The audit that remains continue throughout the financial year is called continuous audit. This audit is usually done or preferred by those companies which are big and have plenty of transactions. This type of audit is essential to compile accounts on time. But at the same time, there may be a clash of duties among the accounting and audit staff.

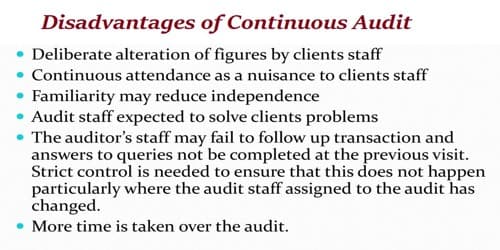

Disadvantages of Continuous Audit

In spite of the above-mentioned advantages of a continuous audit, there are certain drawbacks of such an audit which are as follows:

- Alteration of figures

In this system, the auditor checks the books of accounts in several visits. Figures in the books of account which have already been checked by the auditor at a previous visit may be altered by a dishonest clerk and the frauds may be committed. An alteration may happen intentionally or unknowingly. A dishonest clerk can do it do defraud the accounts.

- Disturbance of the client’s work

The frequent visits by the auditor may disturb the work if the client and cause inconvenience to the latter. There is a possibility of fraud, due to collusion between the audit staff and the clients’ staff. This system establishes intimacy among the staff and auditor. This intimacy may lead to fraud.

- Expensive

The continuous audit is an expensive system of audit because an auditor devotes more time. This audit may not be suitable for small scale concerns because it involves a lot of time, effort and money. The management has to pay a high salary to the auditor, as the audit is performed throughout the year. So, the company needs to pay more amounts as the remunerations of an auditor.

- Queries may remain outstanding

If the auditor’s two visits interval is long then so many queries remain outstanding. In this system, the audit work is not carried out at one time. The audit clerk may lose the thread of work and the queries which s/he wanted to make may remain outstanding as there might be a long interval between two visits.

- Extensive note-taking

Extensive note-taking may be necessary in order to avoid any alteration in the figures after the audit. Sometimes, it becomes routine and unimaginative without serving any purpose.

- Monotony

Under the continuous audit, the work of the auditor becomes mechanical and the auditor’s frequent visit may also lead to monotony in work. The work of audit becomes too mechanical because it remains to continue throughout the year.