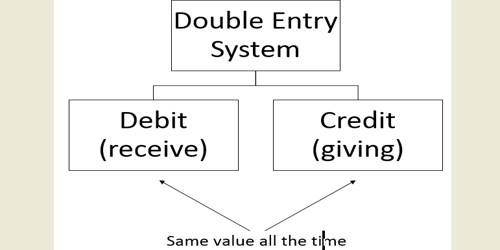

Double Entry System

The double entry system of bookkeeping is the art of recording the two-fold aspects (viz every debit must have a corresponding credit and vice, versa) of each transaction. It means that for every business transaction, amounts must be recorded in a minimum of two accounts. It deals with either two or more accounts for every business transaction. Every financial transaction has an equal and opposite effect in at least two different accounts. For instance, a person enters a transaction of borrowing money from the bank. It is used to satisfy the accounting equation: Assets=Liabilities+Equity. This system, transactions have a dual aspect, every transaction involves two parties – debit and credit where and they are equal.

Accounting is an art of recording, classifying and summarizing the transactions of financial nature measurable in terms of money and interpreting the results thereof. In the double-entry system, transactions are recorded in terms of debits and credits. The double-entry system also requires that for all transactions, the amounts entered as debits must be equal to the amounts entered as credits. It’s a fundamental concept encompassing accounting and book-keeping in present times. Example: To illustrate double entry, let’s assume that a company borrows $10,000 from its bank. The company’s Cash account must be increased by $10,000 and a liability account must be increased by $10,000. To increase an asset, a debit entry is required. To increase liability, credit entry is required. Hence, the account Cash will be debited for $10,000 and the liability Loans Payable will be credited for $10,000.

Advantages – The double-entry system of bookkeeping or accounting makes it easier to prepare accurate financial statements and detect errors. The most scientific and reliable method of accounting is the Double Entry System.

- This system increases the accuracy of the accounting, through the trial balance device

- Profit and loss suffered during the Year can be calculated with details

- By following this system the company can keep the accounting records in detail which eventually helps in controlling

- The recorded details can be used for comparison purposes as well.

- In every transaction, the account receiving a benefit is debited and the account giving benefit is credited.