Double-entry bookkeeping, also known as double-entry accounting, is a method of bookkeeping that relies on a two-sided accounting entry to maintain financial information. It is the idea that every accounting transaction affects a company’s finances in two ways. The general ledger keeps track of both sides of each transaction. Every entry into an account necessitates a corresponding and opposing entry into a different account.

The double-entry system has two equal and corresponding sides known as debit and credit. When a company sells a product, its revenue increases and its cash increases by the same amount. A transaction in double-entry bookkeeping always affects at least two accounts, always includes at least one debit and one credit, and always has total debits and total credits that are equal. When a company borrows money from a creditor, its cash balance rises, but so does the company’s debt.

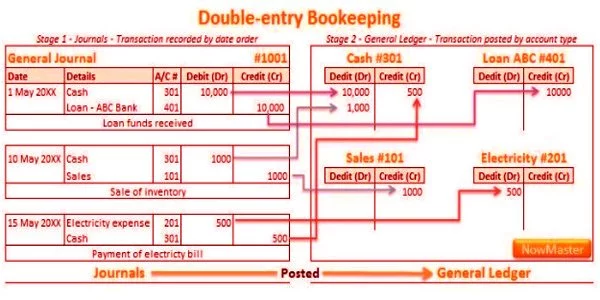

For example, if a business takes out a bank loan for $10,000, recording the transaction would require a debit of $10,000 to an asset account called “Cash”, as well as a credit of $10,000 to a liability account called “Notes Payable”.

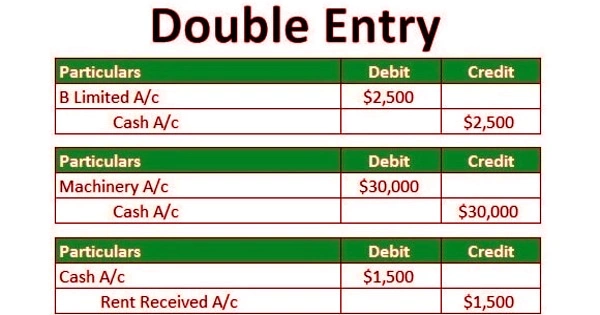

The basic entry to record this transaction in a general ledger will look like this:

Cash 10,000 / Notes Payable / 10,000

The accounting equation must be balanced in double-entry bookkeeping. The accounting equation serves as an error detection tool; if the sum of debits for all accounts does not equal the corresponding sum of credits for all accounts at any point, an error has occurred. However, satisfying the equation does not guarantee the absence of errors; the ledger may still “balance” even if the incorrect ledger accounts have been debited or credited.

The double entry system produces a balance sheet, which includes assets, liabilities, and equity. Because a company’s assets will always equal its liabilities plus equity, the balance sheet is balanced. All of the items that a company owns, such as inventory, cash, machinery, buildings, and even intangible items such as patents, are considered assets. Liabilities represent everything owed to someone else by the company, such as short-term accounts payable to suppliers or long-term notes payable owed to a bank. The ownership stake in the company is represented by equity. Equity may include any contributions made by the owners to the company, plus or minus the company’s profits or losses.

How To Do –

Accounting software is typically used for double-entry bookkeeping. A business can use software to create custom accounts, such as a “technology expense” account to track purchases of computers, printers, cell phones, and so on. You can also connect your business bank account to make transaction recording easier. Accounting software can also easily generate reports, making tax preparation and year-end preparation much easier.