General Banking System of IFIC Bank Limited

The principal reason of banks chartered by the government and the central bank is to make loans to their customers. Banks are expected to support their communities with an adequate supply of credit for all legitimate business and financial needs of consumer and to price that credit reasonably in line with competitively determined interest rates. Indeed, making loans is the principal economic function of banks to fund consumption and investment spending by businesses, individuals, and units of government. How well a bank performs its function has a great deal to do with the economic health of any region, because banking performance support the growth of new businesses and jobs within the banks trade territory and promote economic vitality. Moreover, bank loans often seem to convey positive information to the marketplace about a borrower’s credit quality, enabling a borrower to obtain more and perhaps somewhat cheaper funds from other sources.

This report explores IFIC Bank’s activities as one of the leading non-government organization. This report contains information about all commercial activities that the bank deals with. I have mainly focused on General Banking system of IFIC Bank Limited in this report. General banking operation includes all the general activities performed by the bank. I have discussed about different types of account holder and different types of account such as Saving Account, Current Account, Fixed Deposit Rate (FDR), Pension Saving Scheme (PSS) & other existing accounts with their rates and other activities of General Banking in detail.

Objective of the report:

The primary objective of this report is to comply with the requirement of my course. But the objective behind this study is something broader. The principal intent of this report is to analyze the trends of modern banking and their customer’s satisfaction. Objectives of the study are summarized in the following manner:

- To identify the present state of IFIC Bank Limited.

- To get an idea about the financial strength of IFIC bank.

- To find out the problems exist in general banking department.

- To describe General Banking, SMS Banking, ATM facilities, loan & other facilities provided by it.

- To provide the recommendation for improvement.

Methodology of data collection:

For achieving the specific objective of this study, I have collected the related data both from primary & secondary sources.

Primary data have been collected from:

- Interviewing and interacting with the customers of IFIC Bank.

- Observing different organizational activities.

- Conversation with the staffs of this bank.

Secondary data have been collected from:

- The annual reports of IFIC bank.

- Different papers of the bank.

- Various records of the bank, unpublished data.

- Different textbooks, journals, booklets and

- Web site of IFIC bank.

Historical Background:

International Finance Investment and Commerce Bank Limited (IFIC Bank) is banking company incorporated in the People’s Republic of Bangladesh with limited liability. It was set up at the instance of the Government in 1976 as a joint venture between the Government of Bangladesh and sponsors in the private sector with the objective of working as a finance company within the country and setting up joint venture banks/financial institutions aboard. In 1983 when the Government allowed banks in the private sector, IFIC was converted into a full fledged commercial bank. The Government of the People’s Republic of Bangladesh now holds 32.75% of the share capital of the Bank. Directors and Sponsors having vast experience in the field of trade and commerce own 11.31% of the share capital and the rest is held by the general public.

The Bank had been widely welcome by the business community, from small entrepreneurs for forward-looking business outlook business outlook and innovative financing solutions. Thus, within this very short period it has been able to create an image for itself and has earned significant reputation in the country’s banking sector as a bank with vision.

General banking department is the ‘Heart’ of the banking activities. It performs the core functions of the bank, operates the day-to-day transaction. It is the storage point for all kinds of transaction of foreign exchange department, loan and advances department and itself. IFIC Bank provides different types of accounts and special types of schemes under general banking.

The sponsors of IFIC Bank Ltd. are leading entrepreneurs of the country having stakes in different segments of the national economy. They are eminent industrialists and businessman having wide business reputation.

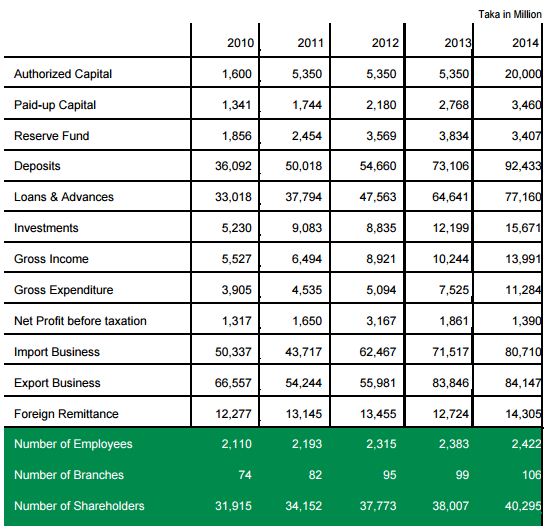

Financial Highlights:

Corporate Banking:

IFIC Bank is offering specialist advices and products to corporate clients to meet diverse demands of the changing market scenario. The bank has an extensive branch network all over the country to expedite the client’s business growth. The bank facilitates the clients to face the challenges and realize opportunities. The bank’s main focus is relationship based banking and understanding corporate and institutional business environments. Products and services for corporate clients include: Working Capital Finance, Project Finance, Term Finance, Trade Finance, Lease Finance, Syndication Loan etc.

Retail Banking:

Retail Banking is mass-banking facility for individual customers to avail banking services directly from the wide branch network all over the country. The bank provides one-stop financial services to all individual customers through its innovative products & services to cater their need. With a view to provide faster and more convenient centralized online banking services, now, all its branches have been brought under the real time online banking system. IFIC Bank offers a wide variety of deposit products, loan product & value added services to suit the customer’s banking requirements. Products and services for individual customer include: Consumer Finance, Deposit Product, Card, NRB Account, Student File, SMS Banking etc.

SME Banking:

The growth of Small and Medium enterprises (SMEs) in terms of size and number has multiple effects on the national economy, specifically on employment generation, GDP growth, and poverty alleviation in Bangladesh. At present, Small & Medium Enterprise sector is playing a vital role in creation of new generation entrepreneurs and ‘Entrepreneurs Culture’ in the country.

Experience shows that borrowers of small enterprise sector prefers collateral free loan since normally they cannot offer high value security to cover the exposure.

To facilitate SME sector of the country, IFIC Bank provides collateral free credit facilities to the small & medium entrepreneurs across the country whose access to traditional credit facilities are very limited. The bank is offering 15 different products for selected target groups, such as – Easy Commercial Loan, Retailers Loan, Muldhan Loan, Women Entrepreneur’s Loan (Protyasha), Transport Loan, Working Capital Loan, Project Loan, letter of Contractor’s Loan, Bidder’s Loan, Working Capital Loan, Project Loan, Letter of Guarantee, Letter of Credit Loan against Imported Merchandize (LIM), Loan against Trust Receipt etc.

Agricultural Credit:

Bangladesh is an agro-based country and majority of the population is dependent on Agriculture. Although maximum of the total population is dependent on agriculture, its contribution to GDP has gradually come down. Moreover, every year a huge amount of food grain and other agricultural products are imported to meet the demand of the country. In order to achieve desired growth in agriculture sector of the country the bank is committed to increase present loan portfolio in agricultural sector. IFIC Bank is offering Agriculture Loan products namely –

(i) Krishi Saronjam Rin – for Agriculture Equipments

(ii) Shech Saronjam Rin – for irrigation equipments

(iii) Poshupokkhi & Motsho Khamar Rin – for Live Stock & Fish Culture &

(iv) Phalphasali Rin – for Fruit Orchard for individuals & group at micro level.

Lease Finance:

Lease means a contractual relationship between the owner of the asset and its user for a specified period against mutually agreed upon rent. The owner i.e. the Bank is called the Lessor and the user i.e. the customer is called the Lessee. Lease finance is one of the most convenient source of financing of assets viz. machinery, equipment vehicle, etc.

IFICBL, the highly capitalized private Commercial Bank in Bangladesh has introduced lease finance to facilitate funding requirement of valued customers and growth of their business houses.

Its lease facility is extended to the items like Industrial Machinery, Luxury bus, Mini bus, Taxi cabs.

Money Transfer:

Joining with one of the world renowned money transfer service “ Money Gram”, IFICBL has introduced its customers to the faster track of remittance. Now IFICBL can bring money in Bangladesh from any other part of the globe in safer and faster means than ever before.

This simple transfer system, being on line eliminates the complex process and makes it easy and convenient for both the sender and the receiver. Through IFICBL–Money Gram Transfer Service, money will reach its destination in minutes by affordable, reliable and convenient financial services.

Treasury & Capital Market:

IFIC Bank Limited is devoted to capital Market of the country and offers world standard brokerage services for individual and institutional investors. The Bank is responsible for origination of sales, buy and trading of securities of Capital markets. It aims to provide relevant support to its customer with sophisticated and innovative financial solutions and delivering the highest quality of services. It has a seat in Dhaka Stock Exchange Limited.

The Treasury Division of IFIC Bank is engaged with Cash Management, Liquidity Planning and Liquidity Protection. It is also conscious to protect all the bank’s Assets and Profits against loss due to domestic as well as global financial realities, particularly Interest and Exchange Rate fluctuations. The Treasury Department is also regarded as a Profit Center, which generates income by trading instruments in the Financial Market.

To manage treasury unit as profit centre, along with guidance from regulatory authorities, the bank equipped itself with clear policies, fit organization structure, deployment of trained staff, modern infrastructural facilities and technological initiatives.

Major functions of treasury division of IFIC Bank are –

Fund Management

- Management of Statutory Requirement Investment

- Trading of Foreign exchange & Money Market Instruments AssetLiability Management

- Risk Management

IFIC Bank has a dedicated Treasury team which is capable of providing all treasury solutions through wide range of Treasury products. IFIC Treasury has four different desks, which are specialized in their own area to provide best services with respect to pricing, best possible solution for customer requirement and market information.

Cheque book issue:

- Firstly the customer will fill up the cheque requisition form.

- Authorized Officer Asses all of these Cheque requisition and send it to the Head Office with a cheque requisition application.

- Head Office sends Cheque book to the branch.

- Put entry in the Cheque book issue Register.

- The leaves of the Cheque book under issue shall be counted to ensure that all the leaves and the requisition slip are intact and the name & account number shall be written on all the leaves of the Cheque book and on requisition slip.

- The name and the account number of the customer shall be written in the Cheque book register against the particular Cheque book series. Customer comes for the Cheque book.

Taken signature in the Cheque book Register from the customer and put entry in the computer software.

Then the Cheque book is handed over to the customer after taking acknowledgement on the requisition slip.

Transfer of an account to another Branch:

Sometimes the customer wants to transfer his account to another branch due to various reasons. IFIC Bank, Chapai Nawabganj Branch, also gives this kind of facility to the customer. In this case, they will have to submit an application to the branch manager stating the reasons. The officer verifies the signature and finds out the balance of the party. The holder also submits the rest cheque leaves along with the application. Then the officer issues an Inter Branch Credit Advice (IBCA) to that branch and a debit voucher with the balance of deposit in that account. He also sends the account opening form and specimen signature card to that new branch. The new branch officer verifies the customer signature with account opening form supplied to him. The amount mentioned in the IBCA considered as the initial deposit of the new branch.

Dispatch Section:

Dispatch division mainly operates the letter to the client, Inter Bank Credit Advice (IBCA), Inter Bank Debit Advice (IBDA), Out ward Bill Collection (OBC) to the other banks for internal transaction with the bank.

These two types of books are:

- Inward mail — for receiving letters

- Outward mail — for sending letters

Establishment section:

This section deals with employees’ salary, many types of internal expenses such as purchases of stationary, equipment, machinery, payment of labor cost and convince. In case of leave of absence employee collects prescribed form from this section.

General Banking:

During my practical orientation I was placed in General Banking of IFIC Bank Limited at Moulvibazar Branch. General Banking is the starting point and main function of all the banking operations. It is the department which provides day-to-day service to the customers. It is associated with financial transactions to facilitate customer service. However, there are other departments for successful banking operations.

Functions of General Banking:

This department maintains following functions:

- Accounts Opening section.

- Cash section

- Clearing section.

- Remittance section.

Accounts Opening Section:

This section opens different types of account for their valued customers. Selection of customer is very important for the bank because bank’s success and failure largely depends on their customers. If customers are bad they creates fraud and forgery by their account with bank and, this destroys the goodwill of the bank. So, this section takes extreme caution in selecting its valued customer.

Current Account (CD):

Current account is convenient for the business persons who needs frequent transaction. In case of Current Account no interest is given to the account holder. There are current accounts for individual, joint current account, proprietorship current account, partnership current account, and limited company current account. It is a running and active account, which may be operated upon any number of times during a working day. There is no restriction on the number and the amount of withdrawals from a current account.

Documentation: Proprietorship:

- Attested photocopy of Trade License

- Two copies of passport size photographs of account holder.

- National ID Card photocopy

- Documentation: Partnership

- Attested photocopy of Trade License

- Two copies of passport size photographs of account holder

- National ID Card photocopy

- Attested photocopy of Partnership deed.

Documentation: Private Limited Company:

- Attested photocopy of Trade License

- Two copies of passport size photographs of directors With

- National Id card photocopy

- Certified copies of Memorandum and Articles of Associations

- Certificate of Incorporation and copy of TIN certificate.

- List of directors as per return of Joint Stock Company with signature

- Resolution for opening account with the bank.

Documentation: Public Limited Company:

- Attested photocopy of Trade License

- Two copies of passport size photographs of directors with national Id card photocopy

- Certified copies of Memorandum and Articles of Associations

- Certificate of Incorporation

- Certificate of Commencement of business and copy of TIN certificate.

- List of directors as per return of Joint Stock Company with signature

- Resolution for opening account with the bank.

Operational Nature of Accounts:

Current Deposit Accounts (CD account)

A current account may be opened by any individual, firm, company, club, associates, etc. Bank: may, however, refuse without assigning any reasons to open current account to any body.

Minimum balance of Tk. 2000 while opening.

- No current account will be opened with Cheques.

- Fund in the current deposit account shall be payable on demand.

- Minimum balance to be maintained of Tk. 2000.

- If minimum balance falls then incidental charges of Tk. 150 will be realized half yearly.

- No interest is payable on the balance of CD.

- In case of closing of current account Tk. 150 is to be realized against incidental charges.

Closing of Current Account:

A customer’s account with a banker may be closed for the following circumstances:

(a) The customer may inform the banker in writing of his/her intension to close the account

(b) The banker may itself ask the customer to close the account when the banker find that the account is not been operated for a long time.

Formalities (When customer informs):

Application to Branch in charge for closing

- Making the account balance nil

- Signing the revenue stamp by the client

- Payment of closing charge.

- Surrender of the unused Cheque leaves by the bank

- Closing of the account by the bank

Formalities (When bank informs):

- Bank communicates with the client if the account is not operated for six months and in case of non response account becomes a dormant account.

- In case non operation for two years then the account becomes “inoperative” account.

- If the current account paying in “Inoperative Current Account for more than one years then the account becomes an “Unclaimed Deposit” account.

- For withdrawal at any amount from that account, permission from head office or controlling office is required.

Saving Deposit Account (SB):

Saving Accounts are especially for the middle-income groups who are generating limited income and have the tendency to save to meet their future need and intend to earn an income from their savings. It aims at encouraging savings of non-trading person(s), institution’s society, clubs etc. by depositing small amount of money in the bank. 5.5% interest is paid to the accountholder.

Both the elements of time and demand deposit are present in this account.

For opening a savings account these documentations are required:

Documentations:

- Two copies of passport size photographs

- National Id card photocopy

- Introductory reference.

- One choppy Photograph of Nominee with

- National Id card photocopy

Closing Formalities of Savings Account:

Formalities for savings account opening and closing are same as current account. Restriction on Withdrawals and Deposit

- The number of withdrawals over a period of time is limited. Two withdrawals per week are permitted. But more than that no interest will be paid on rest amount for that month.

- The total amount of one or more withdrawals on any date should not exceed Tk.20000.00

Short‐Term‐Deposit (STD):

Minimum balance is required in this account is Tk. 25,000 and interest is given to the depositors at the rate of 4%. It is also a time deposit account. The formalities for opening of this account are same to those required for current account. The only difference is that 21(Twenty one) days notice is to be given for withdrawal of any sum of money from Account.

Fixed Deposit Receipt (FDR):

These are the deposits, which are made with the bank for a fixed period specified in advance. It is purely a time deposit account. The bank does not maintain cash reserves against these deposits and therefore the bank offers higher rates of interest on such deposits. Interest is paid at rate determined by the length of the period for, with the deposit is made. Obviously, the longer is the period of deposit, the higher is the rate of interest.

Opening of Fixed Deposit Account:

The depositor has to fill up an application form wherein he/her mentions the amount of deposit, the period for which deposit is to be made and the name(s) in which the fixed deposit receipt is to be issued. In case of a deposit in joint names, the banker also takes the instructions regarding payment of money on maturity of deposit i.e. whether payable jointly or payable to survivor etc. the banker also takes the specimen signatures of the depositor(s). A Fixed Deposit Receipt is than given to the depositor acknowledging receipt of the sum of money mentioned therein. It also contains the rate of interest and the date on which the deposit will fall due for payment. In this account no transaction are allowed and no Cheque book is issued. Customers are given Fixed Deposit Receipt only.

Payment of interest:

It is usually paid on the maturity of the fixed deposit. IFIC Bank Ltd, calculate the interest at each maturity date and provision is made on that “Miscellaneous creditor expenditure payable account” is debited for the accrued interest.

Encashment of FDR:

In case of the premature FDR IFIC Bank Ltd, is not bound to accept the surrender of the deposit before its maturity date. In order to deter such a tendency the interest on such a fixed deposit is made a certain percentage less than the agreed rate. Normally savings bank deposit is allowed.

Renewal of FDR:

In IFIC Bank Ltd, the instrument is automatically renewed within 7 (Seven) days after the date of maturity if the customer does not come to encash the FDR. If the customers don’t want to renew automatically then they need to specify this option when they open that particular FDR.

Pension Savings Scheme (PSS):

This is a scheme to make the customer introduced to the banking system under this schemes the customers are to pay a certain of money at monthly interval up to a period of 3 to 5 years and after the period they will get the returns along with the full interest earned during the period and the principal amount. Most of the clients under this scheme are middle class and lower middle class people

Generally opened by small saver.

- Minimum Amount Tk. 500 and maximum Tk. 50000

- Interest rate 10.00%

- Maturity 3 to 5 years.

Liquidation of PSS:

In case of premature encashment if the period is below 1 year then no interest will be provide. If above 1-year interest will be given.

Monthly Income Scheme (MIS):

This is another attractive scheme offered by this bank under this scheme the depositors an to deposit a fixed amount to the bank and for their fixed amount they are entitled to earn monthly payment from the bank. This is an attractive scheme for the retired person. This is also a kind of FDR, but here the interest is given monthly to the customers the deposit will be 50,000, 10,00,000, respectively.

The rate of interest is 10.00 %

- Maturity is 03 years.

- Liquidation of MIS

- 200 charge for premature encashment as out access duty.

- Closing before 6 months no benefit will be providing.

Pre cashment between 6 months to 1-year interest are provide according to savings rate. – Pre encashment between 1 to 3 years savings interest are provide 1.00 + saving rate

Kinds of Account Holders:

Branch may open accounts of the following categories of depositors:

- Individuals: Individuals are adult persons of 18 years age or more who are competent to enter into contracts.

- Joint accounts: More than one adult jointly or adult with minor’s may constitute joint accounts.

- Sole Proprietorship concern: A business trading concern owned by a single adult person is sole proprietorship concern.

- Partnership firms: A business concern owned and managed by more than one person who may be registered or not registered is a partnership firm.

- Private limited: A body corporate formed and registered under companies Act 1994, with limited members.

- Public limited: A body corporate formed & registered under companies Act 1994 with limited liability of the shareholders and with no upper ceiling of shareholding both certificate of incorporation and certificate of commencement has given by registrar.

- Trusts: Trusts are created by trust deed in accordance with the law.

- Liquidators: Liquidators are appointed by court of law for companies going into liquidation.

- Executor: Executors are appointed by a deceased himself before his death by “with” to settle the accounts of the person after his death.

- Club/Associations/Societies: There are organizations created & registered or not registered under societies registration act.

- Co-operatives: There are corporate bodies registered under society’s registration Act or companies Act or the co-operative societies Act.

- Non-Govt. Organization: NGOs are voluntary organizations created & registered and society’s registration Act or co-operative societies Act.

- Non-Trading concern: These are organization registered under society’s registration Act or companies Act or co-operative societies Act.

Cash Section:

Cash department is the most vital and sensitive organ of a branch as it deals with all kinds of cash transactions. This department starts the day with cash in vault. Each day some cash i.e. opening cash balance are transferred to the cash officers from the cash vault. Net figure of this cash receipts and payments are added to the opening cash balance. The figure is called closing balance. This closing balance is then added to the vault. And this is the final cash balance figure for the bank at the end of any particular day.

Functions of cash department:

- Cash payment

- Cash receipt

Cash payment:

- Cash payment is made only against cheque and pay order.

- This is the unique functions of the backing system which is known as “payment on demand”

- It makes payment only against its printed valid cheque.

- Cheque cancels when amount in figure and in word does differ, cheque is torn or mutilated.

Cash receipt:

- Another important function of this department is receipt of cash. Depositors deposit money in the account through this section by deposit slip.

- It receives deposit from depositors in from of cash.

- So it is the “mobilization unit” of the banking system.

- It collects money only its receipts from.

- It receives cash for issuing pay order TT, DD.

Books maintained by this section:

- Vault register: It keeps accounts of cash balance in vault at the bank.

- Cash receipt register: Cash receipt in whole of the day is recorded here.

- Cash payment register: Cash payments are made in a day are entries here.

- Rough vault register: Cash collection for final entry in vault registers done here, as any error and correction is not acceptable.

- Cash balance book: Balance here is compared with vault register. If no deference is found, indicate no error and omission.

Local Remittance:

Sending money from one place to another place for the customer is another important service of the bank. This service is an important part of transaction system. In this service system, people, especially businessman can transfer funds from one place to another place easily. There are three kinds of technique for remitting money from one place to another these are:

- Pay order (PO)

Pay order gives the right to claim from the issuing bank A payment is an instrument from one branch to another branch of the bank to pay a specific sum of money. Unlike cheque there is no possibility of dishonoring because before issuing pay order the bank takes money in advance. There are three reasons behind use of P.O:

Remitting Purpose

- Advice to Pay

- Payment against bill submitted to the bank.

Pay Order consists of three parties:

- Beneficiary

- Applicant

- Counter Part.

SWOT Analysis of IFIC Bank Ltd.

I have done my internship report at Moulvibazar Branch of IFIC Bank. As every organization has its strength, weakness, opportunity & threats accordingly Moulvibazar Branch individually as a particular organization has also its own strength, weakness, opportunity, threats. SWOT analysis of Moulvibazar Branch is as follows:

Strength:

- Quality services by creating good customer relation & modern sophisticated automated system.

- Has been able to maintain a good image about the Bank.

- Experienced and competing workforce who have expertise knowledge about the bank

- The Branch holds significant amount of loyal customers who always bring in new customers.

- Management consists of knowledgeable and authoritative personnel.

- Interaction of the employees with the top management.

- The corporate culture of IFIC Bank Limited is very much interactive. The environment within the organization is very helpful, positive and informal. There is no barrier between Superiors and subordinate for their free interaction. As the environment is very informal and friendly, it encourages employees to put their best effort and show their best performance.

Weakness:

- The prime weakness that I found is the lack of motivation of workers originating from management’s mal-practices, partiality, inters personnel clash, unsatisfied grievances etc.

- Very moderate level of teamwork because of subtle interpersonal clash.

- Branch area is not sufficient.

- This branch is not an AD branch. Therefore L/C opening is absent here.

- Sometimes the process of information transferring to the management is lengthy.

- There is also shortage of skilled employees in this branch. As it is comparatively busy branch the employees always work in pressure. There are only 20 employees in the branch. There is not any parking area to park the car of the clients.

Opportunity:

- Moulvibazar Branch is becoming comparatively busy place. Business is growing rapidly in this place.

- Locating fewer more branches to four different sub-districts of this region to embrace the banking of those regions.

- Opportunity to serve quality service through the usage of updated technology to the customer of this Branch.

Threats:

- Introduction of other commercial banks with more product/service and benefits.

- Other commercial banks are offering higher salary that may create problem for IFIC Bank Ltd. to retain their experienced managers and executives in this branch.

FINDINGS:

- There is a shortage of employees. They are always in pressure. Due to shortage of employees, customers can’t get quick service.

- Few officers of the bank are competent. Even though many of them simply know the working procedure of what they are doing but don’t know the philosophy behind doing those and some are inefficient to serve the customer.

- Some unskilled staff hinders the overall performance.

- Officers of the desk, where workload is very high, hardly get the chance to go out for development purpose and always feel that their duties for the organization would not be evaluated unless they can show a good amount of deposit collection against their name.

- To provide cheque book it takes minimum ten days. The days should be reduced.

CONCLUSION:

In recent times, banking sector is one of the most competitive business fields in Bangladesh. Since, Bangladesh is a developing country; a strong banking sector can alter the socio economic structure of the country. So we can say, the whole economy of a country in coupled up with its banking system. IFIC Bank Limited is the bank which is highly potential commercial Bank of Bangladesh. This bank performs hundreds of important banking and non-banking activities for both the public and the government as a whole. The Bank has an outstanding attitude to boom our business sector. From the learning and experience point of view I can say that I have really benefited from my internship program at IFIC Bank Ltd. This internship report at IFIC Bank Ltd. (Moulvibazar Branch) will definitely help me to realize my future carrier in banking sector. It is a great opportunity for me to get use to with the operational environment of commercial banking of IFIC Bank. I have tried by soul to incorporate this internship report with necessary relevant information.

RECOMMENDATIONS:

The bank management needs to have a clear operational efficiency and must thoroughly analyze the scopes for further development in order to retain and attract new customers towards any particular branch of a bank, Therefore, it is vital for the commercial banks to closely monitor their performance level, which comprises the functional units, that provides services to its clients. To make better position in the industry banks need to expand some activities & should give emphasis on some field & need to introduce new and diversified financial products to provide wider option to customers. Without having an effective customer base, it becomes difficult for any bank to compete and sustain in the competitive market for the banking services.

Before drawing the end I would like to offer the following suggestions for bringing improvements at Moulvibazar Branch of IFIC Bank Limited:

- Branch can arrange training program on different banking rules & regulation set by Bangladesh Bank which will optimize the efficiency of employees

- Branch should established Foreign Exchange department to acquire more potential customer.

- Branch should enhance loan provision and reserves.

- Branch can arrange several extensive training programs for the employees to learn in detail the bank’s software called “MYSIS”.

- IFIC Bank should set up more ATM booth in all their branches, particularly in this branch.

- IFIC Bank Ltd. should focus on their promotional activities, especially for this Moulvibazar-Dhaka Branch.