Loan And Advance Operation of IFIC Bank Limited

Banking system of Bangladesh has through three phases of development Nationalization, Privatization and lastly Financial Sector Reform. IFIC Bank Limited has started its journey as a private commercial bank on June 24, 1983.

The whole working process of Konapara Branch, IFIC Bank is divided into three sections-1) General Banking Section 2) Credit Section 3) Foreign Exchange Section.

General banking is the starting point of all the operations. It is the department, which provides day-to-day services to the customers. It opens new accounts, remit funds, issue bank drafts and pay orders etc. provide customer through quick and sincere service is the goal of the general banking department.

Foreign exchange department plays significant roles through providing different sorts of L/C services like L/C opening, quicker delivery of goods L/C through SWIFT to the advising bank. Bank credit is an important means for bringing about economic development in a country. IFIC Bank Limited, being one of the private commercial bank of the country, has some prejudice to finance directly on priority basis to agriculture, industry and commerce sector. Hence, it is very clear that IFIC Bank plays an important role to move the economic wheel of the country.

INTRODUCTION:

The financial system of Bangladesh consists of Bangladesh Bank as the central bank, 4 nationalized commercial banks, 5 government owned specialized banks, 44 domestic private banks, 10 foreign banks and 28 non-bank financial institutions. The Financial system also includes insurance companies, stock exchanges and co-operative banks. In our country Bangladesh Bank, as the central bank, has legal authority to manage and regulate all the banks. It performs the traditional central banking roles of note issuance and of being banker to the government and banks. Commercial banks and domestic private banks are the profit-making financial institution that holds the deposits of individuals & business in checking & savings accounts and then uses these funds to make loans. Both general public and the government are dependent on the services of banks as the financial intermediary. I have chosen IFIC Bank Limited as a representative of other private banks. I have learned so many things in my internship program and I tried to relate my academic learning with real life situation and also find out the similarities as well.

Description of the report

Summary

This section includes a detailed description of the three departments of IFIC Bank. They are

- General Banking

- Credit, Loan and Advance

- Foreign Exchange

General Banking:

General banking department is the Heart of all banking activities. It performs the core functions of bank, operates day- to- day transactions .it is the storage point for all kinds of transaction of foreign exchange department, loans and advances department and itself. It also plays an important role in deposit mobilization of the branch. IFIC Bank provides different types of account and special types of saving scheme under general banking

General banking department is divided into various sections namely as follows:

The following things done in this department:

- Accounts opening section

- Deposit section

- Cash section

- Remittance section

- Bills and clearing section

- Accounts sections

- Check book issue

- Transfer of account

- Closing of account

- Dispatch section

OPENING OF ACCOUNT:

When a person want to open an account in IFIC Bank Limited, Federation Branch, needs to communicate with responsible officer. For opening an account a person or company must fill up a bank account opening form and needs to present the following things:

The Procedures that the Bank follows to open an Account:

- Fill up the specific type of form (Savings\Current\Std etc.) that the bank has given to the customer.

- The form should filled up by the applicant himself / herself

- Two copies of passport size photographs have to give to the Bank. In case of partnership account, all partners photograph have to submit.

- Documentation procedures must be fulfilled by the applicants.

- Applicant must sign specimen signature sheet that provided by bank.

- Introducer is mediatory to open any account.

- Introducer’s signature and accounts number will verify by authorized officer

- Authorized Officer will accept the application.

- Minimum balance has to deposit to the bank by applicant (only cash is accepted).

- Authorized officer will give entry to the register and open the account.

- After that the officer will give cheque book to the account holder.

- KYC (knowledge about your customer) should maintain.

The account should be properly introduced by any one of the following:

- An existing Current Account holder of the Bank.

- Officials of the Bank not below the rank of an Assistant officer.

- A respectable person of the locality well known to the Manager/Sub-Manager of the Branch concerned.

DEPOSIT SECTION

The term deposit of money means, to preserve money. After the consumption people want to save some money for future uncertainty. So they deposit it to the bank. On the other hand bank is a service organization that helps people to deposit their money for future. Bank’s main motive is to mobilize the money and gain profit. Banks give loan to other people, they invest it and give interest to the bank, by that the bank earns profit. By mobilizing that sum of money, not only the individuals but also the economy is benefited.

There are four basic types of deposit are mainly used

- Current Deposit.

- Savings account.

- Short term deposit (STD)

- Fixed deposit (FDR)

CASH SECTION

Cash section is very much important for any bank. Without cash section, no bank can do their activities properly. Cash section is directly related to the customer. Following tasks are made in cash section:

- Here the customer deposit and withdraw money.

- Customer may receive different type of financial instrument like Prize bonds.

- Here the customers can pay their utility bills.

- The cash payments of any kinds of remittance (Pay order, Demand order etc.) are made here.

CREDIT DEPARTMENT

CREDIT RISK MANAGEMENT:

Loan and advances Credit may be defined broadly or narrowly. Broadly, credit is finance made available by one party (lender, shareholder / owner) to another (borrower buyer, corporate or non-corporate firm). Narrowly, credit is simply the opposite of debt. Debt is the obligation to make future payments. Credit is the claim to receive those payments.

In perspective of IFIC Bank Limited risk is defined as the probability of losses, financial or else. Now a day’s risk management plays a vital role to reduce uncertainty of assets and or else. The major areas of risks are Credit Risk, liquidity risk, Market risk, Operational Risk and Reputational Risk due to money laundering risk. Market risks include Foreign exchange risk, Interest rate risk and Equity risk.

Lending principles following by IFIC Bank:

The principle of lending is collection of certain expected time tested standards, which ensure the proper use of loan fund in a profitable way and its timely recovery. Different authors described different principles for sound lending.

IFIC Bank follows the following seven principles in its lending activity:

- Safety

- Security.

- Liquidity.

- Adequate yield.

- Diversity.

- Productive purpose.

- National interest.

(1) Safety:

Safety should get the prior importance in the time of sanctioning the loan at the time of minority the borrower may not pay or may unable to [ay the loan amount. Therefore, in the time of sanctioning the loan adequate securities should be taken from the borrowers to recover the loan. Banker should not scarify safety for profitability.

IFIC Bank limited exercises the lending function only when it is safe and that the risk factor is adequately mitigated and covered. Safety depends upon

- The security offered by the borrower and

- The repairing capacity and willingness of debtor to repay the loan with interest.

(2) Security:

Banker should be careful in the selection of security to maintain the safety of the loan. Banker should properly evaluate the proper value of the security. If the estimated value less than or equal to loan amount, the loan should be given against such securities.

(3) Liquidity:

Banker should consider the liquidity of the loan in the time of sanctioning it. Liquidity is necessary to meet the consumer need.

(4) Adequate yield:

The banker should consider the interest rate when go for lending. Always banker should fix such an interest rate for its lending which should be higher than its saving deposits interest rate.

(5) Diversity:

Banker should minimize portfolio risk by putting its fund in the different fields. If banker put its entire loan able fund in one sector it will increase the risk. So if it faces any problem in any sector it can be covered by the profit of another sector.

(5) Productive purpose:

IFIC Bank exercises its lending function only on productive purpose.

(6) National or social interest:

IFIC Bank also considers national aspect of any project while financing .they take utmost care so that the project can’t be detrimental to the society as well as to the nation.

Credit Department:

One of the primary functions of commercial bank is sanctioning of credit to the potential borrowers. Bank credit is an important catalyst for bringing about economic development of a country. Without adequate finance, there can be no growth or maintenance of a stable economy. Bank lending is important for the economy, because it makes possible the financing of agriculture, commercial and industrial activities of a nation. Hence, it is very clear that, IFIC Bank plays an important role to move the economic wheel of the country.

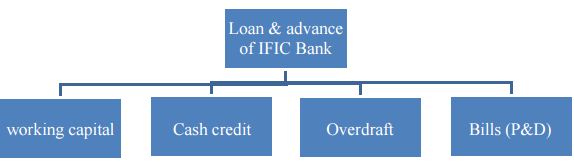

There are different types of loan, which is provided by the bank, but those are the collective form of the following item.

Direct facilities (Funded):

The different types of loans and advance that ICIC Bank offers are as follows

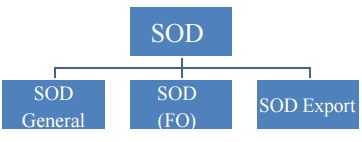

(1) Secured Overdraft (SOD)

It is a continuous advance facility by this agreement; the banker allows his customer to overdraft his current account he withdraws, to his credit limits sanctioned by the bank. The interest is changed on the amount, which not on the sanctioned amount. IFIC bank sanctions SOD against different security.

Types of secured overdraft:

a) SOD (General):

Advance is granted to a client against the work order of government of departments, corruptions, autonomous bodies and reputed multi-national / private organization. The clients’ managerial capability, equity strength, nature of the scheduled work is judged to arrive at a logical decision.

Disbursement is made after completion of documentation formalities. Besides usual charge, documents like a notarized irrevocable power of attorney to collect the bills from the concerned authority and a letter from the concerned authority confirming direct payment to the bank is also obtained. The work is strictly monitored to review the progress at each interval.

b) SOD (FO):

Advance is granted to a client against financial obligations. The security of advance is granted to the person to whom the instrument belongs. The discharged instrument is surrounded to the bank along with a letter signed by holder /holders authorizing the bank to appropriate the proceeds of the instrument on due date towards the repayment of the advance. The bank’s lien is prominently noted face of the instrument under the signature of an authorized bank official. The instrument is issued by another branch of IFIC Bank limited or any branch of some other bank, and then the concerned branch in each intimated to lien mark the instrument.

c) SOD (Export):

Advance allowed to purchasing foreign currency for payment against L/Cs (Back-to –Back) where the exporter cannot materialize before the date of import payment.

(2) Cash credit:

Cash credit (CC) is an arrangement by which a banker allows his customer to borrow a money up to a certain limit.CC is a favorite mode of borrowings by traders, industrials etc. for meeting their working capital requirements.

Cash credit or continuous credit are those, which forms continuous debits and credits up to a limit and have an expiration date. A service charge that in effect of an interest charge is normally made as a percentage of the value of purchases.

Cash credit is generally allowed against hypothecation or pledge of goods. Hence cash credits are two types:

- Cash credit hypothecation

- Cash credit pledge.

Cash credit hypothecation:

Cash credit allowed against hypothecation of goods is known as cash credit hypothecation. In case of hypothecation, borrower retains the ownership and possession of goods on which charge of the lending bank is created.

Cash credit pledge:

Under this arrangement a cash credit is sanctioned against pledge of goods or raw materials. By signing the letter of pledge, the borrower surrenders the physical possession of the goods under the banks effective control as security for payment of bank dues. The ownership of the goods, however, remains with the borrower.

L I M (loan against imported merchandise):

When the importer failed to pay payable to the exporter against import L/C, Then IFICBL gives loan against imported merchandise to the importer. This is also a temporary advance connected with import, which is known as post import finance.

- Working capital:

Loans allowed to the manufacturing units to meet their working capital requirement, irrespective of their size big, medium or large, fall under category.

- Export credit:

Credit facilities allowed facilitating export against L/C fall under this category. It includes loan against packing credit (LAPC), Foreign Documentary Bills Purchased (FBDP) ETC.

- LTR (LTR)

This is an arrangement under which credit is allowed against trust receipt and imported or exportable goods remain in the custody of the importer or exporter but he is execute a stamped trust receipt in favor of the bank where a declaration is made the goods imported or bought with the banks financial assistance are held by him in trust for the bank.

- Local Bills Purchased Documentary:

Payment made against documents representing sell of goods to local export oriented industries, which are deemed as exports, and which are denominated in local currency/foreign currency falls under this head. The bill of exchange is held as the primary security. The client submits the bill and the bank discounts it. This temporary liability is adjustable from the proceeds of the bills.

- Loan against Other Securities:

Loan against other securities is a 100%secured advance, which requires no sanction from the Head Officer. It is sanctioned by making lien on FDR.ICB Unit certificate etc.

- Term loan:

IFICBL considers the loans, which are sanctioned for more than one year as term loan. Under this facility, an enterprise is financed from the starting to its finishing like as from installation to its production. IFICBL offers this facility only to big industries. Interest rate is 15.50%.

The loan term as follows:

- Short term: up to and including 12 months.

- Medium term: more than 12 months up to and including 60 months.

- Long term: more than 60 months.

Overdraft:

A consumer having current is accommodated by overdraft facility against security. permission is given to overdue current account up to sanctioned limit is continuous revolving credit and the borrower may operate any number of times within sanctioned up to validity period of limit

- House building loan:

The loan is provided against 100%cash collateral. Besides, the land and building are also mortgaged with the bank. Rate of interest is 15.50%.

PERFORMANCE AND RATIO ANALYSIS

Asset Activity Ratios

They are also known as asset management ratios or efficiency ratios and are used to judge the efficiency in management of assets. Assets are employed to generate sales for a financial institution and these ratios determine how well the asset is utilized to efficiently generate or convert asset into sales. High asset turnover ratios are desirable because they mean that the company is utilizing its assets efficiently to produce sales. The higher the asset turnover ratios, the more sales the institution is generating from its assets. It consists of fixed asset turnover and net asset turnover.

(a) Fixed Asset Turnover

Fixed Asset Turnover Ratio calculates the value of revenue achieved per dollar of investment. The fixed-asset turnover ratio measures a company/bank’s ability to generate net sales from fixed-asset investments – specifically property, plant and equipment (PP&E) – net of depreciation. A higher ratio indicates better asset management and utilization and vice versa.

Fixed Asset Turnover = Revenue/Net Fixed Asset

The fixed asset turnover of IFIC Bank was 261.65% in 2011. Then it continuously increased drastically to 271.49% in 2012 and 283.62% in 2013.

An unprecedented increase in fixed assets was responsible for this trend in 2013. A possible reason for the increasing value of fixed assets was raising inflation. This means that the new assets bought and recorded from 2012-13 were recorded at a higher value, increasing the amount of fixed assets exponentially.

2 (b) Net Asset Turnover

The net asset turnover ratio measures the ability of management to use the net assets of the company/bank to generate sales revenue. A well-managed company/bank will be making the assets work hard for the business by minimizing idle time for machines and equipment. Too high a ratio may suggest over-trading, that is too much sales revenue with too little investment. Too high a ratio may suggest under-trading and the inefficient management of resources.

Net Asset Turnover = Revenue/Net Asset

Net asset turnover of IFIC Bank was 6.31% in 2011. From 2011 onwards, it had been falling at different rates. It fell to 5.51% in 2012 and 4.97% in 2013. It dropped in 2012 due to a greater percentage increase in net assets compared to revenue. In 2013 the ratio dropped drastically because of significant increase in net assets as well as slight decrease in revenue. The downward trend of net asset turnover, which started from 2012 and continued till 2013, can be explained by the increasing of net assets, the rate of which is substantially greater than the rate of growth in revenue. Rapidly growing fixed assets increased net assets, thus bringing down net asset turnover.

Return On Asset

ROA is an indicator of a company’s profitability. ROA is calculated by dividing a company’s net income in a fiscal year by its total assets. It is known as a profitability or productivity ratio, because it provides information about the management’s performance in using the assets of the small business to generate income. ROA can be used as a valuable tool to measure progress against predetermined internal goals, a certain competitor, or the overall industry. ROA is also used by bankers, investors, and business analysts to assess a company’s use of resources and financial strength.

Return on Asset = Net Profit/Asset

Return on asset of IFIC Bank follows a cyclic trend. It was .90% in 2011. In 2012 it increased to .98%. After the increase in 2012, it also increased again and turns into 1.03% in 2013. The falling in 2011, caused by an economic downturn, coupled with a reduced interest spread and a lower net profit after tax, relative to total interest revenue.

In year 2013, total assets as well as net profit grew faster comparing to 2012 and 2011, causing the return on asset to rise during a period of high profitability. The growth in assets resulted from a significant growth in total credit as well as fixed assets. The return on asset drastically dropped in 2011 because profits took a huge hit from the failing capital market and shrinking net interest margin. The interest spread fell as interest on deposit soared, but the interest on loan could not increase as much due to the lending cap.

- Return On Equity

This ratio shows the amount of net income returned as a percentage of shareholders equity. Return on equity measures a company/bank’s profitability by revealing how much profit a company generates with the money shareholders have invested. It indicates a firm’s efficiency in applying common-stockholders’ (ordinary- shareholders’) money.

Return on Equity = Net Profit/Equity

The return on equity of IFIC Bank was 12.44% in 2011. After that it started to increase and became 14.41% in 2012. Then the ratio turns into 14.83% in 2013. The fall in 2011 was caused by a lower net profit margin resulting from a lower interest rate spread and increased provisions and operating expenses. Profitability dropped due to a domestic economic turndown, combined with the global economic crisis. The sharp fall in 2011 is attributable to a combination of two factors. Firstly, a fall in return is evident from the drop in the interest spread and net profit margin. Profitability dropped due to an increase of interest on deposits and loss in capital market investment.

Return On Deposit

This ratio shows the amount of net income returned as a percentage of total deposits. Return on deposit measures a company’s profitability by revealing how much profit a company generates with the money savers. It indicates a company’s efficiency in applying deposits (liabilities) to earn profit. Here IFIC Bank’s return on deposit of last three years is as follows.

Return on Deposit = Net Profit/Total deposit

Return on deposits of the IFIC Bank was .90% in 2011. It slightly rose in 2012 to 1.22%. The ratio increased to 1.27% in 2013. The fall in 2011 was caused by a substantial increase in deposits and even greater decrease in net profit. The fall in net profit was caused by the stock market crash and the increase in return on deposits, leading to a lower total income for the bank.

Findings

While working at International Finance Investment & Commerce Bank Limited, in Federation Branch I have attained a newer kind of experience. After collecting and analyzing data I have got some findings and recommendations. These findings are from the personal points of view, which are given below:

- Online banking system is available in IFIC Bank that is very important to compete to others in the electronic world.

- For credit appraisal, the bank some time depends on the client for its authentication.

- All the employees are not professionally trained enough in the computer literacy part.

- It can be said IFIC Bank is much more a businessmen’s bank than for the consumers or general public’s.

- In case of opening an account, some big parties are come to open accounts in reference with the high officials of the bank. They do not submit all papers that required opening an account and in future they do not feel any urge to submit those papers, but already they become accounts holder. I think in this case the authority is violating the rule.

- Most of the borrower does not pay their payment timely.

- Most of the clients are under graduate and unable to understand the term and conditions, as a result they fail to understand that when they have to repay the loan, even after repeating them again and again the schedule of their repayment.

- Every time the bank has incurred a very big bad debt because of irresponsibility of employees.

- Loans and advance department take a very long time to sanction a loan; as a result they are losing the clients.

- Sometimes the employees overvalued the mortgage property, As a result if the client fails to repay the loan the bank authority cannot collect even the principal money invested by the selling those assets.

- Some tomes CIB reports are not prepared properly.

Recommendations

Banking is a service –oriented marketing, the business profit depends on its service quality. That is why the authority always should be aware about their service.

Strict Supervision must be adapted in case of high risk borrowers. Time to time visit to the projects should be done by the bank officers.

The average number of days required for sanctioning and disbursement of credit against specific loan proposal should be reduced.

The performance evaluation system is not updated. The organization should follow the 360-degree performance evaluation system. In this case, the superior executives will not be much rude to the subordinates because the top-level employees’ performance will be evaluated by the subordinates.

Selection of borrower shall be made as per rules and procedures of the advances and after making proper assessment of business establishment, respectability, creditability, actual requirement of fund repayment capacity etc. Appraisal of feasibility and viability of the projects shall be done in proper manner examining all the factors by an efficient and qualified appraiser so that no difficulties are faced at any stage of the project from construction to production stage.

The bank should not always be very much sensitive of recovery of loans and will not bring necessary pressures for recovery provided the borrowers are incorrigible and habitual defaulters. The lenders shall not resort to any hasty decision and take legal action against the borrowers if there is any scope for recovery of the dues on compromise terms even by allowing some concession of interest and rescheduling the repayment program by allowing reasonable time to the borrowers.

Problem of the borrower’s projects or business, which have turned sick unavoidable circumstances of unforeseen events, shall be looked into sympathetically by the lending bank. If necessary, bank shall not hesitate to allow further finance to revive the sick unit to ensure safe recovery of the loan in future for which a suitable repayment schedule may be prepared in consultation with borrowers.

The lenders shall take legal action against the incorrigible defaulting borrowers who are avoiding payment on flimsy grounds without bonafide intention to square up their dues without wasting of time. Money suits & criminal cases filed against the bad borrower shall be closely followed up for early decision of the court and immediate steps shall be taken for satisfaction of the decrees against the judgment debtors.

Alertness and education amongst the sub-conscious about their obligation to return bank’s money in time and utilization of funds of funds only for productive purpose of motivation and education field assistants of the lending bank may play vital role.

Highly efficient employee should take responsibility for loan and advance section. CIB report should maintain properly.

Documentation about loans should maintain properly.

The lenders shall sanction and disburse loan to the borrowers in proper time of investment. They will see that no delay is caused in completing formalities and processes which may create problem to the borrowers to divert funds elsewhere or want of scope for investment and thus the funds become stuck up ultimately. So loans should always be sanctioned & disbursed in proper time of investment to ensure recovery of the loan in time from the borrowers.

Conclusion

Banking sector of Bangladesh consists of several nationalized and private banks. They are doing their activities and highly contribute to the national economy. Among them IFIC Bank Limited also makes significant contribution to the economy. They are performing their activities, as a result not only the bank but also the economy is benefited. The bank is performing general banking, Loan-advance, foreign exchange activities etc, as a result they are mobilizing the money and do well for the economy. Although they have some limitations in their services, they are doing tremendous job for the economy. If they can reduce their limitation and introduce new ideas, they can do better in the banking sector of Bangladesh.