Comparative Statics

Most of the economic theory consists of comparative statics analysis. In economics, comparative statics is the comparison of two different economic outcomes, before and after a change in some underlying exogenous parameter. It is a tool used to predict the effects of exogenous variables on market outcomes. It is the determination of the changes in the endogenous variables of a model that will result from a change in the exogenous variables or parameters of that model. It helps us to know the direction and magnitude of changes in the variable when certain date change, so as to cause a movement to a new equilibrium position.

“Comparative statics is commonly used to study changes in supply and demand when analyzing a single market, and to study changes in monetary or fiscal policy when analyzing the whole economy.”

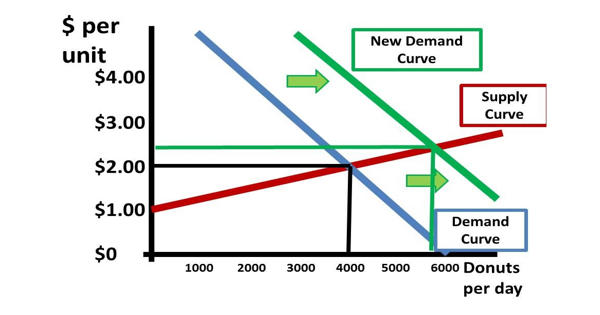

Comparative statics is the method of analyzing the impact of a change in the parameters of a model by comparing the equilibrium that results from the change with the original equilibrium. As a type of static analysis, it compares two different equilibrium states, after the process of adjustment (if any). It does not study the motion towards equilibrium, nor the process of the change itself. The term ‘statics’ is not usually meant to have descriptive content: although terms like ‘comparative dynamics’ and ‘comparative steady states’ are sometimes used, comparative statics analysis can be performed on dynamic economic models. By market outcomes, we mean the equilibrium price and the equilibrium quantity in a market. Comparative statics is a comparison of the market equilibrium before and after a change in an exogenous variable.

Comparative statics is commonly used to study changes in supply and demand when analyzing a single market, and to study changes in monetary or fiscal policy when analyzing the whole economy. There is very limited opportunity to establish the signs of the impacts of changes in macroeconomics or any field that does not have an explicit maximization or minimization operation involved. Comparative statics is a tool of analysis in microeconomics (including general equilibrium analysis) and macroeconomics. It is a method used to analyze the result of changes in a model’s exogenous parameters by comparing the resulting equilibrium to the original one. Comparative statics was formalized by John R. Hicks (1939) and Paul A. Samuelson (1947) but was presented graphically from at least the 1870s.

A comparative statics exercise consists of a sequence of five steps:

- Begin at an equilibrium point where the quantity supplied equals the quantity demanded.

- Based on a description of the event, determine whether the change in the exogenous variable shifts the market supply curve or the market demand curve.

- Determine the direction of this shift.

- After shifting the curve, find the new equilibrium point.

- Compare the new and old equilibrium points to predict how the exogenous event affects the market.

For models of stable equilibrium rates of change, such as the neoclassical growth model, comparative dynamics is the counterpart of comparative statics. But in microeconomics comparative statics is a powerful tool for establishing important deductions of theories.