Bangladesh is a largest of the Muslim countries in the world. The people of the country are deeply committed to lead a Islamic way of life which is best on the principle of Holy Quran and the sunnah. The Al- Arafah Islami Bank Ltd which is established on June 18, 1995 is the rue reflection of this inner urge of its people which started banking with effect from September 27,1995. It is committed to conduct all Financial Activities banking and Investment Activities on the basis of interest free profit and loss sharing system. In doing so it has unveiled in a new horizon and unheard in a new silver lining of hope towards materializing a long cherished dream of the people of Bangladesh for doing their Banking Transaction in line with what is prescribed by Islam. With the active co-operation and participation of Islamic Development Bank (IDB) and some other Islamic Banks, financial institution and government bodies, Al- Arafah Islami Bank Ltd has new earned the unique position of a leading private commercial bank in Bangladesh.

Al- Arafah Islami Bank Ltd has made a positive contribution towards the socio economic development of the country by opening 100 branches in which 20 authorized dealer throughout the country.

The shareholders’ equity of the bank stood at TK. 14,050.69 Million, Total deposits of the bank stood at TK. 118,683.39 Million on 31 December 2012. The no. of employees was 2110 and the number of shareholders was 52,739. During my 03 months internship of Al- Arafah Islami Bank Ltd, the experiences that I learned are expressed in my report.

Origin of the Report:

As a service organization a bank’s performance is to achieve its ultimate goal, which is customer value and satisfaction. This largely depends on their proper utilization of money, secured investment policy and right and just banking activities. Al- Arafah Islami Bank Ltd is a bit different from other commercial banks, that it follows Islami Shariah in its operations.

As an intern with Finance Major I have decided with the permission of my official and academic supervisors to prepare my report on overall banking practices of AIBL. This report is based on an internship program, arranges internship program in attachment with its students after the completion of theoretical courses (i.e., after final semester) of program of Bachelor of Business Administration (BBA). Each intern must carry out a specific project, which is assigned by the concerned organization and approved by the Internship and placement authority. Consequently a report based on the project is to be submitted to the respective authority.

Bank and financial institution play an important role in financial inter mediation and thereby contribute to the overall growth in the economy. At present the financial system in Bangladesh consists of the central bank, nationalized commercial/specialized banks, private banks, foreign banks and other non-bank financial institution. This report is based on one of the leading Islami Banks which is Al-Arafah Islami Bank Ltd.

Objectives of the Report:

The first objective of writing the report is fulfilling the partial requirements of the BBA program. In this report, I have attempted to give on overview of Al-Arafah Islami Bank Limited in general. Some following objectives of the report are as shown.

- To gain or achieve the practical Idea of banking System of AIBL

- To analyze General Banking Activities of AIBL

- To acquire in depth knowledge about AIBL

- To find out the problem of General Banking Activities of AIBL

- To know the financial performance of AIBL

- To suggest some possible recommendations to overcome the problems.

Scope of the report:

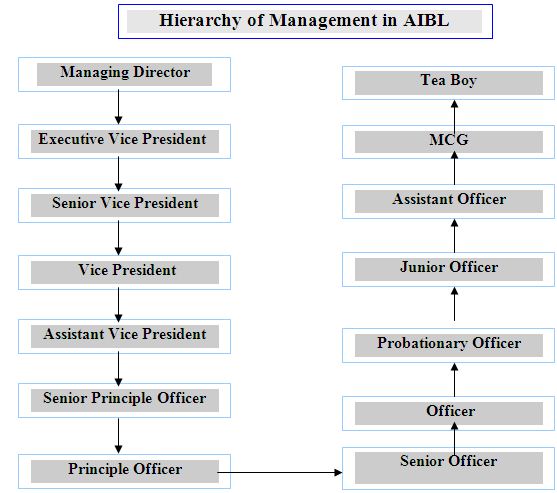

All the tasks and information required in preparing this report have been collected from the Narayangonj Branch and Head office of AIBL. The scope of the organizational part covers the organizational structure, background, and objectives, functional, departmental and Business performance of AIBL as a whole and the main part covers General Banking Activities of AIBL.

Importance of the study:

- To find ways to improve the present banking system of AIBL.

- To achieve practical knowledge of banking side of AIBL.

- To gain practical knowledge about overall banking system & especially general banking sector.

Methodology of the study:

In order to make the report more meaningful and presentable two sources of data and information have been used widely;

The primary sources:

The sources are as follows Face-to-face conversation with the Executives and officers of Bank.

- Informal conversation with the Clients, Officers and Employees.

- Practical work exposures from the different desks of the various departments of the Branch covered.

- Relevant file study as provided by the officers concerned.

The Secondary Sources:

The secondary sources data and information are:

- Annual Report of Al-Arafah Islami Bank Ltd.

- Periodicals published by Bangladesh Bank.

- Various books, articles, compilations etc. Regarding general banking functions.

For the organization, part information has been collected through different published articles, journal.

Limitations:

Objective of the practical orientation program is to have practical exposure for the students. My tenure was for twelve weeks only, which was somehow not sufficient. After working whole day in the office it is very much difficult to study the theoretical aspects of banking when I got home. On the other hand to prepare my internship report I have faced some limitations as follows:

- To collect data and information, it is a common tendency of any departments to keep back their departmental data and information.

- The major limitation is time binding. Experiences come from learning but learning takes time. Three months are not sufficient to learn completely.

- Unavailability to required published documents.

- Lack of my experience and efficiency to prepare the standard report.

- Every organization follows its own secrecy. For a financial institution, it is very risky to disclose the secret information’s to others.

Status of the Bank:

Islam provides us a complete lifestyle. Main objective of Islamic lifestyle is to be successful both in our mortal and immortal life. Therefore in every aspect of our life we should follow the doctrine of Al-Qur’an and lifestyle of Hazrat Muhammad (Sm.) for our supreme success. Al-Arafah Islami Bank started its journey in 1995 with the said principles in mind and to introduce a modern banking system based on Al-Qur’an and Sunnah. Bangladesh is one of the largest Muslim countries in the world, its people are deeply devoted to Islamic way of life as enshrined in the Holy Quran and the Sunnah. Al-Arafah Islami Bank Ltd was established in 1995 under the companies Act, 1994 as a banking Company with limited Liability by shares. It is an interest frees Sarah bank of Bangladesh rendering all types of commercial banking service under the regulation of Bank Companies Act, 1991. The Bank conducts its business on the principles of Mubarak, Bai-Murabaha, Bai-muazzal and Hire Purchase transactions approved by Bangladesh Bank. Naturally its modes and operations are substantially different from those of other conventional commercial banks. There is a Shariah Council in the bank who maintains constant vigilance to ensure that the activities of the bank are being conducted on the precepts of Islam. The Shariah Council consists of prominent Ulema, reputed Bankers, renowned Lawyers and eminent Economist.

Vision of AIBL:

- To be a pioneer in Islami Banking in Bangladesh and contribute significantly to the growth of the national economy.

Mission of AIBL:

● Achieving the satisfaction of Almighty Allah both here & hereafter.

● Proliferation of Shariah Based Banking Practices.

● Quality financial services adopting the latest technology.

● Fast and efficient customer service.

● Maintaining high standard of business ethics.

● Balanced growth.

● Steady & competitive return on shareholders’ equity.

● Innovative banking at a competitive price.

● Attract and retain quality human resources.

● Extending competitive compensation packages to the employees.

● Firm commitment to the growth of national economy.

● Involving more in Micro and SME financing.

Goal of the AIBL:

The motto of the Al-Arafah Islami Bank Ltd is to explore a new horizon of innovative modern banking creating an automated and computerized environment providing one stop service and prepare itself to face the new challenges of globalization with the helm of Islami Shariah.

Objectives of AIBL:

The objectives of Al-Arafah Islami Bank Ltd are not only to earn profit but also to do good welfare to the people. The main objectives of AIBL are listed below:

- To establish a banking system devoid of interest and based on Islamic Shariah.

- To offer banking facilities to those people who are staying outside of the banking habit

- To provide commercial and investment banking services to big business clients.

- To provide facilities of intending Hajees to perform Hajj and Umrah.

Economic Value Addition by the Bank:

Economic Value Added (EVA) indicates the true economic profit of the company. EVA is an estimate of the amount by which earnings exceed or fall short of the required minimum return for shareholders at comparable risk. EVA of the Bank stood at BDT 1,544.58 million as on 31 December 2012 as against that of BDT 1,341.30 million in 2011.

Table – 02:

(BDT in million)

| Particulars | 2012 | 2011 |

| Shareholders Equity | 14,050.69 | 11,989.11 |

| Total Income | 16,692.58 | 11,332.59 |

| Total Expense | (11,937.04) | (7,005.81) |

| Corporate Tax | (1,998.69) | (1,747.87) |

| Capital Charges | (1,212.27) | (1,237.61) |

Economic Value Addition 1,544.5 81,341.30

Source: Annual Report of AIBL For 2012

Year Financial Highlights of the company:

Table – 03: Financial Performance of five years (2008 – 2012)

(In Million Taka)

| Particulars | 2008 | 2009 | 2010 | 2011 | 2012 | Growth (%) |

| Authorized Capital | 2500.00 | 5000.00 | 5000.00 | 10000.00 | 10000.00 | 100.00 |

| Paid up Capital | 1383.81 | 1798.95 | 4677.28 | 5893.37 | 7130.98 | 21.00 |

| Reserve Fund | 905.33 | 1223.18 | 1779.08 | 2437.43 | 4079.63 | 67.37 |

| Shareholder’s Equity | 2705.74 | 3564.73 | 9790.36 | 11989.11 | 14050.69 | 17.20 |

| Deposits | 29690.12 | 38355.50 | 53882.96 | 82186.98 | 118683.39 | 44.41 |

| Investment | 27742.57 | 36134.08 | 53582.96 | 77714.95 | 106650.42 | 37.23 |

| Import | 32,685.13 | 34,074.80 | 55,934.10 | 76,112.10 | 71,931.70 | (5.49) |

| Export | 20,176.64 | 23546.10 | 32,042.40 | 52,202.10 | 58,476.60 | 12.02 |

| Total Income | 2955.61 | 4387.26 | 5490.60 | 5123.00 | 6522.00 | 25.15 |

| Total Expenditure | 2199.43 | 2859.17 | 3928.27 | 1468.00 | 2119.00 | 37.39 |

| Profit before Tax | 1258.89 | 1589.24 | 2852.47 | 3946.62 | 3944.10 | (0.06) |

| Profit after Tax | 668.23 | 858.99 | 1959.04 | 2198.75 | 1945.40 | 11.52 |

| Tax | 235.53 | 590.66 | 660.57 | 1519.00 | 1726.00 | 11.84 |

| Total Assets | 37177.22 | 48515.79 | 74005.01 | 106768.18 | 149320.36 | 39.85 |

| Fixed Assets | 396.76 | 466.30 | 655.39 | 968.13 | 2394.62 | 147.34 |

| Earnings per Share | 3.72 | 2.00 | 4.14 | 2.49 | 2.69 | (14.70) |

| Dividend Per Share (%) | 30.00 | 30.00 | 26.00 | 21.00 | 17.00 | (19.05) |

Source: Annual Report on 2008 to 2012

Financial Position of Narayangonj Branch as on 06.05.2013

S/L No. | Particulars | : | Total Amount (TAKA) | Amount In ‘000’ |

| 01 | CASH IN HAND | : | 2,36,12,086.00 | 2,36,12 |

| 02 | BALANCE WITH SONALI BANK | : | 53,887.37 | 54.00 |

| 03 | BILLS PAYABLE | : | 53,14,141.00 | 53,14 |

| 04 | PROFIT RECEIVABLE INVESTMENT | : | 8,13,80,621.00 | 8,13,81 |

| 05 | QUARD | : | 22,42,590.00 | 22,43 |

| 06 | TOTAL INVESTMENT | : | 92,98,45,590.00 | 22,43 |

| 07 | TOTAL DEPOSIT | : | 132,26,02,060.00 | 132,26,02 |

| 08 | NUMBER OF ACCOUNT | : | 9041 | 9041 |

| 09 | NO. OF INVESTMENT A/C | : | 1117 | 1117 |

| 10 | INCOME | : | 6,37,04,734.51 | 6,37,05 |

| 11 | EXPENDITURE | : | 4,61,50,762.24 | 4,61,51 |

| 12 | NET PROFIT | : | 1,75,53,972.27 | 1,75,54 |

| 13 | INVESTMENT OVERDUE | : | —— | —– |

| 14 | CLASSIFIED INVESTMENT | : | —— | —— |

| 15 | WRITE OFF INVESTMENT | : | 9,13,651.00 | 9,14 |

| 16 | RECOVERY OF CL.FIED INV. | : | —— | —— |

| 17 | IMPORT | : | 1,36,13,020.00 | 1,36,13 |

| 18 | EXPORT | : | 3,52,38,801.00 | 3,52,39 |

| 19 | FOREIGN REMITENCE | : | 1,29,52,384.22 | 1,29,52 |

Table – 04: Daily Position of the Narayangonj Branch as on 06.05.2013

Source: Internal documents of AIBL Branch, Narayangonj

Special Features of AIBL:

- All activities of the bank are conducted according to Islamic shariah where profit is the legal alternative to interest.

- The banks investment policy follows different modes approved by Islamic shariah based on Quaran & Sunnah.

- The bank is committed towards establishing welfare oriented banking system, economic upliftment of the law- income group of people, create employment opportunities.

- According to the needs and demands of the society and the country as a whole the bank invests money to different halal business. The bank participates in different activities aiming at creating jobs, implementing development projects taken by the government and developing infrastructure.

- To render improved services to the clients imbued with Islamic spirit of brotherhood, peace and fraternity and by developing an institutional cohesion.

- The bank is contributing to economic and philanthropic activities side by side. Al-Arafah English Medium Madrasah and AIBL Library are among mention worthy.

Total Deposits:

The total deposit of the bank was Tk. 118,683.39 million at 31st December 2012 as against Tk. 82,186.98 million at 31st December 2011 recording a growth of 44.41% of which Tk. 2,564.75 million was bank deposit and Tk. 116,118.64 million was general deposit. The present strategy is to increase the deposit base through maintaining competitive profit rates and having low cost of funds to ensure a better spread with an average return on investment.

Common function of a bank:

Bank is the financial institution which earns profit through accepting of deposit, extending credit, issuing notes and cheques, receiving and paying interest. Common function of a bank is given at bellow:

- Receiving deposit

- Providing loan

- Introducing currency

- Creation of medium of exchange

- Creation of debt deposit

- Helping internal and foreign business

- Transforming money

- Debt control

- Bill discounting and market control

- Development of agriculture and industrialization

- Assistance of government

- Foreign exchange

- Other functions.

Islamic Banking:

Islamic banking has been defined in a number of ways. The definition of Islamic bank approved by the General Secretarial of the OIC is staled in the following manner. “An Islamic bank is a financial institution whose status, rules and procedures expressly state commitment to the principle of Islamic Shariah and to the banning of the receipt and payment of interest on any of its operations.” Dr. Shawki Ismail Shehta viewing the concept from perspective of an Islamic economy and the prospective role to be played by an Islamic bank therein opines that “It is therefore, natural and, indeed, imperative for an Islamic bank incorporate in its functions and practices commercial investment and social activities, an institution design to promote the civilized mission of an Islamic economy.” Dr. Ziaul Ahmed says, “Islamic banking is essentially a normative concept and could be define conduct of banking in consonance will the ethos of the value system of Islam.”

It appears from the above definitions that Islamic banking is a system of financial intermediation that avoids receipt and payment of interest in its transactions and conducting operations in a way that it helps achieving the objectives of an Islamic economy. Alternatively, this is a banking system whose operation is based on Islamic principle transactions of which profit and loss sharing (PLS) is a major feature ensuring justice equity in an economy. That is why Islamic banks are often known as PLS-banks.

Objectives of Islamic Banking:

The primary objective of establishing Islamic bank all over the world is to promote, foster and develop the application of Islamic principles, law and tradition to the transaction of financial, banking and related business affairs and to promote investment companies, enterprises and concerns which shall themselves be engaged in business as are acceptable and consistent with Islamic principles, law and traditions. But the objective of Islamic bank when viewed from the context of its role in an economy, its specific objectives may be enlisted as following:

- To offer contemporary financial services in conformity with Islamic Shariah;

- To contribute towards economic development and prosperity within the principles of Islamic justice;

- To facilitate efficient allocation of resources;

- To help achieving stability in the economy;

Theoretical Basis of the Concept of Islamic Banking:

Conventional banking is essentially based on debtor-creditor relationship between depositors and the bank in the one hand and between the borrowers and the bank on the interest is considered as the price of credit, reflecting the opportunity cost of money. Islam, on the other hand, considers loan to be given or taken, free of charge, to meet contingency and that the creditor should not lake any advantage of the borrower. The money is lent out on the basis of interest, more often it happens that it leads to some kind of injustice. The first Islamic principle underlying such kinds of transactions is that “deal not unjustly and ye shall not be dealt with unjustly”. Hence, commercial banking in an Islamic framework is not based on debtor-creditor relationship.

The second principle regarding financial transactions in Islam is that there should not be any reward without risk-taking. This principle is applicable both to labor and capital. As no payment is allowed to labor unless it is applied to work, no reward for capital should be allowed unless it is exposed to business risks.

Thus, financial intermediation in an Islamic framework has been visualized on the basis of the above principles. Consequently financial relationships in Islam have been participatory in nature. Several theorists suggest that commercial banking in an interest-free system should be organized on the principle of profit and loss sharing. The institution of interest is thus replaced by a principle of participation in profit and loss. That means, a fixed rate of interest is replaced by a variable rate of return based on real economic activities. The distinct characteristics which provide Islamic banking with its main points of departure from the traditional interest-based commercial banking system are: (a) the Islamic banking system is essentially a profit and loss sharing system and not merely an interest-free (Riba) banking system; and (b) investment (loans and advances in conventional sense) under this system of banking must serve simultaneously both the interest of the investor and those of the local community. The financial relationship as pointed above is referred to in Islamic jurisprudence as Mudarabah.

Distinguishing Features of Islamic Banking:

An Islamic bank has several distinctive features as compared to its conventional counterpart. Six essential differences as below:

i) Abolition of Interest (Riba): Since Riba is prohibited in the Holy Quran and interest in all its form being akin to Riba as, confirmed by Fukaha and Muslim economists with rare exceptions, the first distinguishing feature of an Islamic bank must be that it is interest-free, while the abolition of Riba would be the first and essential difference between the conventional interest-based commercial banks and Islamic banks, if would not the constitute the only difference between them. The nature, outlook and operations of an Islamic bank would have to undergo a complete transaction.

ii) Adherence to Public Interest: Activity of commercial banks being primarily based on the use of public funds, public interest rather than individual or group interest will be served by Islamic commercial banks. The Islamic banks should use all deposits, which come from the public for serving public interest and realizing the relevant socio-economic goals of Islam. They should play a goal-oriented rather than merely a profit-maximizing role and should adjust themselves to the different needs of the Islamic economy.

iii) Multi-Purpose Bank: Another substantial distinguishing feature is that Islamic banks will be universal or multi-purpose banks and not purely commercial banks. These banks are conceived to be a crossbreed of commercial and investment banks, investment trusts and investment management institutions and would offer a variety of services to their customers. A substantial part of their financing would be for specific projects or ventures. Their equity-oriented investments could not permit them to borrow short and lend long. This should tend to make them less crisis-prone compared to their capitalist counterparts.

iv) More Careful Evaluation of Investment Demand: Another very important feature of an Islamic bank is its very careful attitude towards evaluation of applications for equity oriented financing. It is customary that conventional banks evaluate applications, considers collateral and avoids risks as far as possible. Their main concern does not go beyond ensuring the security of their principle and interest receipts. Since the Islamic bank has in built mechanism of risk-sharing, it would need to be careful more careful. It adds a healthy dimension in the whole lending business and eliminates a whole range of undesirable lending practices.

v) Work as Catalyst of Development: Profit-Loss-Sharing being a distinctive characteristic of an Islamic bank, if fosters closer relations between banks and entrepreneurs. It helps develop financial expertise in non-financial firms also enables the banks to assume the role technical consultants and financial advisors and act as catalysts in the process of industrialization and development. The bank would take care of all the responsible and agreed financial needs of their clients thus relieving them of the need to run around for funds to overcome their normal liquidity shortages.

General Banking Activities:

Al-Arafah Islami Bank Ltd General Banking is divided into five sectors.

- Account opening section

- Bills and clearing Section

- Remittance Section

- Deposit Section

- Cash Section

Initially all the accounts are opened through deposit money by the customer and these accounts are called deposit accounts. Normally a person needs to open an account to take services from the bank. Without opening an account, one cannot enjoy variety of services from the bank. Thus, the banking usually begins through the opening of the account with the bank.

ACCOUNT OPENING

The money deposited with the banker is not held by him in trust but as his debts to the depositors and the relationship that exists between the banker and the depositor is strictly that of debtor and creditor. The banker becomes the owner of the money and is free to utilize the same in any way he chooses an is bound at the place where the deposits are maintained to make repayment thereof by an equal amount on demand, at notice or at the end of the specified period with or without interest depending on the nature of the deposits.

The deposits are accepted by the banker through current and saving accounts, which is withdraw able by cheques. The deposits are repayable on demander otherwise and withdraw able by cheques, draft, and order or otherwise.

Necessary documents to open an account:

When a customer/organization/company/firm/society/club etc. want to open bank account he/she have to filled a bank prescribed form and have to attached their necessary documents are as follows.

For an Individual Customer:

- Copy the passport, if available or Employer’s Certificate or Commissioner’s Certificate or Letter of Introduction by a person accepted to the Bank.

- TIN Certificate, if applicable.

- Two recent passport size photographs duly attested by the Introducer.

Proprietorship

- Trade license

- Photograph

Partnership

- Trade license

- Photograph

- Partnership Deed

Private Limited

- Trade license

- Photograph of Directors

- Certificate copy of Memorandum and Articles of Association

- Certificate of incorporation

- List of Directors as per return of joint stock company with signature

- Resolution for opening account with the bank

After observation of all the formalities/documents mentioned above, the applicant is required to deposit minimum Tk. for opening a savings bank account and Tk for opening a current account. This is called initial deposit. As soon as this money is deposited, the bank opens the bank opens an account in the name of the applicant. The banker then supplies the following books to the customer to operate the accounts:

- Deposit book

- A cheque book

General Precautions for Opening an Account:

After opening an account and before issuing a cheque book the authorized officer should check he account opening form for the complete information, which is given by the customers.

- Name of the account holder

- Photo of the account holder

- Date of opening

- Types of account

- Present and permanent address

- Name of Nominee and their address and percentage of share

- Initial deposit

- Specimen signature in the form and in he Specimen Signature Card

- Name, address and the account number of the introducer

Closing of (Saving /Current) Account:

The relationship between banker and customer is a contractual relationship. Like any other contract, therefore, it may be terminated as and when the parties so desire. Moreover, the banker is under a statutory obligation to suspend payment from customer’s account under legislative provision.

However, customer’s account with a banker may be closed in the following circumstances

- The customer may requests to the banker in writing to close the account

- The banker may itself ask the customer to close his account when account has not been operated for alone time

- In case the banker finds that, the customer is not desirable

Al-Wadiah Current Deposit (CD):

Al-Arafah Islami bank Limited receives deposits in their Al-Wadiah current account. Usually business people runs Al-Wadiah current account. Before opening this account, accountholders must deposit 1000/- into their accounts as initial deposit for the first time. In Al-Wadiah current account customer’s can deposit and withdraw money, whenever they want. In this account, there is no restriction of withdrawing money. But in Al-Wadiah current account customers do not get any profit. The bank takes some money as a service charge.

Mudaraba Savings Deposit (MSD):

Al-Arafah Islami bank Limited also receives deposits by Mudaraba Savings Deposit. General people run this accounts. In Mudaraba Savings Deposit account customer’s can deposit money any time when ever they want. But they cannot withdraw money whenever they want, there is some restriction. Customer’s can withdraw money two times in a week and ten times in a month. But if they want to withdraw any big amount they have to give notice to the manager. If bank earn any profits the depositors will get at a predetermined percentage and the bank retains the residual amount as its profit. For opening this account, a minimum requirement of TK. 500/- need to be by the client as an initial savings to open the account. After that, a cheque book is provided to the accountholder.

Mudaraba Short Notice Deposit (MSND):

Mudaraba Short Notice Deposit account is similar like Al-Wadiah current account. In Mudaraba Short Notice Deposit account customer’s can deposit and withdraw money any time whenever they want. But there is a restriction in withdrawing money. They have to inform the manager if they want to withdraw big amount. Like Mudaraba Savings Deposit account the customer’s get profit here. This profit is given every year at a predefined rate of last year.

Mudaraba Terms Deposit Receipt (MTDR):

AIBL receives different kinds of Term Deposits from the depositors. The deposits are generally for 1 month, 3 months, 6 months, 9 months, 12 months, 24 months, 36 & 48 months, and the bank pays a stated profit rate on each of these deposits, which varies depending on the term.

Mudaraba Monthly Installment Terms Deposit (ITD) :

Under this scheme monthly installment is TK. 500 to 5000. Maturity period is 2 years, 3 years, 5 years, 8 years, 10 years, 12 years, 15 years, and 20 years. Profit is given to the customer after deducting the tax. If the account holder died, then account is going to be sleep & deposited amount will be given to the nominee.

Mudaraba Lakhopati Deposit Scheme (MLDS):

Maturity of this scheme is 3 years, 5 years, 8 years, 10 years, and 12 years. Monthly deposit amount is TK. 335, TK. 460, TK. 670, TK. 1275, and TK. 2375 consecutively. In this scheme profit is recorded on daily basis and there is deduction of tax according to the government rules.

AIBL Special Savings Scheme:

This scheme is well known in the market as a well named Deposit Pension Scheme in other banks. If a client deposits an amount of fixed on the monthly basis often a few years i.e. 5 and 10 years he gets amount at a time.

Deposit under Other Schemes:

There are also some other types of deposit schemes in AIBL for collecting deposit from customers. These are Mudaraba Hajj Deposit, Mudaraba Savings Investment Deposit, Mudaraba Profit Payable Term Deposit (PTD), Mudaraba Lakhopati Deposit Scheme (MLDS), Mudaraba Millionaire Deposit Scheme (MMDS), and Mudaraba Kotipoti Deposit Scheme (MKDS).

AIBL Regular Deposit Program:

RDP is a special services plan that follows to save a monthly basic and get a handsome amount at maturity. RDP account gives you the convenience of saving regularly in time with cherished dream RDP in the right solution

To open RDP account all you need is to be over 18 Years of age and a Bangladesh citizen you can open a RDP account within 10 days of the month by filling up a prescribed account opening form at any branch of AIBL.

You need to open an RDP account for 3 or 5 Years i.e. 36 and 60 equal monthly deposits respectively.

Profit rates of AIBL on different Deposits:

Table – 05: Profit rates of AIBL on different Deposits

| Sl. No. | Account Head/Deposit Scheme | Profit Rate in % |

| 1 | Al-Wadiah Current Deposit | Nill |

| 2 | Mudaraba Saving Deposit | 5.00 % |

| 3 | Mudaraba Short Notice Deposit (SND) | 4.00 % |

| 4 | Mudaraba Investment Term Deposit (ITD) | 12 % |

| 5 | Mudaraba PTD | 12 % |

| 6 | Monthly Hajj Deposit | 12 % |

| 7 | MTDR 36 Months | 12.50 % |

| 8 | MTDR 24 Months | 13.00 % |

| 9 | MTDR 12 Months | 13.00 % |

| 10 | MTDR 6 Months | 12.50 % |

| 11 | MTDR 3 Months | 12.00 % |

| 12 | MTDR 1 Month | 12.00 % |

| 13 | Mudaraba Lakhopoti | 12 % |

| 14 | Mudaraba Millionaire | 12 % |

| 15 | Mudaraba Katipothi | 12 % |

| 16 | Double Benefit Deposit Scheme | 12.25 % |

| 17 | Special Savings (Pension) Scheme | 10.25 % |

| 18 | Marriage Saving Investment Scheme (MSIS) | 8.25 % |

Source: Profit Scheme of AIBL

Deposit Mix of the Branch:

The total deposit of the bank was Tk. 118,683.39 million at 31st December 2012 as against Tk. 82,186.98 million at 31st December 2011 recording a growth of 44.41% of which Tk. 2,564.75 million was bank deposit and Tk. 116,118.64 million was general deposit. The present strategy is to increase the deposit base through maintaining competitive profit rates and having low cost of funds to ensure a better spread with an average return on investment. To attract more customers this branch offers the above described schemes. Most of the deposit of this branch came from the Mudaraba Savings Account. The percentage mixes of different deposits are given below in the diagram.

Transaction:

Transaction is a financial event, which changes the financial position of a company. There are three types of transaction that is performed by the Al-Arafah Islami Bank Limited.

- Cash Transaction

- Clearing Transaction

- Transferring Transaction

Cash Transaction:

Cash department is a sensitive and important place of Bank. Cash receiving and cash payment is the first and important duty. A Bank should member that the image of a Bank is dependent on cash officer of Bank. If the Cash officer is not smart, outstanding and handsome person, then it is meant this does not care for its customers.

Cash Receipt:

Receiving cash officer should draw his attention to avoid from these types of notes when he /she taken money from the customers”

- Mutilated note

- Mismatched note

- Discolor note

- Forged note

- Incorrect note

- Burn note

Cash payment:

The officer should enough care when he/she makes payment of a cheque. Some of the important checkpoints are given below:

- Amount of the cheque

- Who is the draw of the cheque

- Verifying the signature

- Posted and cash paid sale on the cheque

- Name of the branch

- Is it a fraud cheque?

After payment, the cheque the officer should maintain/noted account number, name of the draw, and withdrawal amount in a register book.

Telegraphic Transfer (TT):

Telegraphic transfer, it may branch telephone or telex. Transfer means fund/money transfer from one branch to another branch not in same area.

Sometimes the remitter of the funds requires the money to be available to the payee immediately. In that case, the banker is requested by him to remit the funds telegraphically.

The Bank passes T. T by a secret code, which input by the GB in charge and branch Manager.

Mail Transfer Advice:

Where the remitter desires the banker to remit the funds to the payee instead of purchasing a draft himself, the banker does it through a Mail Transfer Advice. The payee must have an account with the paying office as the amount remitted in such a manner, is meant for credit to the payee’s account and not for cash payment.

Pay Order (PO):

Unlike an MT or TT the banker’s payment order is meant for making payment of he banker’s own or of the customer’s dues locally and not for affecting any remittance to an outstation. In a sense, the payment order is used for making a remittance to the local creditor.

The Post are in the form of receipts, which are required to be discharged by the beneficiaries, where applicable on revenue stamps of appropriate value, against payment in cash or through an account. The PO is not a negotiable instrument and cannot be endorsed or crossed like a banker’s draft.

SWOT Analysis:

SWOT analysis provides an opinion and adjustment whether organizations currently position is satisfactory or not.

Strengths of AIBL:

- All activities of the bank are conducted according to Islamic shariah where profit is the legal alternative to interest.

- The bank has earned customer loyalty as organizational loyalty.

- AIBL maintain corresponding relationship with many foreign banks so that it is an effective measure for the smooth business.

- Skilled manpower and efficient employees are being involved to meet the clients’ satisfaction.

- The amount of deposits is one of the biggest strengths of AIBL.

- AIBL is always trying to add new and modern equipment.

Weaknesses of AIBL:

- In addition to that a huge number of financial institution working besides commercial Banks of our country. As such their business is becoming more and more vital weakness of AIBL because our financial market is not expanding in comparison with the establishment of new banks.

- The advertising and promotional activities of this bank are up the mark.

- There some officer who work hard but are not appreciated by the authority.

- AIBL has not set up proper network system among branches.

- The bank does not have any research and development division

- Risk Management system is not strong. The bank has already exposed to a variety of risks the most important of which are credit risk, market risk and liquidity risk.

- IT Division is not strong because bank put due importance to utilization of technology-based service to the customers.

Opportunity of AIBL:

- Favorable business climate for commercial banks in the country in comparison with other business.

- The bank can introduce more innovative modern customer service to better survive in the competition.

- It is high time that they should move towards the online banking system, because some bank already introduces the online banking operations.

- They can also offer the micro credit business for individual and small business.

- Expanding the financial policy with credit facility customer is very secure in business environment.

Threats of AIBL:

- The world is advancing towards technology very fast. Though AIBL taken effort to join the stream, it is not possible to complete the mission due to the poor technological infrastructure of our country.

- Local competitors can also capture as huge market share by offering similar products and services provided by the bank.

- Though the innovative working is in contentious process but the other rival banks are coping it within the short time.

- They are carrying out aggressive campaign to attract lucrative corporate client as well as big-time depositor.

- Bangladesh Bank is always supervising the local and foreign banks in Bangladesh and sometimes it is hampering the normal operation of private bank.

Overall Findings:

- They have not sufficient efficient employees to operate different department in the bank. So they should increase efficient employees in different department.

- Staff meetings and departmental meetings at the branch level does not held or very few which is very essential to develop service quality as well as problem solving. But this practice is very few. So it may create major problem in future.

- PC Bank is not modern and comprehensive banking software. It does not provide adequate support on providing the services. It is not user friendly and management should consider replacing the PC Bank system by a more comprehensive banking system.

- They never keep anything pending.

- ATM booth service is an online popular service. The bank’s online service is very poor. So if they want to survive in competition, they should introduce online service as early as possible.

- Technology that AIBL is using for their banking system is not up to date. There are some international banks in Bangladesh, they are very fast and very up dated. AIBL is losing their clients because of lack of technology.

- There is a gap between the customers and bankers. Customers are unaware about the moral of Islamic Banking System. Sometimes they are not familiar with the rules of Islamic Banking.

- The Al-Arafah Islami Bank is too much centralized. For each and every work branch office has to get permission from the head office. The head office tightly controls each and every branch office. This dependency on head office causes slow down their activities.

- Advertising and promotion are the weak points of Al-Arafah Islami Bank Limited. AIBL does not have any effective marketing activities. Other banks have better marketing strategy.

- Some international and local savings bonds give high rate of returns. AIBL does not buy these because it is against the rules of Islamic Banking System.

Recommendations of AIBL:

Following recommendations are given to overcome the problem:

- In addition with the present services they should include more services. It is badly needed to provide more services to the customer in order to compete in the market.

- Bank should offer more facilities to the customers such as credit card, visa card, ATM machine etc to survive in the competition.

- On-line banking should be introduced for better customer services and to eliminate risk of sending document via post and risk of loss. It also increases quick fund transfer and better satisfaction from customer.

- Proper Banking software should be used to get best benefit from this department. AIBL should use the latest banking technology to provide better services to the customers.

- Staff meetings and departmental meetings at the branch level must be increased to develop service quality as well as problem solving

- The bank should give an aggressive advertisement campaign to build up a strong image and reputation the potential customer.

- AIBL should pursue advertising campaign in order to build a strong image among the people. They should carry out aggressive marketing campaign to attract clients.

8. The management should take immediate decision to take the current opportunities

9. AIBL should give equal priorities to the female candidates in terms of recruitment.

Conclusions:

Banks have their own unique strategy, which leads to their objectives. Some wishes to grow faster and achieve some long range growth. On the other hand some banks want to lead a quite life minimizing risk and convey an image of a sound bank. AIBL is pretty new in its operation. Even though the financial analysis on the banks performance seems the banks doing very well in the banking industry of Bangladesh, and has prosperous future.

AIBL has established goodwill through innovative products and services. Technology development has opened up a new dimension in the development of creative products, efficient services and customer satisfaction. The bank must cope with this technological advancement its present status.

Though there are some drawbacks in some sectors of Al- Arafah Islami Bank Ltd., still modern banking technology and employee and employer sincerity may lead to increased profit. The progress of AIBL in Bangladesh is depended on the environment, structure, special features offered by the bank, rapid increase of deposit, investment, profit, dividend on behalf of short time, the public respond over the bank.

The aim of the internship program is to gain knowledge of practical banking and to compare this practical knowledge with theoretical knowledge. During the 12 weeks internship program, it is not possible to go to the depth or each activities of division because of time limitation. So, objectives of internship program have not been fulfilled with complete satisfaction. However, highest effort has been given to achieve the objectives of internship program. I think this report may show a guideline to AIBL for its future planning and its successful operation to achieve its goal in the competitive environment.