Private equity real estate is an investment strategy in which many investors pool their funds to acquire, develop, run, and sell real estate assets. It is a phrase used in investment finance to describe a particular subgroup of the real estate investment asset class. It refers to one of the four quadrants of the real estate capital markets, which are private equity, private debt, public equity, and public debt.

In this sense, “private equity” refers to an ownership arrangement in which the investment is not publicly listed on a stock market. Instead, it is often owned by a small group of investors, most of whom are institutional investors, high-net-worth individuals, or private equity groups.

Here are some key aspects of private equity real estate:

- Investment Structure: Private equity real estate transactions are frequently structured as limited partnerships, with a general partner (the body in charge of overseeing the investment) and limited partners (the investors). Limited partners provide capital and receive a portion of the profits.

- Diversification: Its funds can invest in a wide range of real estate properties, including residential, commercial, industrial, and retail. This helps investors to diversify their real estate assets.

- Investment Lifecycle: Its investments often have a defined lifespan. The fund may purchase underperforming or undervalued properties, improve them through renovations or operational improvements, and then sell or exit the investment for a profit. This process could take many years.

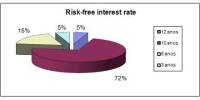

- Risk and Return: It investments often involve higher risk compared to more traditional real estate investments. However, they also have the potential for higher returns. The risk arises from factors such as market fluctuations, economic conditions, and the success of the property’s improvement or development.

- Illiquidity: Investments in private equity real estate are typically illiquid, making it difficult for investors to sell their ownership interests prior to the intended departure or maturity date. Investors should plan for a longer investing horizon.

Private equity real estate funds are usually run by skilled experts who make strategic decisions about property purchase, development, and management. This expertise is critical to the possible success of the venture. Investors interested in private equity real estate should perform extensive research, comprehend the investment strategy and risk profile, and thoroughly analyze the terms and conditions specified in the fund’s offering materials.