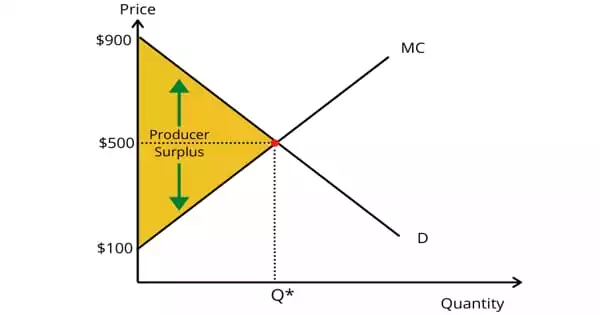

First-degree discrimination, often known as perfect price discrimination, happens when a company charges the highest price feasible for each unit consumed. First-degree price discrimination, often known as perfect price discrimination, is charging customers the highest price they are prepared to pay for a good or service. Because prices differ between units, the firm takes all possible consumer surplus for itself or the economic surplus. The corporation completely captures the consumer surplus in this case. Many sectors that provide client services engage in first-degree price discrimination, which occurs when a corporation charges a different price for each commodity or service sold. In practice, determining a consumer’s maximum willingness to pay is tough. As a result, such a pricing plan is rarely used.

First-degree price discrimination occurs when a company charges each consumer the highest price they are willing to pay. Companies in an ideal world would be able to eliminate all consumer surplus through first-degree price discrimination. This pricing may differ from one consumer to the next because the firm charges the absolute utmost in order for the buyer to purchase their items. This pricing strategy, also known as “perfect price discrimination,” occurs when a company can accurately determine what each customer is willing to pay for a specific product or service and then sell that product or service at that exact price. As a result, the company is able to capture all customer surplus and retain it as economic profit.

First-degree pricing discrimination is a theoretical concept rather than a practical reality. The expectation to negotiate the final purchase price is part of the buying process in various businesses, such as used car or truck sales. It is something for businesses to strive for rather than something they can actually achieve. To calculate how much to charge for each automobile sold, the company selling the used car can utilize data mining to obtain information about each buyer’s previous buying patterns, income, budget, and maximum available output. After all, it’s nearly hard to charge each consumer the absolute utmost they’re willing to pay.

This is a common pricing strategy for organizations with significant fixed costs. For most firms, this pricing technique is time-consuming and difficult to perfect, but it allows the seller to capture the maximum amount of attainable profit for each sale. Customers who do not read their contracts, for example, are frequently charged greater fees by telecommunications and utility companies. After a year or two, such businesses frequently raise the price to a higher ‘variable rate.’ Only when more price-sensitive customers contact them do they offer lower, more acceptable rates.

Perfect pricing discrimination is another name for this method. For four reasons, personalized pricing is extremely difficult to implement in practice. For starters, identifying the willingness-to-pay functions for each consumer is tough. Second, people are frequently irritated when they discover that another client has paid less for a product or service than they have. The third reason personalized pricing generates issues is because perfect price discrimination can lead to arbitrage, in which opportunistic buyers buy a product at a discount in one market and then sell it at a profit in another. The fourth and last reason it is difficult to implement is that it is unlawful in some cases.