Capital gain is an economic term that is an improvement in the value of an asset or investment arising from an asset or investment’s price appreciation. A capital gain can be short-term (one year or less) or long-term (more than one year) and must be redeemed for income taxes. All in all, the gain happens when the current or deal cost of a resource or speculation surpasses its price tag. Capital gains are owing to a wide range of capital resources, including, however not restricted to, stocks, bonds, generosity, and land. As taxable income, the entire value received from the sale of a capital asset is considered. The transfer of a capital asset should take place in the preceding fiscal year in order to be liable for taxes during the financial year. Capital gains are regularly dependent upon tax assessment, of which rates and exclusions may contrast between nations.

The Internal Revenue Service (IRS) classifies capital gains according to the period of possession of the property by the taxpayer. The history of the capital gain comes from the birth of the modern economic system and a number of economic thinkers have defined its evolution as complex and multidimensional. The idea of capital gain might be viewed as equivalent with other key financial ideas, for example, benefit and pace of return; anyway, its distinctive element is that people, not simply organizations, can gather capital gains through regular obtaining and removal of resources. Though capital gains are normally associated with stocks and funds because of their inherent price fluctuations, any security that is sold at a price greater than the purchase price that was paid for it may have a capital gain.

(Example of Capital Gain)

Acknowledged capital gains and misfortunes happen when a resource is sold, which triggers an available occasion. Hidden additions and misfortunes now and then alluded to as paper gains and misfortunes, mirror an expansion or decline in a venture’s esteem yet have not yet set off an available occasion. With the establishment of the Babylonian financial system around 2000 B.C., the official beginning of the realistic implementation of the capital gain occurred. This scheme introduced treasuries where people could deposit silver and gold for safekeeping purposes, as well as negotiate with other members of the economy. Although numerous individuals partner the term with stocks and bonds, capital resources are anything an individual possesses and uses for individual and speculation purposes. This incorporates houses, furniture, mint piece assortments, valuable metals, and jewelry.

The following are not included under capital assets:

- Any stock, consumables, or raw materials kept for the purpose of the organization or occupation.

- Goods that are kept for personal use, such as clothing or furniture.

- Land for agriculture in any part of rural India.

- Special bearer bonds that were issued in 1991.

- Gold bonuses issued by the Central Government, such as the 1977 gold bonus of 6.5 percent, the 1980 gold bonus of 7 percent, and the 1980 security gold bonus.

- Gold deposit bonds issued under the gold deposit scheme (1999) or deposit certificates issued under the Gold Monetisation Scheme (2015).

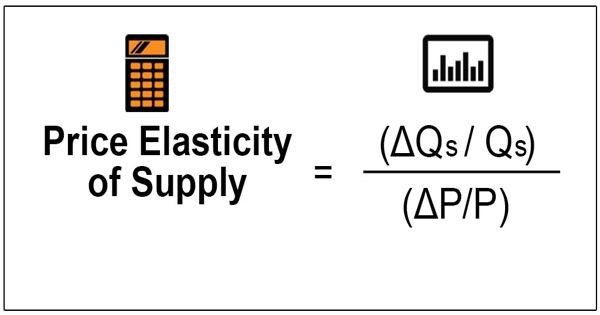

Capital gain is for the most part determined through taking the deal cost of a resource and deducting its base expense and any brought about costs. The subsequent worth will be the capital gain, or capital misfortune if negative. In fact, many governments provide both individuals and companies with supplementary methods of measuring capital gains. By lowering the estimated capital gain amount, these strategies will provide tax relief. Duty cognizant common asset financial specialists ought to decide a shared asset’s hidden amassed capital gains, which are communicated as a level of its net resources, prior to putting resources into an asset with a critical undiscovered capital gain segment. This condition is referred to as the capital gains exposure of a portfolio. When distributed by a stock, capital gains are a taxable duty on the holders of the fund.

The benefit from capital may be realized or unrealized. The realized benefit is the gain from an asset or investment’s final sale. Conversely, when the current price of an asset or investment reaches its purchase price, an unrealized benefit occurs, but the asset or investment is still unsold. Note that lone acknowledged capital increases are burdened, while undiscovered (capital) gains are only paper picks up that are normally liable to bookkeeping announcing yet don’t trigger an available occasion. Profits against an investment may be roughly split into the following categories, depending on the tenure of holding an asset:

- Short term capital gain: When an asset is sold within 36 months of the sale, short-term capital gains are regarded as the income gained from it. For example, if a property is sold within 27 months of the purchase, short-term capital gains can occur. In any case, residency changes on account of various resources. For Mutual Funds and recorded offers, Long term capital gain occurs if a resource is sold subsequent to keeping down for 1 year.

- Long term capital gain: Long-term capital gains are known as the benefit gained from selling an asset kept for more than 36 months. In the largest tax bracket, the rate is 20 percent. A 15 percent long-term capital gains tax limit qualifies for most taxpayers. However, it isn’t material if there should arise an occurrence of mobile resources, for example, gems, obligation situated Mutual Funds, and so on besides, a couple of resources are considered as momentary capital resources if the holding period is under a year.

In the taxation of capital gains gained by individuals and companies, there are generally major variations, and the OECD (Organization for Economic Cooperation and Development) acknowledges three simple categories of individual capital income taxed by its member nations around the world. These incorporate profit pay, premium pay, and capital increases acknowledged through property and offers. The figuring’s of capital gains are subject to the sort of resources and their holding period. The following are a few words that a person must know before calculating income against their capital investments:

- Full value consideration – It is the consideration that is received in exchange for a capital asset by a seller.

- Cost of acquisition – The purchase cost is the value of an asset when it is purchased by a seller.

- Cost of improvement – The cost of enhancement is the amount of costs incurred by a seller to make certain enhancements or improvements to a capital asset.

The average OECD dividend tax rate is 41.8%, with dividends frequently taxed at both corporate and individual levels and listed as first corporate income and second personal income. The cost of purchase, cost of improvement and the total expense incurred in connection with the transfer of ownership must be excluded from the value received. Mutual funds that have amassed acknowledged capital increases over the span of the year should convey those additions to investors. Numerous shared assets circulate capital picks up just before the finish of the schedule year.

In general, an asset or investment’s retention time affects the tax rate applied to a capital gain. Shareholders of record earn the allocation of the fund’s capital gains as of the ex-dividend date of the fund. For example, if the increase is a present moment (as characterized above), it is charged at the normal personal expense rate. Then again, long term (capital) gains are generally charged at a lower charge rate. The capital gain can be taxed at a 20 percent rate, for example, if the ordinary tax rate is 35 percent. The net asset value (NAV) decreases by the sum of the distribution when a mutual fund makes a capital gain or dividend distribution. A distribution of capital gains does not affect the overall return of the investment.

Information Sources: