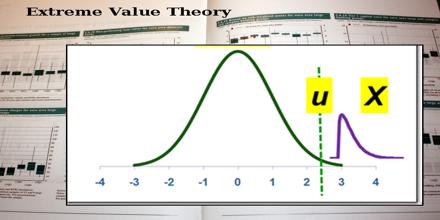

Extreme Value Theory is useful in modelling the impact of crashes or situations of extreme stress on investor portfolios. It seeks to assess, from a given ordered sample of a given random variable, the probability of events that are more extreme than any previously observed. It faces many challenges, including the scarcity of extreme data, determining whether the series is “fat-tailed,” choosing the threshold or beginning of the tail, and choosing the methods of estimating the parameters. Extreme Value Theory is not easily extended to the multivariate case, because there is no concept of order in a multidimensional space and it is difficult to define the extremes in the multivariate case.

Extreme Value Theory