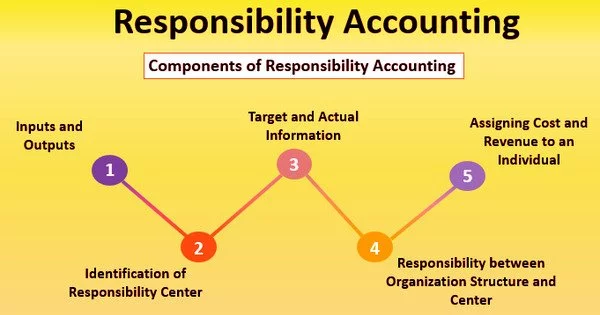

Responsibility accounting refers to the process of identifying and locating the centers of responsibility accounting and their objectives; this enables the organization to analyze and draft a performance report of all the responsibility centers; additionally, these centers are responsible for reporting revenues and expenses in accordance with the responsibility areas.

The following are the components that help a company to implement this accounting system efficiently:

- Inputs and Outputs

Only with accurate input and output data can a responsibility accounting system be implemented. The accuracy of information relating to inputs and outputs is critical to effective implementation. Raw material data, such as labor hours and quantity, is input, while finished product data is output. Costs are the monetary term for inputs, and revenues are the monetary term for outputs. As a result, cost and revenue data are critical for responsibility accounting.

- Responsibility Center

The responsibility accounting system can only be implemented after the responsibility centers have been identified. It is the most important element. The centers are then used to represent organizational decision points. The proper recognition of responsibility centers is essential to the full responsibility accounting system.

- Target and Actual Information

Because the accountability account is primarily concerned with control, any deviation or disruption in the plan must be noted and reported as soon as possible. Data on the target as well as actual performance is critical for evaluating a responsibility center’s performance. Corrective action must be taken following the report of such an issue. This information serves as the foundation for’responsibility’ or performance reports.

- Inter-relation of Organization Structure with Responsibility Center

A clearly defined organizational structure is required for fixing or assigning responsibility. A responsible accounting system cannot succeed without clear lines of authority and an effective organizational structure. As a result, clarity of organizational structure is critical for the successful implementation of responsibility accounting. The accounting system is designed to be compatible with the existing organizational structure. Similarly, a company must create an accounting system that is compatible with the organizational structure.

- Assigning Cost and Revenue to an Individual

A company must assign cost and revenue to an individual in order for this accounting system to be successful. This person will be in charge of the responsibility center. Aside from cost and revenue data, planned and actual financial data are also required. Only through effective budgeting can the accounting plan implementation be communicated to the appropriate levels of management.

Wherever possible, responsibility accounting is used to measure both the inputs and outputs of the responsibility center in monetary terms. The sum of various inputs is referred to as cost, whereas the sum of outputs is referred to as revenue. Where monetary measurement of output is not possible (as in accounting services rendered to the organization), output may be measured in terms of total cost of goods or services transferred, or as a number of units of output.