Market is a public place where buyers and sellers make transactions, directly or via intermediaries. Also sometimes means the stock market. It is an actual or nominal place where forces of demand and supply operate, and where buyers and sellers interact (directly or through intermediaries) to trade goods, services, or contracts or instruments, for money or barter.

Markets include mechanisms or means for:

(1) determining price of the traded item,

(2) communicating the price information,

(3) facilitating deals and transactions, and

(4) effecting distribution.

The market for a particular item is made up of existing and potential customers who need it and have the ability and willingness to pay for it.

Market Characteristics

An industry or market can be analyzed for its attractiveness to a particular company or organization on a number of different characteristics. The list below presents some of the more significant market characteristics that should be considered.

- Current market size

- Projected market growth rate

- Number of competitors, level of fragmentation

- Intensity of competition

- Technological skills required

- Production/operations skills required

- Capital requirements

- Other barriers to entry

- Seasonal and cyclical factors

- Industry profitability and returns

- Social, political, regulatory and environmental factors

- Strategic fits with other businesses already owned.

Types of market

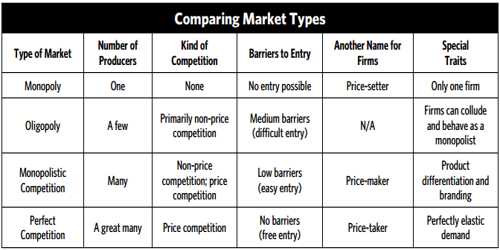

In economics, market types (also known as the number of firms producing identical products).

- Monopolistic competition also called competitive market, where there are a large number of firms, each having a small proportion of the market share and slightly differentiated products.

- Oligopoly, in which a market is dominated by a small number of firms that together control the majority of the market share.

- Duopoly, a special case of an oligopoly with two firms.

- Monopoly, where there is only one provider of a product or service.

- Natural monopoly, a monopoly in which economies of scale cause efficiency to increase continuously with the size of the firm. A firm is a natural monopoly if it is able to serve the entire market demand at a lower cost than any combination of two or more smaller, more specialized firms.

- Perfect competition is a theoretical market structure that features unlimited contestability (or no barriers to entry), an unlimited number of producers and consumers, and a perfectly elastic demand curve.

The elements of Market Structure include the number and size distribution of firms, entry conditions, and the extent of differentiation.

These somewhat abstract concerns tend to determine some but not all details of a specific concrete market system where buyers and sellers actually meet and commit to trade. Competition is useful because it reveals actual customer demand and induces the seller (operator) to provide service quality levels and price levels that buyers (customers) want, typically subject to the seller’s financial need to cover its costs. In other words, competition can align the seller’s interests with the buyer’s interests and can cause the seller to reveal his true costs and other private information. In the absence of perfect competition, three basic approaches can be adopted to deal with problems related to the control of market power and an asymmetry between the government and the operator with respect to objectives and information:

(a) subjecting the operator to competitive pressures,

(b) gathering information on the operator and the market, and

(c) applying incentive regulation.

Information Sources: