Cost of Living refers to the amount of money required to maintain a minimum standard of living, by being able to afford the basic necessities of life such as food, clothing, shelter, transportation, telephone and internet, recreation, education, healthcare, taxes, and other utilities. It determines what amount we pay, for availing the necessary items and amenities.

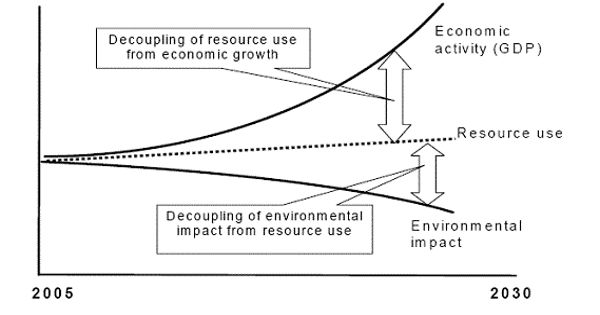

Changes in the cost of living over time are often operationalized in a cost-of-living index. Cost of living calculations are also used to compare the cost of maintaining a certain standard of living in different geographic areas. Differences in cost of living between locations can also be measured in terms of purchasing power parity rates. With the help of cost of living, one can easily make a comparison between one place to another, as it differs from area to area and also changes over time, i.e. the advancement of technology, modernization, and industrialization lead to an increase in the cost of living.

The cost of living is often used to compare how expensive it is to live in one city versus another. The cost of living is tied to wages. If expenses are higher in a city, such as New York, for example, salary levels must be higher so that people can afford to live in that city.

The cost of living is indicated through the measure of a Cost of Living Index and the Parity of the Purchasing Power.

- The Cost of Living Index – This index is a hypothetical price index that measures the living cot over time in countries. The index is availed quarterly and it considers the price of services and goods, allowing for the substitution with other valuables as prices fluctuate. The index is best used to compare the cost of living amongst different countries.

- Purchasing Power Parity – To measure the cost of living, this variable utilizes the difference in currencies to measure the cost of living. It is a theory which states that the rate of exchange between two currencies is equal to the ratio of the purchasing power of the currencies. Thus, it is correct to extrapolate that there is a difference in the cost of living, among the countries that use different currencies.

The cost of living can be a significant factor in personal wealth accumulation because a salary can provide a higher standard of living in a city where daily expenses such as rent, food, and entertainment are less. In contrast, a high salary can seem insufficient in an expensive city such as New York. In a 2018 survey, Mercer, a global human resources firm, finds the cities with the highest cost of living include Hong Kong; Luanda, the capital of Angola; Tokyo; Zurich, and Singapore, in that order. New York City was ranked the costliest city in the United States followed by San Francisco and Los Angeles, Chicago, Washington, and Boston.

Employment contracts and pension benefits can be tied to a cost-of-living index, typically to the consumer price index (CPI). A Cost-of-living adjustment (COLA) adjusts salaries based on changes in a cost-of-living index. Salaries are typically adjusted annually. They may also be tied to a cost-of-living index that varies by geographic location if the employee moves. In this latter case, the expatriate employee will likely see only the discretionary income part of their salary indexed by a differential CPI between the new and old employment locations, leaving the non-discretionary part of the salary (e.g., mortgage payments, insurance, car payments) unmodified.

Annual escalation clauses in employment contracts can specify retroactive or future percentage increases in worker pay which are not tied to any index. These negotiated increases in pay are colloquially referred to as cost-of-living adjustments or cost-of-living increases because of their similarity to increases tied to externally determined indexes. The cost-of-living allowance is equal to the nominal interest minus the real interest rate.

The rising cost of living has spurred debate over the U.S. federal minimum wage and the disparity between the lowest salary allowed by law and the earnings needed to maintain an adequate cost of living. Proponents of a hike in wages cite increased worker productivity levels since 1968 as inequitably correlated to the minimum hourly rate of pay. As pay levels once tracked the increase in productivity, the divergence between earnings and worker efficiency has reached historically disproportionate levels. By contrast, opponents of a minimum wage contend that a raise could spur higher consumer prices as employers offset rising labor costs.

For 2018, the Social Security cost-of-living adjustment (COLA) is 2.0% (a significant increase over the 0.3% figure used for 2017). The maximum Supplemental Security Income (SSI) benefit will go from $735 to $750, while the maximum SSI payment for a couple will go from $1,103 to $1,125. The estimated average monthly benefit for a disabled person will increase from $1,173 to $1,197. The estimated average monthly benefit for a retired person will increase from $1,377 to $1,404. The presumptive Substantial Gainful Activity (SGA) threshold will increase from $1,170 to $1,180 for non-blind individuals, but from $1,950 to $1,970 for blind individuals. The Trial Work Period (TWP) monthly amount will increase from $840 to $850. The amount of earnings needed for a worker to obtain a “quarter of coverage” or “credit” will increase from $1,300 to $1,320. Maximum taxable earnings under the Social Security OASDI program will go from $127,200 to $128,700.

In 2019, Social Security benefits increased by 2.8 percent the largest cost-of-living adjustment (COLA) in seven years.

Example:

The Economic Policy Institute updated its Family Budget Calculator in March 2018. The calculator helps families determine how much salary they will need to cover the cost of living in 3,142 counties in all 611 metro areas.

The calculator finds San Francisco to be the most expensive city and a two-parent household with two children would need a total income of $148,439 with a basic budget for expenses. The least expensive metro area was Brownsville, Texas where the same family would need a median income of $32,203. Interestingly, there is nowhere in the United States where a single adult with no children would be able to cover the cost of living earning the minimum wage.

The most recent survey was published in March 2017. Singapore remains the most expensive city in the world for the fourth year running, in a rare occurrence where the entire top five most expensive cities were unchanged from the year prior. Sydney and Melbourne have both cemented their positions as top-ten staples, with Sydney becoming the fifth most expensive, and Melbourne becoming the sixth. Asia is home to more than five most expensive cities in the top twenty but also home to eight cheapest cities of the cheapest ten.

Information Sources: