Financial econometric is the application of statistical methods to financial market data. It is an active field of integration of finance, economics, probability, statistics, and applied mathematics. Financial econometrics is a branch of financial economics, in the field of economics. The objective of the module is to extend your knowledge and equip you with methods and techniques that allow you to analyze these finance-related issues. Areas of study include capital markets, financial institutions, corporate finance, and corporate governance. Models are constructed for volatility, price impact, correlation, extreme values, and many other financial constructs. Topics often revolve around asset valuation of individual stocks, bonds, derivatives, currencies, and other financial instruments. It generates many new problems, economics provides useful theoretical foundation and guidance, and quantitative methods such as statistics, probability, and applied mathematics are essential tools to solve quantitative problems in finance. A much broader field that covers all areas of measurement and investigation within the area of Economic Science.

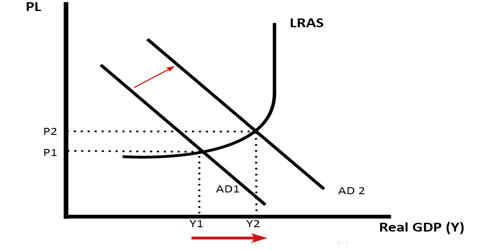

Most financial econometric analyses are carried out in fixed time units. It differs from other forms of econometrics because the emphasis is usually on analyzing the prices of financial assets traded at competitive, liquid markets. These time intervals for many years were months, weeks, or days, but now time intervals of hours, five minutes, or seconds are being used for econometric model building. Financial markets and others generate vast amounts of data on asset returns, their volatility, and other financial variables in long and high-frequency time series. Each Branch of Economics has now developed its own Econometric Methods and Applications, which adds to the literature review.

People working in the finance industry or researching the finance sector often use econometric techniques in a range of activities – for example, in support of portfolio management and in the valuation of securities. Statistical tools are employed to identify parameters of stochastic models, to simulate complex financial systems and to test economic theories via empirical financial data. Financial econometrics is essential for risk management when it is important to know how often ‘bad’ investment outcomes are expected to occur over future days, weeks, months and years. Although econometrics is often associated with analyzing economic problems such as economic growth, consumption, and investment, the applications in the areas of finance have grown rapidly in the last few decades. Financial Econometrics basically utilizes Financial Market Data to build mathematical and statistical financial models and later analyze the statistical significance and make predictions.