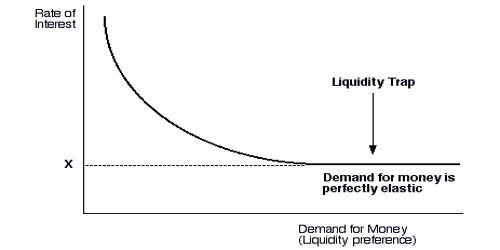

Liquidity Crisis is a negative financial circumstances characterized by a reduction in cash flow. For a single business, a liquidity crisis occurs in the event the otherwise solvent business doesn’t have the liquid assets required to meet its short-term bills, such as paying its loans, spending its bills along with paying its employees. If the liquidity crisis isn’t solved, the company must declare bankruptcy. An insolvent business may also have a liquidity problems, but in that case, restoring profit will not steer clear of the business’s ultimate bankruptcy.

Liquidity Crisis