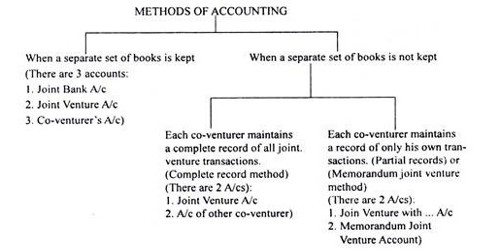

Methods of Keeping Joint Venture Account

A Joint Venture is a temporary form of business, where two or more persons join together to meet the short term objectives. Mainly there are two ways of keeping a joint venture account. Both base the need to consolidate an organization’s accounting books and reporting on the level of control of the parties in the joint venture. Those are (1) Without keeping a separate set of books, (2) With keeping a separate set of books.

The major features of a joint venture −

- There is an agreement between two or more persons.

- A joint venture is made for the specific execution of a business plan/project.

- It is a temporary partnership without the use of a firm name.

(1) Without Keeping Separate Set of Books

A separate set of books for a joint venture transaction is not made under this method. in this method, every co-ventures record all the transactions in his books in connection with the joint venture. Two types of accounts are maintained under this method namely joint venture account and co-venture’s account. There are again three variations.

i. Each co-venture records his own transactions as well as the transactions of the other co-venture and also opening other co-venture’s account for final settlement.

ii. Only one co-venture records the account

iii. Each co-venture records his own transactions only, which is known as the memorandum joint venture method.

Each co-venture will open two principal accounts under this method. Those are Joint venture account and personal accounts of the co-venture.

- Joint Venture Account

This account is prepared to ascertain the profit or loss on a joint venture. Hence, it can be treated as a nominal account. Goods purchased, goods supplied by the co-ventures, expenses incurred, etc. are debited and sale proceeds, unsold stock, stock taken over by co-venture, etc. are credited to joint venture account. The final balance of the joint venture account shows profit or loss which is transferred to the co-ventures’ account according to their profit sharing ratio.

- Personal Account of Co-venture

The co-venturers account is debited with goods and sales proceeds were taken over, remittance share of profit. Similarly, the personal account is credited with cash, goods supplied by the co-ventures.

(2) With Keeping Separate Set of Books

When the size of the venture is considerably large, then a separate set of books of accounts may be maintained. Under this system, accounts are maintained just like in the case of a partnership. They may use this bank account to make any kind of payments and to deposit sale proceeds or any other kind of receipts. While preparing the accounts, the principle of double-entry must be followed. Under this method, the following ledgers are maintained. In addition to the Bank account, a Joint venture account is also opened in the books to keep records of all transactions routed through this account.

i. Joint Venture Account

ii. Joint Bank Account

iii. Co-venture’s Account

- Joint Venture Account

The joint venture account is very unique one where all the purchases, procurement-related expenses, selling and distribution expenses as well as expenses related to the joint ventures are being debited like trading and profit and loss account. No separate account of purchases, wages or any other expenses is opened. The goods supplied by co-ventures etc. are also debited to it. Likewise, sale proceeds, closing stock, goods taken over by co-ventures are credited to joint venture account. If the joint venture account shows a credit balance, it means profit and if it shows debit balance, it is lost and transferred to a co-ventures personal account.

- Joint Bank Account

It is just like a cash book. It records all the cash and bank transactions. It is opened with the contribution of cash made by co-ventures. The investment made by then is deposited into a bank account and will operate this in their joint name. Any receipts of cash and any expenses related to venture are recorded in their account. The joint bank account is closed by transferring the balance to the personal account of co-ventures.

- Co-ventures Account

Like the capital accounts in partnership, the co-venture account is opened in a joint venture. it is credited with the investment of each co-venture and debited with the drawings made by them. The profits of the venture are credited and loss of venture is debited. This account comes to end by cash payment from a joint bank account.

Information Source: