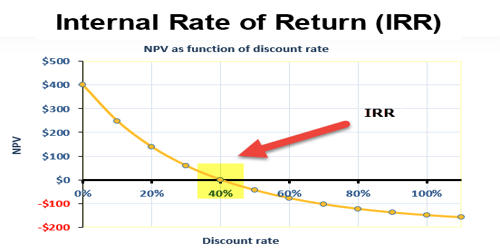

The internal rate of return (IRR) is used to measure and compare the profitability of various business projects and investments. One of the advantages of using the internal rate of return is that the method provides the exact rate of return for each project as compared to the cost of the investment. It can also be used for budgeting purposes such as to provide a quick snapshot of the potential value or savings of purchasing new equipment as opposed to repairing old equipment.

Advantages of Internal Rate of Return (IRR)

(1) IRR method considers the time value of money. It considers the time value of money even though the annual cash inflow is even and uneven. One can measure IRR by calculating the interest rate at which the PV of future cash flows is equal to the capital investment required.

(2) IRR measures the rate of return of projected cash flows generated by your capital investment. The IRR for each project under consideration by your business can be compared and used in decision-making. The ranking of project proposals is very easy under the Internal Rate of Return since it indicates the percentage return.

(3) IRR method discloses the maximum rate of return the project can give. It provides for maximizing profitability. It gives much importance to the objective of maximizing shareholder’s wealth. The profitability of the project is considered over the entire economic life of the project. Once the IRR is calculated, projects can be selected where the IRR exceeds the estimated cost of capital. In this way, the true profitability of the project is evaluated.

(4) IRR method considers and analysis all cash flows of the entire project. It is able to do this by allowing you to compare the positive or negative outcomes of all projects under consideration. This is very easy to visualize for managers, which is why it’s preferable unless they come across occasional outstanding situations, like mutually exclusive projects, etc.

(5) IRR method ascertains the exact rate of return the project earns. When using the IRR method, you’re able to compare it to the rough estimates generated by the required rate of return. If the IRR is far from the estimated required rate of return, the manager can safely make the decision on either side. Also, he can maintain room for estimation errors.

(6) In IRR, there is no requirement for finding out the IRR hurdle rate or the required rate of return. The IRR method is better used with multiple evaluation factors. It is not dependent on the hurdle rate, so the risk of a wrong determination of the hurdle rate is diminished.

(7) There is no need for the pre-determination of the cost of capital or cut off rate. Hence, the Internal Rate of Return method is better than the Net Present Value method.