1. EXECUTIVE SUMMARY

Transamin is a potent synthetic agent that inhibits specifically the actions of plasminogen activator and plasmin which inhibits fibrinolytic action.

Marketing Strategy

Most of the resources of Transamin will be deployed around large use area i.e. in urological surgery and functional uterine bleeding.

Positioning

- Functional uterine bleeding

- Haemorrhage in prostectomy

- Dental extraction in haemophilics or menorrhagia

- Hereditary angioedema

- Streptokinase overdose

Proposition: why this drug- what is its superiority

Differentiation

Transamin has following distinct features and benefits which make it completely different and preferred choice of agent by physicians community than other available products:

a) Improvement over aminocaproic acid in terms of potency

b) Low toxicity

c) No purpuric rash like aminocaproic acid

d) Risk of DVT and PE is less

Key Promotional Activities

Promotional activities will be concentrated around almost all targeted doctors and specific departments like Urology, Gynaecology, General Surgery, Orthopaedic Surgery, Dental Surgery, etc. with frequent visits to build awareness about a safe and effective surgery.

Most Significant Tactical Action

- Gynaecologists and Surgeons should be explained about high incidence of postoperative bleeding, which can be easily managed with Transamin.

- Without creating this awareness selling Transamin in various surgical bleeding will be very difficult here in Bangladesh.

Profit and Loss Account

Sales turn over is gradually increasing over the planned period (Table 9,10.11, Page 12,13,14). Gross Profit although very low but is increasing by value. Three different situations have been analysed based on three different prices. Direct expenditure as % of net sales is also decreasing. Net product contribution although negative seems to be improving over the time.

2. PRODUCT PROFILE

Indications

- Tranexamic acid act by inhibiting plasminogen activation and fibrinolysis, and useful in

- To Gynaecologists: Transamin is the choice of agent in acute Functional uterine bleeding, bleeding in radical cure operation of cervical cancer, Abnormal bleeding at labour, Treatment of Idiopathic or IUD-Induced Menorrhagia

- To Urologists: Prostatic surgery

- Ophthalmologists: Ocular trauma, prevention of corneal oedema

- Neurosurgery: Prevention of Rebleeding in Subarachnoid Haemorrhage

- To Surgeons: Prevention of bleeding after Surgery and Trauma, Bleeding during operation of gastric cancer,

- To ENT specialists: Operation of sinusitis. Tonsillectomy and Adenoidectomy, Thyroid surgery

- Internists: Treatment of gastric and intestinal haemorrhage

- To ENT specialists: in tooth extractions in patients with Haemophilia

Contraindication

Thromboembolic disease

Side-Effects

Nausea, vomiting, diarrhoea, giddiness on rapid intravenous injection

Cautions

Reduce dose in renal impairment, massive haematuria, regular eye examination and liver function test in long term use

Dose

Orally: 1-1.5g 2-4 times daily

I.V: 0.5-1g 3 times daily

Presentations

Oral: Transamin Tablet 250mg

Transamin Capsule 500mg

I.V.: Transamin injection 250mg/5ml

Transamin injection 250mg/2.5ml

Transamin injection 1g/10ml

Since internationally Transamin is available in both tablet and capsule forms it would be convenient to market either 250 and 500mg tablets or 250 and 500mg capsule forms to avoid any confusion.

3. Market Characteristics, Trends

AND COMPETITIVE ENVIRONMENT

Quantitative market data

Overall market situation (IMS, I QTR, 2000)

A. Total pharma market is valued at Tk 14,931m in the year 2000 with a growth rate of 6%.

- Total anti-bleeding market: 41.36 m

B02A: Antifibrinolytic market: 19.18 m with growth rate of 53%

B02G: Haemostyptics: 22,18 m with grwoth rate of -25%

Background of the market

– There is a general fearness about bleeding among physicians, surgeons, gynaecologists

– Little understanding about haemostasis and bleeding by local doctors

– Doctors are learning about bleeding and coagulation cascade with the advent of LMWHs

Competitive environment

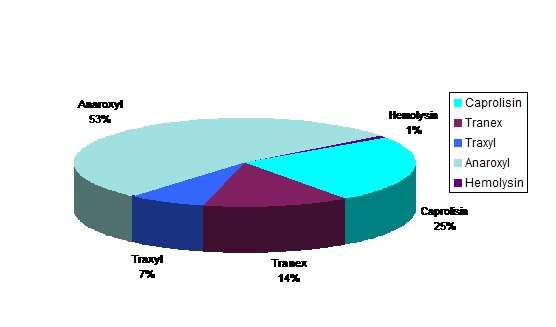

Market share of 5 different brands:

Anti-bleeding market is small but consistent in size with low growth rate. But a large number of brands will emerge as soon as RPR creates the awareness and build a new market. Therefore, from 2001 the market is like to grow faster than its normal trend.

Table-1: Market situation of existing products (IMS)

| Dosage form | Sales in 1998 | Sales in 1999 | Sales in 2000 YTD (1Q) | ||||||

| Vol | Val | Gr% | Vol | Val | Gr% | Vol | Val | Gr% | |

| Caprolisin infus amp 2g x 10ml 20’s pack Tk 645 MRP | 118800 | 3388000 | -29 | 53800 | 5726000 | 69 | 32900 | 10263000 | 193 |

| Tranex cap 500mg 30’s pack Tk 674.50 MRP | 19500 | 5451000 | 599 | 9600 | 4833000 | 0 | 10700 | 5368000 | 14 |

| Tranex inj 500mg/5ml 6 amps pack Tk 287.10 MRP | 9900 | 619000 | 604 | 2300 | 304000 | -51 | 1400 | 363000 | 49 |

| Traxyl cap 250mg 48’s pack Tk 296.16 MRP | 15500 | 3031000 | – | 10600 | 2761000 | 10 | 10400 | 2704000 | -14 |

| Traxyl inj 250mg/5ml 5 amps pack Tk 102.00 MPR | 5900 | 526000 | – | 4600 | 412000 | -22 | 4300 | 382000 | -37 |

| Anaroxyl tab 2.5mg 50’s pack Tk 446.00 MRP | 70900 | 27567000 | -10 | 43800 | 17164000 | -38 | 45900 | 17987000 | -22 |

| Anaroxyl inj 5mg/5ml 5 amps. Pack Tk 160.00 MRP | 54900 | 7447000 | 16 | 28500 | 4011000 | -46 | 29900 | 4197000 | -35 |

| Hemolysin inj 10 amps pack Tk 150.00 MRP | 800 | 101000 | |||||||

| Total |

| 48029000 |

|

| 35211000 | -27 |

| 41365000 | 17 |

Table-2: Pricing position of currently available 3 major brands and Transamin:

| PRODUCT | PACK SIZE | COMPOSITION | CAMPANY | MRP/ Tab/Inj (Tk) | MRP/ Pack (Tk) | MRP/ Pack (US $) |

| Anaroxyl 2.5mg Tab | 50s | Monosemicarbazone Adrenochrome | Organon: Local Manufacture | 10.00 | 500 | 9.26 |

| Anaroxyl 5mg/ml Inj | 5s | Monosemicarbazone Adrenochrome | Organon: Local Manufacture | 32.00 | 160 | 2.96 |

| Traxyl 250mg Cap | 48s | Tranexamic acid | Organon: Local Manufacture | 6.25 | 296.16 | 5.48 |

| Traxyl 250mg/5ml Inj | 5s | Tranexamic acid | Organon: Local Manufacture | 20.00 | 102.00 | 1.89 |

| Tranex 500mg Cap | 30s | Tranexamic acid | Menarini, Italy | 19.15 | 574.50 | 10.63 |

| Tranex 500mg/5ml Inj | 6s | Tranexamic acid | Menarini, Italy | 47.85 | 297.10 | 5.50 |

New scenario based on revised price (02 Nov 2000)

| Transamin 250mg Cap | 100s | Tranexamic acid | Daiichi | 9.77 | 976.75 | 18.09 |

| Transamin 500mg Tab | 100s | Tranexamic acid | Daiichi | 17.58 | 1758.15 | 32.56 |

| Transamin 250mg/5ml Inj | 50s | Tranexamic acid | Daiichi | 97.68 | 4883.76 | 90.44 |

4. Marketing Objective

General statement

To establish Transamin as an agent of choice to stop per-operative (during operation) and post operative bleeding in Urology, Gynaecology, General Surgery, Orthopaedic Surgery, Dental Surgery.

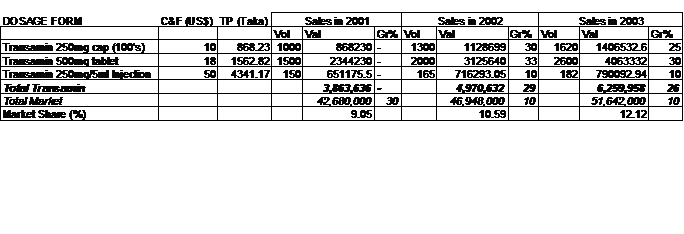

Sales forecast, growth and market share

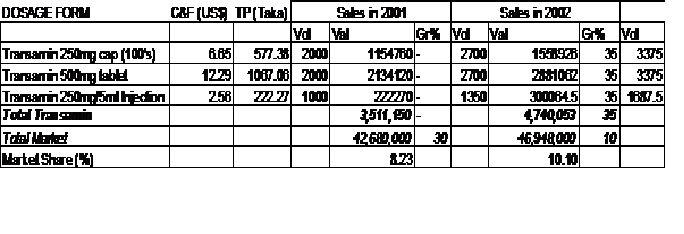

Three year sales forecast of Transamin for 2001, 2002 and 2003 based on C&F price (Table 3) offered by M/s Business Point, and two other scenario based on competitive market pricing is given below.

Table-3:Situation 1, Based on price proposed by Business Point on 02 Nov 2000

Table-4:

Situation 2, Based on proposed price in comparison to Traxyl of Organon

Key issues

- Little understanding of our doctors regarding coagulation cascade and related products

- GP based market: low potential of specialised products

- The market has to be cultivated first by generating interest and developing awareness since currently available brands did not popularise the concept

- High price of Transamin, even if compared against same molecule of other multinationals

Key assumptions

- Need of an anti-bleeding product is generally acknowledged by doctors

- New entrant is likely to emerge as soon as we build up the concept of using anti-bleeding products in various surgical settings

- Currently available brands will reap up the benefit of our aggressive promotion

- Popularising the concept of using anti-bleeding product will largely depend on training and promotional and sponsorship support from Daiichi

5. Marketing STRATEGY

- To Gynaecologists: Transamin is the choice of agent in acute Functional uterine bleeding, bleeding in radical cure operation of cervical cancer, Abnormal bleeding at labour, Treatment of Idiopathic or IUD-Induced Menorrhagia

- To Urologists: Prostatic surgery

- Ophthalmologists: Ocular trauma, prevention of corneal oedema

- Neurosurgery: Prevention of Rebleeding in Subarachnoid Haemorrhage

- To Surgeons: Prevention of bleeding after Surgery and Trauma, Bleeding during operation of gastric cancer,

- To ENT specialists: Operation of sinusitis. Tonsillectomy and Adenoidectomy, Thyroid surgery

- Internists: Treatment of gastric and intestinal haemorrhage

- To ENT specialist: in tooth extractions in patients with Haemophilia

Proposition:

Transamin has following distinct features and benefits which make it completely different and preferred choice of agent by physicians community than other available products:

e) Improvement over aminocaproic acid interms of potency

f) Low toxicity

g) No purpuric rash like aminocaproic acid

h) Risk of DVT and PE is less

Message

Overall key message

Potent antiplasminic activity that diminish the need for blood transfusion

Powerful and suitable adjunct to treatment in gastroduodenal haemorrhage by reducing the mortality and decreasing in surgical requirements

Unique Selling Points

Transamin has a more efficacy with low toxicity and no purpuric rash like aminocaproic acid

Clinical Trial Plan and Life Cycle Management Plan

Since tranexamic acid was launched in the market few years back and supported by lot of international clinical papers/international trials. No clinical trial on Transamin as such is planned in anti-bleeding market.

However to gain confidence of local key opinion leaders a post marketing phase IV/RECORD study will be conducted during planned period.

Packaging/ Dosage Forms

Following strengths have been registered by Business Point in Bangladesh:

Oral: Transamin tablet 250mg (100s pack)

Transamin capsule 500mg (100s pack)

Parenteral: Transamin injection 250mg/5ml

Transamin S injection 250mg/2.5ml

Transamin S injection 1g/10ml

We are planning to launch 250mg capsule, 500mg tablet and 250mg/5ml injection only at this moment, but it is essential to have all the forms available right from the beginning. Smaller pack of 6 capsule/tablet would be convenient for marketing 1-2 days therapy. It is also important to have two different strengths of oral form either in capsule or tablet in stead of one in capsule form and another one in tablet.

Pricing

Transamin is an imported product, therefore price is given by Directorate of Drug Administration and licensing Authority with definite mark up basis which is dependent on duty structure. Pricing calculation is done based on no duty, but 15% VAT. So, 180.88% mark up should be calculated on C&F price to derive MRP, that will give 12.5% commission to retail chemists on trade price.

Table-6, pricing structure – C&F to MRP based on new proposal dated 02 Nov 2000

| Strength & Packs | C&F Price ( US$) | C&F price (Tk) | Landed cost (Tk) | Trade Price (Tk) | MRP (Tk) | MRP/Tab/ Cap/Inj(Tk) |

| Transamin 250mg capsule (100’s) | 10.00 | 540.00 | 583.74 | 868.23 | 976.75 | 9.77 |

| Transamin 500mg tablet (100’s) | 18.00 | 972.00 | 1050.74 | 1562.82 | 1758.15 | 17.58 |

| Transamin 250mg injection (50’s) | 50.00 | 2700.00 | 2918.71 | 4341.17 | 4883.76 | 97.68 |

Discount policy

No provision for general discount. However a 3% discount may be offered in order to secure bulk orders initially, particularly in 2001.

Institutional retail / Purchasing group

Price is the key issue for institutional purchase. Since price of Transamin is relatively high than other available products. Indispensable support of opinion leaders can only be the tool for institutional business.

So Transamin is planned to be included in the purchase list of the institutions by brand name after massive lobbing to the opinion leaders

Distribution

Through in-house distribution channel. No special precautions should be taken in order to store Transamin, since it could be stored in room temperature.

6. Target Customer

Doctors of following categories will be our customers for Transamin:

- Orthopaedic surgeons

- General Surgeon

- Gynaecology & Obstetrics Surgeons

- Urologists/Nephrologists

- Haematologist

- Anesthetist

- Cardiac Surgeons

Total 664 doctors are planned to be covered, of which 50 are opinion leaders, 130 high prescribers and 484 followers.

Table-7

TARGET CUSTOMERS/SALES FORCE ALLOCATION OVERVIEW

| Target customer | Total number | Opinion leaders | High prescribers | Followers | Total coverage (%) |

| Orthopaedic surgeon | 100 | 6 | 12 | 82 | 100% |

| Cardiac Surgeons | 10 | 2 | 3 | 5 | 100% |

| General surgeons | 600 | 15 | 50 | 100 | 28% |

| Gynaecological surgeon | 1200 | 12 | 25 | 200 | 20% |

| Urological/ Nephrological surgeons | 100 | 12 | 20 | 68 | 100% |

| Haematologists | 10 | 1 | 5 | 4 | 100% |

| Anaesthesiologist | 70 | 2 | 15 | 25 | 60% |

| Total | 2090 | 50 | 130 | 484 | 32% |

| Total calls per year per rep | 50X4=200 | 130×4=520 | 484×2=968 |

| 1 Rep equivalent: 4 calls per day X 24 days = 96 calls per month |

| Total number of calls on Transamin: 968 calls per month |

| Rep equivalents needed: 968/96 = 10 Reps |

7. Promotional Strategy and Platform

Promotional objectives and method

1. Develop awareness regarding the use of an antiplasminic agent in high risk surgeries : a priority in order to create the need and develop Transamin prescriptions:

a) to control spontaneous and post operative haemorrhage

b) support of opinion leaders is a necessity

2. Impose Transamin as an agent of choice in the segment where it has the most important

competitive advantage:

a) versus placebo

b) versus control

c) versus aminocaproic acid

3. Develop relationships with prescribers /decision makers

4. Reinforce the image of efficacy by launching all dosage forms/strengths

5. Focus and limit our promotion in hospital through a hospital team: commitment, willingness to succeed

- All prescribers and prospective prescribers of the target doctors (Table 7, Page 9) of Transamin will be covered in 2001 with the objective of increasing awareness and usage of Transamin by highlighting its superiority over other aminocaproic acid and other similar preparations.

- Opinion leaders will be visited four times a moth to establish the concept of using anti-haemorrhagic agent routinely in all high risk surgical cases. High prescribers will be visited at least four times also in a month and the followers will be visited twice in a month. They will be reminded about the better efficacy, tolerability, and compliance of Transamin over competitive products.

- Attractive posology cards, detail aids, booklets, product monograph, video cassettes on mechanism of action and product reminders with creative ideas to highlight benefits of Transamin will be used. For these materials, good retention value and focus on product name and logo will be specifically considered.

Media strategy

Detailing, with more than 40% weightage of promotion for Transamin is planned for 2001. Weightage on doctors meetings will be 20%, and on journal service, product monographs, etc it is 40%.

Budget

Promo Budget for Transamin for 2001 is Tk 1031 K of which Tk 500 K is for doctors’ meeting and symposia, and Tk. 40 K is for advertising. Rests are for detail aids and product reminders (Table 8, Page 12).

8. Sales Force

Number of sales force needed/ available

A dedicated team of 10 persons is required to promote Transamin in 2001 to selected doctors. (Table 7, Page 9). If we employ a dedicated team they will be able to make 4 calls per day since a huge portion of their time will be spent in travelling and waiting for opinion leaders and high prescribers. Alternatively we may also promote this product sharing sales force time of our existing bigger team, but sales force time will remain almost same since making sales calls to opinion leaders and high prescribers is always time consuming (4 calls per day).

Product position in detailing

In detailing, Transamin will be discussed with 1st Priority – in all cycles round the year, since it will be promoted by a dedicated team.

Sales Training

A 4 day special training programme will be organized on Transamin. In order to make the programme an effective one, we need a trainer from Daiichi pharma, Japan. One of the resource person should receive train the trainers course from Daiichi pharma, Japan.

Other resource personnel would be: Training Manager, Medical Affair Associates, National Sales Manager, guest speakers from Bangabandhu SheikhMujibMedicalUniversity, DhakaMedicalCollegeHospital, etc.

We should also request for following materials from Daiichi pharma, Japan for sales force and the trainer:

1 a) Training Manuals for sales force: with any guide, OHPs

slides, etc. for the trainer

b) Souvenirs, brochures, etc. for sales force members attending

training

2 Launching literature 4000 pieces

3 Introduction to Daiichi (booklets) 500 copies

4 Product Monograph for opinion leaders 100 copies

5 Video Cassettes and display materials for doctors meeting

6 Reprints and folders, to be distributed among participants of

clinical meetings, seminars etc. 500 to 2000 copies

7 A second set of literature and give-away for the second

promotional cycle 4000 pieces

Contents of these programs would include haemostasis, coagulation system, pathology of fibrinolysis, product profile, competitive advantage, use of journal reprints, hospital selling, and selling skills in relation to Transamin.

A refreshers course, follow-up training would be conducted after one month of the induction training to measure the knowledge level and reinforce their activity.

9. Tactical Elements

Sales aids

- Sequential use of journals will be the major sales aid for promotional purpose. In addition to journal service detailing folders, posology cards, and detailing pad will be used for Transamin in the first year. Cost and timing for these materials and others are given in Table 8, Page 12.

- Main theme for two folders on Antiplasminic agent will be on risks involved in surgery without preoperative antibleeding product and superiority of Transamin over other agents.

- Themes for rest of the materials are better profile of Transamin in terms of efficacy, tolerability, and compliance versus placebo.

- Message for these materials are- excellent efficacy in simplest treatment: both oral and injectable; safer surgical procedure with Transamin, etc.

Sampling policy

- Sampling of Transamin will be restricted only to opinion leaders to allow them to try it on selective patients so that their confidence on Transamin is reinforced.

- In addition, real prospects of Transamin will receive samples in full course so that they can gain confidence by using it.

Medical advertising

Transamin will be advertised in five (5) five medical journals only published by Urological Society, Gynaecological Society, Bangladesh Orthopaedic Society, Society of Surgeons and Society of Dental Surgeons.

Product Publicity

For 2001, two ‘Product Reminders’ are planned. One pen and one desk organizer. These are the gifts which will have good retention value for the doctors. Product name and logo will be clearly imprinted on these gifts to ensure continuous reminder to the doctors.

Doctors meeting on Transamin will be arranged in relevant departments of all Medical College Hospitals, Orthopaedic Hospital (RIHD). We are planning to organize at least 12 meeting in 2001. If possible foreign speakers will read the key note paper. Number of participating doctors in each meeting is about 200. Budget per meeting is about Tk. 3,00,000 (excluding travelling and honorarium of foreign speaker).

Table-8

Tactical Plan Overview: 2001 |

| Activity (A) Cost (C) | Q1 | Q2 | Q3 | Q4 |

| Training Materials: To be sought from Daiichi a) Training Manuals for sales force: with trainers guide, OHPs, slides, video, etc. b) Product Monographs c) Posters, Display materials d) Reprints: Original

| ||||

| A1 Detailing folder/pad C1 Cost of above (Tk) | 2000 30,000 | 2000 30,000 | 2000 30,000 | 2000 30,000 |

| A2 Use of product reminders C2 Cost of above (Tk) | 2000 100,000 | 2000 100,000 | ||

| A3 Sample drop 250mg tablet (10s @Tk 152) C3 Cost of above (Tk) | 200 30,400 | 200 30,400 | 200 30,400 | 200 30,400 |

| A4 Doctor’s meetings C4 Cost of above (Tk) | 3 50,000 | 3 50,000 | 3 50,000 | 3 50,000 |

| A5 Journal service / folder C5 Cost of above (Tk) | 2 10,000 | 2 10,000 | 2 10,000 | 2 10,000 |

| A6 Advertisement C6 Cost of above (Tk) | 2 20,000 | 1 10,000 | 1 10,000 | 1 10,000 |

| A7 Seminar on Transamin C7 Cost of above (Tk): Excluding cost of foreign speaker | 1 300,000 | |||

| A8 Sponsorship to International Congresses C8 Cost of above (Tk): | 2 400,000 | |||

| TOTAL INVESTMENT | 940,400 | 130,400 | 230,000 | 130,000 |

10. Market Research Plan

A small scale market survey will be done to prepare the market map and to calculate future market potential segment wise.

11. Profit and Loss Account

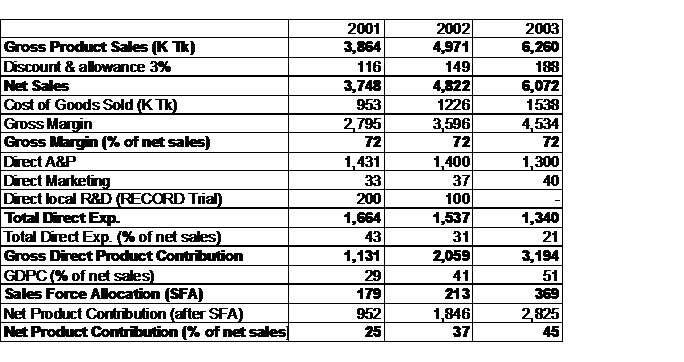

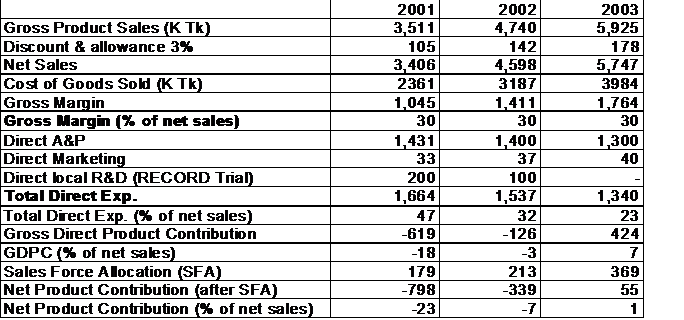

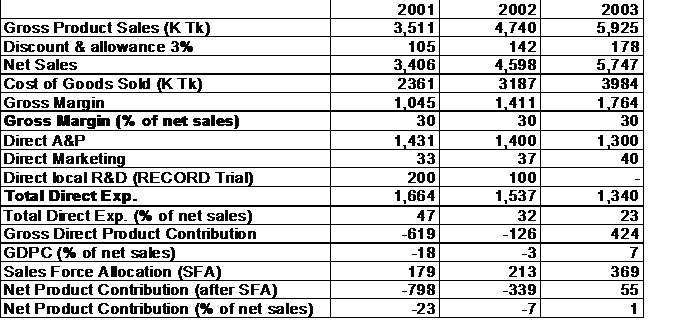

Sales turn over is gradually increasing over the planned period (Table 9,10,11, Page 12,13,14). Gross Profit although very low but is increasing by value. Three different situations have been analysed based on three different C&F and Trade Prices. Direct expenditure as % of net sales is also decreasing. Net product contribution although negative seems to be improving over the time.

Table-9: Profit & Loss Account based on C&F price provided by Business Point (14 Nov 2000)

Profit and Loss Account – SITUATION 1 |

Table-10: Profit & Loss Account based on C&F price in comparison to Traxyl of Organon

Profit and Loss Account – SITUATION 2 |

Table-11: Profit & Loss Account based on C&F price in comparison to Tranex of Menarini

Profit and Loss Account – SITUATION 3 |

12. RISK AND OPPRTUNITYS

High, uncompetitive price of 250mg injection. Price should be competitive and similar with that of Traxyl of Organon and Tranex of Menarini. 500mg injection should also be introduced to compete with 500mg Tranex injection.

Table-12

RISKS AND OPPORTUNITIES: 2001 |

| OPPORTUNITIES | ‘000 Tk | PROBABILITY |

| None. Possibility of bulk sales is less, as the concept of using anti-bleeding products is not yet popular in various hospitals and institutions.

| ||

| RISKS | ‘000 Tk | PROBABILITY |

| 250mg/5ml Injectable sales low due to high price

| 320 | H |

Probability H = high

M = medium

L = low

Key Message

Transamin. A potent synthetic agent, that inhibits specifically the actions of plasminogen activator and plasmin which exhibits fibrinolytic action in various traumatic situation

Conclusion

Create regional and/or national committee of experts to build core users and make Transamin a successful product in Bangladesh.

Recommendation

Utilize large portion of resources on key opinion leaders because fate of the product will mainly depend on their acceptance or rejection .