The alternative depreciation system (ADS) approach measures depreciation using a straight-line method, which divides the difference between the cost of the asset and estimated value after usage by the number of years it is projected to be used. ADS is one of the instruments that the Internal Revenue Service (IRS) allows taxpayers to use in assessing the depreciation permitted on corporate properties. Therefore, it reduces the depreciation expense recorded every year. If the taxpayer elects to use an alternate depreciation system, they need to apply it to all or any property of the identical class placed in commission during the identical year.

ADS is generally used by small companies or those with high growth who do not possess enough immediate taxable income. Understanding when to use Advertisements is crucial for business owners because it can help to lower business taxes by accurately measuring depreciation expenses. IRS laws with respect to ADS, however, can be complicated. For this reason, many business owners want to employ a tax advisor to ensure that they are paying as much depreciation as the IRS requires.

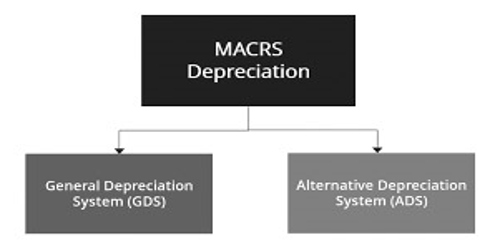

The ADS system sets depreciation as an equal amount annually, aside from the primary and last year, because they may not be a full twelve months. Under the interior Revenue Service (IRS), any business assets that are acquired after 1986 must be depreciated using MACRS. The IRS helps companies to depreciate several forms of business properties, including computers and peripherals; office furniture, fittings, and appliances; automobiles; and construction equipment. Under the MACRS process, a greater depreciation cost may be reported in earlier years and a lower depreciation of asset ownership in later years.

There are two depreciation systems under MACRS: the General Depreciation System (GDS) and therefore the Alternative Depreciation System (ADS). GDS is generally employed in practice; however, in certain circumstances (which are outlined later), ADS is employed. When a business is using the Advertising process, it cannot return to GDS. Taxpayers who want to use the alternative depreciation scheme find that under the general depreciation method the alternative plan would make for a better match of depreciation deductions against income than the recovery period.

The IRS allows ADS to be selected if investors meet particular conditions, but all properties in the same property class put in operation during the year must be protected by-election. Whereas the Advertising approach increases the amount of years an asset may be depreciated, the average cost of depreciation is also reduced. The depreciation amount is ready at an equal amount every year with the exception of the primary and last years, which are generally lower because they are doing not include a full twelve months.

Alternative Depreciation Strategy (ADS) is commonly used by small businesses or those with rapid growth that do not have adequate immediate taxable revenue. Using the ADS method would give such companies advantages over using the GDS method, as they could report lower depreciation in the earlier years, resulting in higher profitability. ADS provides for equal yearly deductions, aside from the primary and last years. Taxpayers must take care about selecting the choice depreciation system. Under the IRS law, if a taxpayer has opted to use an asset’s alternative depreciation scheme, they cannot return to the general depreciation method.

The alternative depreciation system (ADS) offers depreciation over an extended period of your time than the final depreciation system, which could be a declining balance method. The ADS method must be used when making AMT adjustments. Often used to measure depreciation for purposes of earnings and income. Taxpayers choosing the alternative depreciation plan would use this plan for all assets of the same class that were put into operation during the taxable year.

Information Sources: