Audit of Non-Governmental Organizations (NGOs)

The non-governmental organization (NGO) is an organization which is established by a group of people to render service to the nation and people. NGOs should make an audit of books of accounts every year. NGOs, in their own interest, should get their accounts audited regularly, even if there is a negligible transaction, every year and file income tax return. An auditor should perform the following tasks while conducting an audit of NGOs:

NGO has its own memorandum. S, an auditor should study it to know its activities.

NGOs may receive a grant from foreign institutions. So, the auditor should check whether it is received as per the provision of financial rules and regulations of the nation or not.

As per the income tax Act, filing Income Tax Return is also required for NGOs having PAN Card.

The auditor should check the use of government’s grants and a proper account is maintained for the recording of such grants or not.

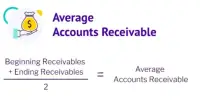

If such an institution has received a donation from any individual or organization, an auditor should check accounting of such amount and its use.

Ensuring the transparency, integrity, and performance of an NGO is of crucial importance to stakeholders such as donors, beneficiaries, contractors or local authorities.

The auditor should examine the amount received as subscription ratifying with counterfoils of the receipts.

The auditor should study the decisions taken by the executives. It can also be used to help position the NGO against other organizations working in the same sector or region.

The auditor should make physical verification of assets ratifying with store ledger.

The auditor should check the liabilities and also that its assets and its transfer are proper or not.

Information Source: