Financial leverage which is also known as leverage or trading on equity refers to the use of debt to acquire additional assets. It is related to the financing activities of a firm. The use of financial leverage to control a greater amount of assets will cause the returns on the owner’s cash investment to be amplified. It also refers to the utilization of borrowed funds to acquire new assets which are assumed to generate a higher capital gain or income as compared to the cost of borrowing. The fixed return sources of capital influence the earning of variable return sources. The effect is known as financial leverage.

Financial leverage is the use of debt to buy more assets. Leverage is employed to increase the return on equity. However, an excessive amount of financial leverage increases the risk of failure, since it becomes more difficult to repay debt.

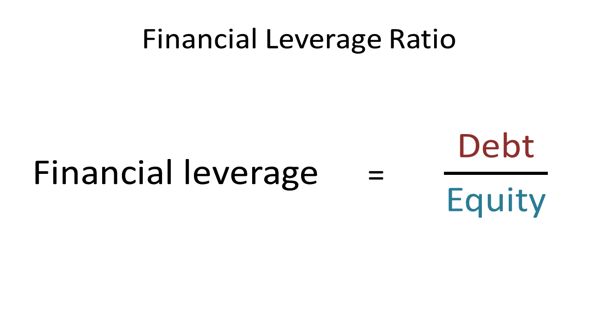

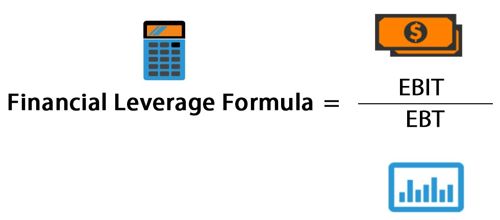

The use of fixed charge capital is known as financial leverage. The financial leverage formula is measured as the ratio of total debt to total assets. If there is no fixed charge capital, there is no financial leverage. As the proportion of debt to assets increases, so too does the amount of financial leverage. The proper utilization of fixed charged capital like debentures, bonds, bank loans, and preference share capital is measured by financial leverage. It is favorable when the uses to which debt can be put generate returns greater than the interest expense associated with the debt.

Advantages

- Enhanced earnings. It may allow an entity to earn a disproportionate amount on its assets.

- Favorable tax treatment. In many tax jurisdictions, interest expense is tax-deductible, which reduces its net cost to the borrower.

The firm having more debt capital and preference share capital in its capital structure has a higher degree of financial leverage and a greater amount of risk. It also presents the possibility of disproportionate losses, since the related amount of interest expense may overwhelm the borrower if it does not earn sufficient returns to offset the interest expense.

Financial leverage is used to measure financial risk. Financial risk refers to the risk of the firm not being able to cover its fixed financial costs. It is the use of borrowed money (debt) to finance the purchase of assets with the expectation that the income or capital gain from the new asset will exceed the cost of borrowing.

Information Source: