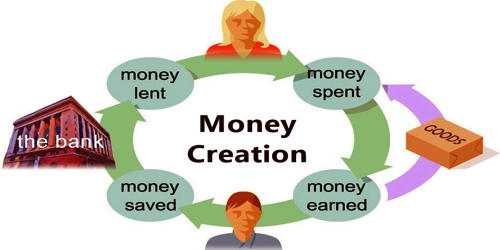

Money is an economic unit that functions as a generally recognized medium of exchange for transactional purposes in an economy. Money issuance or money creation is the process by which the money supply of a country, or of an economic or monetary region, is increased. It is the process in which the banking system creates checkable deposits by lending excess reserves. In most modern economies, most of the money supply is in the form of bank deposits. In most cases, currency issuance is managed and monitored by a country’s central bank, which is also referred to as a monetary authority. Central banks monitor the amount of money in the economy by measuring the so-called monetary aggregates.

The money creation process is the movement of reserves from bank to bank, with each bank using excess reserves to make loans, then keeping a fraction of the reserves to back up newly created deposits. In most nations that issue their own currency, there are unlimited intraday overdrafts that fund spending, for example in the UKpe Supplementary Memorandum by HM Treasury 2001. In most western countries, the monetary authority is independent of the government. In other countries, the central bank’s governor is appointed by the government. Hence, all government spending is money creation and creates an amount of tax and saving, the opposite way round to how most think. An example involves situations where a central bank assumes control over currency transferred to the central bank by commercial banks, which in turn receive respective funds from client deposits delivered into their respective accounts.

Money, i.e. banknotes and coins, has a long history as a means of exchange. At first, the value of the money came from the commodity out of which it was produced, usually some precious metal like gold, silver, or copper. To summarize, the money creation mechanism is a central bank action that links a financial player to an institution with monetary power. Money creation is the process leading to an increase in the money supply. This money supply can be divided into 2 main categories:

- currency: This is notes and coins in circulation within a country or geographical area. It represents about 5% of the world’s money supply.

- book money: This is money in the form of accounting entries. It represents 95% of the world’s money supply. This money does not physically exist, it is simply lines that appear on the debit or credit side of bank accounts.

The money creation process is a natural feature of fractional-reserve banking that occurs as banks act as both safe-keepers of deposits and financial intermediaries making loans. It is the legal and economic lending capacity of commercial banks that is predicated on the volume of business associated with creditworthy borrowers. Banks keep a portion of available reserves to back up deposits, then lend out excess reserves, creating checkable deposits in the process.