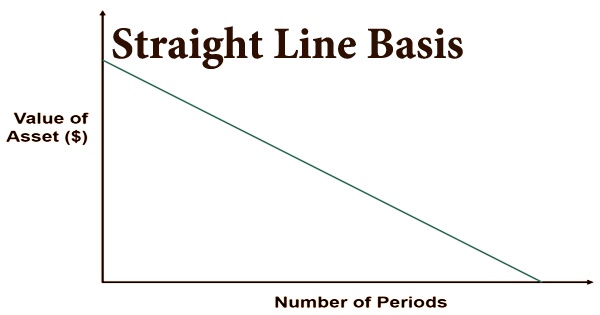

The difference between an asset’s cost and its ultimate salvage value, divided by the number of years it remains usable and in service, is used to calculate depreciation and amortization on a straight line basis. It’s a formula for calculating an asset’s rate of depreciation over its useful life. Other normal techniques used to figure deterioration costs of fixed resources are amount of year’s digits, twofold declining equilibrium, and units created. This technique is otherwise called the Straight-Line Depreciation strategy to compute amortization of elusive resources. The difference between an asset’s cost and its estimated salvage value is divided by the number of years it is expected to be used to measure the straight line basis.

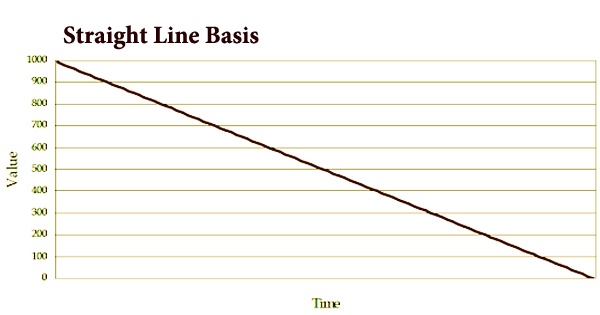

Straight Line Basis ascertains deterioration which is a bookkeeping proportion of the “loss” of worth of a resource over the long run. As such, devaluation addresses the worth a resource misfortunes each time it is utilized. Straight line basis charges an equivalent cost add up to each accounting period. It is assumed that the asset’s value depreciates at the same rate over each accounting period of its useful life. Depreciation is calculated over the “useful life of the asset,” which is a period of time. Each asset has a predetermined lifespan. A house, for example, can depreciate over 30 years, while capital equipment may depreciate over 10 years.

In accounting, there are a wide range of shows that are intended to coordinate with deals and costs to the time frame in which they are brought about. One show that organizations embrace is alluded to as devaluation and amortization. In the field of accounting, various computing techniques are used to precisely align asset expenses with the appropriate time periods. To minimize net profits, companies use the straight line basis to expense the valuation of an asset over accounting periods. Accountants lean toward the straight line basis to ascertain a resource’s devalued worth since it is basic and simple to utilize.

Depreciation of fixed assets such as cars and industrial equipment, as well as amortization of intangible assets such as intellectual property rights and software patents, have a substantial effect on a company’s operating costs, and the precise computation of these values provides a clearer image of gains and losses over time. The measure of the deterioration during any time of the resource’s valuable life might be taken as a “cost” on an organization’s or person’s benefit and misfortune articulation. Organizations use devaluation for actual resources, and amortization for elusive resources like licenses and programming.

Both conventions are used to expense an asset over a longer period of time rather than only during the period in which it was bought. Accounting’s matching theory dictates that depreciation and amortization be registered. The coordinating with rule is the premise of gathering accounting, which requires costs that are caused to be recorded in similar period as the incomes procured. The show is intended to coordinate with deals and costs to the time frame in which they happened, instead of when installment was made or gathered. In other words, businesses will spread the cost of investments over a variety of time periods, allowing them to reap the benefits of the asset without deducting the entire cost from net income (NI).

The straight line basis technique is one of the numerous strategies, and a convenient device to assess the diminishing upsides of resources. To compute straight line premise, take the price tag of a resource and afterward take away the rescue esteem, its assessed sell on esteem when it is not, at this point expected to be required. Then multiply the result by the total number of years the asset is supposed to be useful, also known as the useful life in accounting. It’s quick to calculate, with just three variables in the formula, and it’s easy to implement in a variety of situations. It’s much more reliable than other approaches, and it keeps expenditures consistent across accounting periods.

Straight line basis devaluation doesn’t consider the fast or sped up loss of a resource’s worth temporarily, which is particularly essential for resources like vehicles. It is well known on the grounds that it is not difficult to figure and comprehend, despite the fact that it likewise has a few disadvantages. According to the Generally Accepted Accounting Principles (GAAP) guidelines, there are five ways to calculate depreciation. Each of these strategies is dependent on the existing tax laws as they apply to specific properties.

Formula of Straight Line Basis:

Straight Line Basis = (Purchase Price of Asset – Salvage Value) / Estimated Useful Life of Asset

Straight line basis is likewise used to amortize fixed and immaterial resources, like programming and licenses. Devaluation of fixed resources is like amortization, and in both, the straight line basis is normally used to ascertain the cost sum. Although depreciation does not increase a company’s income, it does add a significant accounting cost, enabling capital asset-intensive businesses to significantly boost their balance sheets. Organizations use deterioration and amortization to discount a resource throughout an extensive stretch of time, instead of deducting the full expense of the resource in the time frame it was bought.

The straight line approach is common among accountants because it is simple to use, produces less errors over the asset’s lifetime, and costs the same amount each accounting cycle. The approach distributes an equal sum to each accounting cycle over the asset’s useful life, making it a predictable cost and allowing net income to be smoothed. In contrast to more perplexing procedures, for example, twofold declining balance, straight line is basic and uses only three distinct factors to compute the measure of devaluation each bookkeeping period. Be that as it may, the effortlessness of straight line basis is additionally perhaps the greatest disadvantage.

The asset’s useful life is dependent on guesswork, which is one of the most apparent drawbacks. The possibility of an asset being redundant sooner than expected due to the disruptive nature of innovative technology, for example, is not taken into account. Furthermore, the straight line basis ignores the asset’s rapid loss of value in the near term, as well as the probability that it will cost more to sustain as it ages.

Information Sources: