Internal reconstruction

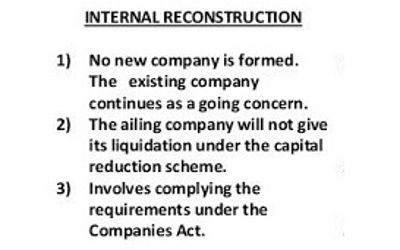

External reconstruction is one in which the company undergoing reconstruction is liquidated to take over the business of an existing company. In the case of internal reconstruction, the losses of the company can be set off against the future profit of the company. It focuses on relieving the company from debts and losses by negotiating with the creditors and reducing the outstanding amount towards them, so as to reach a favorable position.

Internal reconstruction refers to the internal re-organization of the financial structure of a company. It is a scheme of reorganization in which all interested parties in the capital structure volunteer to sacrifice.

Company restructuring is a process in which a company changes the organizational structure and processes of the business. It needs a lot of time and statutory requirements to occur because in internal reconstruction the company has to take the permission of every stakeholder and also of the court. Therefore, in the process of internal reconstruction, only the rights of the shareholders and creditors are changed with a certain reduction of capital, and the rights/claims of the debenture-holders are kept outside the purview of the procedure of internal reconstruction.

Internal reconstruction means a recourse undertaken to make necessary changes in the capital structure of a company without liquidating the existing company. It refers to the internal re-organization of the financial structure of a company. In internal reconstruction neither the existing company is liquidated, nor is a new company incorporated. It is also termed as re-organization which permits the existing company to be continued. It is a scheme in which efforts are made to bail out the company from losses and put it in a profitable position.

Internal reconstruction of a company is done through the reorganization of its share capital. It is a scheme of reorganization in which all interested parties in the capital structure volunteer to sacrifice. They are the company’s shareholders, debenture holders, creditors, etc. Generally, share capital is reduced to write off the past accumulated losses of the company. Under internal reconstruction, the accumulated trading losses and fictitious assets are written off against the sacrifice made by these interest holders in the form of a reduction of the paid-up value of their interest.

Objectives of internal reconstruction

- To resolve the problem of over-capitalization/ huge accumulated losses/ overvaluation of assets,

- When the capital structure of a company is complex and is required to make it simple,

- When change is required in the face value of shares of the company.

Significance of Internal Reconstruction

It is done by the company when:

- There is an overvaluation of assets and undervaluation of liabilities.

- There is a difficulty to meet the financial crisis and there are continuous losses.