing Section cheque, dividend warrants and other forms of financial instruments, which are easy for encashment, are received. The clearing department sends these instruments to the Clearing House of the Bangladesh Bank for collection. As soon as cash is received the amount is deposited in the client’s account. Collection of cheques, drafts etc. on behalf of its customers in one behalf of its customers in one behalf of its customers in one of basic function of a commercial Bank. Clearing stands for mutual settlement of claims made in between member banks at an agreed time and place in respect of instruments drawn on each other. Negotiable instrument Law provides protection to a banker who collects a cheque or a draft if the banker fulfills the following conditions:

- He collects the instrument for customer

- The instrument be crossed

- The banker acts in good faith and without negligence

Types of Clearing:

- Outward clearing: Outward clearing means when a particular branch receive instruments drawn on the other bank within the clearing zone and those instruments for collection through the clearing arrangement is considered as outward clearing for that particular branch.

- Inward Clearing: The bank provides the instruments to other banks through Clearing House which have been collected from different clients. It performs this king of service for its clients without requiring any charge or the remittance.

OBC (Outward Bill Collection)

If a party gives a check to a branch of NCCBL to collect money from a branch of another bank which is not situated in the clearing house then the NCCBL collect money through OBC. In case of OBC two ways exist to collect money from another bank.

- In the first way, the receiving branch of NCCBL send the check with forwarding letter to the branch of another bank which name are included in the check. After receiving the check that branch of the bank send a D.D. to another branch of their bank which are situated in the same clearing house of payee’s branch of NCCBL. After that they issue pay order to the name of payee’s branch name and send the check to the clearing house and NCCBL collect this check through clearing house and credit the payee’s account.

- In the second way, NCCBL, payee’s branch sent the check to another branch of NCCBL which are situated in the same area of another bank’s branch (which name are included in the check). Then the receiving branch of NCCBL collect the amount of check through outward clearing by clearing house of those areas and issue a credit advise to the payees’ branch. After that, payee’s branch credits the payee’s account.

Local Remittance Department

Remittance is significant part of the general Banking. The Bank receives and transfers various types of bills trough the remittance within the country. Obviously the bank charges commission on the basis on the basis of bills amount. NCCBL remittance is safe, swift inexpensive and simple.

Types of Remittance

a) PO (Pay Order)

b) DD (Demand Draft)

c) TT (Telegraphic Transfer)

d) MT (Mail Transfer)

e) SP (Shanchaypotra)

Pay Order:

Pay order is an instrument that contains an order for payment to the payee only in case of local payment whether on behalf of the bank or its constitution. Unlike check there is no possibility of dishonoring pay order. NCCBL charges different amount of commission on the basis of play order amount.

DD (Demand Draft)

By DD any person can send money from one branch to another branch of NCC bank. To send the money he/she must fill up the NCCBL’s prescribed from of DD and paid charge commission and receive DD block. The following information is included in the DD Block:

- Name of the sender Branch

- Name and account of the party who receive the money

- For security purpose a confidential test number are included in the DD Block.

- Amount of money to be transferred.

- Name of receiver Branch

The senders send this block to the Receiver branch of DD. When this DD Block receive by the receiver branch. The authorized officer of the receiver branch tests the DD confidential number and if the test is proved then he/she give the money to the payee.

TT (Telegraphic Transfer)

- To send money urgently NCCBL may be requested for TT on payment of a nominal charge and telegram charges.

- Any person urgently sends money from one branch to another branch within NCCBL through TT.

- When a message of IT send through phone from one branch to another branch in that time the message received by the authorized officer who has a right of power of Attorney. After that, He/she fill up the IT form. Following things are included in the T.T from:

- T.T

- T.T. test number

- Name and Account number of the payee

- Power of attorney number of the sender and receiver of T.T

- The amount to be transferred.

- After fill up of T.T form he tests the Test number of T.T. If he/she ensured through testing the test number then he credit the account of the payee. On the other hand, if the Test number is not proved then he/she callback to the sending branch of T.T. and request to send a new T.T.

MT (Mail Transfer)

Money can be sent through mail transfers to any body who has an account in any other branch of the same bank for this purpose the sender shall have to furnish details like

- The name of the beneficiary and his/her account number

- The amount to be transferred

- The name of the branch where the account is maintained.

Credit Policy Guidelines

The guidelines contained herein are NCC Bank’s general Principals that are designed for implementation by bank. The investment proposal should be forwarded to Head Office for sanction with recommendation showing justification that should include the following:

A. Industry and Business Focus

The Bank shall provide suitable Investment services & products for the following sectors, which must meet the other requisites as set by the Bank from time to time.

| Sectors | |

| Steel & Engineering | Cement |

| Food & Allied | Bricks Fields |

| Agriculture | Edible Oil |

| Textile & Garments | Assembling Industry |

| Pharmaceuticals &Chemicals | Cottage Industry |

| Paper & Paper Products | Electronics & Electrical Commodities |

| Service industries | Construction Company |

| Housing & Real Estate | Trading (Retail/Whole Sale) Others. |

Every year at the time of investment budgeting a clear indication of Bank’s appetite for growth to be reflected. Approved investment budget shall be strictly followed for the development of the Bank.

B. Credit Categories

As initiated by Bangladesh Vide BCD circular No. 33 dated 16-11-89 different kinds of lending were subdivided into 11 categories w.e.f 01-01-90, which was subsequently reduced to 9 vide BCD circular No.23 dated 09-10-93 and again to 7 prime sectors vide BCD Circular No. 8 Dated 25-04-94 for fixation for rates of profit by the individual banks of competitive basis depending of the cost of Funds, prevailing market condition and monetary policy of the country. Loans have primarily been divided into two groups

a) Term Loan:

These are the loans made by the Bank with fixed repayment schedules. The term of investment are defined as follows:

Short Term : Up to 12 months

Medium Term: More than 12 and up to 36 months

Long term : More than 36 months

b) Continuing Loans:

These are the loans and advances having no fixed repayment schedule, but have an expiry date at which it is renewable on satisfactory performance.

Type of Loans and Advances

Depending on the various nature of financing, all the lending activities have been brought under the following major heads:

- SOD (FO)

Advance is granted to a client against financial obligations. The security of advance is granted to the person to whom the instrument belongs. The discharged instrument is surrendered to the bank along with a letter signed by holder/holders. The bank’s lien is prominently noted on the face of the instrument under the signature of an authorized bank official.

Interest rate is 14% to 16%.

- SOD (G)

Granted against the work order of government departments, corporation’s autonomous bodies and reported multinational private organization. To arrive at logical decision, the client’s managerial capability, equity strength, nature of scheduled work is to be judged. Disbursement is made after completion of documentation formalities, besides usual charge, documents like a notarized irrevocable power of attorney to collect the bills from the concerned authority and a letter from the concerned authority confirming direct payment to the bank is also obtained. The work is strictly monitored to review the progress at each interval.

Interest rate is 14% to 16%

- Cash Credit (Hypothecation)

The mortgage of movable property for securing loan is called hypothecation.

Hypothecation is a legal transaction where by goods are made available to the lending banker as security for a debt without transferring either the property in the goods or either possessing. The banker has only equitable charge on stocks, which practically means nothing. Since the goods always remain in the physical possession of the borrower, there is much risk to the bank. So, it is granted to parties of undoubted means with highest integrity. Interest rate is 16%

- Cash Credit (Pledge)

Transfer of possession in the judicial sense of essential in the valid pledge. In case of pledge, the bank acquire the possession of the goods or a right to hold goods until the repayment for credit with a special right to sell after due notice to the borrower in the event of non repayment. Interest rate is 16%

- Consumer Credit Scheme

This scheme is aimed to attract consumers from the middle and upper middle class population with limited income. The borrower should have saving of current deposit account with the bank. Minimum 25% of the purchase cost of the product is to be deposited be the borrower with the bank is equity before the disbursement of the loan. The rest 75% is to be kept as cash collateral (FDR, Shanchay patra etc.) with the bank. The purchased items are hypothecated with the bank. The disbursement of the loan is by debiting loan (general) account to the opened in the same of the borrower. Loan amount is disbursed through a/c payee pay order/ demand draft directly to the seller after submission of the indent, deposit of client equity and completion of documentation formalities. The bank obtains post dated a/c payee cheques drawn in favor of the bank for the monthly installments covering the lending period from the borrower and the loan amount is adjusted on the due date of installments.

- Loan (general)

NCCBL considers the loans, which are sanctioned for more than one year as loan (g). Under this facility, an enterprise of financed from the stating to its finishing, i.e. from installment to its production. NCCBL offers this facility only to big industries.

- Working Credit

Loans allowed to the manufacturing unit to meet their working capital requirement, irrespective of their size big, medium or large fall under the category.

- Staff Loan

Bank official from senior officer and above is eligible for this loan. The maximum amount disbursed is TK. 50000/- for a period of 2 years.

- House Building Loan

This loan is provided against 100% cash collateral, besides; the land & building are also mortgaged with the bank.

Interest rate is 17% p.a.

- Small Loan Scheme

NCCBL introduced three new small loan scheme are:

a) House Renovation Loan

b) Personal Loan

c) Small Business Loan

a) House Repairing/Renovation Loan Scheme

This loan is offered for renovation and modernization of the house/building/flat which are acquired by inheritably or purchasing and other ways to make the properties liable and durable. Interest rate is 16%

b) Personal Loan for Salaried Person

This loan is provided to fixed salaried persons in various organizations to meet any emergency cash needs at various events- treatment/operations of critical disease, matrimonial, maternity expenditure etc.

Interest rate is 17% p0a0 and maximum credit ceiling is TK. 100000/-

c) Small Business Loan Scheme

This loan is offered to the small and promising entrepreneurs to meet their capital requirement and enable then to operate and expand the business purposely.

Maximum credit ceiling is TK 5.00 lac with interest is 16% p.a

- Loan against imported Merchandise (LIM)

Advance allowed for retirement of shipping documents and release of goods imported through L/C taking effective control over the goods by pledge fall under this type of advance, when the importer failed to pay the amount payable to the exporter against import LIC, than NCCBL gives loan against imported merchandise to the importer. The importer will bear all the expenses i.e. the godown charge, insurance fees, etc. and the ownership of the goods is retaining to the bank. This is also a temporary advance connected with import, which is known as post import finance. Interest rate is 16%

- Loan against Trust Receipt (LTR)

Investment allowed for retirement of shipping documents and release of goods imported through L/C fall under this heard. The goods are handed over to the importer under trust with the arrangement that sale proceeds should be deposited to liquidate the investments within a given period. These are also a temporary investment connected with import and know as post-import finance and falls under the category “Commercial Lending”. Interest rate is 16%

- Loan against Other Securities (LAOS)

Loan against other securities is a 100% secured advance, which requires no sanction from the Head Officer. It is sanctioned by marketing of FDR, TCB Unlit Certificate.

Interest rate is 16%

- Heir Purchase

Heir Purchase is a type of installment investment under which the Purchaser agrees to taka the goods on hire at a stated rental, which is inclusive of the repayment of principal as well as profit for adjustment of the investment within a specified period.

- Inland Bill Purchase (IBP)

Payment made through purchase of inland bills/cheques to meet urgent requirement of the customer falls under this type of investment facility. This temporary investment is adjustable from the proceeds of bills/cheques purchased for collection. It fails under the category “Commercial Landing”

- Foreign Bill Purchase (FBP)

Payment made to customer through Purchase of Foreign Currency Cheques/Drafts fall under this head. This temporary investment is adjustable from the proceeds of the cheque/draft

Credit Management:

Credit Management is an art which has been practiced since the earliest days of civilization. Its techniques have been constantly changed according to the needs of the business community.

The purpose of credit management is to examine the role of the credit manager, to look at his relationship with the company, in particular the sales & credit relationship and to consider the organization of the credit department.

The principle tasks of the credit manager:

- Assessment of credit standing of both new & existing customer.

- Maintenance of the sales ledger

- Establishment of terms, having regard to the risk involved & the potential profit.

- Monitoring & control of customer balances.

- Collection of payment as close to terms as possible without jeopardizing future business.

Credit Administration

The department shall be headed by one Manager, Credit Administration and shall report direct to the CEO/MD. The prime function shall be to plan, organize, direct, control and review the operational and administrative functions of credit administration department to ensure efficient and effective support to the related banking departments in line with regulatory and Bank requirements while exercising appropriate control and independent judgment. The Credit Administration function is critical in ensuring that proper documentation and approvals are in place prior to the disbursement of Joan facilities the responsibility of providing administrative support for the lending activities of the bank, day-to-day monitoring of credit exposures, is vested with the Credit Administration Department (CAD)

The primary objectives of establishing a separate Independent CAD is to monitor the bank’s lending activity and to ensure:

A- Disbursement & Documentations

- To ensure standard Loan documents have been prepared in accordance with approval terms and are legally enforceable. If documentations requirements are different from the Bank’s standard approved format, vetting from Legal counsel shall be arranged.

- Disbursements under loan facilities are only be made when all security documentation is in place. CIB report is available and reflects/include the name of all the lenders with facility, limit & outstanding. All formalities regarding large loans & loans to Directors shall be guided by Bangladesh Bank circulars & related section of Banking Companies Act.

- A documentation and disbursement checklist is attached at Annexure-D. Credit Administration Department shall check the Collateral and on having satisfied about the Security documentation Relationship Manager & Credit Administration Department shall jointly sign the compliance of security documentation formalities before disbursement Credit Administration Department shall also issue a Satisfactory Security Certificate/Clearance Certificate before disbursement.

Credit administration shall ensure that all disbursement is per disbursement policy, covered within approved Credit lines and evidence of disbursement is documented.

Exception

Minor incomplete documentations may receive a Temporary Waiver with the prior consent of Approval Authority.

Excess over Limit may be allowed under Pre Fact Credit approvals only:

B-Custodial Duties

- Business Units and Head Office C edit Division shall keep credit files under proper control and use shall be restricted to the authorized personnel only.

- Two custodians and their alternates shall be clearly outlined in writing with regard to security documentations.

- Safe-In & Safe-Out register shall be in force to maintain track of their movement. Any Release of Security Documentation shall be only with the prior approval of appropriate authority.

- Appropriate insurance coverage is maintained and renewed in a timely basis against assets pledged as collateral. Necessary authority to pay the related premium from the account holder to be obtained.

- Cash Collateral such as. FDR, Script, Bonds, Marketable Securities and Security documentation are held under strict control in locked fireproof storage.

C-Compliance Requirements

- All required Bangladesh Bank returns are submitted in the correct format in a timely manner.

- Bangladesh Bank circulars/regulations are maintained centrally, and advised to all relevant departments to ensure compliance.

- All third party service providers like Value’s, Lawyers, Insurers, enlisted and performance reviewed on and annual basis. Bangladesh Bank’s circulars in this regard to be adhered to.

Credit Recovery

A Recovery Unit (RU) under CRM Team (Credit Risk Management) shall directly manage accounts with sustained deterioration (i.e. Risk Rating of Sub Standard-6 and downward) in this connection Request for Action and handover Downgrade checklist (G & H shall be completed by

The Marketing Department within fifteen days of the account being downgraded and forwarded to RU.

On receipt of down graded list RU Unit, shall undertake the following:

- Determine Account Action Plan/Recovery Strategy

- Review documentation the customer and prepare a classified Loan Review

- Report at the earliest for approval of the Head Of credit.

- Preparation of Classified Loan review report on periodical basis to up date the status of Action Plan/Recovery Plan.

- Pursue all options to maximize recovery, including placing customers into receivership or liquidation as an appropriate.

- Where required Legal Actions to be initiated.

- Court Cases to be followed up and necessary steps to be taken for early solutions.

- Ensure adequate and timely loan loss provisions based on actual and expected losses.

Recovery Units shall also ensure that the following is carried out when an account in classified as Sub Standard of worse:

- Facilities are withdrawn or repayment is demanded as appropriate. Any drawings or advances is restricted, and only be approved after careful scrutiny and approval from appropriate executives within CRM.

- CIB reporting is updated according to Bangladesh Bank guidelines and the borrower’s Risk Grade is changed as appropriate.

- Loan loss provisions are taken based on Force Sale Value (FSV).

- Loans, requiring rescheduling are done in conjunction with the Rescheduling guidelines of Bangladesh Bank.

- Prompt legal action is taken if the borrower is not cooperative.

The management of problem loans (Non Performing Loans) warrants effective measure for regularization/rehabilitation. NCCBL shall, therefore, prepare strategy that may include constitution of Review Committees or even Task Force Team for early regularization of such NPL. Adequacy of provisions related to such accounts shall be regularly reviewed to ensure preparation to write off is available. In this regard bank shall conspicuously share the lessons learned from the experience of credit losses and take-required measure in the lending guidelines in light of such experience.

NPL Account Management & Monitoring

Considering the negative impact of NPLs on total position of the bank, the task of regularization of such loans shall be assigned to as Account Manager within the RU, who will be responsible for coordinating and administering the action plan/recovery of the account, and shall serve as the primary customer contact after the account, and shall serve as the primary customer contact after the account is downgraded to substandard. Assistance from Corporate Banking/Relationship Management to be provided to allow RU is work as an Autonomous Unit to ensure appropriate recovery strategies for implementation. On a periodical basis, statements for Classified Loan Review (CLR)

(Annexure-1) shall be prepared by the RU Account Manager to update the status of the action/recovery plan, review and assessment of the adequacy of provisions, and modify the bank’s strategy accordingly.

NPL Provisioning and Write Off

For accounts Risk graded at 10 by the Ban and requiring Write Off as per directives of regulating authorities, the guidelines established by Bangladesh Bank in this regard shall be strictly adhered to. Regardless of the length of time a loan is due, provisions should be raised against the actual and expected losses at the time are estimate. The approval to take provisions, write offs, or release of provisions/upgrade of an account shall be restricted to the Head of Credit of MD/CEO based on recommendation from the Recovery Unit. He request for Action (RFA) or CLR reporting format T under enclosed Annexure to be used to recommend provisions, write-offs or release/upgrades.

The RU Account Manager shall determine the Force Sale Value (FSV) for accounts appearing under Classification Shortfall in the Force Sale! Value compared to total loan outstanding to be fully provider by building adequate provision Where the customer in not cooperative, no value should be assigned to the operating cash flow in determining Force Sale Value.

Force Sale Value and provisioning levels shall be updated as and when new information is obtained, but as a minimum on a quarterly basis.

For calculation of Loan Value and subsequent provisioning, Prevailing Bangladesh Bank Guidelines in this regard be followed.

Incentive Program

Bank will have the policy to introduce Incentive Program to encourage the Recovery Unit/Account Manager to bring down the extent of Non Performing Loans Nature of Incentive in this regard shall be made known through appropriate means.

General procedure for investment

The following procedure is applicable for giving advance to the customer. These are:

- Duly fill-up first information sheet

- Application for Investment

- Collecting CIB report from Bangladesh Bank

- Marking Investment proposal

- Project appraisal

- Head office approval

- Sanction letter

- Documentation

- Charges on Securities

Foreign Exchange

Banks play a very vital role in affecting foreign exchange transaction of a country. Mainly transactions with countries are respect of-import; export and foreign remittance come under the purview of foreign exchange transaction. Central bank records all sort of foreign exchange transactions and therefore, transaction affected by the banks other authorized quarters are to be reported regularly to the Bangladesh Bank.

Foreign Exchange refers to the process or mechanism by which the currency of one country is converted into the currency of another country. NCC bank foreign exchange dept. plays a vital role to earn the bank’s maximum profit. The dept is classified according to their activities.

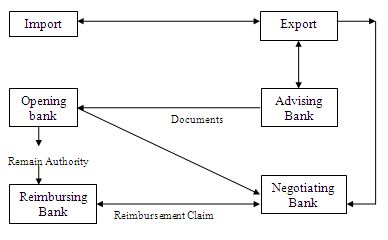

Foreign Trade

The foreign trade of a country refers to its imports & exports of merchandize from & to other countries under control of sale. No country in the world produces all the commodities it requires. On the contrary, a country may produce more of those commodities in the production which it has a greater of comparative advantage & May of May not produce smaller quantities of those in the production of which it has a greater or comparative disadvantage. The commodities which country can economically produce it exports, which those in it has greater disadvantage if imports. Foreign trade constitutes a sizable position of international transaction of a country. Successful companies today are fully aware that they need to be able to rely on the services of bank that can handle foreign trade with a good hand. Ever since its conversion into a full fledged bank in 1993, NCC Bank has been an accomplished Trade Finance Bank. With a highly professional team experienced & competent Professionals we are able to provide wide range of services to companies engaged in foreign Trade.

NCCBL & Foreign Trade Operations:

NCCBL started fully its commercial banking activities on the 17th May, 1993. On the basis of the various services regarding the foreign exchange provided by the NCCBL can be segregated into three board categories.

- Import & Export

- Foreign remittance

- Others

Import & Export

Now a day’s foreign exchange is very important. So long as the role of NCCBL in foreign exchange, issues L/C, negotiates bills, and pays in favor of foreign bank. It is done both interest & commission basis.

Remittance

Remittance is another important sector of the NCCBL from where it earns a lot of foreign exchange every year. Remittance means to send or transfer money or money worth from one place to another. In this case the bank a media to transfer or remit the money. Against the service it charges some commission from the client.

Types of Remittance

Generally the process of remittance can be divided into major categories:

- Inward Remittance

- Outward Remittance

Inward remittance

Inward remittance deals with funds from overseas. The remittance can be performed in two ways:

- Cash remittance deals through TT (Telegraphic Transfer) DD (Demand Draft)

- Remittance due to export.

Outward remittance

Outward remittance id funds remitted to overseas on the behalf of the client. It may be in the following form:

- Telegraphic Transfer (TT)

- Demand Draft (DD)

- Mail Transfer

- Remittance due to import

Functions of Foreign remittance section:

Selling

- Selling of traveler’s cheques to Bangladeshi travelers.

- Selling cash foreign currency in the form of draft and ties to Bangladeshi students for education abroad.

- Selling of foreign currency to Bangladeshi for medical expenses.

- Selling of foreign exchange to non resident stock investor.

Buying

- Buying of International currency from foreigner and Bangladeshi.

- Buying cash foreign currency from foreigner and Bangladeshi.

- Buying of draft from Bangladeshi.

- Buying of foreign currency from FC account of Bangladeshi individual as well as from exporters.

- Buying of foreign currency from non resident investing in shares and stocks of Bangladesh.

Others

Other foreign exchange operation of NCCBL includes FC A/C such as NON resident foreign currency Deposits (NFCD), Non Resident Bangladeshi in Initial Public offer etc. these schemes are only for the non- resident Bangladeshi. These are maintained by the foreign currency. These schemes are very much profitable both for NCCBL and non Resident Bangladeshi.

Money Gram Business of NCCBL

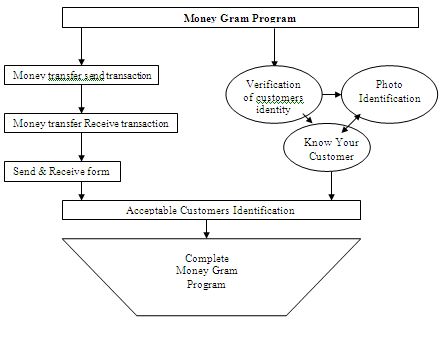

Money Gram

Money Gram, one of the innovative products of the Bank, has been functioning satisfactorily and rendering prompt and efficient services to the wage earners. Money Gram Payment system Inc is a non back provider of electronic money transfer service. Money Gram is providing its customers a service of an unsurpassed quality and superior value. Money Gram has over 25000 Agent locations throughout the world. Persons anywhere require transferring cash quickly, reliably, conveniently and at attractive prices to more than 115 countries can depend Money Gram agents for the service.

NCC Bank makers & inquiry on the Money Gram computer network to obtain authorization to pay recipient & recipient receives the fund.

At NCCBL we provide the recipients immediate attention & due care. We have made it a point to pay for the NCCBL braches at his convenience for payment recipient within minutes. The recipients need not require having a bank account. We do not levy any extra charge. We give a better exchange rate to the recipient.

Money Gram Policies & Procedures

- Record keeping requirements

- Money transfer send transaction

- Money transfer Receive transaction

- Verification of customers identity

- Send & Receive form

- Send transaction approval procedure

- Acceptable Customers Identification

- Photo Identification

- Know Your Customer

Limitations of Money Gram

- People are not more aware about it.

- Many customers illiterate, so they don’t know the procedure.

- Money Gram in this bank can not meet all king of customer need.

- Lack of facility

- Procedure & Service charge are not all time capable for the customer

- There are various illegal money sending facility from abroad & vise versa.

Contribution of foreign exchange business of NCCBL:

The spirit behind foreign trade is nothing but foreign exchange Export Import or Remittance which even the might best is foreign exchange, which has the free access & movement through out all these areas.

The following table presents the contribution of Foreign Business of NCCBL:

| Year | Export | Import | Remittance | Foreign exchange |

| 2003 | 4967.33 | 13089.94 | 1162.10 | 18219.37 |

| 2004 | 5771.65 | 13274.08 | 1969.6 | 21006.68 |

| 2005 | 7776.3 | 16296.30 | 2492.3 | 26564.9 |

| 2006 | 8557 | 17646.8 | 3856 | 30059.8 |

| 2007 | 9577.92 | 28779.21 | 7443.5 | 45800.63 |

Total Foreign Exchange Business of NCCBL from 2003-2007

From above table one thing is very much clear that the foreign exchange operation (including export, import, remittance) of NCCBL increasing day by day.

Export

Export is the process of selling goods and services to the other country. It has an immense contribution to generating income for the bank.

Method of Export Financing

There are two types of credit facilities allowed by the bank to the exporter in relation to export credit.

- Pre Shipment credit.

- Post Shipment credit.

When an exporter intends to ship the goods to an overseas buyer he/she needs fund for purchasing goods to be exported. He/she may also depend upon the bank for arranging credit for the supply of goods.

Post Shipment Finance is more concerned with banks than Pre Shipment Finance. This type of finance starts after the goods have already been shipped.

Function of Export Section:

Export section performs different types of tasks such as:

- Back to back L/C Open.

- Foreign Documentary Bill for Collection (FDBC).

- Foreign Documentary Bill for Purchase (FDBP).

- Local Documentary Bill for Purchase (LDBP).

- Secured Overdraft (SOD) export

- Export Cash Credit (FCC).

- Packing Credit (PC).

- Accepted Bills Payable (ABP).

Export Procedures

A person desirous to export should apply to obtain RD from CCLNE. Then the per son should take step for export purpose into the bank for obtaining EXP form. He/she must submit the following documents:

- Trade License

- ERC

- Certificate form concerned government organization.

After satisfaction on the documents the banker will EXP form the exporter. Now exporter will be getting shipping and documents from the shipment procedure. Exporter should submit all these documents along with letter of indemnity to the bank for negotiation.

Documents of Export

Following major documents are required for export purpose:

- Commercial invoice.

- Bill of lading.

- EXP form.

- Bill of exchange.

- L/C copy.

- Packing list.

- Certificate of Certificate.

- Weight list.

- Quality Control Certificate

- Inspection Certificate

Export View of Last 5 (Five) Years of NCCBL

| Year | Export |

| 2003 | 4967.33 |

| 2004 | 5771.65 |

| 2005 | 7776.30 |

| 2006 | 8557.00 |

| 2007 | 9577.92 |

Import

Foreign Exchange trade is performed under internationally set norms & standards. Import is no exception & all commercial banks serve the importers under those defined norms.

Method of Import financing:

Letter of Credit is most important method of import financing. International trade takes place between sellers & buyers located in different countries. The parties to a trade transaction are not always known to each other. Even if they are known to each other the seller may not have full confidence in the credit worthiness of the buyer of the buyer nay not like to pay before he actually receives the goods. This margin varies to commodities to commodities. According to the Govt. instruction bank does not generally issue the Letter of Credit less than at 50% margin. NCCBL follows this margin prescribed by the Government strictly.

SWOT ANALYSIS

SWOT( Strength, Weakness, Opportunity & Threats) – analysis is an important tool for evaluating the company’s Strength, Weaknesses, Opportunities, and Threats, it helps the organization to identify the how to evaluate its performance and scan the micro environment, which in turn would help the organization to navigate in the turbulent of competition.

- STRENGHT

Innovation- The major strength of NCCBL is product innovation. They have introduced new product every year. Their innovative product creates a positive image. In this year they have introduced the Festival loan for the business man and the salaried person to meet their extra finance during the Festival period i.e. Eid-ul-Fitr, Eid-ul-Azha, Durga Puza that highly appreciated among the customers.

Top Management- The top management of the bank is a key strength for the NCCBL and the contributed heavily towards the growth and development of the bank. The top management officials all have reputed of banking experience, skill and proficiency.

Company Reputation- NCCBL has created a standing in the banking industry of the country chiefly among the new corners. NCCBL ha already established a firm grip in the banking sector having tremendous growth in the profits and deposits within a phase of five years.

Sponsors- NCCBL has been founded by a group of prominent entrepreneur of the country. The sponsor’s directors belongs large industrial conglomerates of the country. The giant name in director’s list is Nurul Islam, owner of Sanawara Corporation, Abdul Halim the owner of Prime Group.

Modern facilities and Online Banking- From the very beginning of the NCC Bank tried to furnish their work surroundings with modern equipment and facilities. For the speedy services to the customer NCC has installed money- counting machine in teller counter. Th bank has already started online banking operation.

String of Branches- From the formative stage NCC tried to furnish their branches by impressive style. These well decorated branches get attention of the potential customers; this is one kind of strategy. The Gulshan branch, Dhanmondi branch is also impressive and is comparable to foreign banks.

Good customer service- Good customer services is another major strength of the NCCBL. They provide a one- stop service. In a highly competitive market the quality of service rendered by the bank to their valued customers is absolutely vital to ensure growth of both deposits loans and advances.

Interactive corporate Culture- The corporate culture of NCC is very much interacting compare to our other local organization. These interactive environments encourage the employees to work attentively. Since the banking job is very much routine work oriented, NCC’s friendly, interactive and also lovely environment boosts up the work capability of the employees.

Alliance in ATM- ATM is the fastest growing modern banking concept. NCC has launched ATM along with seven other contemporary banks jointly which gave the product more acceptability.

- WEAKNESS

Advertising and promotion

Advertising and promotion is the one of the weak point of NCC. NCC does not have any effective truck for aggressive marketing activities. This lacking pushes the bank far behind the form the other competitor. At present only the neon at Shabag is visible.

Disguised Employment

Reference appointment is very much effective in NCC. As a result of this there are many people who are only drawing salaries at end of the month but making a minimum contribution towards the organization. And this is related to the problem of reference appointment. On the other hank there are officers who work hard but are not appreciated accordingly. Those frustrated officers leaving the bank to other bank.

Limitation of Information System (Micro Banker)

Micro Banker is not comprehensive banking software. It is desirable that a more comprehensive banking system should be replaced Micro Banker system.

Limited Network

NCC has limited branches. Now 59 branches are operating over the country. Bank should open their branches in prime locations

- OPPORTUNITY

Diversification

NCC can pursue a diversification strategy in expanding its current line of business. The management can consider can option of starting merchant banking or diversify into leasing and insurance. By expending business portfolio, NCC can shrink business risk.

Credit cards and Tele banking

These are the new retail banking services provided by the foreign banks. NCC can evaluate the option of launching credit cards and Tele Banking system.

- THREATS

Contemporary Banks

The contemporary banks of NCC like Prime Bank, Dhaka Bank and Southeast Bank are its major rivals. They are carrying out aggressive campaign to attract lucrative corporate clients as well as big time depositor. NCC should remain vigilant about the steps taken by these banks, as this will in turn affect NCC strategies.

Multinational Bank

The rapid expansion of multinational bank poses a potential threat to the PCB’s. Due to the booming energy sector more foreign banks are expected to operate in Bangladesh. Moreover the already existing foreign bank’s such as Standard Chartered and CITI NA are new pursing an aggressive branch expansion strategy. Since the foreign bank has tremendous financial strength, it will pose a threat to local banks to a certain extent in terms of grabbing the lucrative clients.

Upcoming Banks

The upcoming local private banks can also pose threats to the PCB’s. The govt. has planned to permit new banks. It is expected that in the next few years more local private banks may emerge. If that happens the intensity of competition will rise further and banks will have to develop strategies to compete against foreign banks.

Default Culture

Default culture is very much familiar to our country. For a bank is very harmful NCC has not faced seriously yet. However the bank grows older it may be ill with this situation.

Major Finding

While working at NCC Bank Ltd. Elephant Road Branch, I have attained to a newer kind of experience. After the collection of data, I have got some findings. These findings are completely from my personal point of view. Those are given below.

v NCC Bank Limited has already achieved a high growth rate accompanied by an impressive profit growth rate in 2005. The number of deposit and investment are also increasing rapidly.

v NCC Bank has an interactive corporate culture. The working environment is very friendly, interactive and informal. And there are no hidden barriers or boundaries while communication between the superior and the subordinate. This corporate culture provides as a great motivation factor to the employees.

v NCC Bank Limited has already established a favorable reputation in the banking industry of the country. It is one of the leading private sector growths in the profits and deposits sector.

v They follow the traditional banking system in general banking department. The entire general banking procedure is not fully computerized.

v From the clients view manual system to verify specimen signature of clients it consumers a lot of time.

v Lack of update products is also a drawback of the general banking area of the NCC Bank. The bank provides only some limited traditional services.

v They face troubles with those clients who have not any knowledge in banking transactions and banking rules.

v NCC Bank has own training Institution for its employees, so they don’t require to train them in other training Institutions.

CONCLUSIONS

There are a number of Private Commercial Banks, Nationalized Commercial Bank’s and foreign Banks operating their activities in Bangladesh. The NCC Bank it is one of them. For the future planning and the successful operation for achieving its prime goal in this current competitive environment this report can be a helpful guideline.

From the practical point of view I can declare boldly that I really have enjoyed my internship at NCC Bank from the first day. Moreover, internship program that is mandatory for my BBA program, although it is obviously helpful for my further thinking about my career.

Banks always contribute towards the economic development of a country. Compared with other Banks NCC Bank is contributing more by investing most of its funds in fruitful projects leading to increase in production of the country. It is obvious that right channel of Banking establish a successful network over the country and increases resources; will be able to play a considerable role in the portfolio of development in developing country like ours.

NCC Bank playing its leading role in socio-economic development of the country. Since inception NCC Bank has been rendering its Banking services with the needs of the nation to cope with the demands of people in the country. By doing many other works for state & society, NCC Bank has emerged as the pioneer of playing key role in the country.

Recommendations

For the probable solutions of the identified problems ensure better progress to NCC Bank in future, some necessary steps are recommended bellow on the basis of collected data, observation, expert staffs opinion and my knowledge and judgment.

- If the entire banking system is fully online on computerized system then they satisfy the customer by providing fast service with minimum service charge.

- NCC Bank should give more attention to advertisement for creating more attraction among its customers, which is helpful to collect more deposits and increase investments scope. That’s why bank should give emphasis of advertisement in various media like TV, News Paper, Internet and Billboard.

- NCC Bank should ensure networking system with its branches then it could easily transfer data within short time.

- Job description should be clarified and proper training facilities should ensure to improve the performance of bottom line management.

- NCC Bank should develop online banking system to compete with other commercial banks. It was observed that the officers of NCC Bank have to spend more time in preparing vouchers; this can be avoided by the automation.

- Credit Card and Automated Teller Machine (ATM) should be introduced as soon as possible because of present market demand of the customer and the educated customer now wants technology based banking.

- Attractive incentives packages for the exporters will help to increase the export and accordingly it will diminish the balance of payment gap of NCC bank. NCC Bank is to be concentrating in always monitoring the performances of its competitors in the field of foreign trade.

- Branches of NCC Bank are not sufficient as per demand of the people. So NCC Bank should setup new branches. They should also focus on the marketing aspects by informing the customers about its products and offering services charges. NCC Bank Ltd. Should focuses in their promotional activities on its marketable products.