Concept of Retirement of a Partner

One major change in the constitution of a partnership firm may occur if a partner undergoes retirement from the firm or in the event of his death. A partner or partner may retire from the firm due to various reasons like old age, better opportunity, ill health, a conflict between the partners and so on. A partner retires when he ceases to be a member of the firm without ending the subsisting relations between the other members of the firm or between the firm and other parties. The retirement of a partner extinguishes his interest in the Partnership firm and this leads to the dissolution of the firm or reconstitution of the Partnership. The retirement of a partner can take place in any of the following grounds:

- In accordance with the constant or consensus among all the members.

- In accordance with the partnership agreement which has already been signed.

- In accordance with the written notice, if the partnership is at will.

Adjustments

When a partner retires his share in the properties of the firm has to be ascertained and paid off. These adjustments are very similar to those which we saw in connection with the admission of a partner. The adjustments that need to be done at the time of retirement of a partner are as follows:

- Calculation of new profit sharing ratio – When a partner of a firm retires, it is for the continuing partners to agree amongst themselves as to in what ratio, they shall share the profit and loss of the firm in the future.

- Revaluation of assets and liabilities – If it is agreed to revalue the assets and liabilities on the retirement of a partner, the Profit and Loss Adjustment Account or Revaluation Account is prepared.

- Adjustment regarding undistributed profits and losses – It is necessary to divide the accumulated reserve or undistributed profit among all the partners in their old profit or loss sharing ratio. When the distribution is over, they do not appear in the Balance Sheet.

- Adjustment regarding goodwill – The valuation of goodwill may be done according to the provisions of the Partnership Deed.

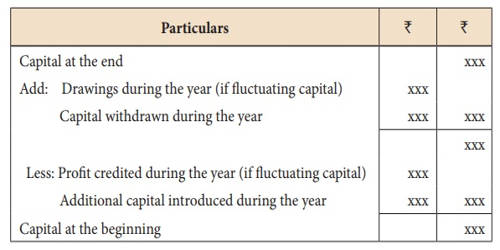

- Mode of payment to the outgoing partners – To find out the amount payable to retiring partner, the following items are considered: Proportionate profit on revaluation and Share of goodwill.