Main objective of this report is analysis General Banking Department of Uttara Bank limited, also focus on Comparative analysis with different banks, market competitor and Performance of Uttara Bank Limited. Other objectives are identify the services and products of Uttara Bank Limited in respect to other banks and know about the Local and Foreign Remittance. Finally find out the internal and external lacking in the daily operation and observe the working environment in commercial bank.

Scope of the study

The study would focus on the following area of Uttara Bank Ltd.

- Comparative analysis with different banks

- Focus on market competitors

- Performance of Uttara Bank Ltd.

Objective of the Report

The study assign for two objectives. The objectives are:

Primary Objective:

This report is to provide a general description of the initial and present status of Uttara Bank Limited (Corporate Branch).

Secondary Objectives:

The following aspects can be listed as the specific objectives for this practical orientation in Uttara Bank Limited:

- To apply theoretical knowledge in the practical field.

- To know about operation procedure of general banking activities of Uttara Bank Limited.

- To identify the services and products of Uttara Bank Limited in respect to other banks.

- To know about the Local and Foreign Remittance.

- To adapt with the corporate environment.

- To understand the remittance business policy of Uttara Bank Ltd with other banks.

- To find out the internal and external lacking in the daily operation.

- To observe the working environment in commercial bank.

Methodology

For smooth and accurate study everyone have to follow some rules and regulations. The study impute were collected from two sources.

Primary data

I have collected primary information be interviewing employees, officers by the process assigned by UBL, observing various organizational procedures, structures, directly communicating with the customers. Primary data were mostly derived from the discussion with the employees and personal experience during Internship period.

Primary information is under consideration in the following manner:

- Practical desk work

- Face to face conversation with officer

- Direct observations

- Face to face conversation with client.

Secondary Data

I have taken the help of different types of secondary data in my report. The sources of those data can be categorized as follows:

Internal Sources

- UBL’s Annual Report

- Different department wise operational manual of the bank.

- Prior research report

External Sources

- Different books and periodicals related to banking sector

- Bangladesh bank report

- Related links available in the Internet

Introduction on Uttara bank

UTTARA BANK LTD. had been a nationalized bank in the name of Uttara bank under the Bangladesh Bank (Nationalization) order 1972, formally known as the Eastern Banking Corporation Limited which was started functioning on and from 28.1.1965. Consequent upon the amendment of Bangladesh Bank (Nationalization) order 1972, the Uttara Bank was converted into Uttara Bank Limited as a public limited company in the year 1983. The Uttara Bank Limited was incorporated as a banking company on 29.6.1983 and obtained business commencement certificate on 21.8.1983. The Bank floated its shares in the year 1984. It has 211 branches all over the Bangladesh through which it carries out all its banking activities. The Bank is listed in the Dhaka Stock Exchange Ltd. and Chittagong Stock Exchange Ltd. as a publicly quoted company for trading of its shares.

Vision

To be the best private commercial bank in Bangladesh in terms of efficiency, capital adequacy, asset quality, sound management and profitability having strong liquidity.

Uttara Bank will be a unique organization in Bangladesh. It will be a knowledge-based organization where the Uttara Bank professionals will learn continuously from their customers and colleagues worldwide to add value. They will work as a team, stretch themselves, innovate and break barriers to serve customers and create customer loyalty through a value chain of responsive and professional service delivery.

Continuous improvement, problem solution, excellence in service, business prudence, efficiency and adding value will be the operative words of the organization. Uttara Bank will serve its customers with respect and will work very hard to instill a strong customer service culture throughout the bank. It will treat its employees with dignity and will build a company of highly qualified professionals who have integrity and believe in the Bank’s vision and who are committed to its success. Uttara Bank will be a socially responsible institution that will not lend to businesses that have a detrimental impact on the environment and people. To be the best private commercial bank in Bangladesh in terms of efficiency, capital adequacy, asset quality, sound management and profitability having strong liquidity. Thus Uttara Bank will be one of the largest private-sector commercial bank in Bangladesh.

Mission

The bank has some mission to achieve the organizational goals. Some of them are as follows-

- The bank looks forward with excitement and a commitment to bring greater benefits to customers.

- Uttara Bank Limited provides high quality financial services to strengthen the well-being and success of individual, industries and business communities.

- Its aim to ensure their competitive advantages by upgrading banking technology and information system.

- UBL intends to play more important role in the economic development of Bangladesh and its financial relations with the west of the world by interlinking both modernistic and international operations.

- The bank intends to meet the needs of their clients and enhance their profitability by creating corporate market.

- The Bank has remained dynamic in its continued efforts to improve & increase core competence & service efficiency by constantly upgrading product quality, service standards, protocol and their effective participation making use of state of the art technology.

- The bank creates wealth for the shareholders

Goal and Objectives

Goal

Uttara Bank will be the absolute market leader in the number of loans given to small and medium sized enterprises through out Bangladesh. It will be a world-class organization in terms of service quality and establishing relationships that help its customers to develop and grow successfully. It will be the Bank of choice both for its employees and its customers, the model bank in this part of the world.

Objectives of the Organization

The objectives of Uttara Bank Limited are specific and targeted to its vision and to position itself in the mindset of the people as a bank with difference. The objectives of Uttara Bank Limited are as follows:

- Building a strong customer focus and relationship based on integrity, superior service.

- To creating an honest, open and enabling environment

- To value and respect people and make decisions based on merit

- To strive for profit & sound growth

- To value the feet that they are the members of the Uttara Bank family-committed to the creation of employment opportunities across Bangladesh.

- To work as a team to serve the best interest of our owners

- To relentless in pursuit of business innovation and improvement

- To base recognition and reward on performance

- To responsible, trustworthy and law-abiding in all that we do

- To mobilize the savings and channeling it out as loan or advance as the company approve.

- To establish, maintain, carry on, transact and undertake all kinds of investment and financial business including underwriting, managing and distributing the issue of stocks, debentures, and other securities.

- To finance the international trade both in import and export.

- To develop the standard of living of the limited income group by providing Consumer Credit.

- To finance the industry, trade and commerce in both the conventional way and by offering customer friendly credit service.

- To encourage the new entrepreneurs for investment and thus to develop the country’s industry sector and contribute to the economic development.

Products and services

Product and Service offerings by Uttara bank Limited are –

Products

Personal Banking Products:

- Personal Loan;

- Car Loan;

- Vacation Loan;

- Any Purpose Loan;

- Different Deposit Schemes;

- Uttaran Consumer-Credit Scheme;

- Monthly Saving Scheme (MSS);

- Monthly Benefit Scheme (MBS);

- Double Growth Deposit Scheme.

a) Personal Loan

As part of establishing a personal banking franchise of Uttara Bank Limited, the bank has successfully launched personal loan. Depending on the size and purpose of the loan, the number of installments varies from 12 to 48 months.

b) Car Loan

The car loan is a term financing facility to individuals to aid them in their pursuit of having a car of their dream. Depending on the size and purpose of the loan, the number of installments varies from 12 to 60 months. In case of brand new cars, the loan tenure will be maximum 72 months.

c) Vacation Loan:

The vacation loan is a term financing facility to individuals to aid them in their hunt for spending a vacation in the country or abroad. Depending on the size and purpose of the loan, the number of installments varies from 12 to 48 months.

d) Any Purpose Loan

The client can get loan up to tk. 5, 00,000 to spend it any way he/she chooses to do. The client may avail of this loan facility in any Uttara Bank Limited’s branches.

e) Different Deposit Schemes

At present Uttara Bank Limited has the following deposit product that has been offered to general public:

- Current Account

- Saving Account

- Short term Deposit Account

- Fixed Deposit Account

f) Uttara Bank Consumer-Credit Scheme

Uttara Bank Limited started Uttaran Consumer-Credit Scheme from 1996. UBL offers opportunity of financial assistance for:

- Motor cycle/car- new or reconditioned;

- Refrigerator/ Deep Freeze;

- Television/ VCD/ DVD

- Radio/ Two-in-one/ Three-in-one;

- Air-Conditioner/ Water Cooler/ Water Pump;

- Washing Machine;

- Personal Computer/ UPS/ Printer/ Type Writer;

- Sewing Machine;

- Household furniture- Wooden & Steel;

- Cellular Phone;

- Fax;

- Photocopier;

g) Monthly Saving Scheme (MSS)

Any adult Bangladeshi National will be eligible to open this account. The period of the scheme will be 5 (five) years and 10 (ten) years term. Monthly installment will be Tk.500/-, 1000/-, 2000/-, 3000/-, 5000/- and 10000/-. Monthly installment to be deposited within 10th day of the month. After due date a penalty of Tk.50/- will be realized from the account holder. If the account holder fails to deposit 3(three) consecutive monthly installments, the account will be automatically closed. No cheque book will be issued against the account. Deposit may be encashed before maturity. But no interest will be paid if encashed before 1(one) year of deposit. Advance will be allowed up to 80% of the deposit after completion of one year Interest will be paid at Savings rate if encashed after 1(one) year of deposit. Advance will be allowed up to 80% of the deposit after completion of one year. Full amount including interest will be paid on maturity. Govt. tax, Surcharge, Source Tax, Levy, Govt. Excise duty will be recovered from the depositor’s A/C. Account holder can appoint a nominee against the account. Bank reserves the right to close the account at any time and make amendment / alteration of the terms & conditions of the scheme without assigning any reason.

h) Monthly Benefit Scheme (MBS)

UBL has introduced monthly benefit scheme for the prudent persons having ready cash and desired to have fixed in income on monthly basis out of it without taking risk of loss and without en-cashing the principal amount. This scheme offers highest return with zero risk.

Double Growth Deposit Scheme

Any adult Bangladeshi National will be eligible to open this account. Minimum Tk.

100000/- and multiples thereof will be accepted as deposit under this scheme. The period shall be of 6 years term. Deposit may be encashed before its maturity and no interest will be paid if encashed before one year of deposit. Interest will be paid at Savings rate if encashed after one year. Advance will be allowed up to 80% of the deposit after completion of one year. Full amount including interest will be paid on maturity. Government tax, Surcharge, Source Tax, Levy, Govt. Excise duty will be recovered from the depositor’s account. Account holder can appoint a nominee against the account. Bank reserves the right to close the account at any time and make amendment/ alteration of the terms & conditions of the scheme without assigning any reason.

Service

As a financial service institution, UBL provides the following services to its clients:

- Personal Banking

- Corporate Banking

- Capital market services

- SME services

- Telephone and Internet Banking

a) Personal Banking

Amongst private sector banks, Uttara Bank Limited has already made its mark in the personal banking segment.

b) Corporate Banking

Uttara Bank Limited offers a full range of tailored advisory, financing and operational services to its corporate client groups combining trade, treasury, investment and transactional banking activities in one package. Whether it is project finance, term loan, import or export deal, a working capital requirement or a forward cover for a foreign currency transaction, Uttara Bank Limited’s corporate banking managers will offer clients the right solution. Customers will find top class skills and in depth knowledge of market trends in Uttara Bank Limited’s corporate banking specialists, speedy approvals and efficient processing fully satisfying client’s requirements-altogether a rewarding experience.

c) Capital market services

Capital market operation besides investment in treasury bills, prize bonds and other government securities constitute the investment basket of Uttara Bank Limited. Interest rate cut on bank deposits and government savings instruments has contributed to significant surge on the stock markets in the second half of the 2004, which creates opportunities for the bank in terms of capital market operations. The bank is a member of DSE and CSE increase over.

d) SME services

Since inception, the Uttara Bank Limited has held socio economic development in high esteem and was among the first to recognize the potentials of SMEs. The bank has pioneered SME financing in Bangladesh in 2003 focusing on stimulating the manufacturing sector and actively promoting trading and service businesses. Uttara Bank Limited SME unit has been working in close collaboration with the USAID, the SEDF, and IFC managed multi donor facility and the World Bank.

e) Telephone and Internet Banking services

Uttara Bank Limited provides services by telephone and internet banking facilities to its clients. The following are the glimpses of the facilities:

Through Telephone Banking:

- Access to the account information at any time from anywhere;

- Request for cheque book and account statements;

- Make cheque status inquiry

- Place stop cheque instruction;

Through Internet Banking:

- Access to the account information at any time from anywhere;

- Fund transfer;

- Make utility bill payment;

- Open and close term deposit;

- Request for cheque book and account statements;

- Place stop-cheque request;

- Make loan repayment;

Inquire interest and foreign currency rates and many more.

General Banking Activities

General banking is the front side banking service department. It provides those customers who come frequently and those customers who come one time in banking for enjoying ancillary services. A bank does not produce any tangible product to sell but does offer a variety of financial services to its customers. There are several types of departments perform in a bank. General banking is one of the most important departments for banking sector. Corporate branch of Uttara bank ltd. has all required of general banking and all these section are run by manpower with their high quality banking knowledge.

Under General Banking department the following sector are included:

- Account opening department

- Local remittance department

- Foreign remittance section

- Cash department

- Collection department

- Clearing department

- Account section

Account opening Department

The relationship between a banker and his customer begins with the opening of an account by the former in the name of the latter. Initially all the accounts are opened with a deposit of money by the customer and hence these accounts are called deposits accounts. Banker solicits deposits from the members of the public belonging to different walks of life, engaged in numerous economic activities and having different financial status. There is one officer performing various functions in this department.

Functions of the Department

The following are the main functions performed by Account opening department:

- Accepting of Deposit

- Opening of Account

- Check Book issue

- Transfer of an Account

- Closing of Account

Accepting of Deposits

Deposits are the life-blood of a commercial bank. These deposits are collected through opening of different kinds of accounts. In this branch the various types of deposits are offered to various customers, which are grouped into:

- Demand deposit account.

- Time deposit account

- Fixed deposit account

Demand deposits account

Demand Deposits can be withdrawn without any prior notice. Uttara bank limited, corporate branch accepts from the public in the following accounts:

- Current account.

- Savings account.

- Short Notice Term Deposit account (STD).

Current account (CA)

This type of account is opened by both individuals and business concerns. Frequent transactions (deposits as well as withdrawal) are allowed in this type of account. A current a/c holder can draw checks on his account for any amount for any numbers of times in a day as the balance in his account permits. This account provides no interest. The minimum balance to be maintained is Tk. 2000. No new account can be opened with a check

Savings Account (SB)

Individuals for savings purposes open this type of account. Current Interest rate of these accounts is 4.25% per annum. A minimum balance of Tk. 2000 is required to be maintained in a SB account interest on SB account is calculated and accrued monthly and credited to the account half yearly. Interest calculation is made for each month on the basis of the lowest balance at credit of an account in that month. A depositor can withdraw from his SB account not more than twice a week up to an amount not exceeding 25% of the balance in the account.

Short Notice Term Deposit (STD)

The deposits in this account are withdrawal on prior notice varying from 7 to 29 days and 30 days or more. The interest is paid on the balance of the account. Current interest rate is 4.50% per annum.

Time Deposit Account

The amount in this account is payable only after stipulated time. The following accounts are under time deposit account:

- Fixed Deposits which are repayable after the expiry of fixed period and are negotiable.

- Bearer Certificate of Deposits (BCD), which are repayable after expiry of fixed period but are negotiable. These are not renewable.

Fixed Deposit Account

These are deposit, which are made with the bank for a fixed period specified in advance. The band need not maintain each reserve against these deposits and therefore, bank gives high rate of interest on such deposits. A FDR is issued to the depositor acknowledging receipt of the sum of money mentioned therein. It also contains the rate of interest and the date on which the deposit will fall due for payment.

| Particular | Rate of Interest |

| Interest Rate Deposit: 1) Savings Deposit 2) Special Term Deposit (STD) | 07.50% 08.00% |

| Fixed Deposit: 1) 03 (Three Month) 2) 06 (Six Month) 3) 01 (One Year) 4) 02 ( Two Year) | 10.00% 10.50% 10.75% 11.00% |

Interest on Deposit

Monthly Savings scheme

Any adult Bangladeshi National will be eligible to open this account. The period of the scheme will be 5 (five) years and 10 (ten) years term. Monthly installment will be Tk.500/-, 1000/-, 2000/-, 3000/-, 5000/- and 10000/-. Monthly installment to be deposited within 10th day of the month. After due date a penalty of Tk.50/- will be realized from the account holder. If the account holder fails to deposit 3(three) consecutive monthly installments, the account will be automatically closed. No cheque book will be issued against the account. Deposit may be encashed before maturity. But no interest will be paid if encashed before 1(one) year of deposit. Advance will be allowed up to 80% of the deposit after completion of one year Interest will be paid at Savings rate if encashed after 1(one) year of deposit. Advance will be allowed up to 80% of the deposit after completion of one year. Full amount including interest will be paid on maturity. Govt. tax, Surcharge, Source Tax, Levy, Govt. Excise duty will be recovered from the depositor’s A/C. Account holder can appoint a nominee against the account. Bank reserves the right to close the account at any time and make amendment / alteration of the terms & conditions of the scheme without assigning any reason

| Amount will be paid on the following matrix: | ||||

| Amount of monthly deposit (Taka) | Period of deposit | Amount to be paid at the end of period | Period of deposit | Amount to be paid at the end of period |

| 500 | 5 years | 36,736.00 | 10 years | 90,791.00 |

| 1000 | 5 years | 73,471.00 | 10 years | 1,81,582.00 |

| 2000 | 5 years | 1,46,943.00 | 10 years | 3,63,163.00 |

| 3000 | 5 years | 2,20,414.00 | 10 years | 5,44,745.00 |

| 5000 | 5 years | 3,64,357.00 | 10 years | 9,07,909.00 |

| 10000 | 5 years | 7,34,715.00 | 10 years | 18,15,817.00 |

Issuing Cheque book

Issuance of fresh cheque book

Fresh checkbook is issued to the account holder only against requisition on the prescribed requisition slip attached with the checkbook issued earlier, after proper verification of the signature of the account holder personally or to his duly authorized representative against proper acknowledgment.

Issue of Duplicate check book

Duplicate checkbook in lieu of lost one should be issued only when an A/C holder personally approaches the Bank with an application Letter of Indemnity in the prescribed Performa agreeing to indemnify the Bank for the lost checkbook. Fresh check Book in lieu of lost one should be issued after verification of the signature of the Account holder from the Specimen signature card and on realization of required Excise duty only with prior approval of manager of the branch. Check series number of the new checkbook should be recorded in ledger card signature card as usual. Series number of lost checkbook should be recorded in the stop payment register and caution should be exercised to guard against fraudulent payment.

Transfer of an account

The customer submits an application mentioning the name of the branch to which he wants the account to be transferred. His signature cards, advice of new account and all relevant documents are sent to that branch through registered post with acknowledgment the balance standing at credit in customers account is sent to the other branch through Inter Branch Credit Advice (IBCA).

Closing of an account

The following circumstances are usually considered in case of closing an account or justifying the stoppage of the operation of an account:

- Notice given by the customer himself or if the customer is desirous to close the account.

- Death of the customer.

- Customer’s insanity and insolvency.

- If the branch finds that the account is inoperative for a long period.

- If Garnishee Order is issued by the Court of Law on the bank branch.

A customer can close out his account at any time by submitting an application to the branch. Upon the request of a customer an account can be closed. After receiving an application from the customer to close an account, the following procedure is followed by a banker. The customer should be asked to draw the final cheque for the amount standing to the credit of his account less the amount of closing and other incidental charges and surrender the unused cheque leaves. The a/c should be debited for the account closing charges etc. and an authorized officer of the Bank should destroy unused cheque leaves. In case of joint account the application for closing the account is to be signed by all the joint holders even if the account is operate by either of them. The last check for withdrawal of the available balance in the account is to be signed by all the joint holders.

Local remittance Department

The word remittance means sending of money from one place to another place through post and telegraph. Banks extend this facility to its customer by means of receiving money from one branch of the bank and arranging for payment to another branch within country.

Functions of the Local Remittance Department

The following are the main functions performed by the credit department:

- Issuing & Payment of Demand Draft.

- All related correspondence with other Branches & Banks

- Balance of D.D. payable & D.D. Paid with advice

- Attached to Sanchaya Patra and Wage Earners Development Bonds.

- Payment of Incoming TT.

- Issuing, encashment of Pay Order and maintenance of record and proof sheet.

- All related statements & correspondences with Bangladesh Bank & other Branches.

- Issuance of Local Drafts

- All related correspondences.

- Issuing of Outgoing TT.

- Issuance of Local Drafts.

- Issuance of T.T. ICA. IBCA & IBDA.

Remittance of Fund

Any one of the following methods may make remittance of funds from one place to another.

- Telegraphic Transfer (T.T)

- Demand Draft (D.D)

- Pay order (P/O)

Telegraphic Transfer (T.T)

It is an order from the Issuing branch to the Drawer Bank /Branch for payment of a certain sum of money to the beneficiary. Telex/ Telegram sends the payment instruction and funds are paid to the beneficiary through his account maintained with the drawer branch or through a pay order if no a/c is maintained with the drawer branch.

T.T Issuing Process

- The Applicant fill up the relevant part of the prescribed Application form in triplicate duly signs the same and gives it to the Remittance Department.

- Remittance Department will fill up the commission part meant for Bank’s use and request the Applicant to deposit necessary cash or check at the Teller’s Counter.

- The Teller after processing the Application form, Cash or check will validate the Application form .The first copy is treated as Debit Ticket while the second copy is treated as Credit Ticket and sent to Remittance Department for further processing. The third copy is handed over to the applicant as customer’s copy.

- Remittance Department will prepare the Telex/Telegram in appropriate form, sign it and send it to the telex Operator/Dispatch Department for transmission of the message.

- Remittance Department will prepare the necessary advice

- Debit Advice is sent to the client if client’s a/c is debited for the amount of T.T

- Debit ticket is used to debit the client’s account if necessary.

- T Confirmation Advice is sent to the Drawee Branch.

- Credit Ticket (2nd copy of the Application Form) is used to credit the UBL General Accounts.

Demand Draft (D.D)

D.D Issuing process

Sometimes customers use demand draft for the transfer of money from one place to another. For getting a demand draft customer has to fill up an application form. The form contains date, name, amount and address and signature of the applicant, cheque number (if cheque is given for issuing the DD), draft number, name of the payee.

- Get the Application form properly filled up and signed by the applicant.

- Complete the lower portion of the Application Form meant for Bank’s use.

- Calculate the total Taka amount payable including Bank’s commission /charges etc.

- If a cheque is presented for the payment of the D.D officer should get the check duly passed for payment by the competent authority and record the particulars of D.D on the back of the cheque.

- If the purchaser desires his account with the branch to be debited for the amount of D.D the officer should get the A/C. holder’s signature verified properly, from signature card on record of the branch and debit client’s a/c for the total amount including commission/ charges etc.

- If cash deposit is desired, request the purchaser to deposit the money at the Teller’s counter.

- The Teller, after processing the Application Form, Cash or Cheque, will validate the Application form.

- The first copy of the Application form is treated as Debit Ticket while the second copy is treated as Credit Ticket and sent to Remittance Department for further processing. The third copy is handed over to the Applicant as customer’s copy.

- Each branch maintains a running control serial number of their own for issuance of DD. on each Drawee branch. This control serial number should be introduced at the beginning of each year, which will continue till the end of the year.

D.D Issue Register

The Remittance Department maintains prescribed D.D Issue Register. All the required particulars of all D. Ds issued should be entered in that Register duly authenticated. Separate folios are opened for each Drawee Branch. While issuing local Drafts of TK.50, 000/- and above, branches shall put a test number in RED INK on the upper portion of the drafts so that the Drawee branch can immediately make payment of the D.D on presentation after getting the Test agreed, if otherwise found in order.

Issue of Duplicate Draft

Duplicate D.D should not normally be issued unless thoroughly satisfactory evidence is produced regarding loss of a draft. If the D.D is reported lost/stolen, a duplicate draft may be issued by the Issuing branch on receipt of a written request from the purchase.

Cancellation of Demand Draft (DD)

The following procedure should be followed for cancellation of a D.D:

- The purchase should submit a written request for cancellation of the D.D attaching therewith the original D.D.

- The signature of the purchase will have to be verified from the original application form on record.

- Manager /Sub -Manager’s prior permission is to be obtained before refunding the amount on cancellation.

- Prescribesd cancellation charge is to be recovered from the applicant and only the amount of the draft less cancellation charge should be refunded. Commission/Postage etc. charge recovered for issuing the D.D should not be refunded.

- The D.D should be affixed with a stamp Cancelled under proper authentication and the authorized officer’s signature on the D.D should also be cancelled with Red in but in no case should be torn. The cancelled D.D should then be kept with the relevant Ticket.

- The original entries are to be reversed giving proper narration. An IBDA for the cancelled D.D should be issued on the Drawee branch.

- Cancellation of the D.D should also be recorded in the D.D Issue Register.

Pay Order (PO)

Pay Order Issue Process

For issuing a pay order the client is to submit an Application to the Remittance Department in the prescribed form (in triplicate) properly filled up and duly signed by applicant. The processing of the pay order Application form, deposit of cash/cheque at the Teller’s counter and finally issuing an order etc, are similar to those of processing of D.D. Application.

As in case of D.D each branch should use a running control serial number of their own for issuance of a pay order. This control serial number should be introduced at the beginning of each year, which will continue till the end of the year. A fresh number should be introduced at the beginning of the next calendar year and so on.

Charges

For issuing each pay Order commission at the rate prescribed by Head Office is realized from the client and credited to Income A/c as usual.

Refund of Pay Order

The following procedure should be followed for refund of pay order by cancellation:

- The purchase should submit a written request for refund of pay order by cancellation attaching therewith the original pay order.

- The signature of the purchaser will have to be verified from the original application form on record.

- Manager/ Sub-manager’s prior permission is to be obtained before refunding the amount of pay order cancellation.

- Prescribed cancellation charge is to be recovered from the applicant and only the amount of the pay order less cancellation charge should be refunded. Commission recorded for issuing the pay order should not be refunded.

- The pay order should be affixed with a stamp ”cancelled” under proper authentication and the authorized officer’s signature of the pay order should also be cancelled with RED ink but in no case should be torn. The cancelled pay order should be kept with the relevant Ticket.

- The original entries are to be reversed with proper narrations

- Cancellation of the pay Order should also be recorded in the pay order Issue Register.

Transaction Types

Collection of Cheque

- Up to TK. 25,000 @ .15%, Minimum TK. 10.

- Above Tk.25,000- 1,00,000, @ .15% Minimum Tk.50.

- Above 1,00,000-5,00,000 @ .10%, Minimum Tk.150.

- Above 5,00,000 @ .05%, Minimum Tk.600-Maximum 1,200

Bank Charge For Issuing DD

- @ .15% Minimum Tk. 25.

Cancellation of DD

- Up to 1000————————-Tk.25.

- Above 1000————————Tk.40.

Payment Order

- Up to Tk. 1000————————Tk.10.

- 1,000-1,00,000 ————————-Tk.25.

- 1,00,000-5,00,000———————-Tk.50.

- Above Tk.5,00,000——————–Tk.100.

Cancellation of Pay order

- Up to Tk. 500————–Tk.10.

- Above Tk. 500————-Tk.25.

Foreign Remittance Department

Uttara Bank Limited has seen successful year in 2008 in terms of expansion of its remittance business with its foreign correspondent and exchange houses. This Bank has drawing arrangement with the Banks and Exchange companies situated at important countries of the world. In the mean time the bank has been able to draw confidence of the Bangladeshi expertise by easy and quick delivery of their hard earned foreign remittance to the payees at home. The volume of the foreign remittance in the year 2008 stood at Tk 36,073.2 million as compared to Tk 29,575.3 million in the preceding year registering an increase of 21.97 percent. On order to keep pace with tome a scheme namely “Express Payment Scheme” has been introduced for inward remittance by using modern equipment. Under this scheme a payee having his account with any branch of UBL gets the proceeds of remittance sent from any part of the world within 2 hours. Besides in order to ensure speedy and improved service the Bank has also introduced “Instant Cash Scheme” for payment of foreign remittance in cash to the customers who have no account with the Bank on submission of Passport/ Driving License/ Voter ID card etc. as identity. Besides there is a scheme named “Instant Draft” as per which under a prior agreement computer printed drafted remitted by the remitted companies and received hare through website is delivered but the International Division of the Bank to the beneficiaries at their home address for payment of money equivalent to foreign currency. Besides, the expatriates can remit their money at low cost, reliably & instantly to the home country through more than 700 correspondent banks worldwide under Swift system.

Cash department

Cash department is very sensitive part of the branch and is handled with extra care. I was not authorized to deal in this section because of its sensitivity. However, I got an interview of the functioning of the section. This section starts the day with cash in vault. Each day some cash that is opening cash balance are taken to the cash counter by a cash officer from the cash vault. The amount of opening cash balance is entered into a register. After whole days transaction the surplus of money remains in the cash counter is put back in the vault and known as the closing balance. This closing balance is added to the vault.

Functions of the Department

The following are the main functions performed by the department:

(a) Shall be responsible for all Cash & Cash Items related matters including record keeping of the information’s received regarding cash remittances

(b) Shall supervise the Cash Remittance under direct guidance of Sub-Manager

(c) Shall be responsible for any receipts and payments as per circular issued from time to time.

(d) Keeping liaison with the Bangladesh Bank, Cash department.

Cash Payment

Cash payment of different instruments is made in the cash section. Procedure of cash payment against cheque is discussed under elaborately. Cash payment of cheque includes few steps

- First of all the client comes to the counter with the check and gives it to the officer in charge there. The officer checks whether there are two signatures on the back of the cheque and checks his balance in the computer. After that the officer will give it to the cash in charge.

- Then the cash in charge verifies the signature from the signature card and permits the officer in computer to debit the client’s account by giving posting. A posted seal with teller number is given.

- Then the cheque is given to the teller person and he after checking everything asks the drawer to give another signature on the back of the cheque.

- If the signature matches with the one given previously then the teller will make payment keeping the paying cheque with him while writing the denomination on the back of the cheque.

- Cash paid seal is given on the cheque and make entry in the payment register.

Clearing Department

According to the Article 37(2) of Bangladesh Bank Order, 1972, the banks, which are the member of the clearinghouse, are called as Scheduled Banks. The scheduled banks clear the chouse drawn upon one another through the clearinghouse. This is an arrangement by the central bank where everyday the representative of the member banks gathers to clear the chouse. Banks for credit of the proceeds to the customers’ accounts accept Chouse and other similar instruments. The bank receives many such instruments during the day from account holders. Many of these instruments are drawn payable at other banks. If they were to be presented at the drawee banks to collect the proceeds, it would be necessary to employ many messengers for the purpose. Similarly, there would be many chouse drawn on this the messengers of other banks would present bank and them at the counter. The whole process of collection and payment would involve considerable labor, delay, risk and expenditure. All the labor. Risk, delay and expenditure are substantially reduced, by the representatives of all the banks meeting at a specified time, for exchanging the instruments and arriving at the net position regarding receipt or payment. The place where the banks meet and settle their dues is called the Clearinghouse.

Functions of the Department

The following are the main functions performed by the department:

- Pass outward instruments to the Clearing-House.

- Pass inward instruments to respective department.

- Return instruments incase of dishonor.

- Prepare IBCA or IBDA for the respective branch and HO.

Collection Department

Cheques, drafts etc. are drown on bank located outside clearing house are sent for collection. Principal Branch collects its client’s above-mentioned instruments from other branches of UBL and branches other than UBL. In case of out ward bills for collection customers account is credited after finishing the collection processor. And in case of in ward bills customers account is debited for this purpose. So it place dual role as follows:

- Collecting Banker

- Paying Banker.

There is one officer working over desk in this department.

Functions of the Department

The following are the main functions performed by the department:

- Preparing of Outward and Inward Collection Item.

- Inter-Branch Transfer.

- Batch posting and checking as and when required.

- Other works as and when require.

Applicability of Collection

Collection is done when:

(i) Paying Bank is located out side Dhaka City.

(ii) Paying Bank is other branches of UBL situated inside Dhaka City.

Paying Bank is outside Dhaka City

Collection department of Principal Branch, UBL sends outward bills for collection (OBC) to the concerned paying bank to get inter Bank Credit Advice (IBCA) from paying Bank. If the paying bank dishonors the instrument, the same is returned to principal Branch.

The Paying Bank of their Own Branches Inside Dhaka City

Collection Department sends transfer delivery item to other branches of same bank situated inside Dhaka City. Upon receiving IBCA customer’s a/c is credited.

Accounts Section

In banking business transaction are done day and these transition are to be recorded properly and systematically as the banks with the depositors money. Any deviation on proper recording may hamper public confidence and the bank has to suffer a lot. Improper recording of transactions will lead to the mismatch in the debit side and credit side. To avoid these mishaps the bank provides a separate department whose function is to checque he mistakes n passing vouchers or wrong enters or fraud or forgery. This department is called Account section.

Functions of Accounts department

The functions of accounts department can divide into two categories – one is day to day task and another is periodical task.

Daily Task: Here day to day function refers to the every day tasks. Accounts department of UBL Corporate branch performs the following day to day functions:

- Recording the transactions in the cashbook.

- Recording the transactions in general and subsidiary ledger.

- Preparing the daily position of the branch comprising of deposit and cash.

- Preparing the daily Statement of Affairs showing all the assets and liability of the branch as per General Ledger and Subsidiary Ledger separately.

- Making payment of all the expenses of the branch.

- Recording inters branch fund transfer and providing accounting treatment in this regard.

- Checking whether all the vouchers are correctly passed to ensure the conformity with the ‘Activity Report’; if otherwise making it correct by calling the respective official to rectify the voucher.

- Recording of the vouchers in the Voucher Register.

- Packing of the correct vouchers according to the debit voucher and the credit voucher.

Periodical Task: Periodical functions of accounts department include the preparation of different weekly, monthly, quarterly, and annually statement. The accounts department prepares the following statement:

- Preparing the monthly salary statements for the employees.

- Publishing the basic data of the branch.

- Preparing the weekly position for the branch which is sent to the Head Office to maintain Cash Reserve Requirement (C.R.R)

- Preparing the monthly position for the branch which is sent to the Head Office to maintain Statutory Liquidity Requirement (S.L.R)

- Preparing the weekly position for the branch comprising of the break up of sector wise deposit, credit etc.

- Preparing the weekly position for the branch comprising of denomination wise statement of cash in tills. Preparing the budget for the branch by fixing the target regarding profit and deposit so as to take necessary steps to generate and mobilize deposit.

- Preparing an ‘Extract’ which is a summary of all the transactions of the Head Office account with the branch to reconcile all the transactions held among the accounts of all the branches.

Investment & Deposit Department

Investment

Investment is the action of deploying funds with the intention and expectation they will earned a positive return for the owner (Broking ton 1986, p 68). Funds may be invested in either realizes or financial assets. When resources are used for purchasing fixed and current asset in a production process or for a trading purpose than it can be termed as real investment.

Investment Objectives of UBL

The objectives and principals of investment operation of the banks are:

- To diversify its portfolio by size of investment, by sectors ( Public & privet), by economic purpose, by securities and geographical area including industrial and commercial area.

- To a ensure mutual benefit both for the bank and the investment client.

- To make investment socio-economic requirement of the country in the view.

- To encourage social upliftment enterprises.

- To increase the number if potential investors by making participatory and productive investment.

- To finance various development scheme for poverty.

- To invest in the from of goods and commodities rather then give out cash money to the investment clients.

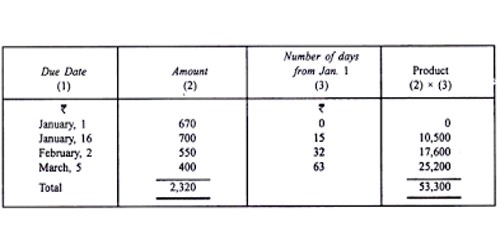

Growth of investment

The investment of the bank demonstrated steady growth over the years.

Investment (Sector Wise)

Figure: Investment (sector wise)

| Particulars | 2010 | 2009 | 2008 | 2007 | 2006 | |

| 01 | Authorized Capital | 1633 | 1600 | 1600 | 1000 | 1000 |

| 02 | Paid-up Capital | 2395.10 | 1597.31 | 798.6 | 399.3 | 199.7 |

| 03 | Reserve Fund | 3935.5 | 3280.8 | 2890.2 | 2054.2 | 1885.8 |

| 04 | Deposits | 67666.07 | 51753.68 | 50817 | 43586.4 | 39360.2 |

| 05 | Advances | 48672.68 | 39451.35 | 37141.3 | 28477.4 | 25163.9 |

| 06 | Investments | 18591.12 | 22502.48 | 11188.3 | 14455.8 | 9564.5 |

| 07 | Gross Income | 6589.5 | 6423.4 | 6313.5 | 382.09 | 426.50 |

| 08 | Gross Expenditure | 298.34 | 278.54 | 270.74 | 261.12 | 265.04 |

| 09 | Net Profit(pre-tax) | 49.45 | 52.53 | 62.47 | 68.31 | 78.26 |

| 10 | Import Business | 2954.25 | 2834.20 | 2620.49 | 2408.00 | 2309.24 |

| 11 | Export Business | 2305.56 | 2176.88 | 2072.89 | 1913.31 | 1819.18 |

| 12 | Foreign Correspondents | 320 | 290 | 256 | 295 | 322 |

| 13 | Number of Employees | 3562 | 3562 | 3562 | 3382 | 3265 |

| 14 | Number of Branches | 211 | 211 | 198 | 198 | 198 |

Loans and Advances

In 2009 Uttara Bank Ltd. registered a stead growth in the credit portfolio posting a growth of 13.17 percent. Total loans and advances of the Bank stood at Tk 28.477.4 million during the year as compared to Tk 25,163.9 million of the previous year. Average loan per Branch stood at Tk 137.6 million.

The Bank disbursed loan Tk 151.6 million in this sector in 2008. To cater to the urgent financial need of the service-holders having limited income an amount of Tk 127.2 million was disbursed up to 31st December 2009 under Personal Loan Scheme. Besides the Bank distributed loan to the tune of Tk 829.5 million, Tk 1,701.5 million and Tk 3,486.4 million up to 31st December 2009 under three special projects namely “Uttaran Consumer Loan Scheme”, “Uttaran Small Business Loan Scheme” and “Uttaran House Repairing and Renovation Scheme” respectively.

Risk Management

Risk management is a very important subject of banking activities. Adequate risks are there in different steps of a Bank. To prevent these risks Bangladesh Bank has identified five (5) Risk Management Sector. Following are the risks:

- Credit risk management

- Asset Liability Management

- Foreign Exchange risk management

- Money Laundering prevention

- Internal controlling

Credit risk management

Under the instructions of Govt. and Bangladesh Bank Uttara bank has its own credit principle. In the branch banking system the unit of banking business are the branches. In the branch level the application of credit is examined by Relationship Manager. After better being examined it is send to the Credit Risk Management Unit of Head office through regional Office. The after classifying different perspective under the banks own credit principles CRM unit place the acceptable credit applications to the Credit Committee.

Asset Liability Management

There is Asset Liability Management Committee for the management of Asset and Liability which comprises of the upper level executives of the bank. Mainly this committee meets at least once a month and deals with the significant topics like-

- Money situation risk of the market,

- Liquidity crisis risk relating to the Balance Sheet

- Transfer Pricing

- Risk relating to the interest rate of Deposit and Credit &

- Money principles of the Bangladesh Bank

Problems, Recommendation, Conclusion & Bibliography

Problems involved in rendering service

- As a large branch UBL, Satmosjid Road Branch, Dhaka does not provide necessary Prospectus that can supply the overall information about various schemes of NCCBL.

- In UBL, , Satmosjid Road Branch, Dhaka maximum officers are working in a specific desk for a long time and for this reason they may feel monotony and certainly they are not be able to know the overall banking activities through they have enough eagerness to know.

- Foreign Exchange Section is one of the busiest sections in Bank. Sometimes it is found that all works are not performed efficiently due to insufficiency to Officer/Staffs’

- Training facility isn’t sufficient especially for the lower level officers.

- Some of the deposit schemes of UBL in TV; Newspaper of in any mass media is not available.

- Still now, like most of the branches of UBL, , Satmosjid Road Branch, Dhaka, follows the traditional banking system.

- UBL, , Satmosjid Road Branch, Dhaka, has no reception section and has no receptionist, that may receive phone calls and complains from customer and supply the enough information.

- In this branch there is lack of modern equipments.

Recommendation

Uttara Bank is one of the most flourishing Bank of Bangladesh with wide growth opportunities in the industry. From our performance evaluation I saw that the Uttara Bank losing its business in comparison and other bank because of its lack of use modern age banking technology and human resources. To improve the business condition of Uttara Bank Ltd. and to gain the lost market share I suggest implementing the following suggestions. By following these recommendations Uttara Bank would be able to build up a strong platform of satisfied customers and create better performance.

- Since today general banking activities depend on technology, the general banking department of UBL Corporate Branch should be completely computerized.

- They should open SMS banking.

- UBL should introduce online banking system all branches through the country to grab customer.

- Some employee of Corporate Branch has lack of banking and computer knowledge. So Bank should arrange training programs on these subjects.

- The cash counter should follow the modern banking system to provide better services.

- UBL needs to increase the job satisfaction level of its employees by providing several performance based awards.

- UBL should increase its manpower level. Additional and skilled manpower in the officer and staff level should be recruited in an urgent basis.

- It was observed that, UBL is absent in various marketing activities like TV, Print Media, Bill Boards, and Sponsorships etc. Bank should advertise about itself so that it can attract more clients that will increase the business volume of the bank.

- The remuneration of the employees should increase early.

Conclusion

Uttara Bank Limited is bank of new generation. Though I tried to include at my report about deposit, customer service and general banking, I followed their rules and regulation and tried to use them in my report to prepare this report with my best effort.

Though all departments and sections are covered in the internship program, it is not possible to go to depth of each activities of branch because of time limitation. Bank is an institution, which acts as a financial intermediary. Since bank collect deposit from various source by paying interest to them and grant loan to some other parties at high rate to interest then the interest paid to the depositor, the differences between the two interests is termed as the profit.

Uttara bank Ltd. Should pay more attention to loan and advance which not only increase it’s profit position but also alleviate poverty level of Bangladesh by providing loan to the capital seeker, increase standards of living.