Executive Summary

Banking system of Bangladesh has gone through three phases of development: Nationalization, Privatization and Lastly Financial Sector Reform, Credit and Commerce Bank Ltd (NCCBL) started its journey in the financial sector of the country as an investment company back in 1985. The company operated up to 1992 with 16 Branches and thereafter with the permission of the Central Bank converted in to a fully fledged scheduled private commercial bank in May, 1993 with paid up capital Tk.39.00 core to serve the nation from a broader platform.

My internship project is divided into two sections. There are Organization part and Analysis part in the project. In the organization part I have tried to concentrate application & limitation of GAAP on general banking loan and advances, Foreign LC and SWOT analysis. NCCBL has office automation like online banking (only for three branches), own software MICRO BANKER. For completing my analysis part, I have done questionnaire survey among the customers of NCCBL. I tried to keep all the data confidential that I collected from our respondents. Survey method was cost efficient and convenient. I have used SPSS 14.0 to analyze the data. In questionnaire I have 16 questions in total. I have used frequency distribution, pie chart, cross tab, and ANOVA and regression analysis. Through my analysis I have tried to prove that how the customers of NCCBL are satisfied with the current quality of service they are providing.

1.1 Introduction

Financial Institutions have historically have been distinguished by the types of services they provide. In recent years Financial Institutions have diversified their services by creating new subsidiaries that perform additional services or by merging with other types of financial institutions. The result has been the creation of financial conglomerates, composed of various units offering specialized services. Diversification also offers benefits to financial institutions.

National credit and commerce Bank Limited was incorporated in Bangladesh as a banking company. I worked in the account opening desk, clearing and loan department of NCCBL. This gives me the opportunity to know more on different aspects of the company. So, I prepare my internship report on overall banking system of NCCBL.

1.2 OBJECTIVES OF THE INTERNSHIP WORK AND THE REPORT

Every work is done to gain some particular objectives. My Internship program also contains certain important objectives. They are given below

1. To understand the Banking business in Bangladesh. How Banking transactions Take place.

2. To observe the authorities, tasks & responsibilities of the bankers.

3. The rules and regulations of private commercial Banks

3. To know the background of the NCCBL

4. To know the Overall Banking system of NCCBL

5. To understand the Financial and Accounting techniques of NCCBL. In fact this is the prime objective and I have chosen this as the topic of my report.

6. To have the idea about the communication between the Branch office and Head office.

7. To better understand about the foreign exchange activities.

8. To learn the Banking Laws.

9. To appraise the total achievements and success of NCCBL

1.3 Methodology of the study

This report is prepared by two sources:-

1. Primary Sources.

2. Secondary Sources.

Primary Sources: Basically this type of Sources includes:

ü Face-to-face conversation with the respective officers and staff of the Branch.

ü Informal conversation with the clients.

ü Relevant file and documents study as provided by the concerned officers.

ü Practical work exposures from the different desks of the department of the branch.

Secondary Sources: Secondary data were collected in the following ways:

ü Data gathered within the organization itself.

ü Data gathered from Texts

ü Internet sources.

ü General reports

ü Annual reports

ü Official documents

ü Credit manual and foreign exchange manual of the bank.

1.4 Scope of the study

In spite of limitation I also got some facility to complete my internship report. National Credit and Commerce Bank Ltd. (NCCBL) is operating widely with 64 branches all over the Bangladesh. This report is strictly confined NCCBL’s operation in Dhaka. The report is based on the observation and studies during my internship period in Motijheel Main branch. Since my working place was the Motijheel Main branch, which is not the authorized dealer to perform the foreign exchange activity so, I cannot include it in my report. According to the study at first I will focus on the company’s background, management style, present status and specially the products of NCCBL etc. I tried to focus on the Bank’s functional areas such as general banking, accounts, credits & advance and card division of NCCBL. The employees those who held a responsible post in the entire department helped me a lot. They gave me all essential data and conversation with me. This bank has given me the opportunity to observe the banking environment for the first time indeed. I got an opportunity to gather experience by working in the different departments of the branch under the supervision of different departmental heads. National Credit and Commerce Bank Ltd. (NCCBL) is a well-reputed bank in Bangladesh. Within a very short period of time it has been recognized as one of the leading private sector bank.

1.5 Limitations

ü The first obstacle was that they would not provide any remuneration even for doing internship in NCCBL. It is not an easy task to concentrate hard without any benefit.

ü As the officers are very busy with their daily work, they could provide very little time.

ü Limitation of time was one of the most important factors that shortened the present study. Due to time limitation many aspects could not be discusses in the present study.

ü Confidentiality of data was another important barrier that was faced during the conduct of this study. Every organization has their own secrecy that is not revealed to others. While collecting data on NCCBL, personnel did not disclose enough information for the sake of confidentiality of the organization.

ü Sufficient books, publications and figures were not available. If these limitations were not been there, the report would have been more useful.

ü Rush hours and business was another reason that acts as an obstacle while gathering data.

ü Since there is no strong marketing department in this bank, marketing procedures and promotional strategies are not enriched by information.

However, omitting this, the report will help us understand the whole customer oriented departments of the bank.

2.1 Banking Sector in Bangladesh

Definition of Bank:

Whoever, being an individual firm, company or corporation generally a deal in the business of money and credit is called a bank. Banker means a person transacting the business of accepting for the purpose of lending or investment of deposit of money from the public repayable on demand or otherwise and withdrawal by cheques, drafts or otherwise. The purpose of banking is to ensure transfer of money from surplus unit to deficit units. Banks in all countries work as the repository of money. The general public deposit money in the bank for safe custody as well as to earn interest on it.

Entrepreneurs try to obtain money from the banks as project loan for long‑term investment. They also obtain working capital from the bank to run their business smoothly. Banking sector these owe a great deal to the deposit holders on the one hand and the entrepreneurs on the other. They are expected to play the role of friend, philosopher and guide for the deposit holders and as wells entrepreneurs.

Since liberation, Bangladesh passed through fragile phases of development in the Banking sector. Some banks were nationalized in the post liberation period to save the institutions and the interest of the depositors. Those handing the banking sector have borne the burden of putting banks on reliable footings. Despite all that was done, some elements of irregularities appeared. With the assertion of the role of the Central Bank, Bangladesh Bank started adopting measures for putting banking institutions on right track. Yet the performance of public sector management of banks left some negative effects in the money market in particular and the economy in general. The agility among the borrowers manipulates the banking sector as a whole. In effect, a default culture among other effects appeared on the scene.

The opening of private and foreign participants to the banking sector was intended to obtain desirable results from banking. The authorization of private bank was designed to

create competition among the banks and competition in the form of efficiency within and the productivity in enterprises funded by banks. Unfortunately, for the people at large banking sector is yet to obtain the credit for efficiency, curability and growth.

The clever, among the user of banking services, have influenced the management of bands, for obtaining short term and long-term loans. They sometimes showed inflated equity to get money for investment in business and industry. Few diverted their loan money to purposes different from the loan proposal, and invested in non‑profitable units have failed to repay their loans to the banks. For this reason new entrepreneurs are not getting capital while defaulting entrepreneurs have started obtaining either relief in the form of rescheduling of the repayment program of additional invest able money for diversified units.

Banking in Bangladesh Perspective

Banking is the backbone of national economy; all sorts of economic and financial activities revolve round the axis of the bank. As the industry produces goods and commodities, so does the bank creates and controls money‑market and promotes formation of capital. From this point of view, banking‑a technical profession can be termed as industry. Services to its customers are the products of banking industry besides being a pivotal factor in promoting capital formation in the country. As all economic and fiscal activities revolve round this important “Industry’, the role of banking can hardly be over emphasized.

Circumstances being such, it becomes imperative to find out the role of banks now playing in the country and analyze its operational aspects so as to ascertain the importance of this delicate financial sector and its overall impact on our national economy. To ascertain the role of banks and to analyze its operational aspects and its overall impacts on our national economy a thorough study as to its distribution, expansion and contribution is essential to comprehend its past, present and future bearings for the

Growth and development of the banking sector of the country. In the global context, the role of banks is far-reaching and more penetrating in the economic and fiscal discipline, trade, commerce, industry, export and import all carried through the bank. Banks are the only media through which international trade and commerce are being carried out and entire credit transactions, both national and international.

2.2 National Credit and Commerce Bank Ltd.

A Short Profile

HISTORICAL BACKGROUND OF NCCBL

National Credit and Commerce Bank Limited bears a unique history of its own. The organization started its journey in the financial sector of the country as an investment company back in 1985. The aim of the company was to mobilize resources from within and invest them in such way so as to develop country’s Industrial and Trade Sector and playing a catalyst role in the formation of capital market as well. Its membership with the bourse helped the company to a great extent in this regard. The company operated up to 1992 with 16 branches and thereafter with the permission of the Central Bank converted in to a fully fledged scheduled private commercial bank in May, 1993 with paid up capital Tk.39.00 crore to serve the nation from a broader platform.

During last 12 years of its operation NCCBL has acquired commendable reputation by providing sincere personalized service to its customers in a technology based environment.

The Bank has set up a new standard in financing in the Industrial, Trade and Foreign exchange business. Its various deposit and credit products have also attracted the clients both corporate and individuals who feel comfort in doing business with the Bank.

The initial authorized capital of the Bank was Tk.75.00 crore and paid up capital Tk.19.50 crore at the time of conversion which is now raised to Tk.39.00 crore. The present authorized capital is Tk.250.00 crore and paid up capital is Tk.60.78 crore. The sponsors of the new bank consisted of 26 Members who comprised the first Board of Directors. The share price of the bank is currently being quoted at both Dhaka and Chittagong bourses at an average price of Tk.320.00 against per value of Tk.100.00.

NCC Bank based upon its commendable business performance for the year ended 2004, has meanwhile declare stock dividend at the rate of 30%. The Bank which started with 16 branches in 1993 has at present 36 (thirty six) branches and 03 (three) booths located in prime commercial areas of Dhaka, Chittagong, Sylhet, Feni, Khulna, Jessore and Rangpur district head quarters out of which as many as 17 (seventeen) are authorize d dealer branch3es,fully equipped for dealing in direct foreign exchange businesses.

NCC bank is now positioned to best suit the financial needs of its customers and make them partners of progress.

2.3 Types of business

NCCBL was licensed as a scheduled bank. It is engaged in pure commercial banking and providing services to all types of customers ranging from small and medium enterprises to large business organizations. It is working for the economic welfare by transferring funds from the surplus economic unit to those who are in deficit.

2.4 Vision

The purpose of the bank is to become ‘the bank of choice’ in the communities they serve. The bank accomplishes this by offering to their customers the financial services which is expected by their customers while providing a return to their owners. In accomplishing this mission, the bank has now been free from all the natures of a problem bank through fulfilling all the conditions set by the central bank. They proudly say: “NCCBL is profit making and problem free.”

2.5 Mission

NCCBL shall be at the forefront of national economic development by:

ü Anticipating business solutions required by all NCCBL’s customers everywhere and innovatively supplying them beyond expectation.

ü Setting industry benchmarks of world class standard in delivering customer value through our comprehensive product range, customer service and all our activities.

ü Building and exciting team based working environment that will attract, develop and retain employees of exceptional ability who help celebrate the success of bank’s business of bank’s customers and of national development.

ü Maintaining the highest ethical standards and a community responsibility worthy of a leading corporate citizen.

ü Continuously improving productivity and profitability and thereby enhancing shareholder value.

2.6 NCCBL- At present

Like clothes, shops, candy shops, bakeshops, food shops, NCCBL is not a “debt shop” the term being used by many to call the present say banks. It is now been called a modern bank that undertakes all its operations at an international standard.

It started operations as a commercial bank in 1993 recovering from some primary difficulties. NCCBL has now emerged as a major player in the financial sector. The bank has been able to attain a commendable CAMEL rating and it performance has been outstanding in terms of profitability for the year ended 2000. Listed in both the Dhaka and Chittagong bourses since late 1999 with an IPO that raised the paid-up capital of the bank to Tk.39 crore, the current price levels of its shares and turnover in trading is evidence of its high rating among investors.

Banks are the pillars of the financial system. Specially, in Bangladesh, the health of the banking system is very vital because the capital market is little developed here. As the banks are still the major sources of credit and exercise great influence on the financial

System, it is extremely important that the country’s banking system should be in good health in the interest of investment activities, meeting the needs of all kinds of finance and related matters. Over the years, NCCBL has built itself as one of the pillars of Bangladesh’s financial sector and is playing a pivotal role in extending the role of the private sector of the economy.

Under the dynamic guidance of its Board of Directors headed by Chairman Mr. Nurul Islam, the current management has been arching ahead with new zeal to reach its goal in 2001. The bank is pledge bound to perform even better in the coming years, opining new branches adding new and better products and services to its customers at their doorsteps.

The bank has a strong branch network nationwide with 44 branches and 1 booth to effectively address the needs of its cross segment customer base.

2.7 Objectives of the Bank

ü Achieve value and respect of the customers and maintain harmonious banker- customer relationship.

ü Strive for good profit and sound growth

ü Contribute towards the formation of national capital.

ü Achieve and sustain in the domestic leading market position in both customer and corporate banking sector.

ü To become the most efficient bank in terms of technology application.

2.8 Vision of the Bank

ü To build a sustainable

ü Respectable financial institution

ü To be a leading Commercial Bank

ü With a social focus, assisting in the economic development of the country.

2.9 Mission of the Bank

ü To mobilize resources from within to the development and growth of the country.

ü To play a catalyst role in the formation of capital market.

ü Anticipating business solutions required by all our customers everywhere and innovatively supplying them beyond expectation.

ü Setting industry benchmarks of world class standard in delivering customer value through our comprehensive product range, customer service and all our activities.

ü Maintaining the highest ethical standards and a community responsibility worthy of a leading corporate citizen.

ü Continuously improving productivity and profitability and thereby enhancing value.

ü To assists high quality service to customer and to participate in the growth and expansion of our national economy.

ü To set high standard of integrity and bring total satisfaction to our clients, share holder and employees.

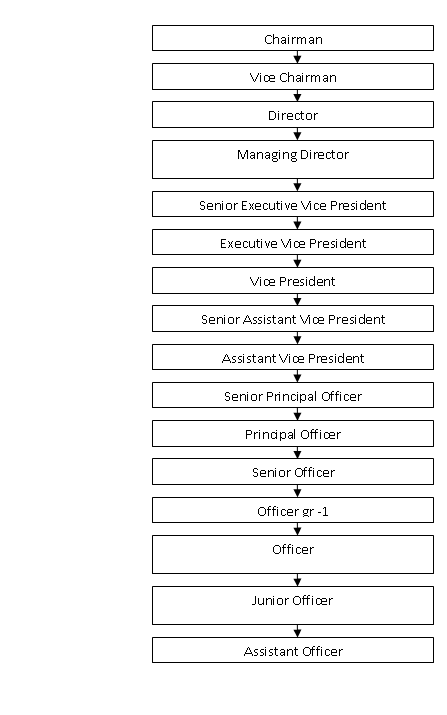

2.10 Management Hierarchy

2.11 Branches

SL. No. | Name of the Branch |

01. | Motijheel Main Branch, Dhaka. |

02. | Agrabad Branch, Chittagong. |

03. | Khatungonj Branch, Chittagong. |

04. | Khulna Branch, Khulna. |

05. | Babu Bazar Branch, Dhaka. |

06. | Jubilee Road Branch, Chittagong. |

07. | O. R. Nizam Road Branch, Chittagong. |

08. | Chowhatta Branch, Sylhet. |

09. | Dhanmondi Branch, Dhaka. |

10. | Moghbazar Branch, Dhaka. |

11. | Gulshan Branch, Dhaka. |

12. | Malibagh Branch, Dhaka. |

13. | Cox’s Bazar Branch, Cox’s Bazar. |

14. | Laldighirpar Branch, Sylhet. |

15. | Jatrabari Branch, Dhaka. |

16. | Mirpur Branch, Dhaka. |

17. | Feni Branch, Feni. |

18. | Kodomtoli Branch, Chittagong. |

19. | Lakshimur Branch, Lakshimur. |

20. | Mitford Branch, Dhaka. |

21. | Bangshal Branch, Dhaka. |

22. | Majirghat Branch, Dhaka. |

23. | Moulovibazar Branch, Moulovibazar. |

24. | Jessore Branch, Jessore. |

25. | Rangpur Branch, Rangpur. |

26. | Kawran Bazar Branch, Dhaka. |

27. | Dilkusha Branch, Dhaka. |

28. | Islampur Branch, Dhaka. |

29. | Halishahar Branch, Chittagong. |

30. | Foreign Trade Branch, Dhaka. |

31. | Modunaghat Branch, Chittagong. |

32. | Uttara Branch, Uttara. |

33. | Baralekha Branch, Moulovibazar. |

34. | Syedpur Branch, Nilphamari. |

35. | Patgram Branch, Lalmonirhat. |

36. | Bariyarhat Branch, Chittagong. |

37. | Nababgonj Branch, Dhaka. |

38. | Rajshahi Branch, Rajshahi. |

39. | Madhobdi Branch, Norshingdi. |

40. | Elephant Road Branch, Dhaka. |

41. | Andorkilla Branch, Chittagong. |

42. | Bogra Branch, Bogra |

43. | Hajigonj Branch, Chandpur |

44. | Nababpur road Branch |

45. | Madaripur Branch, Madaripur. |

46. | Chakaria Branch, Cox’s Bazar. |

47. | Chaumuhani Branch, Noakhali. |

48. | Banani Branch, Dhaka. |

49. | Jagannathpur Branch, Sunamgonj. |

50. | CEPZ Branch, Chittagong. |

51. | Comilla Branch, Comilla. |

52. | Shyamoli Branch, Dhaka. |

53. | Savar Branch, Dhaka. |

54. | Bijoynagar Branch, Dhaka. |

55. | Keranihat Branch, Chittagong |

56. | Raipur Branch |

57. | Joydevpur Branch, Gazipur |

2.12 Nature of Business

NCCBL is a progressive commercial bank in private sector in Bangladesh. It creates now opportunities for its clients. It gives customized services and maintains harmonious banker – client relationship. It contributes towards formation of national capital, growth of savings and investment in trade, commerce and industrial sectors. It provides different types of commercial banking services to the customers of all strata in the society within the stipulation laid down in the bank companies Act. 1999, rules and regulations framed by the Bangladesh Bank from time to time.

Share

On 30th December 1999 NCCBL’s ordinary share was 19, 50,000 of Tk. 100 each.

| Total issue: (19,50,000 ordinary shares of Taka 100 each | Tk. 19,50,00,000.00 |

| Out of which: Pre-IPO placement: (14,25,000 share @Tk. 100 each) | Tk. 14,25,00,000.00 |

| Public Officer: (5,25,000 share @Tk. 100 each) | Tk. 5,25,00,000.00 |

2.13 Underwriters of Share:

The Following banks and financial institutions over served as an underwriters:

ü AB Bank Limited

ü Prime Bank Limited

ü Dhaka Bank Limited

ü Bay Leasing And Investment Limited

ü Uttara Finance & Investment Limited

ü National Life Insurance Co. Limited

ü Bangladesh Industrial Finance Co. Limited.

ü National Securities & Consultants Limited

ü Swedish Investment Mgt. Limited

ü Raspit Securities Mgt. Limited

2.14 Office Automation

Technology, computer, internet these thins brings a new generation of banking service to the customer. Eight to ten years ago customers cannot think about that they can withdraw or deposit money from their account at least within one hour. But now it takes only at best five minutes for withdraw their money. This is the simple example what technology brings to banking sector. In before bankers has to maintain huge ledger book for their daily or any sorts of banking record. But now they can do it by on click and by strike of few buttons. Online banking is now getting more and more necessary part banking sector. NCCBL has also realized the current fact and they also try to serve online banking service to their valued customer. Though they do not launch online banking service extensively but within this year and next year they are trying to introduce online banking service at least primarily for the branches of Dhaka and some other key areas. Now they have only three branches under online banking service. Mirpur branch, Dhanmondi branch, Uttara branch and Elephant Road branch are now serving online banking service. These three branches have Wide area Network (WAN) among themselves. So customers

can get online banking service only from these three branches. NCCBL has own software. They had Software named ADNAN-2004, but now they are working with MICROBANKER which they purchase from India. They have web page (www.nccbank-bd.org). Customer can get detail information from the web page. NCCBL also has credit card and ATM machine.

2.15 Target Customers

Due to the predecessor company’s involvement investment financing sector of the country the bank inherited it stop corporate customer. Moreover the bank is involved in import trade financing. Bulk importers of consumer durable food grains industrial raw materials are its customers. The bank has financed in textile and apparels sectors. The bank has a trend of choosing customers from diversified groups. The bank has first class customers in the construction sectors involved in high rise building, heavy construction and roads and high way construction.

2.16 Current position of NCC Bank

AUTHORIZED, PAID‑UP, RESERVE FUND AND OTHER RESERVE

The authorized capital of the Bank stood at Tk. 2500.00 million in 2008 while with the issuance of Rights Share, paid-up capital increased a d stood at Tk. 975.04 million in 2008.

The reserve fund has also increased to Tk. 562.74 million during the year recording an increase of 32.34% over the previous year’s figure of Tk. 425.22 million.

DEPOSIT

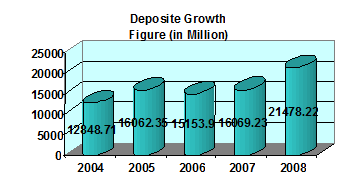

Bank’s deposit as at 31st December 2008 stood at Tk. 21,478.22 million with an increase of 33.66% over last year’s figure of Tk. 16,069.23 million. The chart below shows the growth of deposit for last 05 years

CREDIT

Bank’s credit policy has been reviewed and revised during the year 2005 to make the same need oriented and also to comply with Bangladesh Bank directives conveyed through guidelines for Core Risks Management and Prudential Guidelines for Consumer Finance. As a result, Bank’s credit activities could be made more organized. With the support of various non conventional products like Small Loan Scheme, Housing Loan Scheme, Festival Loan, etc. Bank’s lending base could be expanded further which contributed to the profitability during the year. Banks SME lending and credit facilities extended to maize producers of country’s northern area’s farmers also received good response and acclamation in the financial sector.

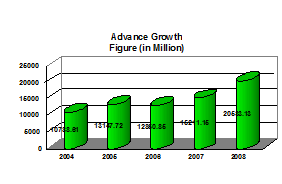

During the year total advance of the Bank stood at Tk. 20,533.13 million with an increase of 34.98% over the last year’s figure of Tk. 15,211.15 million and Advance Deposits ratio being 0.96: 1 in 2008.

INVESTMENT

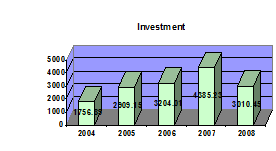

Banks investment in Government approved Securities, Treasury Bills etc. during the year stood at Tk 3,010.45 million as against Tk. 4,385.23 million of the previous year.

FOREIGN EXCHANGE BUSINESS

The Bank put due care to its Foreign Exchange Business which is one of the major sources of income and contributes notably towards its profitability. Under the purview of Bank’s Credit Policy and Government Policy, the Bank tries to cater the needs of Exporters and Importers of the country. With the expertise of the concerned officers at the Head office and Branches, Bankers business in this sector recorded notable development during 2008.

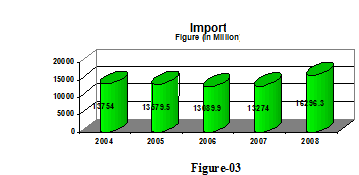

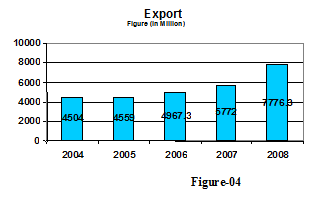

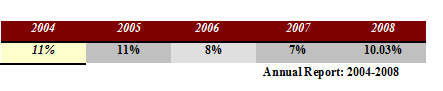

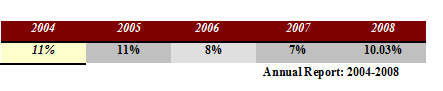

The amount of export and import business handled by the Bank in 2008 was Tk 7,776.30 million & Tk16, 296.30 million respectively as against Tk 5,771.65 million & Tk. 13,274.08 million in 2007.

CREDIT ADMINSTRATION

Credit Administration Department has been strengthened further by assigning competent and expert officers to monitor/supervise both pre and post sanction activities. To make the Department an independent, one In charge has also been assigned. The department is now engaged in ensuring proper documentation of Loans/Advances and timely recovery of the same. Recovery Department is also laying its expected role in realizing Bank’s dues from defaulting borrowers.

3.1 Introduction

The Head Office is located at 7-8, C/A. Motijheel, Dhaka. It monitors and controls the banking operations of the branches scattered in different strategic business locations in Bangladesh. At present, there are 8 divisions in the Head Office. The classifications of the different division are mentioned as follows:

3.2 Credit Division

The Credit Division is one of the most essential and valuable divisions of every commercial banks. The Credit Division of the bank deals with issues regarding corporate finance, general credit, special schemes such as House Building Loan (HBL) and Consumer Credit Scheme (CGS) etc.

3.3 Audit Inspection Recovery Distribution

Although the loan Administration Division is not at per with the Credit Division of the bank in terms of human resource, the performance of the bank relies heavily on this division. It is responsible for credit monitoring, documentation, distribution L.D.O’s (Loans, Discounts and Overdrafts), preparing MSOCF (Monthly statement of outstanding credit facilities) and dealing with TR (Trust Receipt) etc.

3.4 Central Account Division

This division monitors several important functions of banking operations performed in different branches across the country. It deals with accounts, financial planning, budget and monitoring, preparation of returns and statement, reconciliation, maintenance of PF (Provident Fund), gratuity and superannuation fund, local treasury etc.

3.5 Human Resource Division

The necessary of having an efficient Human Resource Division is one of the unique requirements for the success of any business organization. National Credit and Commerce Bank Limited unlike other commercial banks has a proficient Human Resource Division that deals with recruitment and manpower planning, performance evaluation, disciplinary actions, promotion, cadre charge, employee service rules and benefits, training and development. An Executive Vice President leads this division with the assistance of a Vice President.

3.6 Establishment Division

Logistic and General Services Division is considered as the centre for providing necessary supporting services to other department as will as the employee. The function of this division includes providing utility services, maintenance of premises, and purchase of printing and general stationery, dispatch and transport pool. A Senior Vice President monitors this division.

3.7 International Division

The role of the International Division is very vital to providing various banking service to the clients. This division also maintains the mutual relationship with many corresponding banks on several issues such as agency and credit line arrangement, reconciliation, authorized signature control, TKC (Test key control), issuance of power of attorney, fund management and treasury operations (foreign) etc.

3.8 Information Technology Division

It is very significant to adapt with the ongoing information technology revolution to provide faster services to the clients. The Information Technology Division supervises the overall computerization of the banking operations and networking, provides system support, deals with data processing and data entry, procures and maintain hardware,

maintain and develop software required by the bank to facilitate and support the day to day operations.

3.9 Card Division

The core functions of the Card Division include dealing with issues regarding debit card, ATM card, and customer and vendors management. A first Vice President heads this division.

3.10 Marketing and Branch Division

This division is expected to deal with issues regarding marketing of asset and liability products, branch expansion etc. this division involves introducing new financial products. It also deals with renovation of new branches and location of new branches.

3.11 Training Division

The main objective of this division is to make the employees efficient. Usually this division offers training to their employee time to time. This is helpful to the employee to do their job efficiently and effectively.

3.12 Treasury Division

The key responsibility of this division is to utilize its fund to various profitable businesses. Usually financial organization has huge capital and they invest these capitals in various business.

3.13 Public Relation Division

The main objective of the public relation department is to make a bridge within the organization and outsiders. This division directly deals with general public.

3.14 Board Division

This division deals with board of directors of the organization. Usually when the board meeting held where it will held and other activities are done by this department.

4.1 Information of General Banking

Deposits are the foundation upon which banks thrive and grow. They are unique items on a bank’s balance sheet that distinguishes it from other types of business firms. The ability of a Bank’s management and staff to attract checking and savings accounts from businesses and customers is an important measure of the bank’s acceptance by the public. Deposit provides most of the raw material for bank loans and thus represents the ultimate source of bank profits and growth. Deposits generate cash reserves, and it is out of the excess cash reserves a bank holds that new loans are created.

4.2 NCCBL Products & Services:

ü Time Deposit Scheme

ü Monthly Savings Scheme

ü Deposit Insurance Scheme

ü Inward & Outward Remittances

ü Traveler’s Cheques

ü Import Finance

ü Export Finance

ü One stop Service

ü Working Capital Finance

ü Loan Syndication

ü Underwriting and Bridge Financing

ü Trade Finance

ü Industrial Finance

ü Foreign Currency Deposit A/C

ü NFCD (Non Resident Foreign Currency Deposit Account)

ü Consumer Credit.

4.3 Functions of General Banking Department:

1. Account opening.

2. Account closing.

3. Cheque book issuing.

4. Telephone receiving

5. Account enquiry.

6. Providing accounts statement

7. Solvency certificate issuing

8. Account transfer.

4.4 Types of Deposits offered by the Bank:

Today, Bank offers different types of Deposits. The number and range of deposit services offered by banks is impressive. They are:

ü Current deposit account

ü Saving deposit account

ü Term deposit

ü Fixed deposit

ü Special Saving scheme

CURRENT DEPOSIT ACCOUNT

NCCBL opens current accounts for its clients to facilitate their day-to-day operations. The amount deposited in the current account can be withdrawn at any time. No interest is given on the current account. In certain cases, however, interest is available at an agreed rate where withdrawals are subject to a written notice for a specified period. The minimum balance requirement for this account is Tk.1000 and Tk.250 is deducted from the account in case of closing the current account.

.Different types of current deposits are as follows:

1. Individual current account

2. Joint account

3. Proprietorship account

4. Partnership account

5. Limited company account.

Scenarios of current deposit account of NCCBL:

Last five (5) years current deposit of NCCBL as below-

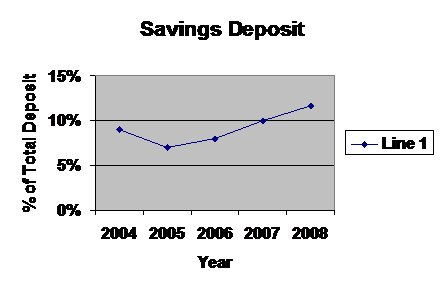

SAVING DEPOSIT ACCOUNT

To encourage saving habit amongst the general public, banks allow depositors to open savings accounts. As the name indicates, these accounts are opened for the purpose of savings. Interest is awarded on the balance of the account. For opening a savings account minimum Tk. 500 is taken as deposit. NCCBL offers attractive rate of profits of its saving deposits. This rate is 6.00% per annum.

Scenarios of Savings Deposit account of NCCBL

FIXED DEPOSIT RECEIPT

Fixed deposit accounts are repayable after the expiry of the predetermined period fixed by the customer. The period of the FDR ranges from three months to one year. Longer the period, the rate of’ interest is higher. Amount of FDR is payable once a time. If the client does not withdraw the amount and give’ further instructions for renewal within one month from the date of maturity, then the FDR account would get renewed for a further three months and the rate of interest would L prevailing rote for fixed deposit.

| Fixed Deposit/Bearer Certificate of Deposit for 1 Month | 9.50% |

| Fixed Deposit/Bearer Certificate of Deposit for 3 Months | 10.00% |

| Fixed Deposit/Bearer Certificate of Deposit for 6 Months | 10.25% |

| Fixed Deposit/Bearer Certificate of Deposit for 1 Year | 10.50% |

| Fixed Deposit/Bearer Certificate of Deposit for 3 Year and above | 10.50% |

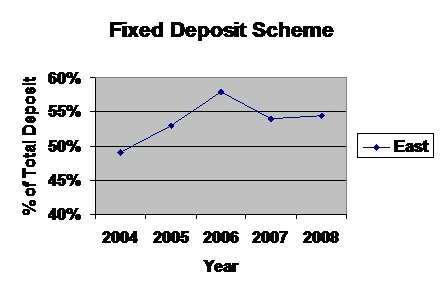

Scenarios of NCCBL Fixed deposit:

Fixed Deposit of NCCBL for last 5 years

SHORT TERM DEPOSIT (STD)

According to characteristics, short term deposit is similar to current deposit except interest. Though it is CD account but bearing some interest. Currently this interest rate is 4.50%.

Rules and Regulation for opening Short Term Deposit (STD) Account:

STD account rules and regulation are just like current deposit account except following rules:

STD Account holder enjoys interest by following cases:

Account Holder Type | Amount (Daily) | Interest Rate |

| Collection account of DESCO, T&T | Above Tk.10.00 lac | 4.5% |

| Other type of Customer | Above Tk.1.00 lac | 4.5% |

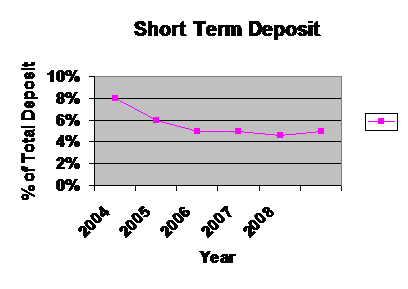

Scenario of Short Term Deposit of NCCBL:

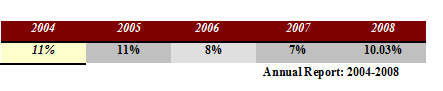

2004 | 2005 | 2006 | 2007 | 2008 |

8% | 6% | 5% | 5% | 4.57% |

Rate of Interest on Deposit offered by the Bank

| Types of Deposit | Rate of Interest (0/0 per annum) |

| •FDR for 1 months | 8.00 |

| •FDR for 3 months | 11.50 |

| •FDR 6 months | 11.75 |

| •FDR for 12 months | 12.00 |

| •Short Term Deposit | 6.00 |

| •Savings Bank Deposit | 7.00 |

| •Special Saving Scheme | 12.00 |

4.6 NCCBL’s Own Deposit Schemes/Products:

NCCBL is now offering various depository products for mobilizing the savings of the general people. To get the deposit from the little saver portion of the country, NCCBL has started few Scheme which by this time gained high popularity among the depositors. To ensuring risk free and profitable investment of limited income of majority of people & thereby provide maximum benefits, NCCBL has lunched following savings schemes:

ü Special Savings Scheme

ü Special Fixed Deposit Scheme

a) Special Savings Scheme

ü Two types of Account can be opened under this scheme. One for term of 5 years and another for a term of 10 years. Rules for both the accounts shall be the same.

ü Monthly installments of deposit will be Tk.500 and its multiple up too Tk.10,000 only as mentioned below to be deposited every month during the entire period of the scheme as fixed at the time of opening of the account. Account may be opened for any installment later on the same is changeable.

ü The depositor(s) will be paid a fixed amount after expiry of the term as follows:

SL. No. | Monthly Installment (Taka) | Amount to be paid on completion of | |

5 Years (Taka) | 10 Years (Taka) | ||

01. | 500/- | 38,134/- | 1,00,804/- |

02. | 1,000/- | 76,268/- | 2,01,608/- |

03. | 1,500/- | 1,14,402/- | 3,02,412/- |

04. | 2,000/- | 1,52,530/- | 4,03,216/- |

05. | 2,500/- | 1,90,670/- | 5,04,020/- |

06. | 3,000/- | 2,28,804/- | 6,04,824/- |

07. | 3,500/- | 2,66,938/- | 7,05,628/- |

08. | 4,000/- | 3,05,072/- | 8,06,432/- |

09. | 4,500/- | 3,43,206/- | 9,07,236/- |

10. | 5,000/- | 3,81,340/- | 10,08,040/- |

11. | 10,000/- | 7,62,680/- | 20,16,080/- |

ü Introduction may be waived but photograph will be required to open the A/C. Account in the name minor can also be opened.

ü A person is allowed to open more than one account for different installment in a branch/bank.

ü No withdrawal shall usually be allowed before 5 years. If any Account is needed to be closed before 5 years, interest at prevailing rate on saving A/C shall be paid along with the principal.

ü No interest on the deposited amount shall be paid if the AC is closed before 6 months, in case of premature closure of any account Tk.100 to be realized as account closing charge.

ü In case of withdrawal of money by closing the A/C after 5 years (for 10 years term) full amount applicable for 5 years term and interest at prevailing rate on saving A/C for the rest period along with principal shall be paid.

ü Monthly installment will have to be deposited by 10th day of each month (In case of holidays, deposit can be made on next working day). Advance installments are always acceptable.

ü In case of lapses in depositing installment, the deposit slip of that particular installment to be used with month-wise up to date late fees @2% per month per installment (on due installment) mentioning in the respective column of deposit slip along with due installment to be deposited.

ü If an account holder fails to deposit 3 consecutive before the expiry of 5 years time the A/C shall be treated out of this scheme and interest at prevailing rate on savings A/C shall be paid.

ü Deposit book to be issued for the mentioned installment size and period at the time of account opening.

ü In case of missing of deposit book a sum of Tk.100 to be realized while issuing duplicate book but in that case, pages of installment so far paid earlier to be removed/cancelled from the duplicate book.

ü No pass book to be issued in favor of the account holder.

ü Under the scheme, an account holder can instruct the bank to make payment of installment to the debit of his/her separate A/C with the branch.

ü Depositors may nominate on or more persons against the account as “Nominee”. In case of death of A/C holder, transaction in the A/C will be suspended and payment will be made to the nominee(s). If there is no nominee, payment will be made to the legal heirs of the deceased (depositor’s) against succession certificate.

ü If any Excise Duty/Income tax etc. is levied by the Government on Deposit/interest earned, the same will be paid by debiting account.

ü On completion of any term (5/10 Years) payment shall be made one month from the date of deposit of last installment.

ü Maximum up to 80% loan on deposit may allow to the A/C holder at ruling lending rate of the bank.

b) Special Fixed Deposit Scheme:

ü Minimum Tk.50, 000 or multiple amount is acceptable under this scheme.

ü The duration of the Scheme shall be 5 years after which depositors can take back the principal amount, if not renewed.

ü The duration of time between deposit and payment of first profit have to be minimum on month.

ü Monthly interest will be given to the depositors against the deposited amount according to the following schedule.

Amount of Deposit (Tk.) | Monthly Profit (Tk.) |

50,000/- | 500/- |

1,00,000/- | 1,000/- |

2,00,000/- | 1,500/- |

3,00,000/- | 2,000/- |

4,00,000/- | 2,500/- |

5,00,000/- | 3,000/- |

6,00,000/- | 3,500/- |

7,00,000/- | 4,000/- |

8,00,000/- | 4,500/- |

9,00,000/- | 5,000/- |

10,00,000/- | 10,000/- |

ü No profit/interest shall be due for payment if the Deposit is enchased before one year and if any dividend is paid that will be adjusted by debit to principal.

ü No withdrawals of principal shall usually be allowed before 5 years, if any account is needed to be closed before 5 years but after one year interest at prevailing rate on Savings A/C shall be paid. But if the profit is more than the amount receivable at prevailing rate on Savings A/C, then it shall be adjusted by debit to principal.

ü Under the scheme, an account holder can instruct the bank to make deposit of monthly profit to his/her separate A/C with the branch.

ü Depositors may nominate one or more persons against the account as “Nominee”. In case of death of A/C holder, transaction in the A/C will be suspended and payment will be made to the nominee(s). If there is no nominee, payment will be made to the legal heirs of the deceased (depositor’s) against succession certificate.

ü Proper receipt/instrument for the deposit is to be provided to customer which is not transferable.

ü Maximum 80% loan may be allowed against lien of the receipt/instrument at ruling rate of the bank. In that case, monthly dividend will be deposited/transferred to the loan account only.

ü If any Excise duty/Income tax etc. is levied by the Government on deposit/interest earned, the same have to be borne by the depositor.

![Internship report on National credit and commerce bank Ltd [part-1]](https://assignmentpoint.com/wp-content/uploads/2013/03/ncc-bank.jpg)