Debentures are nothing but documents. In other words, they possess documentary value. Debentures are some of the debt instruments which can be used by government, companies, organization for the purpose of issuing the loan. It is basically just a bond. It acknowledges the fact that the company has borrowed a debt. The person who buys these debentures becomes the company’s creditor.

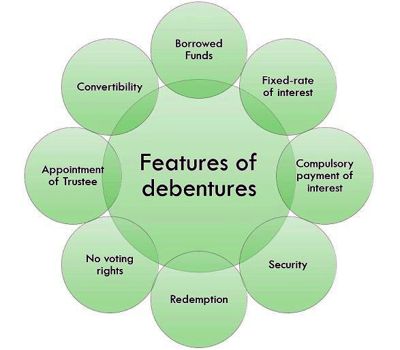

Features of debentures

Following are some of the features of Debentures:

- Borrowed Funds

Debentures may or may not carry a charge on the company’s assets. Debentures are the capital funds that are borrowed by the authority bodies from the public while seeking capital; however, the company needs to repay the capital to the investors within a stipulated period of time. Interest on debenture is payable even if there is a loss.

- Fixed-rate of interest

Debenture-holders are entitled to periodical payment of interest at an agreed rate. It is always issued with a fixed rate of interest which is payable once every six months or annually to the investors as decided by the shareholders in the annual general meeting. Debenture holders are the creditors of the company carrying a fixed rate of interest.

- Compulsory payment of interest

Interest payable on a debenture is a charge against profit and hence it is a tax-deductible expenditure. The company is obligated to the debenture holder interest payment in priority irrespective of the condition of profit or loss in their business. They are also entitled to the redemption of their capital as per the agreed terms.

- Security

Debentures may be either secured or unsecured. They can enforce the security by sale in case of default. Debentures can be secured against the assets of the companies even if the company becomes insolvent debenture holders will get their money by selling the assets of the company. Usually, debentures are secured by a charge on or mortgage of the assets of the company.

- Redemption

A debenture is redeemed after a fixed period of time. Redemption of debenture implies paying back of the sum to the debenture holders against the issued debentures as mentioned in the company’s prospectus on the completion of a fixed period of time or date at par, premium, or discount.

- No voting rights

They have no voting rights. Debenture holders are the creditors of the company; thus, have no right to say or make a vote on any internal matters of the company until their rights are being affected or the company asks their opinion in special circumstances.

- Appointment of Trustee

At the time of issuing of debentures to the public investing in your company, a deed is signed by the person appointed as trustee, the trustee is supposed to ensure that the borrowing firm fulfills its institution. They can apply for winding up of the company to safeguard their interests.

- Convertibility

Debenture holders have the right to sue the company for any unpaid dues. Debentures are generally transferable. Debentures have an option of convertibility, i.e., the company may issue convertible debentures at the option of debenture holders which are convertible into equity shares. Debenture-holders can sell them on stock exchanges at any price.

Information Source: