Joint Venture Account

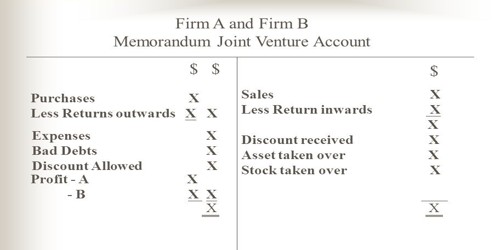

This account is prepared to ascertain the profit or loss on a joint venture. This account represents the results of the business, that is, profit or loss. A joint venture account is debited and a bank account or credit account is credited on the account of goods purchased or expensed. This account is debited by the cost of goods, expenses; goods supplied by the venturers, etc. Hence, it can be treated as a nominal account. It is credited and a bank account or debtor account is debited in case of either cash sale or credit sale. If the credit side of this account is greater than the debit side, the difference represents profit on joint venture and vice versa in the opposite case. Goods purchased, goods supplied by the co-ventures, expenses incurred, etc. are debited and sale proceeds, unsold stock, stock taken over by co-venture, etc. are credited to joint venture account. If a significant amount of control is exercised, the equity method of accounting must be used. The memorandum joint venture account effects a profit and loss, each venturer calculates his share of profit or losses.

The nature of the joint venture accounting depends on whether or not a separate legal entity is formed to undertake the joint venture. Balance in the joint venture accounts represents profit or loss and later that amount of profit or loss will be transferred to the personal accounts of co-venturers. The final balance of the joint venture account shows profit or loss which is transferred to the co-ventures’ account according to their profit sharing ratio.

Following are the major features of a joint venture −

- There is an agreement between two or more persons.

- A joint venture is made for the specific execution of a business plan/project.

- It is a temporary partnership without the use of a firm name.

- Agreement for joint ventures is automatically dissolved as soon as the specific project is over.

- Profit & Share are shared on the same terms and conditions agreed upon.

Accounting Records: To keep a record of the joint venture transactions, there are three following types of accounting methods −

- When one of the Venturers keeps Accounts,

- When Separate Books of Accounts are kept for the Joint Venture, and

- When Separate Books of Accounts are not kept for the Joint Venture.