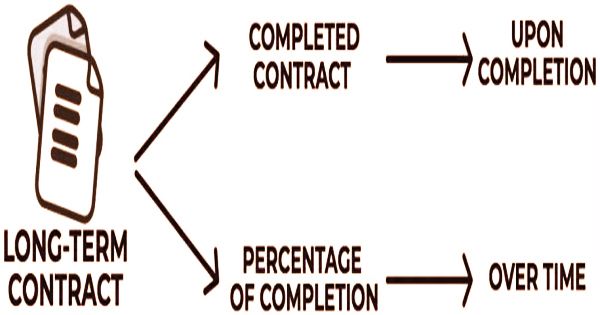

The Completed-Contract Method (CCM) is an accounting method that allows taxpayers and companies, even though cash payments have been given or obtained during a contract period, to delay documentation of revenue and expenditures until after a contract is completed. This approach is used here under the terms of a contract, there is confusion regarding the receipt of funds owed from a client. GAAP permits another technique for income acknowledgment for long haul development gets, the level of-culmination strategy. With this technique, income is perceived when the agreement is satisfied. In the building industry or other industries that tend to include long-term contracts, CCM is commonly used. When the remaining costs are negligible, the contract is deemed complete.

CCM is utilized when there is capriciousness in the assortment of assets from the client. It is easy to use, as it is anything but difficult to decide when an agreement is finished. This strategy yields similar outcomes as the level of consummation technique, yet simply after an undertaking has been finished. This approach does not yield any valuable knowledge for the reader of a company’s financial statements before completion. This practice of accounting compares with the accounting techniques of cash and accrual. The delay in the receipt of revenue, however, allows a corporation to postpone recognition of associated income taxes.

(Example of Completed Contract Method)

The finished agreement strategy is utilized when expenses are hard to gauge, there are numerous progressing little positions (once work), and ventures are of brief length. The money strategy perceives incomes and costs when money is either gotten from customers or paid to merchants. Simply stated: sales or expenditures become actual when cash changes hands. This form (CCM) will only be used if the job is done within two years of the start of the contract. Even if real money does not change hands at any time, the accrual accounting method considers revenues and expenditures during the time when the activities that received the revenue or generated the cost occurred.

Moreover, under the finished agreement technique, there is no compelling reason to assess expenses to finish a task all expenses are known toward the fruition of the venture. And because the recognition of revenue and expenditures only happens at the completion of a project, the timing of the recognition of revenue can be both delayed and extremely erratic. Given these problems, only in the following situations could the procedure be used:

- If accurate estimates of the percentage of completion of a project cannot be derived; or

- If there are inherent risks that can interfere with a project completion; or

- At the point when agreements are of quite a transient nature that the outcomes revealed under the finished agreement strategy and the level of fruition technique would not shift really.

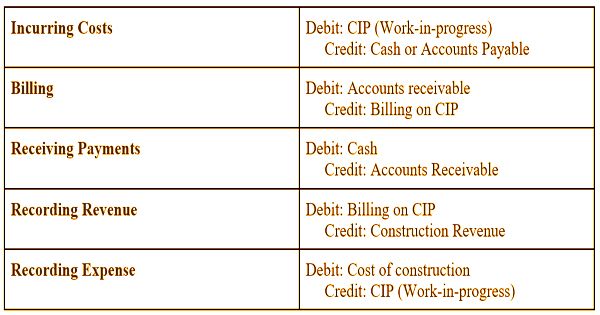

Journal entries for the completed contract method are as follows:

The completed-contract method is unique in that it enables all identification of income and expenditures to be postponed before a contract is completed. This can provide the balance sheet of a company with both advantages and disadvantages. In the event that an agreement is being represented under this technique, record billings gave and costs acquired on the asset report during all periods preceding the finish of the agreement, and afterward move the whole measure of these billings and expenses to the pay endless supply of the basic agreement. On the one side, tax liabilities are also delayed, in-kind because revenue identification is postponed. Recognition of costs, which can minimize taxes, is likewise delayed.

An agreement is thought to be finished when the leftover expenses and dangers are immaterial. On the drawback, if a group of agreements completes at the same time, this may make an unexpected flood of incomes or costs, which can cause extremist accounting report vacillations. If there is an expectation of a loss on a deal, record it even under the completed contract method at once; do not wait to do so until the end of the contract term. This can make companies appear inconsistent with market analysts from the viewpoint of aesthetics, which might consequently flag those businesses as investment risks.

Information Sources: