Payback Period is the time where a project’s net cash inflows are equal to the project’s initial cash investment. Payback period (PBP) is the time (number of years) it takes for the cash flows of incomes from a particular project to cover the initial investment. Payback period is defined by CIMA as, ” The time required for the cash inflows from a capital investment project to equal the initial cash outflows.”

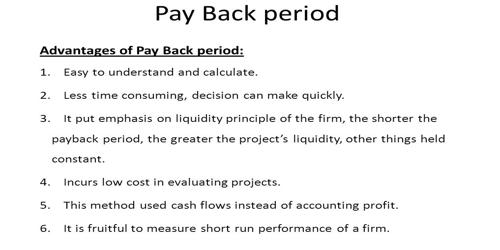

Advantages of Pay Back Period (PBP) –

(a) Pay back period is simple and easy to understand and compute. The calculation process is quicker than and simple than any other appraisal techniques. This helps the managers to make quick decisions, something that is very important for companies with limited resources.

(b) This period is universally used and easy to understand. A longer payback period indicates capital is tied up. Managers of such companies use this method to make a quick evaluation regarding projects with the small investment and short payback period.

(c) This period gives more importance to liquidity for making decisions about the investment proposals. Though other methods also use the same inputs, they need more assumptions as well. For instance, the cost of capital, which other methods use, requires managers to make several assumptions.

(d) This period deals with risk. Investment risk can be assessed through the payback method. The project with the shortest PBP has less risk than with the project with the longest PBP.

(e) The payback method is very useful in the industries that are uncertain or witness rapid technological changes. Such uncertainty makes it difficult to project the future annual cash inflows. Thus, using and undertaking projects with short PBP helps in reducing the chances of a loss through obsolescence.

(f) The short term approach of the payback period is an added advantage of the calculation of the capital expenditure. Since this analysis favors projects that return money quickly, they tend to result in investments with a higher degree of short-term liquidity. Such information is extremely crucial for small businesses with limited resources. Small businesses need to quickly recover their cost so as to reinvest it in other opportunities.

Consequently, despite its lack of rigorous analysis, there are still situations in which the payback period can be used to evaluate prospective investments. This method is often used as the initial screen process and helps to determine the length of time required to recover the initial cash outlay (investment) in the project.