The financial accelerator is a concept in macroeconomics that explains how financial markets and the availability of credit can amplify the effects of economic shocks. In macroeconomics, it is the process by which adverse economic shocks are amplified by worsening financial market conditions. The financial accelerator theory suggests that changes in the financial sector can have a significant impact on the real economy. In general, the financial and macroeconomic downturn is exacerbated by adverse conditions in the real economy and financial markets.

The basic idea of the financial accelerator is that when there is a shock to the economy, such as a recession or a sudden increase in interest rates, it can affect the financial sector in a way that exacerbates the initial shock. This, in turn, can cause further economic decline or growth, creating a feedback loop.

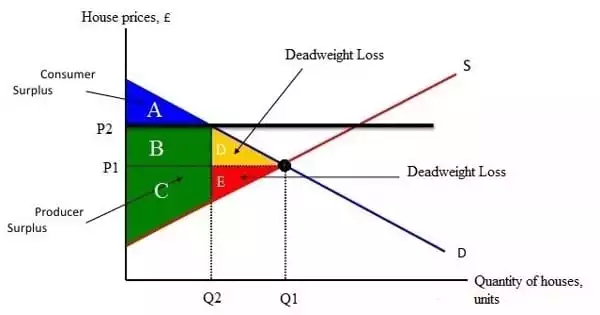

For example, suppose there is a decline in the housing market, which leads to a decrease in the value of mortgage-backed securities held by banks. This decrease in the value of assets reduces banks’ net worth and their ability to lend, which further decreases the demand for housing and exacerbates the initial decline in the housing market.

Financial accelerator mechanism

The real economy and financial markets are linked because firms require external finance to engage in physical investment opportunities. The ability of a company to borrow is primarily determined by the market value of its net worth. This is due to asymmetry of information between lenders and borrowers.

The financial accelerator theory suggests that this feedback loop can work in reverse as well. If the financial sector is strengthened through policies such as bank bailouts or monetary stimulus, it can help to mitigate the effects of economic shocks and stabilize the economy.

Lenders are likely to know little about the dependability of any given borrower. As a result, they typically require borrowers to demonstrate their ability to repay, frequently in the form of collateralized assets. As a result, a decline in asset prices harms the firms’ balance sheets and net worth. Their investment suffers as a result of the deterioration in their ability to borrow.

Reduced economic activity reduces asset prices even further, resulting in a feedback cycle of falling asset prices, deteriorating balance sheets, tightening financing conditions, and declining economic activity. A financial accelerator is a term used to describe this vicious cycle. It is a financial feedback loop or a loan/credit cycle, which, starting from a small change in financial markets, is, in principle, able to produce a large change in economic conditions

Overall, the financial accelerator theory provides an explanation for how changes in the financial sector can impact the broader economy and how policymakers can use financial policies to stabilize the economy.