Disequilibrium is a condition where internal and/or external forces are preventing or causing the market to fall out of balance from achieving market equilibrium. It may happen very briefly or over a prolonged period of time. Usually, there is no or just temporary imbalance in financial markets, because trade takes place constantly and the prices of financial assets can be changed instantaneously with each trade to balance supply and demand. Disequilibrium can be brought about by transient changes in monetary factors or because of long haul basic uneven characters. It is likewise used to depict a shortfall or surplus in a nation’s parity of installments.

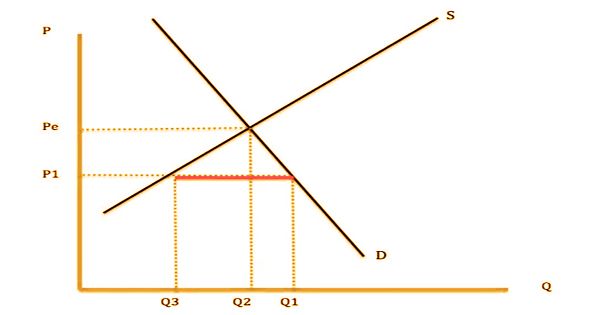

Disequilibrium due to price below equilibrium:

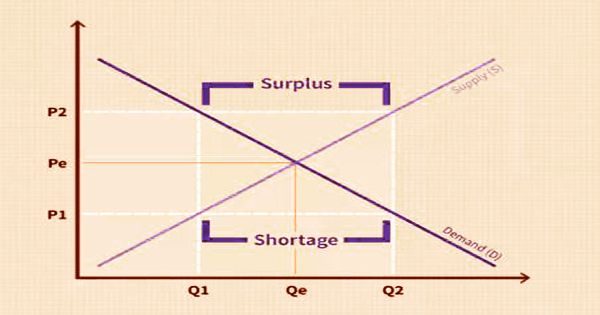

With a P1 price, the demand (Q1) is higher than the supply (Q3). As customers attempt to get the restricted stock, this imbalance will lead to a shortage (Q1-Q3) and long queues. In a free market, by putting up the price to ration the demand, consumers would expect companies to cope with this imbalance.

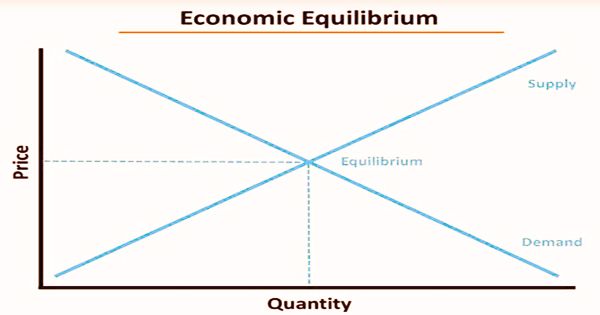

To all the more likely get disequilibrium, it is valuable to get a handle on the condition of financial balance first. A market in harmony is supposed to be working proficiently as its amount provided rises to its amount requested at a balance cost or a market-clearing cost. It refers to when economic factors, without the effects of external forces, are in their natural state; it is also referred to as market balance. For a product or service, there are no surpluses or shortages in an equilibrium economy.

When market forces are balanced, equilibrium is reached. A typical example is when supply forces and demand forces for a commodity reach an equilibrium point, and a steady price is an indication of such stability. Using the word “general disequilibrium” to characterize the state of the markets as we most frequently find them, many contemporary economists have contrasted them. Keynes observed that in any sort of imbalance, markets will most likely have so many contingent factors influencing financial markets today that true equilibrium is more of a concept.

On the off chance that costs become excessively high, the interest for an item or administration will decrease to the point that providers should lessen the cost. Alternately, if costs are excessively low, the interest for an item or administration will increment to the point that providers will either raise costs or produce more. Consumers could, however, reduce the quantity of wheat they buy, given the higher market prices. If this imbalance happens, the quantity supplied will be greater than the quantity ordered and there will be a surplus, creating a market imbalance.

Example of Disequilibrium

Economic equilibrium is just a theory in motion. Market dynamics are continually evolving and changing dynamically, such that the market never really achieves balance. If prices rise to P2, producers will be willing to make more wheat available for sale on the market from their storage barns, as higher prices will cover their production costs and contribute to higher profits. The difference between Q2 and Q1, where Q2 is the quantity supplied and Q1 is the quantity requested, reflects the surplus in the graph. Suppliers would want to sell the wheat quickly until it gets rancid, given the surplus product supplied, which will continue to reduce the sales price.

The previous occasions where the cost turns out to be excessively high or too low is instances of disequilibrium. Subsequently, a straightforward method to clarify disequilibrium is that it is where flexibly doesn’t coordinate interest, causing an unevenness. In principle, inevitably, the business sectors would locate another financial harmony when the market powers rebalance. Since assets are not dispensed productively, the market is supposed to be in disequilibrium. In a free market, when the availability of the good causes the price to rise, the price is supposed to rise to the equilibrium price.

Economics believes that people are rational and that they aim to maximize utility. Nevertheless, other variables are at work in the real world. Disequilibrium in goods can be seen more clearly since there is an active demand for relatively homogeneous products. As an energy source and as an input to various other manufactured goods, oil is one of the most frequently used commodities and therefore has an active demand and real-time pricing.

Information Sources: