Loan Advancement Procedure of IFIC Bank Limited

Banking system of Bangladesh has through three phases of development Nationalization, Privatization and lastly Financial Sector Reform. IFIC Bank Limited has started its journey as a private commercial bank on June 24, 1983.

The whole working process of Federation Branch, IFIC Bank is divided into three sections-1) General Banking Section 2) Credit Section 3) Foreign Exchange Section. I was assigned on credit Sections for three (03) months. So my report is based on Credit, its risk and assessment system.

General banking is the starting point of all the operations. It is the department, which provides day-to-day services to the customers. It opens new accounts, remit funds, issue bank drafts and pay orders etc. provide customer through quick and sincere service is the goal of the general banking department.

Foreign exchange department plays significant roles through providing different sorts of L/C services like L/C opening, quicker delivery of goods L/C through SWIFT to the advising bank. Bank credit is an important means for bringing about economic development in a country. IFIC Bank Limited, being one of the private commercial bank of the country, has some prejudice to finance directly on priority basis to agriculture, industry and commerce sector. Hence, it is very clear that IFIC Bank plays an important role to move the economic wheel of the country.

INTRODUCTION:

The financial system of Bangladesh consists of Bangladesh Bank (BB) as the central banks, 4 nationalized commercial banks (NCB), 5 government owned specialized banks, 30 domestic private banks, 10 foreign banks and 28 non-bank financial institutions. The Financial system also embraces insurance companies, stock exchanges and co-operative banks. In our country Bangladesh Bank (BB), as the central bank, has legal authority to supervise and regulate all the banks. It performs the traditional central banking roles of note issuance and of being banker to the government and banks. Commercial banks and domestic private banks are the profit-making institution that holds the deposits of individuals & business in checking & savings accounts and then uses these funds to make loans. Both general public and the government are dependent on the services of banks as the financial intermediary. We have chosen IFIC Bank Limited as a representative of other private banks. We have learned so many things in our course and here we tried to relate the theories with real life situation and also find out the similarities.

OBJECTIVE OF THE REPORT

The main objective of education is to acquire knowledge. To acquired knowledge ultimately we must do some practical application in addition to theoretical knowledge. Through this report, I tried my level best to present my practical knowledge as well as to find out-

General:

- To observe the general banking and advance operation of IFIC Bank Limited, and their services.

- How a bank operates their activities in different areas being a single organization.

- What a bank is doing for Bangladesh to develop national economy.

- To get an overall practical knowledge concerning banking activities as a financial institution.

Specific:

- Presentation of an introduction to the organization- IFIC Bank Limited as a whole

- To get overall idea about the credit and general banking of IFIC Bank Limited.

- To recommend necessary steps to overcome such problems faced by the IFIC Bank Limited

- To identify the major areas of inefficiency.

About IFIC Bank

International Finance Investment and Commerce Bank Limited (IFIC Bank) is banking company incorporated in the People’s Republic of Bangladesh with limited liability. It was set up at the instance of the Government in 1976 as a joint venture between the Government of Bangladesh and sponsors in the private sector with the objective of working as a finance company within the country and setting up joint venture banks/financial institutions aboard. In 1983 when the Government allowed banks in the private sector, IFIC was converted into a fully fledged commercial bank. The Government of the People’s Republic of Bangladesh now holds 32.75% of the share capital of the Bank. Directors and Sponsors having vast experience in the field of trade and commerce own 8.62% of the share capital and the rest is held by the general public.

Bank’s Mission

Our Mission is to provide service to our clients with the help of a skilled and dedicated workforce whose creative talents, innovative actions and competitive edge make our position unique in giving quality service to all institutions and individuals that we care for.

We are committed to the welfare and economic prosperity of the people and the community, for we derive from them our inspiration and drive for onward progress to prosperity. We want to be the leader among banks in Bangladesh and make our indelible mark as an active partner in regional banking operating beyond the national boundary. In an intensely competitive and complex financial and business environment, we particularly focus on growth and profitability of all concerned.

Description of the report

This section includes a detailed description of the three departments of IFIC Bank. They are

- General Banking

- Credit, Loan and Advance

III. Foreign Exchange

General Banking:

General banking department is the Heart of all banking activities. It performs the core functions of bank, operates day- to- day transactions .it is the storage point for all kinds of transaction of foreign exchange department, loans and advances department and itself. It also plays an important role in deposit mobilization of the branch. IFIC Bank provides different types of account and special types of saving scheme under general banking.

General banking department is divided into various sections namely as follows:

The following things done in this department:

- Accounts opening section

- Deposit section

- Cash section

- Remittance section

- Bills and clearing section

- Accounts sections

- Check book issue

- Transfer of account

- Closing of account

- Dispatch section

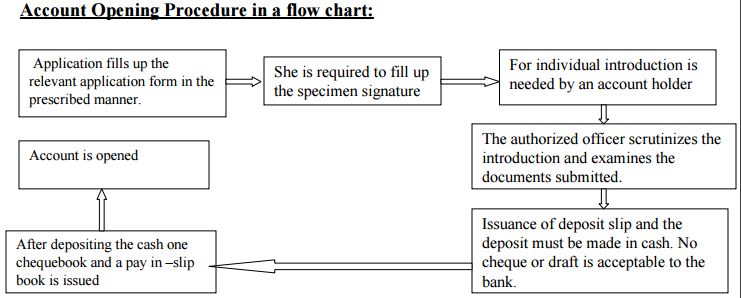

OPENING OF ACCOUNT:

When a person want to open an account in IFIC Bank Limited, Federation Branch, needs to communicate with responsible officer. For opening an account a person or company must fill up a bank account opening form and needs to present the following things:

The Procedures that the Bank follows to open an Account:

- Fill up the specific type of form (Savings\Current\Std etc.) that the bank has given to the customer.

- The form should filled up by the applicant himself / herself

- Two copies of passport size photographs have to give to the Bank. In case of partnership account, all partners photograph have to submit.

- Documentation procedures must be fulfilled by the applicants.

- Applicant must sign specimen signature sheet that provided by bank.

- Introducer is mediatory to open any account.

- Introducer’s signature and accounts number will verify by authorized officer

- Authorized Officer will accept the application.

- Minimum balance has to deposit to the bank by applicant (only cash is accepted).

- Authorized officer will give entry to the register and open the account.

- After that the officer will give cheque book to the account holder.

- KYC (knowledge about your customer) should maintain.

The account should be properly introduced by any one of the following:

- An existing Current Account holder of the Bank.

- Officials of the Bank not below the rank of an Assistant officer.

- A respectable person of the locality well known to the Manager/Sub-Manager of the Branch concerned.

DEPOSIT SECTION

The term deposit of money means, to preserve money. After the consumption people want to save some money for future uncertainty. So they deposit it to the bank. On the other hand bank is a service organization that helps people to deposit their money for future. Bank’s main motive is to mobilize the money and gain profit. Banks give loan to other people, they invest it and give interest to the bank, by that the bank earns profit. By mobilizing that sum of money, not only the individuals but also the economy is benefited.

There are four basic types of deposit are mainly used

- Current Deposit.

- Savings account.

- Short term deposit (STD)

- Fixed deposit (FDR)

CASH SECTION

Cash section is very much important for any bank. Without cash section, no bank can do their activities properly. Cash section is directly related to the customer. Following tasks are made in cash section:

- Here the customer deposit and withdraw money.

- Customer may receive different type of financial instrument like Prize bonds.

- Here the customers can pay their utility bills.

- The cash payments of any kinds of remittance (Pay order, Demand order etc.) are made here.

REMITTANCE SECTION

Money transferred from one place to another through banking channel is called remittance. Remittances of funds are one of the most important activities of the Commercial Banks. The main instruments used for remittance of funds are:

- Payment order (PO):

- Demand Draft (DD)

- Telegraphic Transfer (TT)

- Mail Transfer (MT)

DEMAND DRAFT (DD):

Demand Draft means money transfer from one branch to another branch of the same bank. It may occur between the two different banks. DD issues and receives is a regular task of this branch. In case of DD issue a branch charges commission. This commission depends on amount, which will be transferred.

Process of DD:

When anybody want to transfer money from this branch to another branch of IFIC Bank Limited or other bank at first the client needs to communicate with responsible officer and then he/she collects a printed DD form. After filling this form he/she needs to deposit cash with commission to the cash counter and takes a receipt. In case of DD four (4) copies of vouchers are prepared.

Original and duplicate copy is send to the responding branch. Triplicate copy is send to the Head Office with daily schedule. This branch preserves the quart-duplicate copy.

MAIL TRANSFER (MT):

Mail transfer means money transfer from one branch to another branch of the same bank. It may occur between the two different banks. MT issues and receives is a regular task of this branch. In case of MT issue a branch charges commission. This commission depends on amount, which will be transferred.

Process of MT

When anybody want to transfer money from this branch to another branch of IFIC Bank Limited or other bank at first the client needs to communicate with responsible principal officer and then he/she collects a printed MT form. After filling the form he/she needs to deposit cash with commission to the cash counter and takes a receipt. In case of MT four (4) copies of vouchers are prepared. Original and duplicate copy is send to the responding branch. Triplicate copy is send to the Head Office with daily schedule. This branch preserves the quart-duplicate copy.

TELEPHONE TRANSFER (TT):

Telephone Transfer (TT) means transfer of money from one branch to another branch of the same bank through telephone message. Telephone transfer is quicker process than mail transfer. In case of TT issue this branch charges commission. This commission depends on amount, which will be transferred

Process of TT:

When anybody wants to transfer money through telephone message from this branch to another branch of the same bank he/she needs to communicate with responsible officer. At first the client collects a printed TT form and after filling the form he/she needs to communicate with Second

Officer and then deposits cash with commission to the cash counter and finally takes a receipt. In case of TT issues, this bank prepares three (3) copies of vouchers. Original copy is sending to the responding Branch and the duplicate copy is sending to the Head Office with schedule. This branch preserves the triplicate copy.

PAY ORDER (PO):

- Pay Order gives the payee the right to claim payment from the issuing bank

- Payment is made by the Issuing branch only.

- Pay order generally used in the clearing house area.

- Payment is made by the clearing.

- Commission is charged by the issuing branch.

- The deposit may be cheque or cash.

CLEARING SECTION

The amount of Cheques, Pay Order (P.O), and Demand Draft (D.D) collection from other banks on behalf of its customer is a basic function of a Clearing Department. Every working day IFIC Bank Limited, Federation Branch, receives about 35-60 cheques that are made on another bank. When IFIC Bank Limited, Federation Branch, receives this type of cheques then it sends these cheques to the Clearinghouse of Bangladesh Bank through the Head Office. The Clearinghouse is formed with the representative of every scheduled bank. IFIC Bank Limited representative gives the cheque to the representative of respected branch on which cheque is made. After one or two days the bank on which cheque is made sends a message about the validity of the cheque that means it provides information about account and deposited money on this account.

Procedures of clearing follows

- Crossing of the cheque.

- Computer posting of the cheque.

- Clearing seal & proper endorsement of the cheque.

- Separation of cheque from deposit slip.

- Sorting of cheque 1st bank wise and then on branch wise.

- Computer print 1st branch wise & then bank wise.

- Preparation of 1st Clearing House computer validation sheet.

- Examine computer validation sheet with the deposit slip to justify the computer posting

- Copy of computer posting in the floppy disk.

- Sent to the local office.

ACCOUNTS SECTION

Accounts department is very important department of general banking. There are many transactions are made in every day in bank. Here the transactions are recording properly. If there is any fault made then the accounts section may check it and do action against it. To avoid these mishaps, the bank provides accounts department; whose function is to check the mistakes in passing vouchers or wrong entries or fraud or forgery. If any discrepancy regarding transaction arises, the department report to concerned department.

TRANSFER OF ACCOUNT:

- The customer submits an application mentioning the name of the branch to which the account to be transferred.

- The signature card, advice of new account and relevant documents are sent to that branch through registered post.

- The balance standing at credit in customer’s account is sent to the other branch through Inter Branch Credit Advice (IBCA).

- No exchange should be charged on such transfer.

- Attention is also given in this connection.

CLOSING OF ACCOUNT:

A banker can close the account of the customer under the following considerable circumstances:

- Death of customer

- Customer’s insanity and insolvency.

- Order of the court.

- Specific charge for fraud forgery.

DISPATCH SECTION:

- Keeping records of the documents send to other branches or banks.

- Letters are sending to their respective destination.

- Send those documents safely and correctly.

- Receives documents come through different medium, such as postal service, courier service, via messenger etc.

CREDIT DEPARTMENT

CREDIT RISK MANAGEMENT:

Loan and advances Credit may be defined broadly or narrowly. Broadly, credit is finance made available by one party (lender, shareholder / owner) to another (borrower buyer, corporate or non-corporate firm). Narrowly, credit is simply the opposite of debt. Debt is the obligation to make future payments. Credit is the claim to receive those payments.

In perspective of IFIC Bank Limited risk is defined as the probability of losses, financial or else. Now a day’s risk management plays a vital role to reduce uncertainty of assets and or else. The major areas of risks are Credit Risk, liquidity risk, Market risk, Operational Risk and Reputational Risk due to money laundering risk. Market risks include Foreign exchange risk, Interest rate risk and Equity risk.

Credit Department:

One of the primary functions of commercial bank is sanctioning of credit to the potential borrowers. Bank credit is an important catalyst for bringing about economic development of a country. Without adequate finance, there can be no growth or maintenance of a stable economy.

Bank lending is important for the economy, because it makes possible the financing of agriculture, commercial and industrial activities of a nation. Hence, it is very clear that, IFIC Bank plays an important role to move the economic wheel of the country.

Procedure for giving advance:

First step:

The potential borrower will submit application to SBL for loan by filling up of a specific Application form. The Application form (request for Credit Limit) contains following particulars:

- a) Name of the Borrower—–

- b) A/C No.————-

- c) Bunnies address (with telephone no.) [Residential address and Permanent address]——-

- d) Introducer’s name, A/C no. & address—–

- e) Date of establishment/ incorporation——

- f) Trade license number, date and expiry date (Photocopy of trade license enclosed)—- —-

- g) GIR/TR no. & amount of income tax paid last year——

- h) Constitution/ Status (Mention whether sole proprietorship/ partnership/ Public Ltd. company/ Private Ltd. company)——–

- i) Particulars of individual/ Proprietor/ Partners/ Directors (Name & Designation, father’s/ Husband’s name, present & permanent address with Telephone no., % of shares held)——-

- j) Experience and background of Individual/Proprietors/ Partners/ Directors——–

- k) Full particulars of assets in the personal name of Individual/ Proprietor/ Partners/ Directors with valuation———–

- l) Names of Subsidiaries/ Affiliates, percentage of share holding and nature of business———

- m) Nature and details of business/ products (for which credit facility is applied for), Markets (Present market price per unit, Factory price), Estimated sales for next one year…………

- n) Credit facilities required (type, amount, period, purpose, and mode of adjustment)……….

- o) Details of securities offered with estimated value (Primary security, Collateral security, market value of the security)……….

- p) Details of liabilities in the name of the client or in the name of any other partners/Directors or Subsidiaries/Affiliates Nature of advance, amount, security and validity of limit)…..

- q) Balance Sheet/ Income Statement of Statement of Accounts of the following years attached (Preferably last 3 years)……..

- r) Other relevant information………

- s) Proposed debt/equity ratio………

- t) Signature of the Applicant…………..

Step 2:

After receiving the loan application form, Federation Branch sends a letter to Bangladesh Bank for obtaining a report from there. This report is called CIB (Credit information Bureau) report. This report is usually collects this report if the loan amount exceeds Tk. 50 Lac. But SBL usually collects this report if the loan amount exceeds Tk.10 Lac. The purpose of this report is to being informed that whether the borrower has taken loan from any other bank; if ‘yes’ then whether these loans are classified or not.

Step 3:

After receiving CIB report if the Bank thinks that the prospective borrower will be a good borrower, then the bank will scrutinize the documents. In this stage, the Bank will look whether the documents are properly filled up and signed.

Step 4:

Then comes the processing stage. In this stage, the Bank will prepare a Proposal a proposal contains following relevant information:

- a) Name of the Borrower—

- b) Nature of Limit—–

- c) Purpose of Limit——

- d) Extent of Limit—

- e) Security—

- f) Margin—

- g) Rate of Interest——-

- h) Repayment——-

- i) Validity——

Federation Branch has the discretionary power to sanction loan (SOD) up to Tk.25 Lac against financial obligations by taking post-facto approval from Head Office. But in that case, the Branch Manager has to give attention to the following matters:

- The interest rate of the loan must not be less than prescribed rate of interest or 15.5%

- The borrower must maintain minimum 20% margin.

Except this case, the branch has to send the proposal to the Head Office. Head Office will prepare a minute and submit it before the Executive Committee (EC). The minute has to be passed by Credit Committee (CC) and the Executive Committee (EC) and lastly to the Board of Directors (BOD) Meeting.

Step 5:

After the sanction advice, Bank will collect necessary documents (charge documents). These documents are given below:

Loan (general):

- a) Joint Promissory Note

- b) Single Promissory Note

- c) Letter of Undertaking

- d) Loan Disbursement Letter

- e) Debit Figure Confirmation Sheet

- f) Letter of Continuity

- g) Letter of Authority

- h) Letter of Revival

- i) Right of Recall the Loan.

- j) Letter of Guarantee

- k) Letter of Indemnity

- l) Trust Receipt

- m) Hypothecation of Goods

- n) Hypothecation of Vehicles

- o) Counter Guarantee

- p) Letter of Lien

- q) Letter of Lien in case of advance against FDR

- r) Letter of Authority to encase FDR

- s) Letter of Agreement for Packing Credit

- t) Letter of Guarantee for opening L/C

- u) Charges over Bonds or Certificates or shares etc. by third person, firm or company to secure specific and general liability.

- v) Memorandum of Deposit of Title Deeds

- w) Hypothecation of goods to secure a Demand Cash Credit Or Overdraft/Loan amount

- x) Guarantee by Third party.

Step 6:

Charge documents as required for the different types of advances, are mentioned below: D.P note signed on revenue stamp

- A) Loan (general):

- Letter of arrangement

- Letter of disbursement

- Letter of partnership

- Letter of pledge

- Letter of hypothecation

- Letter of lien and ownership

- Letter of lien for packing credit

- Letter of lien

- Letter of lien and transfer authority

- Legal documents for mortgage property

- B) Overdraft:

- Letter of partnership

- Letter of arrangement

- Letter of continuity

- Letter of lien

- Letter of lien and ownership

- Letter of lien and transfer authority

- C) Cash credit (pledge):

- Letter of pledge

- Letter of authority empowering the bank to deduct / realize warehouse, staff salary and other incidental expense for inspection, maintenance of goods etc.

- Letter of declaration handing over the possession of goods stored or to be stored in the warehouse against the facility.

- Letter of disclaimer in case of Hired go down signed by the owner of the warehouse.

- Letter of hypothecation.

- D) Cash credit (Hypothecation):

- Letter of authority empowering the bank to inspect goods and possession of the goods in case of duly drafted by the lawyer of the bank.

- Stock report duly signed by the borrower on fortnightly basis or after every deposit in the loan account or before realizing fund against limit.

- Letter of declaration duly signed by the party clearly starting that the goods hypothecated are not in any case encumbered elsewhere.

- Sufficient insurance cover inserting the name of the Bank as mortgage with bank mortgage clause.

Step 7:

For withdrawing the loan amount, the customer creates a CD account and the loan is transferred to the CD A/C. Afterwards the customer can withdraw the money.

Step 8:

Credit disbursement:

After verifying all the documents, the branch disburses the loan to the borrower. The loan officer disburses the loan to the borrower loan account. A “Loan Repayment Schedule” is also prepared by the branch and is given to borrower.

Step 9:

After the disbursement of loan, the bank follows the following manner:

- Constant supervision.

- Working capital assessment.

- Stock report.

- Break Even analysis.

- Rescheduling of repayment.

Step 10:

The loans are repaid in installment. This installment is according to bank directives. Some loans are repaid all at a time. If any loan is not repaid then notices are served to the customer. Sometimes legal actions are also taken for recover the loan.

FOREIGN EXCHANGE DEPARTMENT OF IFIC BANK

One of the largest businesses carried out by the commercial bank is foreign trading. The trade among various countries falls for close link between the parties dealing in trade. The situation calls for expertise in the field of foreign operations. The bank, which provides such operation, is referred to as rending international banking operation. Mainly transactions with overseas countries are respects of import; export and foreign remittance come under the preview of foreign exchange transactions. International trade demands a flow of goods from seller to buyer and of payment from buyer to seller. In this case the bank plays a vital role to bridge between the buyer and seller.

Foreign Exchange Department is an international department of the bank. It deals with globally and facilitates international trade through its various modes of services. It bridges between importers and exporters. Bangladesh Bank issues license to scheduled banks to deal with foreign exchange. These banks are known as Authorized Dealers. If the branch is authorized dealer in foreign exchange market, it can remit foreign exchange from local country to foreign country. This department mainly deals with foreign currency. This is why this department is called foreign exchange department.

Some national and international laws regulate functions of this department. Among these,Foreign Exchange Act, 1947 is for dealing in foreign exchange business, and Import and Export Control Act, 1950 is for Documentary Credits. Governments’ Import and Export policy is another important factor for import and export operation of banks.

EXPORT

Activities under the export section includes,

- Pre – Shipment advances

- Purchase of foreign bills

- Negotiating of foreign bills

- Export guarantees

- Advising/ confirming letters – letter of credit

- Advance for deferred payment exports

- Advance against bills for collection

IMPORTS

Activities under the import section includes

- Opening of letter of credit (L/C)

- Advance bills

- Bills for collection

- Import loan and guarantees

REMITTANCES

Activities under the import section includes

- Issue of DD, MT, TT, etc.

- Payment of DD, MT, TT etc.

- Issue and enhancement of traveler’s cheque

- Sale and enhancement foreign currency note

- Nonresident accounts

- Rate computation

DEALINGS

- Maintenance of foreign currency account

- Forward contracts

- Exchange position and cover operations

- Documentary letter of credit

Most Commonly Used Documents in Foreign Exchange

- Bill of exchange

- Bill of Landing

- Commercial Invoice

- Certificate of origin of goods

- Inspection certificate

- Packing List

- Insurance certificate

- Pro-forma invoice/ indent

- Master receipt

- GSP certificate

Findings

While working at International Finance Investment & Commerce Bank Limited, in Federation Branch I have attained a newer kind of experience. After collecting and analyzing data I have got some findings and recommendations. These findings are from the personal points of view, which are given below:

- Online banking system is available in IFIC Bank that is very important to compete to others in the electronic world.

- For credit appraisal, the bank some time depends on the client for its authentication.

- All the employees are not professionally trained enough in the computer literacy part.

- It can be said IFIC Bank is much more a businessmen’s bank than for the consumers or general public’s.

- In case of opening an account, some big parties are come to open accounts in reference with the high officials of the bank. They do not submit all papers that required opening an account and in future they do not feel any urge to submit those papers, but already they become accounts holder. I think in this case the authority is violating the rule.

- Most of the borrower does not pay their payment timely.

- Most of the clients are under graduate and unable to understand the term and conditions, as a result they fail to understand that when they have to repay the loan, even after repeating them again and again the schedule of their repayment.

- Every time the bank has incurred a very big bad debt because of irresponsibility of employees.

- Loans and advance department take a very long time to sanction a loan; as a result they are losing the clients.

- Sometimes the employees overvalued the mortgage property, As a result if the client fails to repay the loan the bank authority cannot collect even the principal money invested by the selling those assets.

- Some tomes CIB reports are not prepared properly.

SWOT Analysis

STRENGTHS

- Good position in bank world.

- Usage of MISYS bank software.

- Efficient management.

- Cooperation with each other.

- Usage of SWIFT technology.

- Good banker-customer relationship.

- Strong financial position.

- Energetic as well as smart force.

Weakness

- Reluctance to marketing campaign.

- Existing of manual vouchers.

- Lack of power.

- Lack of computer skilled manpower.

- Employee is not professionally trained enough.

- Existence of classical loan .(about 2.5% of total loan)

OPPORTUNITIES

- Launching ATM card.

- Huge business area.

- Growth of sales volume.

- Change in political environment.

- Offer Money Gram facility.

- Also offer Customer facility.

- The management can consider options of starting merchant banking or diversity of leasing and insurance.

THREATS

- Poor economical condition of our country.

- Entrance of new private commercial banks.

- Different attractive service offered by some foreign banks.

- Daily basis interest on deposit offered by some multinational banks.

- Existing card service of different banks.

Recommendations

Banking is a service –oriented marketing, the business profit depends on its service quality. That is why the authority always should be aware about their service.

- Strict Supervision must be adapted in case of high risk borrowers. Time to time visit to the projects should be done by the bank officers.

- The average number of days required for sanctioning and disbursement of credit against specific loan proposal should be reduced.

- The performance evaluation system is not updated. The organization should follow the 360-degree performance evaluation system. In this case, the superior executives will not be much rude to the subordinates because the top-level employees’ performance will be evaluated by the subordinates.

- Selection of borrower shall be made as per rules and procedures of the advances and after making proper assessment of business establishment, respectability, creditability, actual requirement of fund repayment capacity etc. Appraisal of feasibility and viability of the projects shall be done in proper manner examining all the factors by an efficient and qualified appraiser so that no difficulties are faced at any stage of the project from construction to production stage.

- The bank should not always be very much sensitive of recovery of loans and will not bring necessary pressures for recovery provided the borrowers are incorrigible and habitual defaulters. The lenders shall not resort to any hasty decision and take legal action against the borrowers if there is any scope for recovery of the dues on compromise terms even by allowing some concession of interest and rescheduling the repayment program by allowing reasonable time to the borrowers.

- Problem of the borrower’s projects or business, which have turned sick unavoidable circumstances of unforeseen events, shall be looked into sympathetically by the lending bank. If necessary, bank shall not hesitate to allow further finance to revive the sick unit to ensure safe recovery of the loan in future for which a suitable repayment schedule may be prepared in consultation with borrowers.

- The lenders shall take legal action against the incorrigible defaulting borrowers who are avoiding payment on flimsy grounds without bonafide intention to square up their dues without wasting of time. Money suits & criminal cases filed against the bad borrower shall be closely followed up for early decision of the court and immediate steps shall be taken for satisfaction of the decrees against the judgment debtors.

- Alertness and education amongst the sub-conscious about their obligation to return bank’s money in time and utilization of funds of funds only for productive purpose of motivation and education field assistants of the lending bank may play vital role.

- Highly efficient employee should take responsibility for loan and advance section.

- CIB report should maintain properly.

- Documentation about loans should maintain properly.

- The lenders shall sanction and disburse loan to the borrowers in proper time of investment. They will see that no delay is caused in completing formalities and processes which may create problem to the borrowers to divert funds elsewhere or want of scope for investment and thus the funds become stuck up ultimately. So loans should always be sanctioned & disbursed in proper time of investment to ensure recovery of the loan in time from the borrowers.

Conclusion

Banking sector of Bangladesh consists of several nationalized and private banks. They are doing their activities and highly contribute to the national economy. Among them IFIC Bank Limited also makes significant contribution to the economy. They are performing their activities, as a result not only the bank but also the economy is benefited. The bank is performing general banking, Loan-advance, foreign exchange activities etc, as a result they are mobilizing the money and do well for the economy. Although they have some limitations in their services, they are doing tremendous job for the economy. If they can reduce their limitation and introduce new ideas, they can do better in the banking sector of Bangladesh.