Accounting for responsibility entails identifying several responsibility centers (branch, department, units, etc.) within an organization and monitoring their inputs and outputs in order to understand their performance. It is a system of internal accounting that compares actual performance of several responsibility centers to budget. It aids the organization in meeting its accounting objectives.

However, because it is a costly and complex system, responsibility accounting is not appropriate for small businesses with little resources. Subordinates may become dissatisfied as a result of rigorous supervision and control. As a result, there is a risk of conflict between individual and organizational goals. It only works for costs that can be controlled. Responsibility centers are difficult to define.

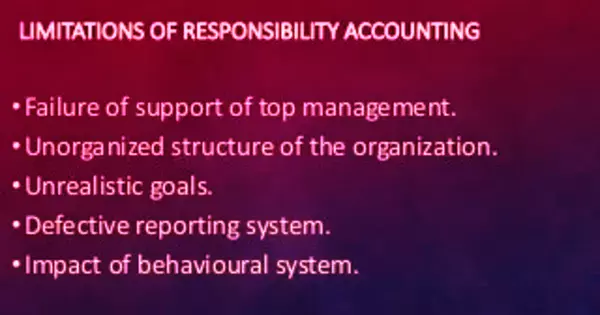

The following are the disadvantages of responsibility accounting:

- It is a Costly System of Accounting

Because this structure fosters decentralization, it necessitates skilled and competent line managers to appropriately manage departments. As a result, it is more expensive to hire skilled managers and personnel.

Meeting the requirements of an effective responsibility accounting system can be tough at times. It causes the entire system to be erroneous. A good classification of controllable and non-controllable costs is a must for an efficient responsibility accounting system. However, practical issues arise as a result of the complexity and variety of expenses.

- Possibility of Employee Frustration

Employees may become frustrated and stressed as a result of the intense supervision and control. Frustration and despair have a negative impact on their performance, perhaps reducing production and profitability.

Because the system necessitates the presence of highly skilled managers, the cost to the organization rises. This accounting system only deals with controllable costs and ignores uncontrollable costs.

- Only For Controllable Costs

Only controllable costs can be measured and controlled using responsibility accounting. It does not work when the expenditures are uncontrollable. If a corporation fails to adequately express the person’s goals and responsibilities, the system may fail to produce correct results. Separate departmental pursuits may result in inter-departmental rivalry, which may be detrimental to the enterprise as a whole. Managers may behave in their personal best interests, but not in the best interests of the company.

- May Lack Accuracy

If the organization lacks a rapid and effective reporting system, the results of responsibility accounting may be inaccurate. Delays in reporting make it harder for top management to assess performance and take corrective action in the event of an error.

Assume a corporation is unable to detect and communicate the triggers and variations to the manager in a timely manner. Reports on accountability may be delayed. Each responsibility center is free to prepare reports at its own pace. Delayed distribution or half-baked figures will cause more problems than they will solve.

- It is a Complex System

It is quite tough to create an organizational chart and effectively assign authority and responsibility to the appropriate person. Setting goals or objectives for each center is a difficult task. As a result, it is a complicated accounting method.

There may be times when the goals of the individual and the company conflict. It may stymie effective implementation. This accounting method may produce inaccurate findings in the absence of an effective reporting system.

- Not Suitable For Small Organizations

Responsibility accounting is a complicated and expensive system. As a result, it is not appropriate for small business enterprises with fewer operational activities and resources. It cannot be totally relied on as a management control tool. It is merely a system for directing management’s attention to areas of performance that required additional inquiry.