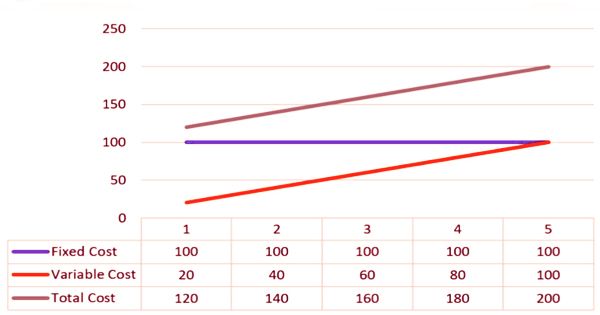

The Marginal Production Cost is the rise or decrease in the overall cost of manufacturing one more unit of a commodity or service one more client that a company will incur. It is a basic concept used to make economically optimal choices and an important component of accounting and financial analysis in management. Divide the change in production costs by the change in quantity, to determine the marginal cost. For instance, in most assembling attempts, the minimal expenses of creation diminish as the volume of yield expands in light of economies of scale. Expenses are lower since you can exploit limits for the mass acquisition of crude materials, utilize apparatus, and connect with particular work.

(Marginal Cost Of Production)

The Marginal Cost Of Production can be calculated as:

Marginal Cost (MC) = ΔCost / ΔQuantity

If a company’s total cost of production is defined as:

TC = FC + (Q × VC)

Then the first-order derivative of the total cost function is its marginal cost. The marginal cost is, in this case, directly proportional to its variable cost.

MC = dTC / dQ = VC

Where:

TC = Total Cost

FC = Fixed Cost

Q = Quantity

VC = Variable Cost

MC = Marginal Cost

Costs of Production

The aim of the marginal cost analysis is to decide at what point to maximize production and overall costs, an enterprise may achieve economies of scale. The manufacturer has the ability to make a profit if the marginal cost of manufacturing one additional unit is lower than the per-unit price. Output, however, would reach a stage where diseconomies of scale would join the picture and marginal costs will again begin to grow.

The marginal cost of production is a financial aspect and administrative bookkeeping idea frequently utilized among makers as a method for disconnecting an ideal creation level. Nonetheless, expenses may not differ straightforwardly on a for each unit premise. It is conceivable that expanding creation by a unit may not cause a relative increment in costs. This is on the grounds that diverse business exercises face various types of cost practices. The cost of adding one more unit to their production schedules is also studied by manufacturers. The advantage of manufacturing one additional unit and generating sales from that item would minimize the total cost of producing the product line at a certain production level.

Unit Costs: The conventional definition of variable costs will be unit costs, where an increase in a single unit of output contributes to a proportional cost increase. The cost of materials used to manufacture another coffee mug, for instance.

Batch Costs: Batch costs would differ not by the individual unit of creation but rather by the quantity of clusters for a given number of units delivered. Maybe taking the espresso cup model further, an artistic molding machine ought to be raised to an ideal temperature before creation may start. Past this point, there are no extra expenses to work this machine until creation is halted. Starting the following cluster would then acquire this startup cost again.

Product Costs: Product costs exist irrespective of the amount of batches or units manufactured. This is an expense that is specifically attributed to a single item in a product portfolio. The cost of designing and selling a holiday version of a coffee mug, for example, will not be influenced by the number of mugs produced.

Customer Costs: Instead of any fixed level of output or expansion of a product line, consumer costs are borne by the number of customers serviced. This could take the form of after-sales service or legal expenses arising from a contractual arrangement.

Organization Sustaining Costs: Organizational sustaining costs are costs that are acquired because of general business tasks. These are costs that are brought about by paying little heed to any amount of creation. These might incorporate such things as the fixed compensations of representatives at an organization or reviewing expenses for getting ready to budget summaries to investors.

All the costs that differ from that level of output are included in the marginal cost of production. For instance, if a business wants to build a completely new factory to manufacture more items, the cost of building the factory is a marginal cost. Depending on the amount of the good being made, the quantity of marginal costs varies. As long as the marginal costs are less than the marginal income, a company can continue to manufacture additional units.

Information Sources: