A hostile takeover is when one corporation acquires another against the wishes of the board and/or management of the target company. The distinction between a hostile and a friendly takeover is that, in a hostile takeover, the board of directors of the target company does not authorize the deal. In a shared arrangement, most mergers and acquisitions occur. There is a negotiation phase, and the two companies agree to become one by complete disclosure of the financial situation and prospects of each entity. Via either a tender offer or a proxy battle, a hostile takeover may be achieved.

In any case, in a hostile takeover, on the grounds that the objective organization has not consented to be gained, they may not share the entirety of the significant money related data that isn’t public information. In some cases, an organization’s administration will safeguard against undesirable hostile takeovers by utilizing a few dubious methodologies, for example, the poison pill, the crown-gem guard, a freebie, or the Pac-Man protection. For instance, Company X is hoping to seek a corporate-level procedure and venture into another geological market.

- Company X approaches Company Y with a bid-offer to purchase Company Y.

- The Board of Directors of Company Y decides that this is not in the best interest of the shareholders of Company Y and refuses the offer to tender.

- Despite seeing the bid-offer denied, Company X continues to push for an attempted acquisition of Company Y.

- Company X is still attempting to purchase Company Y in the above case, considering the rejection of its bid. This situation will then be referred to as a hostile takeover attempt. Some protections, such as the poison pill or a golden parachute, can be used by target firms to fend off hostile takeovers.

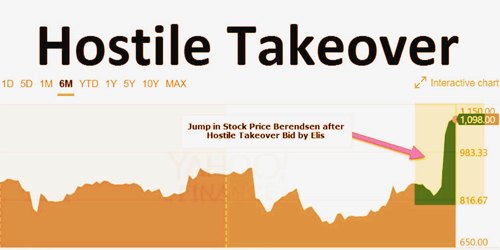

Example of Hostile Takeover

When a party tries to gain ownership of a business without the permission or approval of the board of directors of the target company, a hostile takeover bid occurs. There are two hostile takeover tactics that are frequently used: a tender offer or a proxy vote.

Tender offer – At the point when a company or an organization, a financial specialist, or a gathering of speculators makes a tender offer to buy the portions of one more organization including some hidden costs over the current market esteem, the directorate may dismiss the offer. A tender offer is really a proposal to buy stock offers from Company B investors at a higher cost than normal to the market cost. The objective of a delicate offer is to gain enough democratic offers to have a controlling value enthusiasm for the objective organization. The offer of the stock possibly happen if an adequate number of investors, typically a lion’s share, consent to acknowledge the offer. Indeed, most tender offers are made restrictive on the acquirer having the option to get a pre-defined measure of offers.

Proxy vote – A proxy vote is the takeover company’s act of persuading current shareholders to vote out the target company’s management so that it will be easier to take over. If appropriate proxies are obtained by a business that makes a hostile takeover bid, it may use them to vote to approve the offer. For instance, Company A could convince investors of Company B to utilize their intermediary votes to make changes to the organization’s top managerial staff. The objective of such an intermediary vote is to eliminate the board individuals contradicting the takeover and to put in new board individuals who are more open to an adjustment in proprietorship and who, thusly, will cast a ballot to endorse the takeover.

Factors that play into a hostile takeover from the acquisition side also align with those of any other takeover, such as thinking that a business might be substantially undervalued or having access to the brand, operations, technology, or market foothold of a company. Hostile takeovers can also be strategic actions by activist investors who aim to alter the practices of a business. There are many protections that can be used by the management of the target organization to deter a hostile takeover. They include the following:

- Poison Pill – This sort of protection is intended to make the objective organization less appealing or alluring to the gaining organization. A model would be a proviso in the investor understanding that says if there is a takeover, existing investors (aside from the acquirer) can purchase extra offers at a limited value, which would weaken the acquirer’s offers and make them less significant. The expectation is that by making the obtaining more troublesome and more costly, the future acquirer will desert their takeover endeavor.

- People Pill – This is a requirement that some key employees of the target company must resign in the event of an acquisition, denying valuable leadership to the acquiring company.

- Pac-Man Defense – The target company buys shares of the purchasing company and tries to purchase its own. If it feels it is in danger of losing control of its own company, the acquirer will abandon its takeover attempt. Obviously, this strategy allows Company B to have a lot of money to purchase a lot of shares in Company A. Thus, for a small company with minimal financial resources, the Pac-Man protection is typically not workable.

- Crown Jewel Defense – The target company sells off its most valuable assets in the event of a takeover attempt, making it less appealing.

To secure against threatening takeovers, an organization can build up stocks with differential voting rights (DVR), where a stock with less democratic rights delivers a higher profit. This makes imparts to a lower casting a ballot power an alluring venture while making it more hard to create the votes required for an unfriendly takeover if the board claims an enormous enough bit of offers with additionally casting a ballot power. The term is frequently utilized comprehensively to incorporate a scope of protections, including giving both extra obligation to make the objective less alluring and investment opportunities to workers that vest upon a merger.

Information Sources: