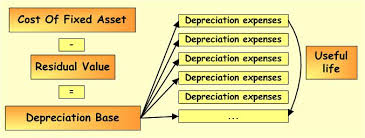

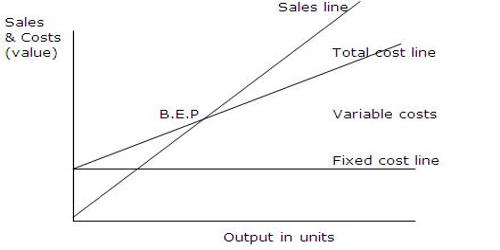

General purpose of this article is to discuss on Accounting for Depreciation. Regarding financial purposes depreciation have to be accounted for because assets will loss of value from use in addition to age. The expense of the asset is allocated in several periods to match revenue earned from the asset to the expense with the asset. If the expense of the asset was recognized in total when the asset was acquired the income statement would be off, showing very high expenses plus a low net-income. For all depreciation methods depreciation expense for a period is debited and accumulated depreciation is credited. The depreciation expense is an expense account going on the income statement.

Discuss on Accounting for Depreciation