Introduction

Islami Bank Bangladesh is one of the pioneer private commercial bank of Bangladesh. It was incorporated on 13.03.1983 as a public company with limited liability under company act, 1913. The Bank started its business from 30.03.1983. IBBL is based on Islamic Sharia’h. It is the first Islamic Bank in Southeast Asia. Now, it is the leading private commercial Bank in Bangladesh. Complying Islamic Shari’ah commits IBBL to do its all activities in interest free profit sharing. IBBL through its steady progress and continued success has, by now, earned the reputation of being one of the leading private sector banks of the country.

Vision

The vision of IBBL is to always strive superior financial performance, be considered a leading Islamic Bank by reputation & performance.

- To establish & maintain modern banking techniques.

- To ensure soundness & development of financial system based on Islamic principles.

- To build–up a strong & efficient organization with highly motivated professionals.

- To work for the benefit of people& encourage savings in the form of direct investment

- Ensuring stability in financial system with accountability, transparency &integrity.

- To encourage saving in the form of direct investment.

- To encourage investment particularly in projects which are more likely to lead to higher employment.

Mission

To establish Islamic banking through the introduction of a welfare oriented banking system and also ensure equity and justice in the field of all economic activities, achieve balance growth and equitable development through diversified investment operations particularly in the priority sectors and less developed areas of the country. To encourage socio-economic uplift and financial services to the low-income community particularly in the rural areas.

Functions

The functions of Islami Bank Bangladesh Limited are as under:

- To make investment.

- To maintain all types of deposit accounts.

- To conduct foreign exchange business.

- To extend other banking services.

To conduct social welfare activities through Islami Bank Foundation.

Methodology

The study is performed based on the information extracted from different sources collected by using a specific methodology. The methods of completing the paper have included some steps, which are followed one by one. First of all I selected the topic of the paper then I had to collect information relating to the topic by primary and secondary sources and through personal interview. As a Internee of IBBL it was easy for me to collect data. After gathering the information I had to determine the procedure of research and sampling plans. After gathering all the information I required, I have come up with an expected result of the term paper.

Population:

All the Branches of IBBL located in everywhere in Bangladesh has been taken into consideration as population.

Sample:

Islami Bank Bangladesh Ltd, Head Office.

Islami bank Training & Research Academy (IBRTA)

Data collection:

Source of data of this Paper can be divided into two categories:

Sources of Information

v Primary Sources:

- Practical experience of banking.

- Training, workshop & seminar.

- Related files, books study provided by the officers concerned.

v Secondary Sources:

- Business Development Conference 2011

- Research papers, training materials, and magazines.

- Annual Report, Audit Reports of IBBL

- Banking related textbooks, relevant books, and Research papers, Newspapers and Journals, Manuals.

- Class notes of IBTRA, Website of IBBL.

Limitations of the Study

From the intention to make the term paper realistic and properly accepted this paper has been conducted. However, many problems appeared in the way of conducting the study. During the study it was not possible to visit the whole area covered by the bank although the financial statements and other information regarding the study have been considered. The study considers following limitations:

v The major limitation I faced in preparing this paper was the sensitivity of the data. As it is a highly competitive market, if the margin information is released to other competitors, it may have a negative impact on their business. Resultantly, in some cases management were reluctant to give some specific data.

v Confidentiality of data was another important barrier that was confronted during the conduct of this study. Every organization has their own secrecy that is not revealed to others. While collecting data on IBBL, personnel did not disclose enough information for the sake of confidentiality of the organization

v Rush hours and business was another reason that acts as an obstacle while gathering data

v Time limitation is also a big factor, which hinders the data collection process. Due to time limitation many aspect could not by discussed in the present study.

Introduction

The special feature of the investment policy of the Bank is to invest on the basis of profit-loss sharing system in accordance with the tenets and principles of Islamic Shariah. Earning profit is not the only motive and objective of the Bank’s investment policy rather emphasis is given in attaining social good and in creating employment opportunities. Pursuant to the Investment Policy adopted by the Bank, a ‘7-year Perspective Investment Plan’ has been drawn-up and put into implementation. The plan aims at diversification of the investment port-folio by size, sector, geographical area, economic purpose and securities to bring in phases all sectors of the economy and all types of economic groups of the society within the fold of Bank’s investment operations.

Accordingly, the plan envisages composition of the investment port-folio with 12% for agriculture and rural investment, 14% for industrial term investment, 14% for industrial working capital, 6% for housing and real-estate, 6% for transport and communication, 0.5% for electricity, gas, water and sanitation services, 2% for storage, 43% for import, export and local trade and trade related activities 1% for poultry and dairy,2% for Rural Development Scheme, 2.5% for other Special Scheme, 0.5% for Micro Industry and 1% for other productive purposes by the end of the plan period, i.e. the year 2002.

Further, in order to diversify investment portfolio, the Bank engaged itself in investment operations through special schemes introduced during the years. The Bank is planning to introduce yet other new investment schemes in addition to welfare-oriented Investment Schemes.

Investment

The special feature of the investment policy of Islamic Banks is to invest based on profit-loss sharing system in accordance with the tenets and principles of Islamic Sharia. Earning of the profit is not the only motives and objectives of the Islamic Bank’s investment policy rather emphasis is given in attaining social good and in creating employment opportunities.

Objectives and Principles of Investment

—To invest fund strictly in accordance with the principles of Islami Shariah.

—To diversity its investment portfolio by size of investment, by sectors (public and private) by economic purpose, by securities and by geographical area including industrial, commercial & agricultural.

—To ensure mutual benefit both for the Bank and the investment client by professional appraisal of investment proposals, judicious sanction of investment close and constant supervision and monitoring thereof.

—To make investment keeping the socio economic requirement of the country in view.

—To increase the number of potential investors by making participatory and productive investment.

—To finance various development schemes for poverty alleviation, income and employment generation with a view to accelerate sustainable socio-economic growth and for enlistment of the society.

—To invest in the form of goods and commodities rather than give out cash money to the investment clients.

—To encourage social enlistment enterprises.

—To avoid even highly profitable investment in fields forbidden under Islamic Shariah and are harmful for the society.

Investment Management Of IBBL

One of the significant and revolutionary development in the banking area of the world during last four decades is the emergence and extra ordinary development of Islamic Banking in different countries of the world which has drawn the attention of the scholars and general public of the Muslim and non-Muslim countries including the world bodies like International Monetary Fund, World Bank etc.

Investment Operation of IBBL

Investment operation of a Bank is the greatest share of total revenue generated from it, maximum risk is centered in it and the very existence of a Bank mostly depends on prudent management of its Investment Port-folio. Bank landing is important to the economy.

Adequate finance can maintain a stable output. But as liquidity and profitability are conflicting considerations, IBBL, as a bank, while employing the funds pays due regard to both profitability and liquidity.

Investment and credit department receive application from clients in a prescribed application form supplied by the Islami Bank Bangladesh Limited. This application form contains detail about the borrowers such as names address of the borrowers/ directors/partners/proprietors, type and nature of the business, security offered, market of the borrower product, annual sales and production etc.

The applicant must duly sign the application form. The branch officer after receiving the application form scrutinize the information provided in the form, collect additional financial information of the proposed firm, detail financial and other relevant information of sister concern, if any. After appraising the investment request and its securities the branch makes an investment proposal with detail information to the head office for approval. The officer in-charge and manager must sign this investment proposal as well. If head office approves the investment proposal, the branch prepares all documentation and make arrangement for investment disbursement Islami Bank (B.D) offer various types of investment.

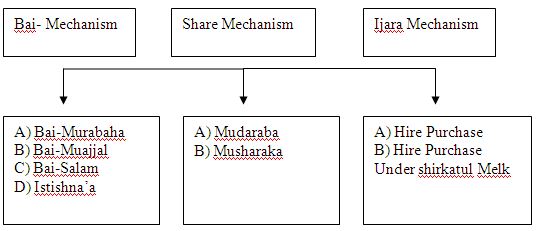

Different Investment Modes & Their Mechanism

Bai-Mechanism:

Bai Murabaha

The terms “Bai-Murabaha” have been derived from Arabic words and (Bai and Ribbun). Te word means purchase and sale and the word means an agreed upon profit “Bai-Murabaha” means sale on agreed upon profit. Bai-Mudaraba may be defined as a contract between a buyer and a seller under which the seller sells certain specific goods (permissible under Islamic Shariah and the Law of the land), to the buyer at a cost plus agreed profit payable in cash or on any fixed future date in lump-sum or by installments. The profit marked-up may be fixed in lump-sum or in percentage of the cost price of the goods.

Important features:

¨ It is permissible for the client to offer an order to purchase by the bank particular goods deciding its specification and committing him to buy same from the bank on murabaha, i.e. cost plus agreed upon profit.

¨ It is permissible to make the promise binding upon the client to purchase from the bank, that is, he is to satisfy the promise or to indemnify the damages caused by breaking the promise without excuse.

¨ It is also permissible to take cash / collateral security to guarantee the implementation of the promise or indemnify the damages.

¨ Stock availability of goods is a basic condition for signing a Bai-murabaha agreement. Therefore, the bank must purchase the goods as per specification of the client to acquire ownership of the same before signing the Bai-Murabaha agreement with the Client.

¨ After purchase of goods the Bank must bear the risk of goods until those are actually sold and delivered to the Client, i.e., after purchase of the goods by the Bank and before selling of those on Bai-Murabaha to the Client buyer, the bank bear the consequences of any damages or defects, unless there is an agreement with the Client releasing the bank of the defects, that means, if the goods are damaged, bank is liable, if the goods are defective, (a defect that is not included in the release) the Bank bears the responsibility.

¨ The Bank must deliver the specified Goods to the Client on specified date and at specified place of delivery as per Contract.

¨ The bank shall the goods at a higher price (Cost + {profit) to earn profit. The cost of goods sold and profit markup therewith shall separately and clearly be mentioned in the Bai-Murabaha agreement. The profit Mark-up may be mentioned in lump sum or in percentage of the purchase/cost price of the goods. But, under no circumstance, the percentage of the profit shall have any relation with time or expressed in relation with time, such as per month, per annum etc.

¨ The price once fixed as per agreement and deferred cannot be further increased.

¨ It is permissible for the bank to authorize any third party to buy and receive the goods on Bank behalf. The authorization must be in a separated contract.

Bai Muazzal:

The terms “Bai” and “Muazzal” have been derived from Arabic words Baiun. The word Baiun means purchase and sale and the word Azl means a fixed time or a fixed period. “Bai-Muazzal” means sale for which payment is made at a future fixed date or within fixed period.

In short, it is a sale on Credit. Bai-Muazzal may be defined as a contract between a buyer and a seller under which the seller sells certain specific goods (permissible under Islamic Shariah and the Law of the Country), to the buyer at a cost plus agreed profit payable in cash or on any fixed future date in lump-sum or by installments. The seller may also sell the goods purchased by him as per order and specification of the Buyer.

Important feature:

i) Bank is not bound to declare cost of goods and profit mark-up separately to the client.

ii) Spot delivery of the item and payment is deferred.

iii) The bank transfers ownership and possession of the goods to the client before receipt of sale price.

iv) Client may offer an order to purchase by the bank any specified goods and committing himself to buy the same from the Bank on Bai-Muajjal mode.

v) It is permissible to make the promise binding upon the client to purchase from the bank. That is, he is either to satisfy the promise or to indemnify damage caused by breaking the promised.

vi) Cash /Collateral Security should be obtained to guarantee the implementation of the promise or to indemnify the damages.

vii) Mortgage / Guarantee /Cash Security may be obtained before / at the time of signing the agreement.

viii) Stock and availability of goods is a pre- condition for Bai- Muajjal agreement. The responsibility of the bank is to purchase the desired goods at the disposal of the client to acquire ownership of the same before singing the Bai-Muajjal agreement with the client.

ix) The Bank after purchase of good must bear the risk of goods until those are actually delivered to the client.

x) The Bank must deliver the specified goods to client on the specified date and at specified place of delivery as per contract.

xi) The Bank may sell the goods at one agreed price, which will include both the cost price and the profit.

xii) The price once fixed as per agreement and deferred cannot be further in increased.

Bai – Salam

Bai-Salam may be defined as a contract between a buyer and a seller under which the seller sells in advance the certain commodities, products, permissible under Islamic Shariah and the law of the land to the buyer at an agreed price payable on execution of the said contract and the commodities/products are ideas are delivered as per specification, size, quality, quantity at a furniture time in particular place. In other word, Bai-Salam is a sale where by the seller undertakes to supply some specific commodities/ products/ to the buyer at a future time in exchange of an advanced price fully paid on the spot. Under this mode Bank will executive purchase contract with the client and make payment against purchase of product, which is under process of production. Bai-Salam contract will be executed after making any investment showing price, quality, quantity, time, place and mode of delivery. The profit to be negotiated. It this mode the payment as the price of the goods is made at the time of Agreement and the delivery of the goods is deferred.

Importance Features:

Bai-salam is mode of investment allowed by Islamic Shariah in which commodity/product can be sold without having the said commodity (ies)/product(s) either in existence or physical/constructive possession of the seller. If the commodity /product are ready for sale, Bai-Salam is not allowed in Shariah. Then sale may be done either in Bai-Muajjal mode of investment.

Generally, Industrial and agricultural products are purchased /sold in advance under Bai-Salam mode of investment to infuse finance so that product is not hindered due to shortage of fund/cash.

- It is permissible to obtain collateral security from the seller client to secure the investment from any hazards Vis non-supply of supply of commodity (ies)/product, supply of low quality commodity (ies)/ product(s) etc.

- It is also permissible to obtain mortgage and /or personal guarantee from a third party as security before the signing of the agreement or at the time of signing the agreement.

- Bai-salam on a particular commodity (ies)/product(s) or on a product of a particular field or farm cannot be affected.

Bai Istishna:

Istishna is a contract between a manufacturer/seller and a buyer under which the manufacturer/seller sells specific product(s) after having manufactured, permissible under Islamic Shariah and Law of the Country after haying manufactured at an agreed price payable in advance or by installments within a fixed period or on/within a fixed future date on the basis of the order placed by the buyer.

Important Feature:

- Istisna’a is an exceptional mode of investment allowed by Islamic shariah in which product(s) can be sold without having the same in existence. If the product(s) are ready for sale, Istishna’a is not allowed in shariah. Then the sale may be done either in Bai-Murabaha or Bai-Muajjal mode of investment. In this mode, deliveries of goods are deferred and payment of price may be deferred.

- It facilitates the manufacturer sometimes to get the price of the goods in advance, which he may use as capital for producing the goods.

- It gives the buyer opportunity to pay the price in some future dates or by installments.

- It is a binding contract and party is allowed to cancels the Istishna’a contract the price is paid and received in full or in part or the manufacturer starts the work.

- Istishna’a is specially practiced in Manufacturing and industrial sectors. However, it can be practiced in agricultural and constructions sectors also.

Share Mechanism:

Mudaraba

It is a form of partnership where one party provides the funds while the other provides the expertise and management. The first party is called the Sahib-Al-Maal and the latter is referred to as the Mudarib. Any profit accrued is shared between the two parties on a pre-agreed basis, while capital loss is exclusively borne by the partner providing the capital.

Importance Features:

- Bank supplies capital as Sahib- al –Mall and client invest if in the business with his experience.

- The client maintains administration and management

- Profit is divided as per agreement.

- Bank bears the actual loss alone.

- Client cannot take another investment for that specific business without the permission of the Bank.

Musharaka

An Islamic financial technique that adopts “equity sharing” as a means of financing projects.

Thus, it embraces different types of profit and loss sharing partnership. The partners (entrepreneurs, bankers etc.) share both capital and management of a project so that profits will be distributed among them as per rations, where loss is shared according to ratios of their equity participation.

Important Features:

The investment client will normally run manages the business. The bank shall take part in the policy and decision making as well as overseeing (supervision and monitoring) the operation s of the business of the client. The bank may appoint suitable personal(s) to run the manage the business and to maintain books of accounts of the business property. As the investment client shall manage the enterprise, the bank may more share of profit to him than that of his proportion capital contribution. Loss, if any, shall be shared on the basis of capital ratio.

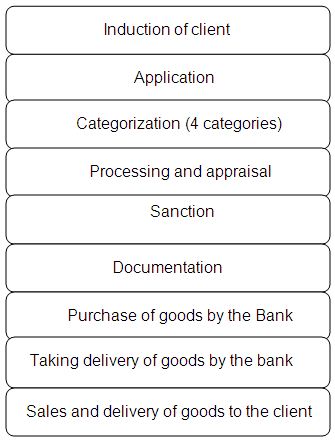

Operational Procedure of Investment mechanism of IBBL

Application:

ü Obtain application in triplicate from the client of F-167A and record the same in the Investment Proposal Received and Disposal Register (B-53).

ü Obtain and affix attested photograph(s) of the Proprietor /Partner/Directors/ Trustee/ Administrator on the top right hand corner of the application.

ü Scrutinize the application of the Client to see that-

(a) All columns are properly field in;

(b) Particulars and information given therein are complete and correct in all respects;

(c) All required Documents/papers as listed in the footnote for the application is submitted;

(d) It is signed by the client as per specimen signature with the bank and duly verified by the authorized official of the bank.

Categorization:

Categories the proposal as under:

- Hire Purchase under Shirkatul Melk Commercial:

Investment on hire purchase under Shirkatul Melk mode to individual /firm/company /society for commercial purpose shall be termed as hire purchase under Shirkatul Melk Commercial.

- Hire Purchase under Shirkatul Melk Industrial:

Hire Purchase under Shirkatul Melk investment to industrial undertaking in the form of land, building, machineries, equipment, transport, etc shall be termed as Hire Purchase under Shirkatul Melk Industrial

- Hire Purchase under Shirkatul Melk Agriculture:

Hire Purchase under Shirkatul Melk investment to agriculture sector in the form of Agriculture equipment’s, machineries, shallow Tube–well, Tractor, trailers, Transport etc. shall be termed as Hire Purchase under Shirkatul Melk agriculture.

- Hire Purchase under Shirkatul Melk Transport:

Hire Purchase under Shirkatul Melk Industrial in the form of transport –Bus, truck, car, taxi, lunch, steamer, cargo vessel, air transport etc. shall be termed as Hire Purchase under Shirkatul Melk transport.

- Hire Purchase under Shirkatul Melk Real Estate:

Hire Purchase under Shirkatul Melk Industrial in the form of land building, market, apartments, for use /rental shall be termed as Hire Purchase under Shirkatul Melk Real Estate.

Processing and Appraisal:

Enter the Application in the “Investment Proposal Received and Disposal Register (B-53) and allot a Serial Number to it.

- Examine shariah permissibility of the goods. Reject the proposal outright, if not permitted by Islamic Shariah.

- Check-up Credit Restriction Schedule of Bangladesh Bank and Head Office Current Investment Policy Guidelines.

- Visit the Business establishment of the Client. Talk to the business and important personalities of the locality to ascertain the Honesty, Integrity and Business dealings of the Client.

- Request for confidential report of the client from local Bank Branches. Confident Report from Credit Information Bureau (CIB) of Bangladesh Bank through Head Office Investment Division as per Instruction Circular of Head Office in this Regard.

- Obtain Financial Statement/Balance Sheet of the Client for the last three consecutive years for Investment Proposals of Tk. 50.00 lac or above as per Head Office Instruction.

- Inspect Land, Building, other Assets and Properties proposed to be Mortgaged or Hypothecated.

- Forward Documents, Title Deeds and other relevant Papers to approve Lawyer of the Bank for examination and furnishing his opinion.

- Obtain Lawyer’s Opinion as per clause No. 8.02.

- Please study the following carefully and note down the actual findings in the Appraisal Form against each item :

- Work out the purchase and sale prices of the goods as per guidelines.

Signature of the Client:

After completion of Document, enter Document in Documents Execution Register

(B-103). Movement of Document, if any, should be duly recorded in the Document Ex-custody Register duly singed by the Custodians.

Purchase of Goods by the Bank:

- That the goods desired by the Client are first purchased by the Bank and the ownership of the Bank on the goods is established, i.e. Bank must transform its money into goods.

- That after purchase of the goods, the risk of the goods is borne by the Bank until the possession of the Merchandise has been passed on the Client.

- That the specification of the goods, delivery schedule and other terms of contract are fulfilled.

- Obtain deal-wise application Order for Purchase on F-136 after due study.

- Open investment account in Investment Account Opening Register (B-102).

- Enter the Account Particulars in the Investment Ledger (B-105).

- It should be carefully noted that purchase of goods shall be made only after completion of all the Documentation formalities, including Pre-Audit memo (F215).

- In case purchase of Bai-Murabaha goods by the Bank on Credit/deferred payment basis, the Bank shall execute a Credit Purchase Agreement with the seller to that effect mentioning date of delivery of Goods to the bank and that of payment by the Bank.

- If the goods are to be purchased from the local or outstation market and money is to be paid/remitted thereof and other expenses such s TA/DA, transportation etc, shall be borne by the Bank, which shall ultimately be loaded on the cost of Goods.

Taking Delivery of Goods by the Bank:

- After finalization of purchase of Bai-Murabaha Goods either by the Bank officials or through any Agent from the local or out station market the Bank shall request the seller to deliver the goods purchased to the Bank’s Authorized official /Agent or to the Bank go down against proper acknowledgement.

- After taking delivery of the goods by the Bank or trough and Agent, the Bank shall make payment of the price of the goods to producers /sellers /supplier through DD/TT/PO against Cash memo which will exclusively be issued in the name of the Buying Agent.

- The Bank shall not be invest in such cases where the allotting Authority will not accept the Letter of Authority and agree to deliver the goods to the Bank as per authorization of this Allotted.

Growth of Investment

Investment of the Bank increased to Tk. 180054 million as on 31.12.2008 from Tk.144921 million as on 31.12.2007 showing an increase of tk 35133 million ,i.e 24.24% growth as against 21.45% growth of the banking sector.This increased investment growth of the bank in 2008 is due the trust given to promote investment for effective utilization of depositors’ fund.The percentage of increase of Investment of IBBL in 2007 was 27.60%.

The share of Investment of IBBL in banking sector as on 31.12.2008 increased to 8.41%, from 8.27% as on 31.12.2007.

Mobilization

Mobilization of Deposits

The year 2009 was another successful year of mobilization of deposit. Total deposit stood at Tk. 243,653 million as on 31st December 2009 as against Tk.202,115 million of the preceding year registering a growth of Tk.41,538 million, i.e. 20.55% growth as compared to the growth rate of 18.31.% of the Banking Sector during 2009. The percentage of growth of Deposit in 2008 was 21.52%.

The share of deposit of IBBL in banking sector as on 31.12.2009 was 7.77%.

Out of total Deposit in the banking sector as on 30.06.2009 Nationalized Commercial Banks’ share was 29.49%, Specialized Banks’ share was 5.46%, Private Commercial Banks’ (excluding Islamic Banks) share was 42.49%, Islamic Banks’ share was 15.27% and Foreign Commercial Banks’ share was 7.29%. As on 30.06.2008, share of deposit of Nationalized Commercial Banks, Specialized Banks, Private Commercial Banks (excluding Islamic Banks), Islamic Banks and Foreign Banks was 31.60%, 5.95%, 40.92%, 13.61% and 7.93% respectively.

Total number of depositors of IBBL increased to 4,591,463 as on 31st December 2009 from 4,361,896 of the preceding year, registering an increase of 5.26% as against increase of 14.70% as on 31.12.2008.

a) Sector-Wise Investments

Sector-wise distribution of investment as on 31st December 2009 vis-à-vis the corresponding period of last year is given below:

(Amount in Million Taka)

Sl. No. | Sector | 2009 | 2008 | ||

Amount | % to Total Investment | Amount | % to Total Investment | ||

1 | Industrial | 114,884 | 53.53% | 99,233 | 55.11% |

2 | Commercial | 71,381 | 33.26% | 51,332 | 28.51% |

3 | Real Estate | 8,649 | 4.03% | 10,172 | 5.65% |

4 | Agriculture (including investment in Fertilizer and Agriculture Implements) | 14,057 | 6.55% | 9,110 | 5.06% |

5 | Transport | 3,520 | 1.64% | 4,082 | 2.27% |

6 | Others | 2,125 | 0.99% | 6,125 | 3.40% |

Total | 214,616 | 100.00% | 180,054 | 100.00% | |

b) Mode-wise Investment

Amount in Million Taka)

| Mode | 2009 | 2008 | ||

Amount | % to Total Investment | Amount | % to Total Investment | |

| Bai-Murabaha | 117,180 | 54.60% | 96,217 | 53.44% |

| Hire Purchase under Shirkatul Melk | 73,871 | 34.42% | 63,159 | 35.08% |

| Bai-Muajjal | 7,318 | 3.41% | 6,550 | 3.64% |

| Purchase & Negotiation | 11,289 | 5.26% | 10,223 | 5.68% |

| Quard | 2,833 | 1.32% | 2,151 | 1.19% |

| Bai-Salam | 2,082 | 0.97% | 1,719 | 0.95% |

| Musharaka | 43 | 0.02% | 35 | 0.02% |

Total | 214,616 | 100.00% | 180,054 | 100.00% |

A four (4) years perspective Business Plan for the years 2010 to 2013 has been adopted by IBBL which is under implementation. Investment plan is part of that plan which has been formulated keeping in view the national economic priorities and aiming at diversification of the Investment portfolios by size, sector, geographical area, economic purpose and securities to bring in phases all sectors of the economy and all types of economic activities covering different economic strata of the society within the fold of Bank’s investment operations.

Welfare Oriented Investment (Special Scheme)

In addition to the normal commercial and industrial investment operations, many special Investment Schemes like:

i) Rural Development Scheme,

ii) House-hold Durables Scheme,

iii) Investment Scheme for Doctors,

iv) Transport Investment Scheme,

v) Car Investment Scheme,

vi) Small Business Investment Scheme,

vii) Micro-Industries Investment Scheme

viii) Agricultural Implements Investment Scheme,

ix) Housing Investment Scheme,

x) Real Estate Investment Program,

xi) Mirpur Silk-weavers’ Investment Scheme,

xii) Poultry Investment Scheme and

xiii) Small Transport Investment Scheme, targeting different economic groups, have been introduced by the Bank over the years.

xiv) SMES Investment scheme.

xv) Women Entrepreneurs Investment Scheme.

xvi) Rural Housing Investment scheme.

The schemes have been implemented and being expanded to meet the specific and welfare oriented needs of the different segments of people of the country.

The Bank, since its inception, has been working for the upliftment and emancipation of the under-privileged downtrodden and neglected sections of the population and has taken up various financing schemes for their well-being. The objectives of these schemes are to raise the standard of living of low-income group.

Household Durables Scheme:

The objective of the Scheme is to increase standard of living and quality of life of the fixed income group by extending them investment facilities to purchase household articles such as furniture like almirah, sofa set, wardrobe; electric and electronic equipment like television, refrigerator, gas cooker, air conditioner, PC, washing machine; electric generator-IPS, UPS; motor cycle; corrugated iron sheet, cement, rod, wood etc. for construction of dwelling house; gold ornaments, tube-well, mobile telephone set etc.; medical/ engineering instruments/ equipment, educational instruments/ equipment, computer, books etc. for students.

Among the schemes, the objective of Household Durables Scheme is to increase standard of living and quality of life of fixed income group by providing them investment facilities to purchase different household durable items.

As on 31 December 2009, investment under Household Durable Scheme was Tk. 686.49 million among the 18864 investment clients as against Tk. 636.40 million among the 22016 investment clients in 2008.

Objectives

- To assist service holders with limited income in purchasing household durable.

- To assist the fixed income group in raising the standard of living.

- To create opportunity for the service holders to enjoy the benefit of modern and sophisticated living and at the same time lead a decent and honest life.

Eligibility

Interested permanent officials of the following organizations may apply for investment:

- Government Organizations.

- Semi-Government Organizations and Autonomous Bodies.

- Banks and Financial Institutions.

- Armed Forces, BDR, Police and Ansars.

- Teachers of Universities, GovernmentColleges, School and Senior Madrashas.

- Officers of International Financial & Relief Organization.

- Officers of the multinational companies.

- Officers of the local established and renowned public limited companies.

- Permanent Teachers & Officers of prominent Private Universities, Medical Colleges & University Colleges.

- House Owners.

- Doctors, Engineers, Architects, Chartered Accountants/ FCMA and other important professionals.

- Investment clients of IBBL.

- Deposit client of IBBL.

- Shopkeepers and Businessman.

- Wage earners, Panel lawyers of IBBL, C & F Agents enlisted in IBBL etc.

- Graduate & post Graduate Students of Universities, MedicalColleges, EngineeringColleges, UniversityColleges for purchase of PC, Medical/Engineering Equipment/ Machinery, Books etc.

- In case of Government, Semi-Government and Autonomous Organizations the age of the investment clients must be 25 and above with at least three years of service and he must have at least three years of service prior to his retirement. In case of private organizations, teachers of school, college and madrashas the age of investment clients must be in between 30-50 with at least five years of service and he must have five years of confirm service prior to his retirement in the same organization.

- In case of others service holders the age limit must be within 27-60 years.

- In case of students the minimum age must be 18 years and maximum 25 years.

Security

The investment client shall execute/provide the following documents in order to secure the investment:

- All required charges documents as per rules of the Bank.

- A written undertaking to the effect that the monthly installments shall be paid regularly.

- Personal guarantee of an official of the same rank or superior rank. The guarantee shall have to be duly authenticated by the competent authority of the concerned organization.

- Personal guarantee of another person, preferably family member.

Housing Investment Scheme:

The Bank has introduced this scheme to ease the serious housing problem in the urban areas and to make arrangement for comfortable accommodation of the fixed income group. Officials of the Defense Forces; Permanent Officials of Government, Semi-Government and Autonomous Organizations; Teachers of the established Universities, University Colleges & Medical Colleges; Graduate Engineers, Doctors and Established Professionals; Bangladeshi Officials of reputed Multinational Companies, International Financial Organizations, Donor Agencies, Foreign Embassies etc. Officials of local established & reputed Public Limited Companies; Wage Earner Professionals like Doctors, Engineers, Accountants, Teachers and any other profession doing good job abroad with hand-some pay-package shall be eligible to apply for availing investment facilities under the Scheme.

Objectives

- To extend the benefits of the investment of the Bank under the Scheme to different sections of the people.

- To assist in solving the existing housing problem of the country.

- To assist the service holders and professionals with fixed income to arrange for house of their own.

- To extend the investment facilities of the bank to every nook and corner of the country, by size of investment, by sector of investment and on the basis of geographical area.

To make investment facilities easily available under Islamic Shariah to those people who do not want to avail investment facilities from interest-based financial institutions.

Eligibility

- Initially the following categories of people shall be eligible to apply for availing investment facilities under this Scheme:

- Officials of the Defense Forces.

- Permanent Officials of Government, Semi-Government and Autonomous Organizations.

- Teachers of the established Universities, University Colleges & Medical Colleges.

- Graduate, Engineers, Doctors and established professionals.

- Bangladeshi Officials of reputed Multinational Companies, International Financial Organizations, Donor Agencies, foreign Embassies etc. Officials of local established & reputed Public Limited Companies.

- Wage earner professionals like Doctors, Engineer, Accountants, Teachers and any other profession doing job abroad with hand-some some-package.

Security

- Personal guarantee of the clients, his/her spouse, adult son(s) and daughter(s) shall have to be obtained.

- Mortgage of land and building to be constructed thereon, apartment/ flat/ house in favor of the Bank till the full payment of dues to the Bank.

- An undertaking from the client as well as from the dependants (nominees) to the effect that the retirement benefits including Provident Fund will be appropriated towards adjustment of the house building investment liability of the client prior to any other appropriation, if the liability relating thereto or any of it remains unadjusted at the time of getting the retirement benefits.

Transport Investment Scheme:

To ease the existing transportation problem and ensure speedy economic growth and development of the country particularly the expansion of trade, commerce and industry, the Bank has taken up this Scheme. Under this Scheme investment is being allowed to the existing successful businessmen and potential entrepreneurs in this sector for all types of road and water transport like bus, mini-bus, truck, launch, cargo-vessel, transport for rent-a-car service; and baby-taxi, tempo, pick-up van for self- employment; and ambulance for clinic & hospital. The Bank is also extending investment facilities to multinational companies, established business houses and well to do officials and professionals for acquisition of private cars, microbus and jeeps.

(Taka in million)

Particulars | 2005 | 2006 | 2007 | 2008 | 2009 | 2010 |

| Transport Investment | 2947 | 2698 | 2624 | 3087 | 3630 | 4732 |

Investment Scheme for Doctors:

The Bank has taken up this Scheme to help unemployed qualified doctors to go for self-employment and to provide latest medical equipment to specialist doctors to extend modern Medicare facilities throughout the country.

Objectives

- To provide investment facilities for establishment of chambers, clinics, pharmacies and procurement of medical equipment by the unemployed medical graduates and thus to provide self-employment.

- To assist newly passed unemployed medical graduates to establish clinics by way of formation of groups by 5 years.

- To assist experienced and established physicians to procure improved and modern medical equipment and thus to improve the standard and techniques of treatment.

- To assist specialists and consultant physicians to procure specialized medical equipment for extending improved treatment to the people.

Eligibility Criteria

- Newly passed medical graduates who are willing to establish chambers, pharmacies and small clinics in district and Thana level towns.

- Experienced and established doctors who are settled in district and other towns but cannot procure modern medical equipment to improve their techniques of treatment.

- Specialized and consulted physicians who are willing to procure latest and specialized type of medical equipment.

- Newly passed medical graduates who are willing to from groups in order to establish clinic.

- Priority is given to specialist and consultant physicians like dentists, child specialists, and ophthalmologists etc.

(Taka in millions)

| Particulars | 2005 | 2006 | 2007 | 2008 | 2009 | 2010 |

| Investment Scheme for Doctors | 64 | 33 | 24 | 15 | 17 | 15 |

Small Business Investment Scheme:

This Scheme has been taken up for self-employment of educated unemployed youths for rural and urban areas and to provide investment to small businessmen and entrepreneurs. Investment is extended for about 200 economic- activities in sectors as live-stock, fishery, agro-faming, processing and business, manufacturing, trading/shop-keeping, transportation, agricultural implements, for forestry and service viz. laundry, signboard painting etc.

(Taka in million)

| Particulars | 2005 | 2006 | 2007 | 2008 | 2009 | 2010 |

| Small Business Investment | 630 | 768 | 876 | 1105 | 1160 | 1703 |

Rural Development Scheme (RDS):

The Rural Development Scheme (RDS) was launched in 1995 with the objective to alleviate rural poverty by providing small & micro investment facilities to the agricultural & rural sector to create opportunity for generation of employment and raising income of the rural poor. At present 136 branches among 10676 villages under 289 thanas of 61 districts under 6 divisions.

The female members in this scheme constitute about 88% of the total beneficiaries. These rural poor are provided with collateral free investment facilities for 21 types of crops production and 343 off-farm activities in the rural areas starting from tK.10,000 to a maximum limit of Tk. 30,000. To meet up the higher investment need of the successful graduated members of RDS, another scheme has been introduced under the name and style of ‘Micro Enterprise Investment Scheme (MEIS)’ under which the clients are provided with investment facilities from Tk. 30,001 to Tk. 200,000 million against securities.

Objectives

The main objectives of the Scheme are:

w To extend investment facilities to agricultural, other farming and off-farming activities in the rural areas.

w To finance self-employment and income generating activities of the rural people, particularly the rural unemployed youths and the rural poor.

w To alleviate rural poverty through integrated rural development approach.

w To extend investment facilities for hand tube-wells and rural housing, keeping in view the needs of pure drinking water and housing facilities of the rural dwellers.

w To provide education and Medicare facilities to the poor rural people.

Security Requirements

Generally, security will not be required against investment under the Scheme as entire Scheme has been drawn taking into account the social welfare objective of the Bank for upliftment of the socially down-trodden and economically backward and weaker section of the population of the society. However, Group discipline should be strictly followed and complied with so that only the right persons are selected and included as member of the Group.

In case of investment for purpose of pond fishery, special ceiling in off-farm activities and agricultural and irrigation implements, Branch should obtain after due verification, of land documents of the clients and keep their documents as collateral by way of simple deposit of title deeds through a memorandum of deposit executed by the client/owner.

Besides, in all cases, each member of the Group will give personal guarantee for the other members of the same Group and the members will be jointly and severally liable and responsible for payment of investment.

(Taka in millions)

| Particulars | 2005 | 2006 | 2007 | 2008 | 2009 | 2010 |

| Rural Development Scheme | 1106.47 | 2242.22 | 2884.66 | 3011.72 | 3752.20 | 4000 |

Performance of Investment

Five Year Investment Performance

(Taka in million)

| SI. | Year | 2006 | 2007 | 2008 | 2009 | 2010 | |

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 |

| 1 | Deposit | Amount Growth | 132419 22.86% | 166325 25.61% | 200725 20.68% | 243653 21.39% | 291312 19.56% |

| 2 | General Investment | Amount Growth | 120402 22.10% | 154000 27.90% | 191230 24.18% | 227863 19.16% | 279195 22.53% |

| 3 | General Investment to Total Deposit Ratio | % | 85.77% | 87.13% | 89.08% | 94.00% | 96.00% |

| 4 | Investment in Share & Securities | Amount | 3558 | 20058 | 7533 | 11137 | 12269 |

| 5 | Total Investment | Amount Growth | 123960 21.36% | 174058 40.41% | 198763 14.19% | 239000 20.24% | 291464 21.95% |

| 6 | Compensation | Amount | 401 | 487 | 462 | 686 | |

| 7 | Full Overdue | Amount | 4155 | 4043 | 4494 | 5648 | 5008 |

| 8 | % of full overdue to gen investment | % | 3.45% | 2.63% | 2.35% | 2.48% | 1.79% |

| 9 | Classified Investment | Amount | 3898 | 4426 | 4311 | 5063 | 4510 |

| 10 | % of net classified Invt. To Gen. | % | 3.24% | 2.87% | 2.25% | 2.22% | 1.62% |

| 11 | Net classification Invt. | Amount | 1971 | 2559 | 2509 | 3100 | 2500 |

| 12 | % of net Classified Invt. Gen .Invt | % | 1.64% | 1.66% | 1.31% | 1.36% | 0.90% |

| 13 | Provision Requirement | Amount | 2889 | 3311 | 3797 | 4138 | 5200 |

| 14 | Rescheduled Investment (Performing) | Amount | 1512 | 3985 | 7544 | 13446 | 12124 |

| 15 | Rescheduling Investment(Non-Performing) | Amount | 5050 | 4434 | 5626 | 15858 | 13461 |

| 16 | Total Rescheduled Investment | Amount | 6562 | 8419 | 13170 | 29304 | 25585 |

| 17 | % of Reschedule Invt. To Gen. Investment | % | 5.45% | 5.47% | 6.89% | 12.86% | 9.16% |

| 18 | Total non –performing Investment | Amount | 10498 | 11230 | 12153 | 23706 | 19871 |

| 19 | % of non-performing Invt.toGen.Investment | % | 8.72% | 7.29% | 6.36% | 10.40% | 7.12% |

| 20 | Written off Investment | Amount | 2967 | 3045 | 2843 | 2765 | 2539 |

| 21 | % of Written off Invt.to Gen.Invt. | % | 2.46% | 1.98% | 1.49% | 1.21% | 0.91% |

| 22 | Cash Recovery from Written off Inv. | Amount | 111 | 69 | 191 | 201 | 254 |

| 23 | Investment Income | Amount Growth | 10999 33.14% | 14562 32.39% | 19525 34.08% | 20768 6.37% | 24931 20.05% |

| 24 | Other Income | Amount Growth | 2743 28.18% | 2843 3.65% | 3929 38.20% | 3918 -0.28% | 4721 20.50% |

| 25 | Total Income | Amount Growth | 1374 32.12% | 17405 26.66% | 23454 34.75% | 24686 5.25% | 29652 20.12% |

| 26 | Operating Profit | Amount Growth | 3534 20.99% | 5363 51.75% | 8303 54.82% | 8463 1.93% | 11437 35.14% |

| 27 | Capital Adequacy Ratio | Actual Required | 9.43% 9.00%^ | 10.61% 10.00% | 10.72% 10.00% | 11.65% 10.00% | 10.00% 9.00% |

Investment Strategies and Action Plan in 2011

- To enhance capacity and capability of the employees of the Bank to handle investment operations through imparting appropriate training .

- To arrange training and motivational programs for investment clients and their officials on Islamic Banking including legal issues.

- To develop new Entrepreneurs.

- To induct best of the best investment clients, check exodus of good investment clients .

- To launch dynamic campaign to hunt good investment client from the market.

- To involve each and every employee of the Bank to induct new good business. Each and every employee will induct at least one good investment clients (excluding RDS&MEIS) in each month.

- To be aware of over –financing and under financing and to give prompt decision on investment proposals

- To have a clear picture of investment diversification and opportunities in the market in terms of Size ,Sector, Geographical Area, Economic Purpose, Security –wise.

- To maintain asset quality particularly in RMG and Textile sector .

- To obtain proper Primary and Collateral Securities and ensure proper Supervision , Monitoring and Control of Investment.

- To keep our investment cost minimum to offer competitive and lower rates and facilities to clients .

- To give due consideration to high risk , high return and low risk , low return investment proposals.

- To encourage investment involving less risk weight.

- To adopt modern technology in the investment operations.

- To deploy mobilized fund, as far as possible, locally by the concerned Branch.

- To observe strictly the single Party Exposure Rule.

- To prefer Syndication for large investment.

- To give due importance to increase Agriculture and SME Investment , particularly investment in various development, employment generation & poverty alleviation schemes like Real Estate, Transport, Doctors, Women, Entrerpreneurs, RDS, Small Business, Agricultural Implements, Rural Housing, HDS etc.

- To take effective steps to recover non-performing investment, particularly Bad & Doubtful and written of investment.

- To give due consideration to maintain a balanced investment portfolio of all branches in terms of size, economic purpose, area, mode and security.

- To Increase investment at environment friendly Solar Energy /Bio Gas, Effluent Treatment plant (ETP), Biological processing plant, Wastage Refinery plant and discourage investment in environment polluting industry.

- To enlighten the manpower with uptodate legal knowledge.

- To ensure proper documentation with the help of law Department , if necessary.

The year theme of the Bank for 2011 is ‘Year of Welfare and Green Which is in line with the objectives of Islamic Economics, Maqasid al Shari’ah as well as ethical & sustainable Banking . This is, no doubt, a challenging task. By the Grace of Amlighty Allah, concerted efforts, constant monitoring, continuous supervision of all concerned and advice & guidance of the policy makers, we shall be able to address the challenges.

SWOT Analysis

SWOT analysis means the compositions of four things & they are S for Strength, W for Weakness and O for Opportunities & T for Threats. It’s a basic mechanism to measure the organizations present or current situations. It used by almost all organizations in the world today to identify those above four things randomly. It’s all about to utilize the brain storming capability of managers of organization to justify any situation or future intentions to justify their decision making process of organizations. It’s although used by the organizations for the basic & relevant purposes now a day.

Strength:

- Adequate Finance: Islami Bank Bangladesh Ltd. has adequate finance. That is why they need not to borrow money from Bangladesh Bank or any other banks.

- More funds for Investment: For adequate financial ability they can provide loan to the more investment clients.

- Honest and Reliable Employees: All of the employees of Islami Bank are honest and reliable. They are always devoted themselves to the works for better customer service. They have no corruption report.

- It has vast years of experience since its establishment.

- IBBL is only the Bank which is the pioneer of welfare banking system among all other financial and banking organization.

- At IBBL, the top management is the driving force and the think tank of the organization where policies are crafted and often cascaded down.

- IBBL provides its customer excellent and consistent quality in every service.

- IBBL is a financially sound company.

- IBBL utilizes state-of-the art technology to ensure consistent quality and operation.

- IBBL provides its works force an excellent place to work.

- IBBL has already achieved a good will among the clients.

- IBBL has a research division.

Weakness:

- IBBL lacks well-trained human resource in some area.

- IBBL lacks aggressive advertising

- The procedure of credit facility is to long compare to other banks.

- Employees are not motivated in some areas.

- Absence of structured marketing and credit policy

- Lack of coordination among the branches and Head Office

Opportunities:

- Emergence of E-banking will open more scope for IBBL.

- IBBL can introduce more innovative and modern customer service.

- Many branches can be open in remote location.

- IBBL can recruit experienced, efficient and knowledgeable work force as it offers good working environment.

- The successful launcing and needs to an Islamic Money Market in the country.

Threats:

- The worldwide trend of mergers and acquisition in financial institutions is causing problem.

- Frequent taka devaluation and foreign exchange rate fluctuation is causing problem.

- Lots of new banks are coming in the scenario with new service.

- Local competitors can capture huge market share by offering similar products.

- The rules and regulations of Bangladesh are not favorable for Islami Bank. So they have to face various problems to operate their activities according to Islami Shariah.

- Lack of skill personnel because of poor salary structure rather than other private banks.

- Unknown attitudes of the people about the Islamic Banking.

MAJOR FINDINGS

- Bangladesh is not a full Islamic country, all activities are not operating according to the Shariah of Islam. But the IBBL is trying to operate their activities as much as possible. Yet some limitations and problems are arising and that’s why to encapsulate the overall study we need to detect some findings which are present below:

- Islamic Banking is a new phenomenon in our country during last two decades. So majority of our people have no proper knowledge about the activities of Islamic Banking as well as its investment mechanism hamper large scope of investment of IBBL.

- No Islami money market is available. Easily money transaction is no possible for the interest free banking system. Call money rate is not responded according to Islami Shariah

- Most of the people in our country have a bad impression of IBBL’s operations regarding indirect generation of interest which meaning no difference between investment of IBBL loan / Credit / advance of conventional banks for this reason, they are not too much interested to make investment with IBBL. Because of improper insufficient application of Islamic Banking rule in our country. The investment operations of IBBL can’t run smoothly.

- IBBL, which is committed to avoid interest, can’t invest the permissible part of its statutory liquidity Reserve and short Term liquidity surplus in those securities.

- This Bank can’t invest in all economic sectors, which are prohibited by the law of Islam.

- Profitable investment portfolio of IBBL requires clear investment knowledge according to Islamic Shariah. But sometimes IBBL can’t invest its assets in proper portfolio due to insufficient and unskilled manpower in these regards .As a result, there is a large amount of money being idle and thus potential profit is not increasing.

- This Bank revalues its investment operations within limited number of investment modes and does not initiate investment modes according to changing /diverse needs of people.

- Sometimes investment operations of IBBL are hampered due to increase, dishonest, indiscreet, hypocritical nature of people.

- IBBL has no strong promotional activities to increase motivate its present and potential investment client. IBBL does not grant investment portfolio for new entrepreneurs new businessmen new companies etc., which ultimately create “Class Banking”.

- There are limited scopes to deal women entrepreneurs and professionals for making investment by women interpreters.

- In rural areas for low-income community, this Bank grants investment an group not individual. as a result, the mission, using invested money in income generating activities so the poor needy population can become self reliant – is failed. Moreover, it enhances group dependence.

- IBBL has lack of modern technologies and equipment’s like cash card and credit card system.

- Numbers of employees are fewer than the volume of works that creates problem for prompt service.

- Absence of efficient personnel and infrastructure fit for Islamic trade financing on International Business.

- There is no Shariah Board in Bangladesh for foreign exchange business, which can guide them in their activities.

SUGGESTIONS

Suggestions:

- To develop customers service with harmony.

- Prompt customers’ service is needed, like –one stop services.

- To strengthen sufficient logistic supports.

- To easy procurement & procedures in respect of all transactions.

- To recruit sufficient skilled manpower with sound computer literacy and English proficiency.

- To provide online services all over the country immediately.

- To directly credit the foreign remittances through online banking.

- To analyze & build-up consciousness of competitors strategies.

- To motivate the human resources for mobilizing deposit, reduction of overdue etc.

- To enhance employees’ remuneration comparing to others.

Conclusion:

IBBL is trying to develop banking sector through welfare and servicing to the people. Islami economy and banking are bound together. IBBL has emerged facing the many obstacles yet. This bank is trying to operate their activities according to Islam.

Most of the people in our country have a bad impression about IBBL’s operations regarding indirect generation of interest, which means no difference between investments of IBBL loan/credit/advance of conventional banks for this reason. They are not much interested to investment with IBBL because majority of our people have no proper knowledge about the activities of Islami banking as well as its investment mechanisms. IBBL through its steady progress and continuous success has, by how, earned the reputation of being one of the leading private sector banks of the country. The bank has shown steady progress in this important sector. IBBL’s capital adequacy, deposits, reserves, earning per share, export, import and remittances are increasing day by day. So, no doubt IBBL is a growing profitable financial institution.

Interest free banking system is no more a concept. It is now a Reality, a dynamic system, embodying a set of superior banking mechanism. More than 300 Islamic bank and financial institutions are operating in different Countries throughout the world with a marked success from this inception in our country in 1983. IBBL has been operating with real and confidence in corporation with other conventional banks. Bringing a new concept in such business sector, which is growing too rapidly in the world, is rally bold step. As a large Islamic commercial bank, Islamic bank took various steps to create employment and socio-economic development for the poor through Islamic shariah as well as to create an overall climate for the introduction of large scale Islamic banking environment in Bangladesh.

The significant growing of IBBL has encouraged the traditional banks to open Islamic banking window, like –HSBC, Dhaka Bank Ltd., Prime Bank Ltd., The city Bank Ltd. Though IBBL has reached the top position among the PCBs in our country, it has to more concentrate its customers’ service to survive in the long run by facing the competitors’ strong strategies in banking era.

In my study I have found that IBBL has reached this position by its commitment, people’s love and dedicated human resources. Islami Bank has been shown its supremacy in all kinds of banking operations in our country.

The competent management of IBBL should come forward to take pragmatic strategic decision like –easy procurement, one stop service, and time savings customers’ service with sufficient logistics supports for the future betterment of the Bank.

To conclude we must say that, Islami bank Bangladesh Limited (IBBL) has immense potential in Bangladesh. It can play vital role in bringing revolutionary changes in our life with both material and moral world and in individual and collective level.