Year-to-date (YTD) is a period which is determined on the basis of the number of days from the beginning of the calendar year (or fiscal year) to the date specified. YTD information is useful for evaluating market patterns over time or comparing rivals or peers in the same industry with performance data. It is commonly utilized for the computation of speculation returns on a security or an association’s salary to the current date. It is usually utilized in bookkeeping and accounts for money related announcing purposes.

In certain cases, year-to-date is used, primarily to document the outcomes of operation in the span between a day (exclusive, as this day may not yet be “complete”) and the beginning of the year. Managers may make a contrast between the current performance of the company and the performance of previous years by measuring YTD outcomes. Therefore, if someone uses YTD while bearing on the calendar year, it’s the fundamental quantity between January 1 and also the specified date. If someone uses YTD in relation to a financial year, it’s the fundamental quantity between a company’s yr start and also the specified date.

Year to Date (YTD)

For instance, the financial year for many companies is on January 1. As of the current date (April), the YTD results for Company A are $500,000 in January, 250,000 in February, 356,000 in March, and $485,000 in April, a total of $1,591,000 YTD. Comparing the YTD outcomes with the previous fiscal year’s results helps the manager of the organization to recognize areas that may need improvement.

On the other hand, to prevent distortion of performance due to seasonal or other factors, the YTD comparison should be carried out on companies with a similar fiscal year start date. In the absence of a precise reference to the YTD for a calendar or fiscal year, it is fair to say that the YTD refers to a calendar year.

YTD financial information is beneficial for management because it could be a great way to test in on the financial health of an organization on an interim basis instead of waiting until the tip of the year. YTD is also given in financial statements in the sense of finance, describing the results of a corporate organization. Providing current YTD results, as well as YTD results from the same date for one or more prior years, enables owners, employees, investors, and other stakeholders to equate the current performance of the business with that of previous periods. Employees’ tax could also be supported by total earnings within the tax year up to now.

The formula for measuring a portfolio’s YTD return in relation to the calendar year is as follows:

Year to Date (YTD) = Specified date value / Start of calendar year value – 1

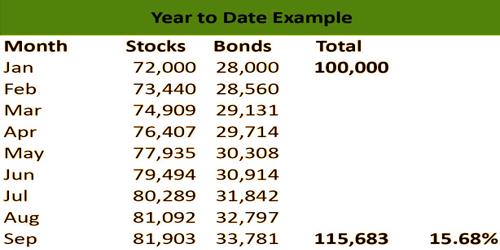

Any situation in which a person wants to calculate the change in value from the beginning of the year to a given date can be applied to the YTD formula. For example, the formula can be used to measure the YTD on sales figures, business expenses, earnings, stock returns, bond returns, etc., instead of calculating the YTD on a portfolio.

Examples of Year to Date (YTD)

Year to Date (YTD) describes the return up to now this year. As an example, the year to date return for the stock is 8%. This suggests from January 1 of this year to this point, the stock has appreciated by 8%. The YTD return refers to the amount of profit produced after the first day of the current year by an investment. To assess the performance of investments and portfolios, investors and analysts use YTD return details. It may be misleading to compare YTD steps if not much of the year has occurred, or the date is not clear. Measures of YTD are more susceptible than late changes to early changes.

YTD earnings also confer with the number of cash a private has earned from Jan 1 to this date. This amount typically appears on an employee’s pay stub, together with information about Medicare and social insurance withholdings and tax payments. Contrast YTD to the 12-months-end (or Year-end) definition, which is more immune to seasonal influences. YTD earnings can also define the amount of money received since the beginning of the year by an independent contractor or company.

Information Sources: