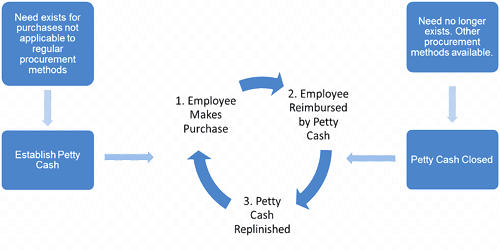

Imprest System is a form of the financial accounting system. It is an accounting system designed to track and document how cash is being spent. It is a method of maintaining petty cash. The most common example of an imprest system is the petty cash system. Under the system a fixed sum of money is advanced to the- petty cashier for meeting possible petty expenses (like postage, telegrams, etc.) of the business for a certain period say a week, a fortnight or a month. Control over petty cash occurs during the replenishment process. Control can also occur when an independent person confirms that the petty cash custodian’s cash and receipts add up to the imprest amount.

The essential features of an imprest system are:

- A fixed amount of cash is allocated to a petty cash fund, which is stated in a separate account in the general ledger.

- All cash distributions from the petty cash fund are documented with receipts.

- Petty cash disbursement receipts are used as the basis for periodic replenishment of the petty cash fund.

- Variances between expected and actual fund balances are regularly reviewed and investigated.

An imprest system of petty cash means that the general ledger account Petty Cash will remain dormant at a constant amount. Petty cash refers to a small amount of currency and coins that a company uses to pay small amounts without writing a check. Money so given to the petty cashier is known as the “impress” amount. At the end of regular agreed intervals, the petty cashier submits his statement of petty expenditures. One person is designated as the petty cash custodian. The general cashier on receipt of such statement refunds to the petty cashier the exact amount spent by him ((petty cashier) during, the period. This person is responsible for disbursing the small amounts and for documenting each payment with a petty cash receipt. Thus at the commencement of each succeeding period, the balance of petty cash in hand will restore the original sum.

Imprest System is designed to provide a rudimentary manual method for tracking petty cash balances and how cash is being used. If a business uses the imprest system, it will create an imprest account to pay for small, routine, or incidental expenses. The main feature of this system is the need to document all expenditures. This account has a fixed balance and is replenished using another account, such as cashing a cheque drawn from a bank account. Doing so is an excellent way to maintain a high level of control over cash disbursements. Due to the rise of electronic transactions, the imprest system is becoming less common. Many businesses now prefer to use credit cards for incidental purchases or to ask employees to pay in cash then apply for reimbursement. It is used to run and manage a petty cash fund.