Concept of Capital Budgeting Decision

Capital Budgeting is the process of making investment decisions in fixed assets or capital expenditure. A capital budgeting decision is both a financial commitment and an investment. The resources of a business firm are invested in current and fixed assets. Current assets are acquired for the smooth running of business whereas fixed assets are purchased for generating revenue. The profitability of a firm depends upon the productive capacity of the fixed assets. Furthermore, the decision of investing in fixed assets has a far-reaching impact because it requires huge capital for a long period. By taking on a project, the business is making a financial commitment, but it is also investing in its longer-term direction that will likely have an influence on future projects the company considers. The failure of any project may lead the firm in the door of liquidation. Therefore, the cost, benefit, and probable risk of the proposed project should be analyzed systematically before making the investment.

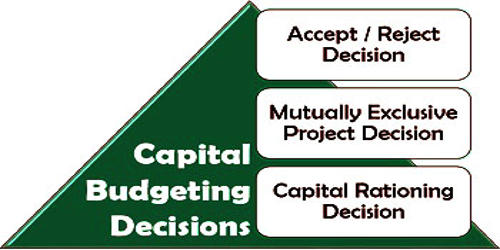

Capital budgeting decisions comprises of three words ‘Capital’, ‘Budgeting’, and ‘Decision’. The capital budgeting process can involve almost anything including acquiring land or purchasing fixed assets like a new truck or machinery. Capital means the fund or resource available for investing. Budgeting is the numerical aspect of planning. Decision or decision making is the process of deciding whether alternative action is to be undertaken or not. It is important because it creates accountability and measurability. Any business that seeks to invest its resources in a project without understanding the risks and returns involved would be held as irresponsible by its owners or shareholders. In this way, capital budgeting decision is the process under which different investment alternatives are evaluated and the best alternative is selected. It is a tool for maximizing a company’s future profits since most companies are able to manage only a limited number of large projects at any one time.

The rationale behind the capital budgeting decisions is efficiency. A firm has to continuously invest in new plant or machinery for expansion of its operations or replace worn-out machinery for maintaining and improving efficiency. In other words, capital budgeting decision is concerned with the long-term investment decision i.e. making a capital expenditure. Capital budgeting is the process by which investors determine the value of a potential investment project. The expenditure on a fixed asset such as land and building, furniture and fixtures, plant and machinery, etc. is called capital expenditure. The main objective of the firm is to maximize profit either by way of increased revenue or by cost reduction. The life of these fixed assets is more than one year. So, capital budgeting decision is concerned with long-term planning.