Objective of the report

There are two types of objective of the report. They are:

• Broad Objectives

To understand the all procedure the bank follows

To understand the current condition of the loan and advance of the bank

To know all the product they offers.

• Specific objective

To know the Last 5 (five) years financial performance of Bank Asia Limited

To have clear idea about different loan categories in Bank Asia Limited

Overview of the bank

History of Bank Asia

Bank Asia has been launched by a group of successful entrepreneurs with recognized standing in the society. The management of the Bank consists of a team led by senior bankers with decades of experience in national and international markets. The senior management team is ably supported by a group of professionals many of whom have exposure in the international market. It set milestone by acquiring the business operations of the Bank of Nova Scotia in Dhaka, first in the banking history of Bangladesh. It again repeated the performance by acquiring the Bangladesh operations of Muslim Commercial Bank Ltd. (MCB), a Pakistani bank.

In the year 2003 the Bank again came to the limelight with oversubscription of the Initial Public Offering of the shares of the Bank, which was a record (55 times) in our capital market’s history and its shares commands respectable premium. The asset and liability growth has been remarkable. Bank Asia has been actively participating in the local money market as well as foreign currency market without exposing the Bank to vulnerable positions. The Bank’s investment in Treasury Bills and other securities went up noticeably opening up opportunities for enhancing income in the context of a regime of gradual interest rate decline.

Bank Asia Limited started its service with a vision to serve people with modern and innovative banking products and services at affordable charge. Being parallel to the cutting edge technology the Bank is offering online banking with added delivery channels like ATM, Tele-banking, SMS and Net Banking. And as part of the bank’s commitment to provide all modern and value added banking service in keeping with the very best standard in a globalize world.

Bank Asia is a third generation public limited commercial bank. It received the Certificate of Incorporation on September 28, 1999 and came to operation on November 27, 1999. Now after 12 faithful years of dedicated and reliable services, Bank Asia has created an envious position for itself among the leading banks of the country with an Asset base of TK. 117 billion, Deposit of TK 95 Billion 6 and 70+ outlets all over the country. But most importantly, the Bank has an unsurpassed legacy attached with its image.

Introduction

The Bank Asia limited is one of the most renowned and recognized third generation private banks of Bangladesh. Within a very short time it has established its existence among a huge number of rivals. Bank Asia Limited has always been strongly committed to provide a better quality service to the customer, not only they care about the customer at time Bank Asia authority also provides excellent facility to its employees to have their full job satisfaction. Like any other bank Bank Asia limited has three departments:

• General Banking

• Credit & Marketing Department

• Foreign Trade Department Bank

Foreign Exchange Department

The principal function of a Foreign exchange department is to handle foreign inward remittances as well as outward remittances; buying and selling of foreign currencies, handling and forwarding of import and export documents and giving the consultancy services to the exporters and importers. Besides this, the department also gives the financial assistance in relation to the foreign trade, i.e., it gives assistance to the exporters by way of financing the exports and imports by giving them the financial assistance to clear the consignments or open a letter of credit. The department issues letters of credit for their importer clients and handles letters of credit received from overseas correspondents in favor of exporters.

Bank Asia Limited, Moghbazar Branch is not an Authorized Dealer (AD) branch so they do not have the permission to buy and sell foreign currency. So for the Non-AD branches Bank Asia all the foreign currency transaction is done by the Central Trade Service Unit (CTSU). Bangladesh Bank has given the CTSU the authority to do foreign currency transaction. All the paper work for L/C is done by the branch, which is then forwarded to the CTSU for the monetary transaction.

Credit Department

This is the survival unit of the bank because until and unless the success of this department is attained, the survival is a question to every bank. If this section does not properly work the bank it may become bankrupt. This is important because this is the earning unit of the bank. Banks are accepting deposits from the depositors in condition of providing interest to them as well as safe keeping their interest. Now the question may gradually arise how the bank will provide interest to the clients and the simple answer is Loans & Advance.

Credit is continuous process. Recovery of one credit gives rise to another credit. In this process of revolving of funds, bank earns income in the form of interest. A bank can invest its fund in many ways. Bank makes loans and advances to traders, businessmen, and industrialists. Moreover nature of credit may differ in terms of security requirement, disbursement provision, terms and conditions etc. The bankers have to keep in mind that lending is for the best interest of the community and lending should be directed to productive sectors only.

Credit product

Bank Asia Limited offers various types of loan to customer. Each and every product is designed in different way to meet the needs of the customers. The verities of product that they offer are:

• Auto Loan

• House Finance

• Senior Citizen Support

• Consumer Durable Loan

• Unsecured Personal Loan

• Loan for Professionals

Auto Loan

This product will allow car financing to the customer segment. Under this scheme, the vehicle is hypothecated to the bank only. In addition to this registration requirement, on a case-to-case basis, bank may also secure the loan partially by the commonly acceptable form of cash/quasi cash securities available in the market.

• Customer Segment: Any Bangladeshi individual who has the means and capacity to repay bank loan, e.g. salaried executives of multinational and middle to large size local corporate, Government officials, Officials working in reputed NGOs (Non Government Organizations), international aid agencies & UN bodies, any tax paying

businessmen of repute, any employed / self-employed tax-paying individual having a reliable source of income.

• Loan Feature: The Loan amount Maximum Tk.20,00,000.00 for both Recondition & Brand New Car. Repayment of the loan is maximum 6 years for brand new car and 5 years for recondition car. Loan repayment will be equal monthly installments. There is no hidden cost and no early settlement and partial adjustment fees. The interest rate would be a competitive interest rate in the market.

• Eligibility: The age of the borrower should be at least 25 years and maximum up to 65 years old at loan maturity. Borrower should have a surplus of at least Tk. 15,000 of income. An employed person should have a minimum service of 3 years and has to be a confirmed employee of the organization he works for. Self employed should have a minimum of 3 years of business running.26

House Finance

This product will facilitate the customer to have financing for purchase of flat/house, construction of new house, extension and renovation of existing house etc.

• Customer Segment:Any Bangladeshi individual who has the means and capacity to repay bank loan, e.g. salaried executives of multinational and middle to large size local corporate, Government officials, Officials working in reputed NGOs (Non Government Organizations), international aid agencies & UN bodies, any tax paying

businessmen of repute, any employed / self-employed/ tax-paying individual having a reliable source of income.

• Loan Feature: The Loan amount Tk. 3,00,000.00 to Maximum Tk.75,00,000.00. Repayment of the loan is maximum 15 years including maximum 1 year grace period. Loan repayment will be equal monthly installments. Loan to price ratio 70: 30 that is the bank will provide 70% of the total cost of the house and the rest 30 % has to be paid by the borrower. There is no hidden cost and no early settlement and partial adjustment fees. The interest rate would be a competitive interest rate in the market.

• Eligibility: The age of the borrower should be at least 25 years and maximum up to 65 years old at loan maturity. Minimum income of the borrower should be debt burden ration based. An employed person should have a minimum service of 1 year and has to be a confirmed employee of the organization he works for. Self employed

should have a minimum of 3 years of business running and land lord having substantial rental income.27

Senior Citizen Support

Senior Citizen Support is a terminating facility offered by Bank’s Retail Banking Division to the Senior Citizen in the society living in the cities / towns where the Bank has its operations. It is a special loan package to the senior citizen having repayment capacity. It is an unsecured facility.

• Customer Segment

The senior citizen in the society i.e. retired persons having pension facility or rental/Interest income.

• Loan Feature

Loan amount Tk. 25,000.00 to Maximum Tk.2,00,000.00

Repayment tenure 1year to Maximum 3 years.

Payment method- Equal Monthly Installments.

Competitive interest rate

No early settlement & partial adjustment fees

No hidden cost.

• Eligibility

Age limit: Minimum 57 years, Maximum 65 years at loan maturity Monthly surplus income (after meeting expenses) shall be at least two times of the installment amount.

Categories of Loan and Advance

All loans and advance is group into four categories for the purpose of classification, the name of the

categories are:

Continuous Loan

Demand Loan

Fixed term Loan

Short-term Agriculture & Micro – Credit

Continuous Loan

The loan accounts in which transactions may be made within certain limit and have an expiry date for full adjustment. For example cash credit and overdraft.

Demand Loan

The loans that becomes repayable on demand by the bank. If any contingent or any other liabilities are turned to forced loan those too will be treated as Demand Loan. Such as forced loan against imported merchandise, payment against documents, foreign bill purchased and inland bill purchase.

Fixed Term Loan

The loans, which are repayable within a specific time period under a specific repayment schedule. For example auto loan, house finance, etc.

Short-term Agriculture & Micro – Credit

This will include the short-term credits as listed under the annual credit program issued by the Agriculture Credit and Financial Inclusion Department (ACFID) of Bangladesh Bank. Credit in the agricultural sector repayable with in 12(twelve) months will also be included herein. Short-term Micro –

Credit will include any micro – credit not exceeding an amount determined by the ACFID of Bangladesh Bank from time to time and repayable within 12(twelve) months, be those termed in any names such as Non-agricultural credit, Self-reliant credit, Weaver’s credit or Bank’s individual project credit.

Default loan classification

Past Due/Over Due

Any continuous loan if not repaid or renewed within the fixed expiry date for repayment or after the demand by the bank will be treated as past due/over from the following day of expiry.

Any demand loan if not repaid or renewed within the fixed expiry date for repayment or after the demand by the bank will be treated as past due/over from the following day of expiry.

In case of any installment or part of installment of a fixed term loan is not paid within the fixed expiry date, the amount of unpaid installment will be treated as past due/overdue from the following day of the expiry date.

The short-term agricultural and micro-credit if not paid within the fixed expiry date of repayment will be considered as past due/overdue after six months of the expiry date.All unclassified loan other than Special Mention Account (SMA) will be treated as Standard.

A continuous loan, demand loan or term loan which will remain overdue for a period of 2(two) months or more will be put into the Special Mention Account (SMA). Loans in the Special Mention Account (SMA) will have to be reported to the Credit Information Bureau (CIB) of Bangladesh Bank.

Loans expect short-term agricultural and micro-credit in the Special Mention Account (SMA) and Sub-Standard will not be treated as defaulted loan.

Any continuous loan will be classified as:

Sub-standard if it is past due/overdue for 3 (three) months or beyond but less than 6(six) months.

Doubtful if it is past due/overdue for 6 (six) months or beyond but less than 9 (nine) months.

Bad/Loss if it is past due/overdue for 9 (nine) months or beyond.

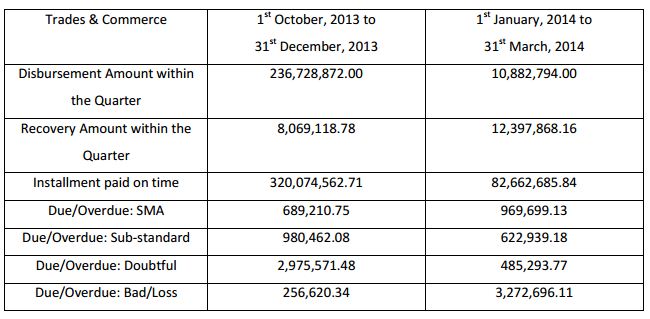

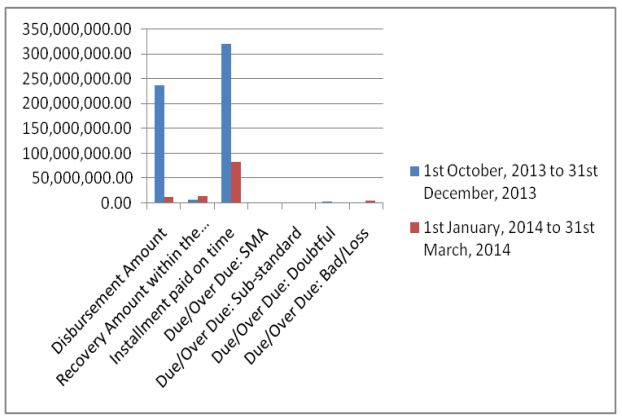

Loan and Advance Statistics

Loan and Advance Statistics

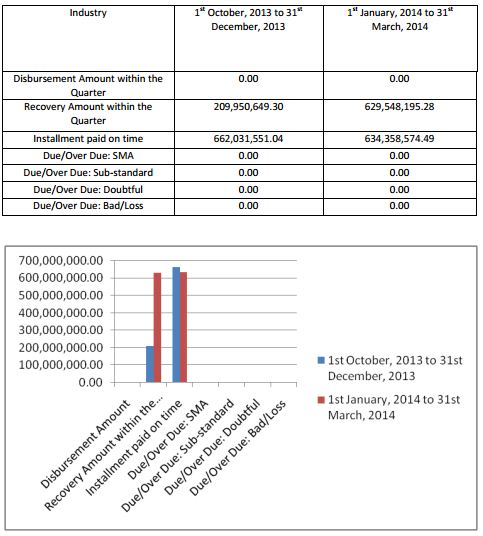

All the four category loans has been merge together and sorted into broader sectors like Industry loans, Trade & Commerce loans, Construction loans, Transport loans, Consumer finance loans, Public Sector loans and Private Sector loans. This topic will give a vivid idea about how much loan is being disbursed in each of the sector and how much is recovered in one quarter.

All the calculation or table presented in this chapter is in taka.

In this quarter 31st March, 2014 the disbursement amount within the quarter of the trades & commerce sector has decreased than the last quarter but the recovery amount within the quarter has increased. Increase in recovery lead to a decrease in sub-standard due/overdue. It also shows that the amount of doubtful due/overdue has decrease but an increase in bad/loss due/overdue indicated that most of the doubtful due/overdue has shifted to bad/loss due/overdue. Installment paid on time has also decreased leading to an increase in SMA due/overdue. This shows those new loans are entering into SMA due /overdue.

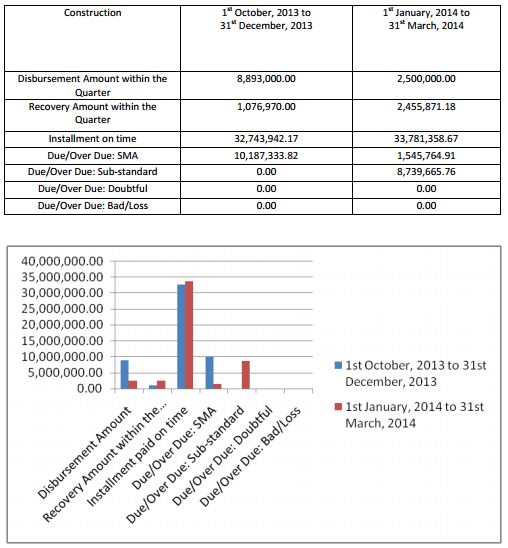

Construction

In this quarter 31st March, 2014 the disbursement amount within the quarter of the construction sector has decreased than the last quarter but the recovery amount within the quarter has increased. Increase in recovery lead to a decrease in SMA due/overdue. It also shows that the amount of sub-standard due/overdue was zero in last quarter but now it shows that huge amount of new loans has enter into that default category. It is good to see that no doubtful or bad/loss due/overdue is there for this sector in either quarter. Installment paid on time has increased but every little, not like the trades & commerce sector.

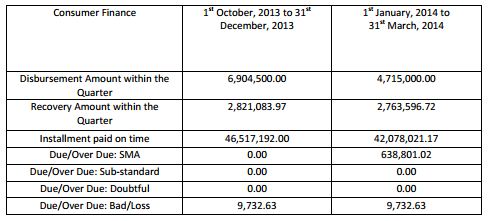

Consumer Finance

In this quarter 31st March, 2014 the disbursement amount within the quarter of the consumer finance sector has decreased than the last quarter and also the recovery amount within the quarter has decreased. The installment paid on time has also decrease. All the positive factor of this sector has decrease leading to an increase in SMA due/overdue. In last quarter there were no SMA but now in this quarter it is Tk. 638,801.02. Although there is no sub-standard or doubtful due/overdue in this quarter and also the bad/loss due/overdue has not increase that the previous quarter.

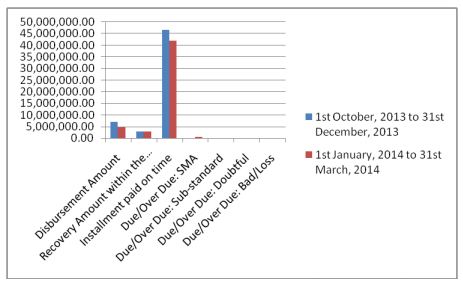

Industry

In this quarter 31st March, 2014 the disbursement amount within the quarter of the industry sector was zero. No new loans have been given to this sector. The earlier loans recovery is still on the process. The recovery amount within the quarter has increased than the last quarter. Installment paid on time has also increased than the previous quarter. There is no default loan in this sector.

Financial Statement Analysis

Ratio Analysis

Ratio Analysis is a form of Financial Statement Analysis that is used to obtain a quick indication of a firm’s financial performance in several key areas. The ratios are categorized as Short-term Solvency Ratios, Debt Management Ratios, Asset Management Ratios, Profitability Ratios, and Market Value Ratios.

Ratio Analysis as a tool possesses several important features. The data, which are provided by financial statements, are readily available. The computation of ratios facilitates the comparison of firms which differ in size. Ratios can be used to compare a firm’s financial performance with industry averages. In addition, ratios can be used in a form of trend analysis to identify areas where performance has improved or deteriorated over time. All the calculation or table presented in this chapter is in taka.

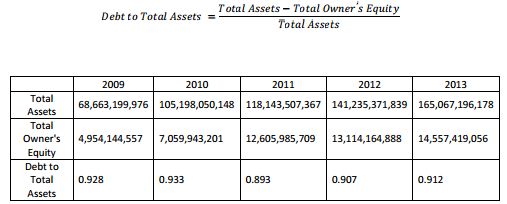

Debt to Total Assets

Total debt to total assets is a leverage ratio that defines the total amount of debt relative to assets. This

enables comparisons of leverage to be made across different companies

The debt to total assets ratio of Bank Asia has no fixed trend. In 2010 it increased from 0.928 to 0.93 but the following year 2011 it decreased to 0.893. Like wise in next year 2012 it again increased from 0.893 to 0.907 but in 2013 it seems to be out of the up and down trend. In 2013 debt to total assets ration increased from 0.907 to 0.912. Till 2011 they had no trend but now it seems they have a increasing trend, which is not a good situation. If the trend continues to go like this then the company will have high degree of levarage leading to a low level of financial flexibility. The highest debt to total assets ratio was in 2010 0.932 and the lowest was in 2011 0.893.

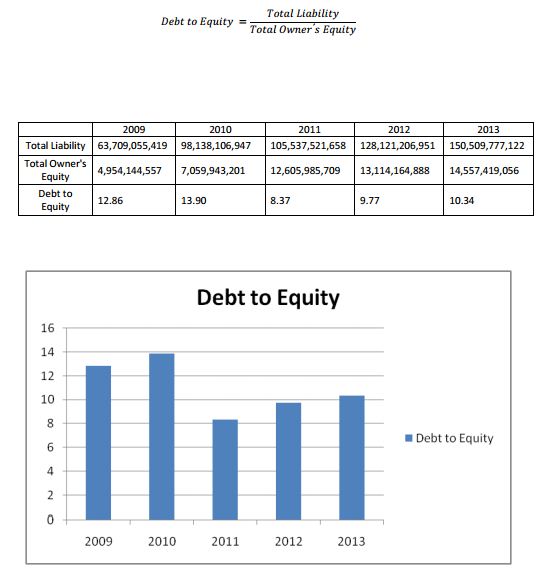

Debt to Equity

Debt to equity ratio is use to measure a company’s financial leverage. This is calculated by dividing total liabilities by stockholders’ equity. It indicates what proportion of equity and debt the company is using to finance its assets

The debt to equity ratio of the bank shows that it has an increasing trend from 2011 to 2013. In 2010 the debt to equity ratio increased from 12.86 to 13.90. In 2011 it decreased to 8.37 but then afterwards the ratio seems to increase from 8.37 to 9.77 in 2012 and to 10.34 from 9.77 in 2013. Till 2011 they had no trend but now it seems they have a increasing trend. For a bank assets are loans that they disburse and liabilities are deposits that they get from their customers. A banks job is to take deposits from one customer and lend that money as loan to another. So a bank is likely to have a high debt to equity. The debt to equity of 2013 shows that to finance an asset the bank has used 1 taka of its owner equity and 10.34 taka of liability.

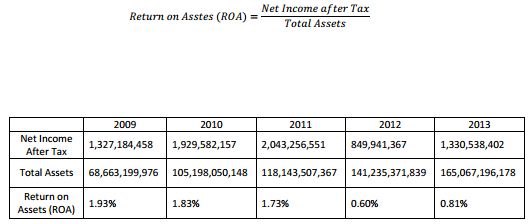

Return on Assets (ROA)

The Return on Assets Ratio indicates the income earned by the firm on its assets. It is important to remember that the ratio is based on accounting book values and not on market values.

This ratio shows that the bank has a decreasing trend from 2009 to 2012. In 2009 return on assets of Bank Asia was 1.93% which decreased in 2010 to 1.83% in 2010. Likewise in 2011 it continued to decrease. It decreased from 1.83% to 1.73% in 2011, but in 2012 it has the highest downfall. In 2012 it decreased by 1.13%. 0.60% was their return on assets in 2012. Then again in 2013 the percentage increased, it increased from 0.60% to 0.81%. The highest ROA was in 2009 1.93% and the lowest was in 2012 0.60%. The ROA of 2013 indicates that the bank is earning a profit of 0.0081 of every 1 taka of assets.

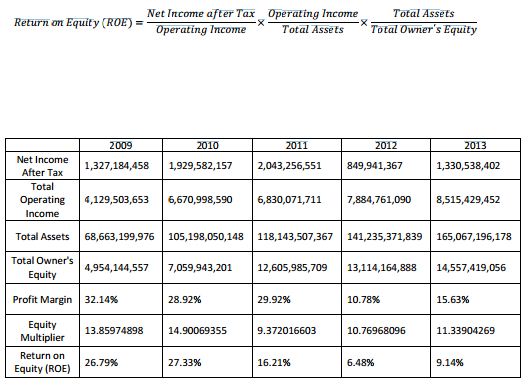

Return on Equity (ROE)

The Return on Equity Ratio indicates the income earned by the firm on its shareholders’ equity. It is important to remember that the ratio is based on accounting book values and not on market values.

The profit margin of Bank Asia in 2009 was 32.14% which decreased to 28.92% in 2010. In 2011 the profit increased but every little, it rose to 29.92% from 28.92%. In 2012 it had a sightful decrease; it fell to 10.78% from 29.92%. In 2013 it again increased, now it is 15.63% which means for every 1 taka Bank Asia has a profit margin of 0.1563 taka. The highest profit margin was in 2009 32.14% and the lowest was in 2012 10.78%.

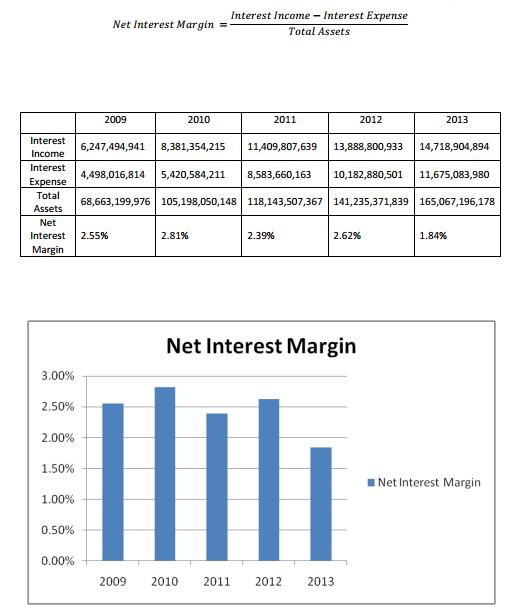

Net Interest Margin

Net interest margin shows how successful a firm’s investment decisions are compared to its debt situations. A negative value denotes that the firm did not make an optimal decision, because interest expenses were greater than the amount of returns generated by investments.

The net interest margin of the bank has an up and down trend. In 2010 it increased from 2.55% to 2.81% but in 2011 it decreased to 2.39%. In 2012 it again had a positive growth. The ratio increased from 2.39% to 2.62% but in recent year that 2013 it again decreased. Now it is 1.84%. The highest net interest margin was in 2010 2.81% and the lowest was in 2013 1.84%. This means that their investment decision compared to debt situation was not better than the last year. In 2013 the bank was able to generate a profit of 0.0184 taka for every 1 taka of its assets.

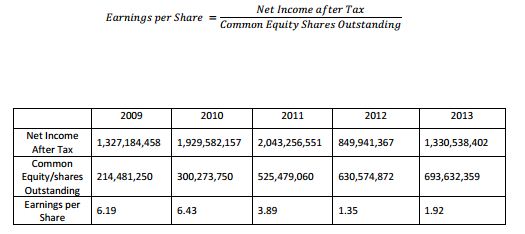

Earnings per Share

The earnings per share ratio (EPS) measure the amount of a company’s net income that is theoretically available for payment to the holders of its common stock. A company with high earnings per share ratio is capable of generating a significant dividend for investors, or it may plow the funds back into its business for more growth; in either case, a high ratio indicates a potentially worthwhile investment, depending on the market price of the stock.

The earnings per share (EPS) of Bank Asia has a positive increase for one year then negative growth for consecutive years and then again a positive growth. In 2010 the EPS increased to 6.43 from 6.19, but in 2011 and 2012 it had a negative growth. In 2011 it was 3.89 which again decreased in 2012 to 1.35. In recent year that is 2013 it has a positive growth. Now the ESP is 1.92. The highest earnings per share was in 2010 6.42 and the lowest was in 2012 1.35. This indicates that the earnings per share are 0.0192 taka for every 1 taka asset the bank uses.55

Conclusion and Recommendation

Recommendation

The branch has been in the operation for last 5 (five) years without any downfall but during these 4 (four) months of my internship experience and while preparing the report I felt some minor change might help the branch as well as the organization to perform more effectively.

The branch lack staff in the customer service department. If more staff is recruited in the customer service then the employees will be able to serve customer faster.

The branch should start a token system customer service, so that the customers can be served according to the token number.

The software (staler) that is use to do daily works sometimes does not work properly. As a result customer of any department of the branch is not served on time, the organization need to improve its software system to have more customer satisfaction.

The branch should have more staff in the credit department so that they monitor the loans time to time and can recover the loans as bad/loss and sub-standard due/overdue has increased a lot then the previous quarter.

The net interest margin has decreased in 2013 that means they are not making proper investment decision. They need to increase their interest margin by either decreasing the interest on deposits or increasing it on loans.

The organization should look into its Earnings per Share (EPS). Their EPS is very low in recent years. They should increase their net income after tax to have an increase in EPS.

The organization is not into promotional activities. They need to do some promotional activities so that people come to know about them. This will help to increase their number of customers.

Conclusion

Loans and advance credit program is an important development scheme in the banking sector in most of the developing economies including Bangladesh. In Bangladesh people of limited monthly income are faced with the problem of improving their standard of living. Loans and advance credit program helps them to improve their standard of living.

While preparing this report I got the chance to see the current scenario of an organization’s loans and advance in the market. Through this report I saw that the current situation of loans and advance of Bank Asia Limited, Moghbazar branch is not in a good position. In this quarter their bad/loss due/overdue has increased a lot. This report also helped me to understand the performance of the whole organization. To some extent I felt the organization is not living up to its standard in the recent years. I have tried my level best to combine my theoretical and 3 months internship knowledge to prepare this report. I hope the report will be useful to the reader.