Market Power and Regulation

Jean Tirole is one of the most influential economists of our time. He has made important theoretical research contributions in a number of areas, but most of all he has clarified how to understand and regulate industries with a few powerful firms.

Thus regulation is essentially a balancing act between restraining market power (anti-trust) and preserving economic efficiency. Regulators face a tradeoff between lowering prices for users, which means a wider diffusion of the product or service, and guaranteeing a rate of return for the firm or firms that supply the product or service.

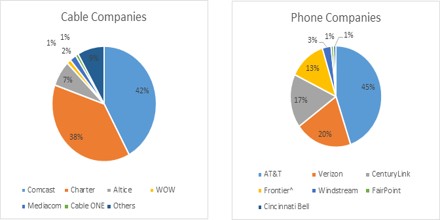

Market dominance arises when a small number of firms hold a commanding advantage over infrastructure (railroad lines), utilities (power or water), or intellectual property a patent to key technology. Likewise, this is where much regulation is focused.

The principle is that one type of regulation is not going to work for everyone; therefore regulators should offer a menu of options to firms.

A newer challenge for regulators is the growing importance of two-sided markets, where the provider of a platform product or technology makes deals with sellers and buyers of a service. A current example is Uber, which provides a matching platform for drivers and riders. Other examples are debit and credit card companies selling their product to both merchants and cardholders or computer operating systems sold to developers and users.

About Market Power

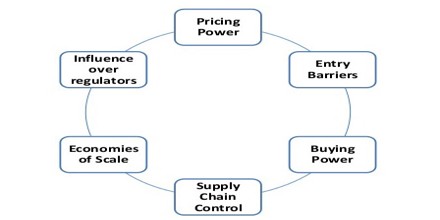

Market power is an organization’s ability to control the price of a product by manipulating its supply, its demand, or both. Market power is also referred to as economic strength. Companies that possess market power are referred to as price makers because they are able to determine the price for a product or service, even as they maintain market share.

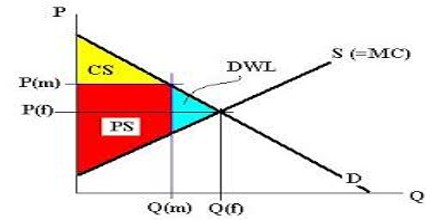

A firm with market power has the ability to individually affect either the total quantity or the prevailing price in the market. Price makers face a downward-sloping demand curve, such that price increases lead to a lower quantity demanded. The decrease in supply as a result of the exercise of market power creates an economic deadweight loss which is often viewed as socially undesirable. As a result, many countries have anti-trust or other legislation intended to limit the ability of firms to accrue market power. Such legislation often regulates mergers and sometimes introduces a judicial power to compel divestiture.

The ideal marketplace condition is what is referred to as a state of perfect competition, in which there are numerous companies producing competing products, and no company has any significant level of market power. Of course, that is merely a theoretical ideal that rarely exists in actual practice. Many countries have antitrust laws or similar legislation designed to limit the market power of any one company. Market power is often a consideration in government approval of mergers. A merger is unlikely to be approved if it is believed that the resulting company would constitute a monopoly or would become a company with inordinate market power.

Regulation

The basic reasons for regulation A first reason for regulation is that financial institutions are highly interconnected, through complex, often short-term, borrowing and lending arrangements. When a single large financial institution goes bankrupt, insolvency may therefore quickly spread to other financial institutions in a systemic financial crisis with immense negative consequences for the economy, such as the one that followed the Lehman failure in 2008. A second reason is that many de facto lenders to financial institutions are ordinary consumers and households, e.g., through deposits and pension savings. Since households may not have sufficient information to evaluate and monitor the health of the banks where they keep their deposits, consumers can suffer severe consequences when a financial institution fails.

Interbank markets Rochet and Tirole (1996a) built on the work of Holmström and Tirole to model the interconnectedness of banks and the case for regulation. While decentralized interbank markets are prone to systemic crises, decentralized interbank markets encourage peer monitoring across banks. This benefit is undermined when governments are expected to bail out failing banks ex post, since an anticipated bail-out makes it less worthwhile for a bank to monitor its counterparties ex ante.

Jean Tirole’s research is characterized by respect for the particulars of different markets and the skillful use of new analytical methods in the economic sciences. He has developed deep analytical results about the essential nature of imperfect competition and contracting under asymmetric information. Tirole has also distilled his own and others’ results into a unified framework for teaching, policy advice, and continued research. His contributions provide a splendid example of how economic theory can be of great practical significance.