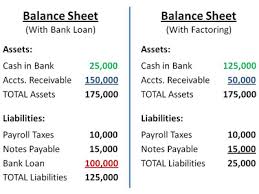

Loan Factoring is often a financial transaction and a form of debtor finance where a business sells it’s accounts receivable to a third party (called a factor) at a discount. A Business can sometimes Factor it’s Receivable Assets in order to meet its present in addition to immediate Cash desires. Forfaiting is a Factoring arrangement employed in International Trade Financial by Exporters who would like to sell their receivables to some forfaiter. A loan factoring it’s essentially a funding source that agrees to pay for the company the worth of the expenses less a low cost for commission in addition to fees. The loan factoring advances almost all of the invoiced amount on the company immediately along with the balance upon bill of funds from the invoiced party.

Loan Factoring