The loss ratio is a percentage representation of the ratio of losses paid out to premiums generated in the insurance sector. It’s the inverse of the gross profit margin (commonly known as the gross profit margin). It’s the ratio of premiums earned to losses paid. That is, a comparison of how much the corporation spent on claims settlements vs how much it made from paying consumers.

Paid insurance claims and adjustment expenditures are included in loss ratios. Insurance claims paid plus adjustment charges divided by total earned premiums is the loss ratio formula. Client risk profiles are frequently underestimated, resulting in a greater loss ratio. The loss ratio in insurance is the proportion of total claims losses (paid and reserved) plus adjustment charges divided by total premiums generated.

To quantify overall cash outflows linked with their operational activities, insurers will compute their combined ratios, which include the loss ratio and the expenditure ratio. Property and casualty insurance loss rates (for example, vehicle insurance) commonly vary from 40% to 60%. Loss ratios are used to evaluate an insurance company’s health and profitability. When a company receives more premiums than it pays out in claims, the loss ratio rises, signaling that the company is in financial trouble.

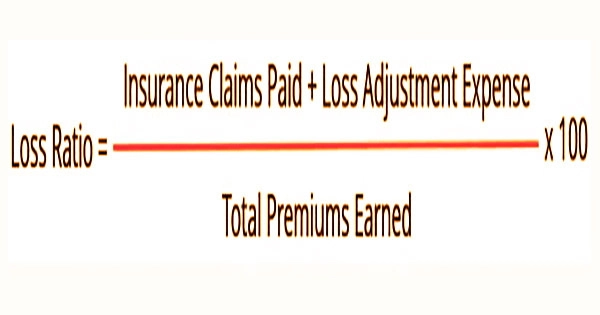

The formula for the loss ratio is provided below:

Where:

- Insurance claims paid is the amount of money paid out by the insurance company for claim settlements.

- Loss adjustment expense is the money incurred by the insurance company to investigate and verify claims. Adjusters’ salaries and expenditures, investigative charges, and other administrative costs are also included in this category.

- Total premiums earned is the amount of money (premiums) paid from clients to the insurance company.

Premiums are being collected at a higher rate than claims are being paid out. Insurers with continuously high loss ratios, on the other hand, maybe in financial trouble. They could not be collecting enough premium to cover claims and expenditures while still making a profit. To simplify the calculation above, divide insurance claims paid by total premiums generated, omitting the loss adjustment expenditure.

When a rapid computation is necessary or the loss adjustment expenditure number is not readily available, the variation is typically employed. The words “permissible,” “target,” “balancing point,” and “anticipated” loss ratio are all used to describe the loss ratio required to meet the insurer’s profitability goal. This ratio is 1 minus the expense ratio, with expenses being general and administrative costs, commissions and advertising costs, profit and contingencies, and other costs. Benefit-expense ratios, which compare an insurer’s expenditures for acquiring, underwriting, and maintaining a policy to the net premium charged, are related to loss ratios.

The loss ratio is used to give insurance firms a high-level picture of their financial performance by comparing the expenses of claims paid to the premiums received. To arrive at a combined ratio, an insurer will add the benefit-expense ratio to their loss ratio. The loss-to-gain ratio compares paid claims, including modifications, to the net premium, whereas the benefit ratio looks at corporate costs.

Insurance payout expenses (sometimes known as “losses”) are occasionally included in the loss ratio. The insurer would normally divide the incurred or actual experienced loss ratio (AER) by the allowable loss ratio when calculating a rate modification. As a result, a loss ratio below 100% does not always indicate a profitable business. Other expenses, such as sales commissions, salaries, overhead expenses, marketing expenses, and other general expenses, which are not reflected in the loss ratio but are reflected in the expense ratio, should be considered when determining profitability.

Furthermore, losses for healthcare providers will be larger than losses for property or casualty insurance due to the increased number of possible claims each month. Despite the fact that the insurance business keeps a share of its premiums after paying claims, it is unclear if the firm is successful. Additional costs, like as overhead, payroll, marketing, and so on, are not factored into the ratio.

The combined ratio compares the amount of money flowing out of a firm due to costs and total losses to the amount of money coming in from premiums. Each insurance firm sets its own loss ratio objective, which is based on the expenditure ratio. A loss ratio in banking is the total amount of unrecoverable debt divided by total outstanding debt.

Information Sources: